TLDR

- Solana bounced off the $120 support level after sharp losses during the Asian trading session

- Daily trading volume exploded by 278% to reach $6.3 billion, representing 9% of SOL’s market cap

- SOL ETFs attracted $10 million in new assets from Monday to Thursday last week, bringing total assets to $1.1 billion

- On-chain metrics show strong network activity with weekly active users hitting 5.1 million and transaction volumes reaching 764.9 million

- Technical indicators suggest SOL could drop to $97 if the $120 support level fails to hold

Solana’s price tested a critical support level at $120 over the weekend as markets reacted to unexpected tariff announcements from President Donald Trump.

The cryptocurrency fell to a session low of $118 during the Asian trading session on Sunday before quickly recovering. The sharp price movement came after Trump threatened to impose 100% tariffs on Canada if the country struck a deal with China.

Trading activity increased dramatically during the sell-off. Daily volume jumped 278% to $6.3 billion, accounting for 9% of Solana’s total market cap.

The Crypto Fear and Greed Index dropped from 54 to 29, reflecting growing uncertainty among investors. Market participants remain cautious about the near-term outlook as trade tensions continue to affect cryptocurrency prices.

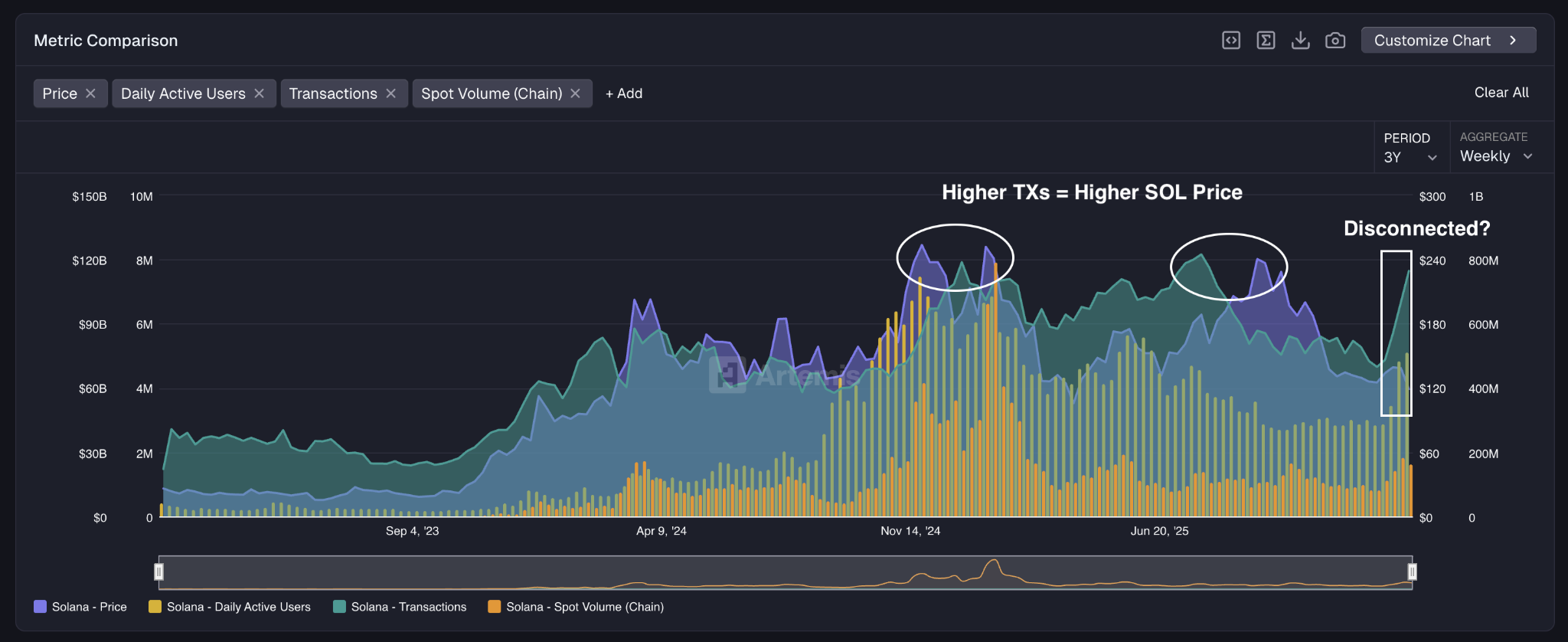

Despite the price decline, Solana’s network fundamentals showed strong growth. Weekly active users reached 5.1 million last week, up 4% from the previous week and marking the highest level since June 2025.

Transaction volumes also increased substantially. The network processed 764.9 million transactions last week, up 64% from 466 million transactions in late December.

Network Activity vs Price Action

The current transaction volume levels match those seen when SOL traded above $200 in previous months. This creates a disconnect between network usage and token price.

Historical data shows that similar transaction volumes corresponded with SOL trading at $253 in November 2024 and $240 in September 2025. The gap suggests the current price may not reflect the network’s actual usage and adoption.

Institutional interest in Solana remains steady. SOL ETFs received $10 million in inflows from Monday to Thursday last week. Total ETF assets now stand at $1.1 billion.

Crypto ETF Weekly Flows (Mon – Fri)

🔴 Bitcoin $BTC spot ETFs saw $1.3B in net outflows

📉 Second-largest weekly outflow on record🔴 Ethereum $ETH spot ETFs recorded $611M in net outflows

🟢 Solana $SOL spot ETFs posted $9.5M in net inflows

🔴 $XRP spot ETFs saw $40.6M in… pic.twitter.com/vWtFbxhJdA

— Trader Edge (@Pro_Trader_Edge) January 25, 2026

Technical Outlook

The $120 level has proven to be a key support zone for SOL. Buyers have stepped in to defend this price point multiple times.

$SOL UPDATE

will reclaim imo, many people got shaken out again. pic.twitter.com/vAt4v4Q8xQ

— Don 🐂 (@DonWedge) January 26, 2026

The Relative Strength Index on the daily chart fell below its 14-day moving average. This indicates that selling pressure has increased in recent sessions.

If SOL breaks below $120, the next support level sits at the lower bound of a descending price channel. A failure to hold that level could push the price toward $97, which would be the lowest point since April 2025.

Resistance currently sits at $145. Solana has faced selling pressure each time it has attempted to break above this level.

The 4-hour chart showed a sell signal during Sunday’s Asian session decline. However, buying pressure returned quickly once the price hit $120.

A move above $125 would signal a potential trend reversal. This could open the path for SOL to test $130 and then $145.

Current market sentiment favors continued downside pressure. The combination of macroeconomic uncertainty and trade tensions continues to weigh on cryptocurrency prices across the board.

Transaction volumes on Sunday confirmed the $120 level as a highly contested area. The outcome at this price point will likely determine Solana’s direction in the coming sessions.