Li Lin, founder of Huobi and chair of Avenir Capital, raised about $1 billion to build an Ether-focused trust. He aims to announce the vehicle within two to three weeks, according to a Bloomberg report. The plan centers on accumulating Ether through a Nasdaq-listed shell company.

The round included large checks from known institutions. HongShan Capital Group reportedly committed $500 million, while Avenir added $200 million. Together, the group framed the initiative as a structured, long-horizon accumulation strategy.

The project positions Ether as the core asset. Organizers target institutional-style governance and public-market access via the shell company. As a result, supporters expect clearer reporting and oversight than an informal pool.

Who is backing the trust

Li partnered with several industry figures to advance the plan. He teamed up with Shen Bo, co-founder of Fenbushi Capital, and Xiao Feng, CEO of HashKey Group. Meitu founder Cai Wensheng also joined as a key supporter.

Each partner brings a different capability. Fenbushi contributes venture discipline and network reach. HashKey adds regulated infrastructure experience across custody and brokerage.

Meitu’s founder extends the link between consumer technology and crypto treasury moves. His presence signals interest from tech entrepreneurs who have executed public-company crypto buys before. Consequently, the trust targets both crypto-native and traditional circles.

How the trust is structured

Organizers plan to use a Nasdaq-listed shell company to hold and disclose the Ether position. This approach allows public-market investors to gain exposure through equity rather than direct token custody. Therefore, the vehicle can tap established listing and reporting standards.

A trust format typically focuses on simple accumulation and secure storage. It reduces active trading and emphasizes transparent net-asset reporting. In turn, investors monitor Ether holdings, issuance, and any fees.

Timing matters. The team signaled a launch announcement within two to three weeks. Ahead of that, they finalize governance, service providers, and disclosure cadence.

Market context and ETH performance

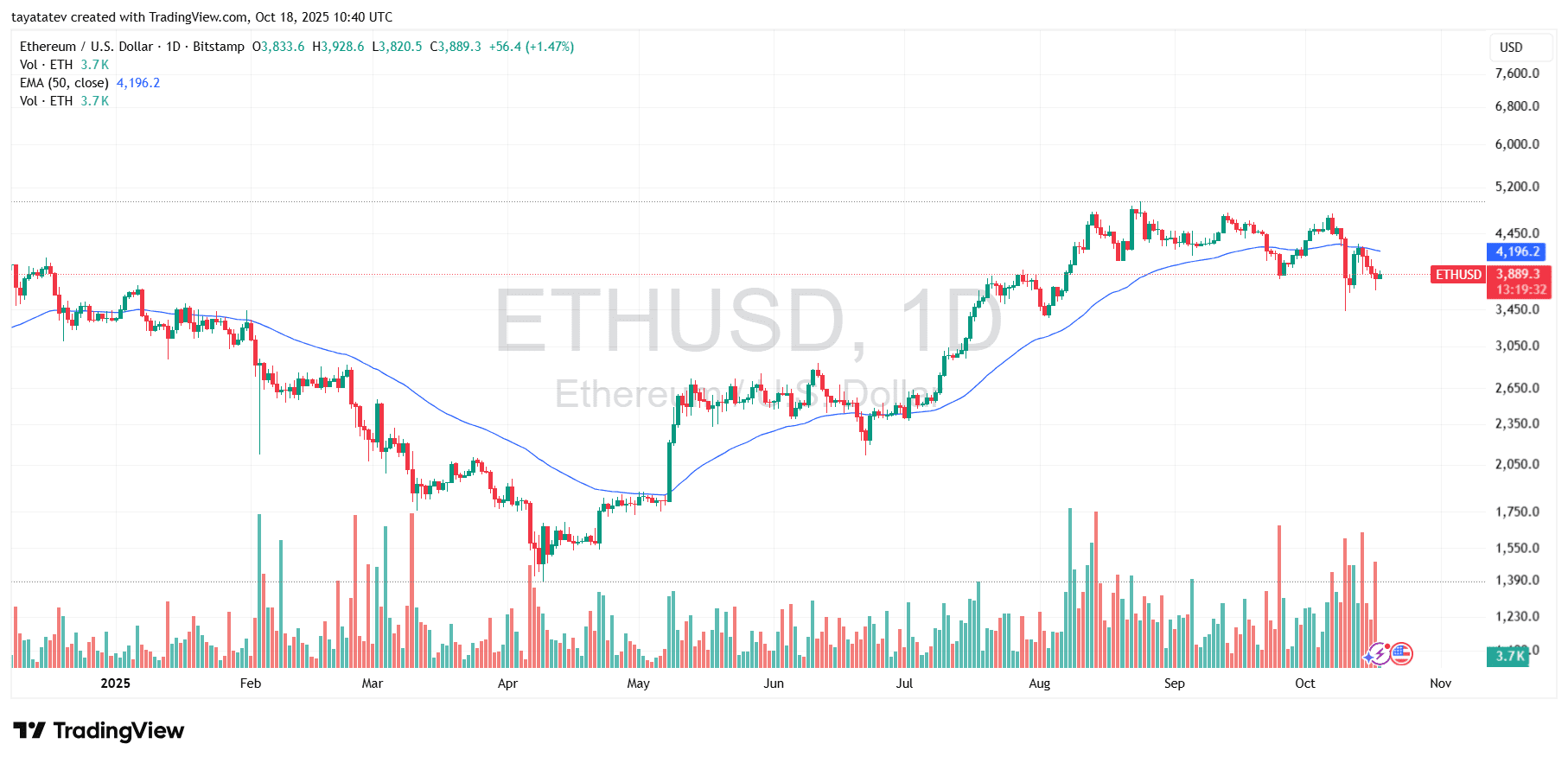

The report surfaced as Ether showed strength on weekly time frames. At publication, ETH traded around $3,857–$3,884, up more than 9% over seven days. Those figures provide context for the trust’s initial mark and potential tracking error.

However, a trust vehicle does not set market direction. It mirrors Ether’s moves and adds layers such as fees and operational costs. As a result, secondary-market prices can sometimes trade at a premium or discount to the underlying value.

Investors often compare vehicles on expense ratios, creation/redemption mechanics, and custody design. These details shape tracking quality over time. Clear disclosures help the market price those differences.

Li Lin’s background with Huobi

Li founded Huobi in 2013 and later sold the exchange to Justin Sun. After the sale, disputes emerged over branding and conduct. Lawsuits referenced the “Huobi Global” name and allegations of fraud.

These conflicts outlined the separation between the founder and the successor operator. They also underscored the need for clean governance in future ventures. Consequently, the new trust’s structure will likely stress role clarity.

A trust demands regulated service partners and verifiable processes. Therefore, launch materials should specify administrators, custodians, and auditors. This transparency can address concerns raised by past industry controversies.

Avenir Capital’s broader crypto exposure

Avenir already holds significant Bitcoin exposure through U.S. spot ETFs. In August, it reported about 16.5 million shares of BlackRock’s iShares Bitcoin Trust (IBIT). That position places Avenir among notable institutional holders of Bitcoin exposure.

Beyond Bitcoin, Avenir moved toward Ether and Solana strategies. In September, it helped launch a $500 million Solana treasury. These steps show a broader multi-asset approach inside the firm.

As Avenir backs the Ether trust, it extends that diversification. It balances ETF exposure with direct-asset vehicles and public-company structures. In turn, its portfolio reflects several rails into crypto markets.

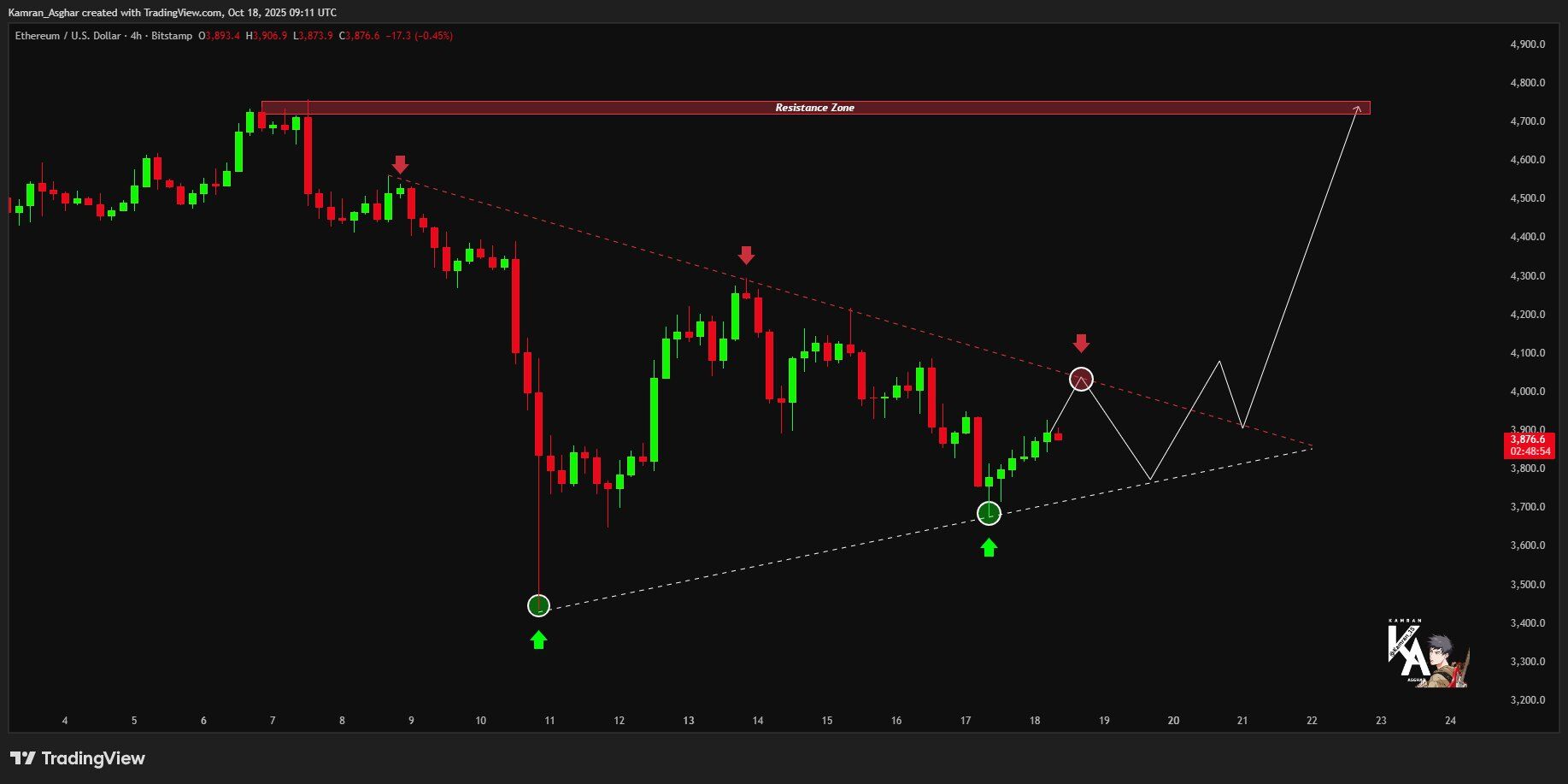

ETH 4H triangle: breakout needs confirmation

Price compresses inside a symmetrical triangle, with lower highs along the dashed resistance and higher lows along the rising base. Buyers defended the latest swing low near 3,780–3,800, keeping the structure intact. However, momentum remains neutral until candles close above the triangle’s top line with follow-through.

Next, watch the rejection cluster around 3,980–4,050, where the downtrend line and recent supply intersect. A clean 4H close above that band, ideally on rising volume, would validate a breakout and open room toward the prior distribution area. Until then, expect whipsaws as price oscillates between the triangle rails.

Conversely, a 4H close back below the rising baseline would neutralize the setup and shift focus to the liquidity shelf around 3,720–3,750. As long as higher lows hold, the bias stays constructive; yet the market must convert overhead supply into support before any sustained advance.

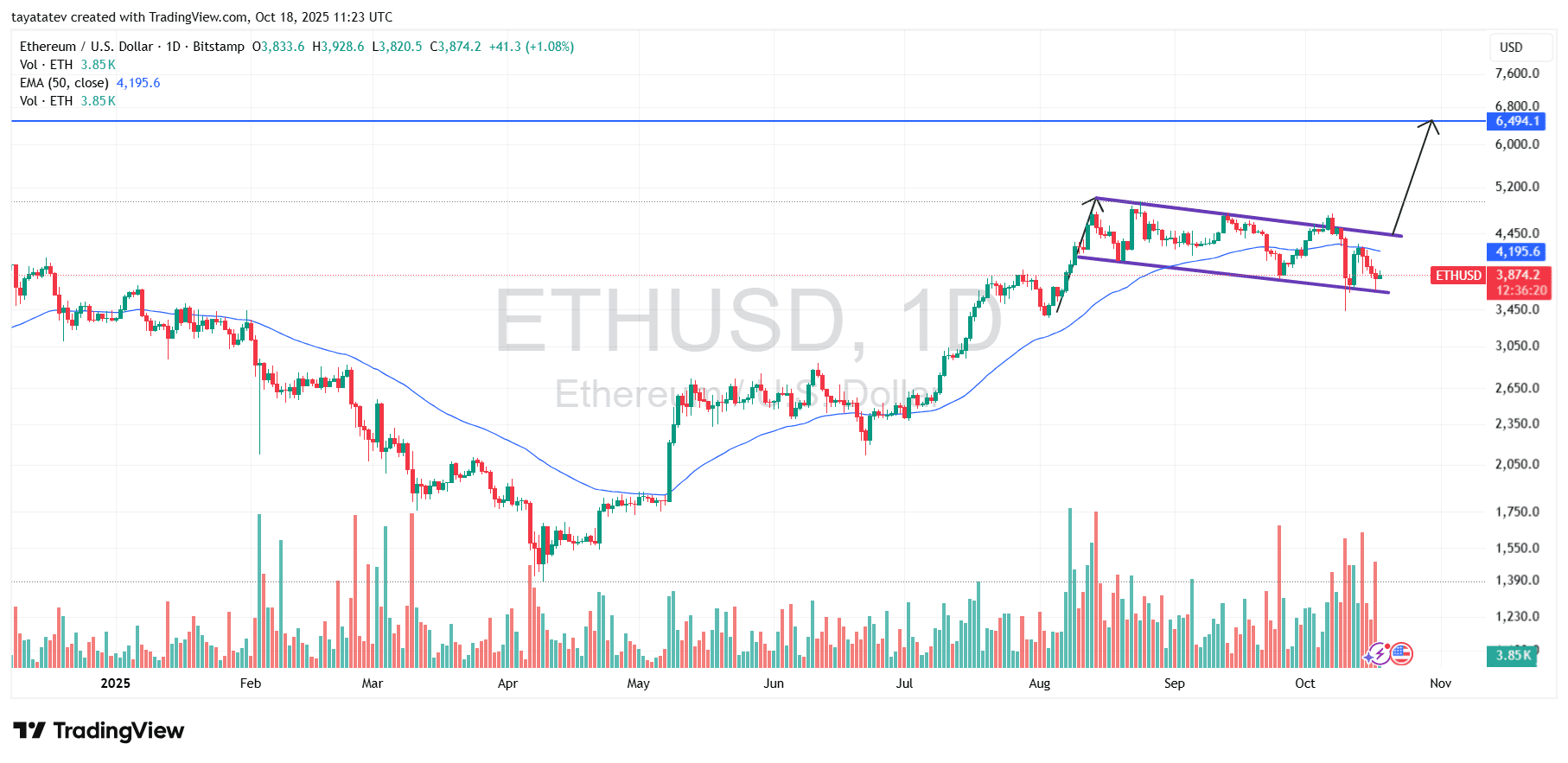

ETH daily: Oct. 18, 2025, 11:23 UTC — bullish flag points to ~$6.51K on confirmation

Ethereum trades near $3,874 on the daily chart created Oct. 18, 2025. The structure shows a bullish flag after a sharp August–September advance. A bullish flag is a steep rally (“pole”) followed by a downward-sloping, low-volume channel that resets momentum before continuation.

Price sits below the 50-day EMA at $4,196, yet it continues to respect the flag’s lower rail. Volume cooled through the consolidation, which fits the pattern. However, confirmation still requires a daily close above the flag’s top line near $4,45K with rising volume.

If buyers break and hold above that upper trendline, the measured move activates. From the current price, a 68% continuation projects to about $6,509, aligning with the marked supply zone around $6,49K–$6,80K. Until that breakout, watch the base near $3,55K–$3,60K; losing it would invalidate the setup and delay upside.

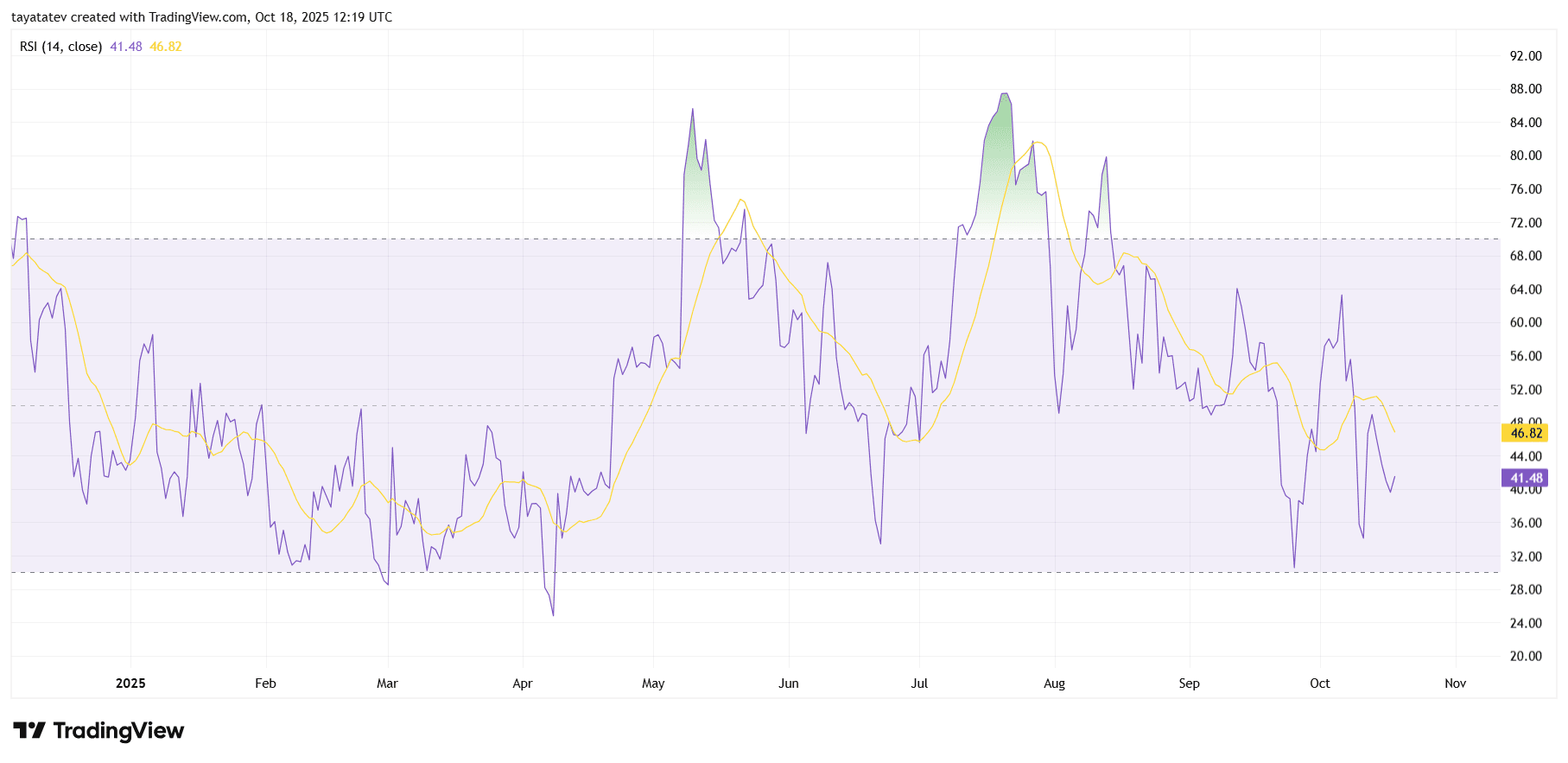

ETH daily RSI — Oct. 18, 2025, 12:19 UTC

Ethereum’s 14-day RSI prints 41.48 with its RSI moving average near 46.82. RSI gauges momentum strength on a 0–100 scale; below 50 favors sellers, above 50 favors buyers. Today, RSI sits in the 30–50 band, so momentum remains weak, and it also tracks below its own average, which keeps short-term pressure tilted lower.

However, recent structure shows improvement. After the early-October dip that pressed RSI to the low-30s, the oscillator formed a higher low around 41 while price retested support—this hints at bullish divergence and fading downside force. If RSI reclaims 50–55 and crosses above its moving average, momentum would align with any price breakout from the daily consolidation.

Conversely, watch the lower band. A drop back toward 35–32 would signal renewed weakness and raise the risk of another support test on price. Until RSI closes back above 50, expect a range-bound tone; once it does, upside follow-through becomes more probable as momentum turns positive.