BitMine Immersion Technologies added 379,271 Ether (ETH) worth almost $1.5 billion after last weekend’s market crash. The Ether treasury buildup came in three purchases: 202,037 ETH after the weekend crash, 104,336 ETH on Thursday, and 72,898 ETH on Saturday. Arkham Intelligence and BMNR Bullz surfaced the transactions. BitMine has not confirmed them yet.

The Ether treasury held by BitMine now exceeds 3 million ETH, or about 2.5% of the total supply. At reported marks, that stake equals about $11.7 billion. The Ether treasury drive started in early July, when ETH traded near $2,500.

Therefore, the Ether treasury accumulation keeps moving toward BitMine’s stated goal of 5% of supply. The pace shows steady ETH intake during volatile sessions. The on-chain trail links Ether treasury flows to specific dates and sizes.

Ethereum vs. Bitcoin: Tom Lee talks flip risk and DAT bubble

Tom Lee discussed Ethereum and the DAT bubble in separate comments. While speaking with Cathie Wood on Thursday, he said, “Ethereum could flip Bitcoin similar to how Wall Street and equities flipped gold post 71.” The Ethereum remark cites the 1971 end of the gold standard and the market shift that followed.

In addition, Tom Lee addressed the digital asset treasury segment. He said many DATs trade below NAV, pointing to stress. As he told Fortune on Thursday,

“If that’s not already a bubble burst… How would that bubble burst?”

The DAT bubble phrasing highlights NAV gaps rather than price targets.

Even so, the Ethereum focus remained clear in his interview. Tom Lee referenced positioning data and structure. The Ethereum theme appears alongside BitMine’s Ether treasury buying.

DAT Bubble watch: NAV discounts hit digital asset treasuries

The DAT bubble concern centers on NAV discounts. When a digital asset treasury trades below NAV, the wrapper signals weaker demand. That gap reflects secondary-market pricing rather than wallet balances.

10x Research reported that Metaplanet and Strategy traded near or below NAV on Saturday. The note aligns with Tom Lee on NAV and the DAT bubble. The digital asset treasury picture therefore includes multiple operators and similar discounts.

However, 10x Research added a caveat about execution inside the digital asset treasury field. They wrote that DATs with strong capital bases and trading-savvy management “may still generate meaningful alpha.” The NAV comment does not change the data. It simply separates digital asset treasuries by operating quality.

Ether Treasury expansion: Li Lin raises $1B for Ethereum

Parallel to BitMine’s Ether treasury move, Li Lin has reportedly raised about $1 billion to invest in an Ether treasury. The Huobi founder and Avenir Capital chair aims to build a listed vehicle focused on Ethereum. Prior reporting ties the plan to structured governance and public-market access.

The Ether treasury proposal from Li Lin indicates broader appetite for ETH accumulation. The effort seeks transparent reporting and oversight. As a result, the Ethereum strategy may appeal to institutions that prefer listed exposure.

Therefore, Ethereum demand could come from multiple Ether treasury operators. BitMine runs a large stash, while Li Lin targets a fresh pool. The Ethereum accumulation story extends beyond a single balance sheet.

Market backdrop: leverage flush, gold envy, and Ethereum positioning

Tom Lee told CNBC after Friday’s session that traders are still “licking their wounds” from the leverage flush. He also noted “gold envy,” since the metal has been a strong performer this year. The comment places Ethereum and Bitcoin flows beside a traditional hedge.

Moreover, Tom Lee said leveraged longs in crypto sit near record lows. In his words, “we’re at the basement and working our way back up.” The remark describes positioning rather than a forecast. It also frames why Ethereum moves may lean on spot rather than leverage.

As of the latest marks, crypto markets are down about 15% from the October 7 record high. Meanwhile, gold has pulled back roughly 3% from its Thursday peak. Inside that setting, the Ether treasury buys by BitMine and the Ethereum plan by Li Lin stand out. The DAT bubble and NAV discounts remain part of the same picture, as digital asset treasuries adjust to tighter spreads.

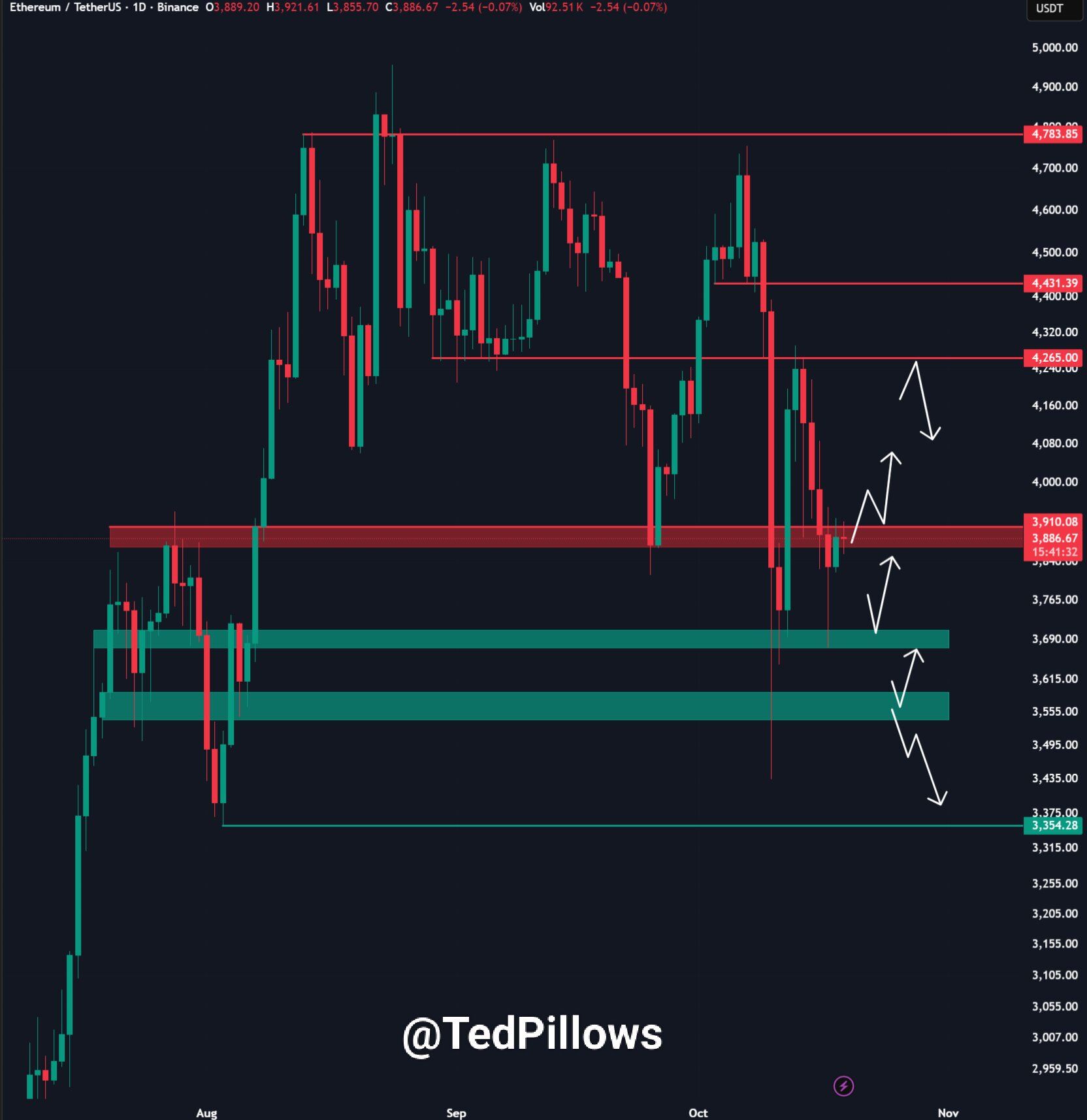

Ethereum levels: reclaim $4,000 or revisit $3,700–$3,560

Ethereum trades sideways near the $3,890–$3,910 band shown as a red supply zone on the chart. Buyers must reclaim and hold $4,000 to open room toward the next marked resistances around $4,160–$4,265, then $4,430–$4,450. The structure shows lower highs, so momentum needs a daily close back above $4,000 to shift near-term control.

If price fails at $3,900–$4,000, sellers regain the initiative. The first demand block sits around $3,740–$3,700. A clean break there exposes the deeper green zone at $3,620–$3,560, which capped multiple wicks earlier in the move. The final defense on this chart appears near $3,380–$3,320, where prior liquidation lows printed.

Intraday, the path remains reaction-driven. A quick reclaim of the red band ($3,900–$4,000) likely invites a squeeze toward $4,160–$4,265 before heavier supply at $4,430+. Conversely, repeated rejections below $4,000 keep the bias toward testing $3,700, then $3,560 if bids thin.

Volumes look muted compared with prior selloffs, so levels matter more than momentum signals here. Therefore, watch the $4,000 pivot for confirmation and the $3,700 / $3,560 shelves for responses. The chart outlines both continuation and breakdown paths without favoring either.