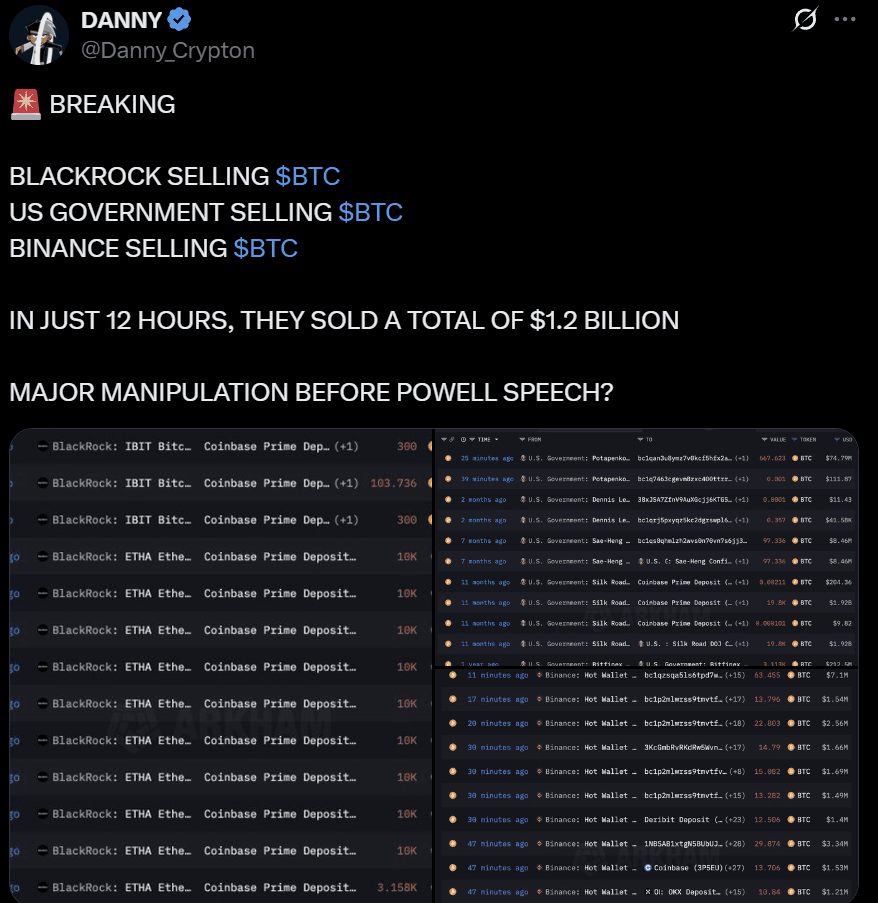

Bitcoin (BTC) price extended losses on Oct. 15 as major entities reportedly unloaded over $1.2 billion worth of BTC ahead of Jerome Powell’s speech. The bearish moves by BlackRock, the US government, and Binance increased the bearish pressure against Bitcoin prices.

BTC’s price failed to hold above the $115,000 resistance zone, suggesting strong bearish pressure near the price level. Bulls now defend the $111,000 support. If BTC breaks below this level, the next support for the token lies near its 200-day EMA at around $108,000.

Whale Shorts, Insider Speculation, and Trump’s Tariff Shock Deepen Bitcoin’s Slide

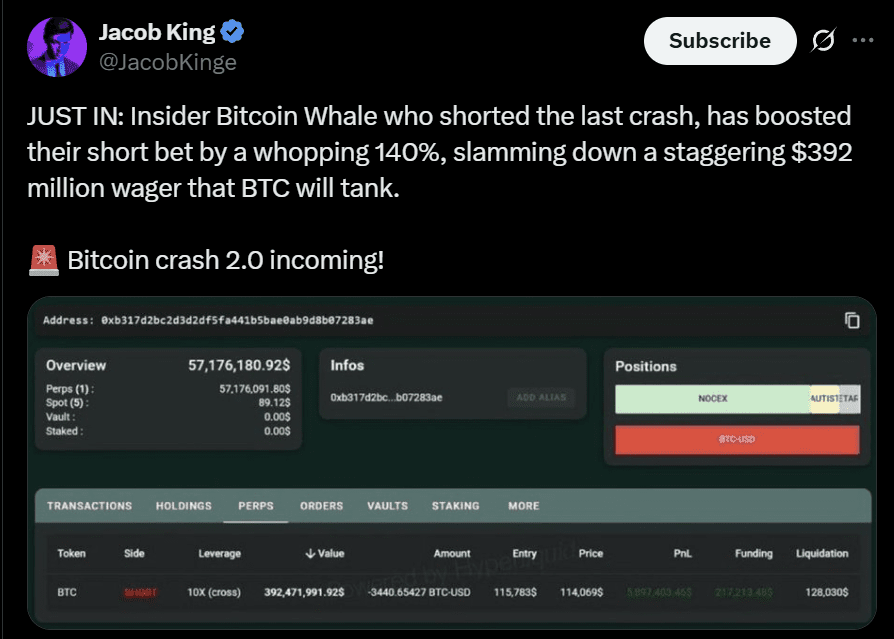

Reports of a whale opening a $392 million short added to the bearish mood. The same wallet had previously shorted BTC and ETH during October 11’s flash crash.

The incident led to allegations that the wallet owner had access to possible insider information. Elon Musk’s renewed praise for Bitcoin’s energy-backed design failed to offset the negative momentum as the token’s attempted rebound stalled below key resistance.

The wave of selling that rattled Bitcoin markets deepened after blockchain data traced multiple high-value movements from institutional and government-linked wallets. BlackRock’s Bitcoin ETF wallets reportedly transferred hundreds of BTC to Coinbase Prime within hours of similar outflows from Binance and US government–associated addresses.

Independent market analyst Danny noted the timing coincided with broader macro jitters and renewed speculation of policy-driven trades. The market impact was amplified by a separate development involving a high-profile on-chain address that opened massive short positions days before the latest crash.

Onchain tracker Jacob King identified the wallet 0xb3…3ae as a recurring actor, active during the Oct. 11 market drop. During the previous crash, the address suspiciously opened short positions right before President Trump’s tariff tirade against China.

Once again, the address reportedly deposited $40 million in USDC on Oct. 13 before opening leveraged Bitcoin shorts exceeding $340 million. It mirrored activity seen ahead of the Oct. 10 selloff, when the same wallet profited heavily within hours of Trump’s tariff announcement.

The analyst suggested the entity might possess exceptional timing or privileged awareness of market-sensitive news, though no direct link to officials or insiders was proven.

Trump’s tariff measures, which expanded restrictions on Chinese imports and halted soybean exports, reignited concerns about inflation and trade imbalances. The resulting risk aversion weighed on all major risk assets, including Bitcoin.

Meanwhile, Elon Musk’s renewed defense of Bitcoin’s energy model—calling it “impossible to fake energy”—contrasted sharply with the bearish tone. Yet, his comments failed to shift market momentum as traders remained focused on the heavy institutional flows and potential insider-driven activity across major wallets

Analysts Warn of Correction Risks as Technical and On-Chain Levels Align

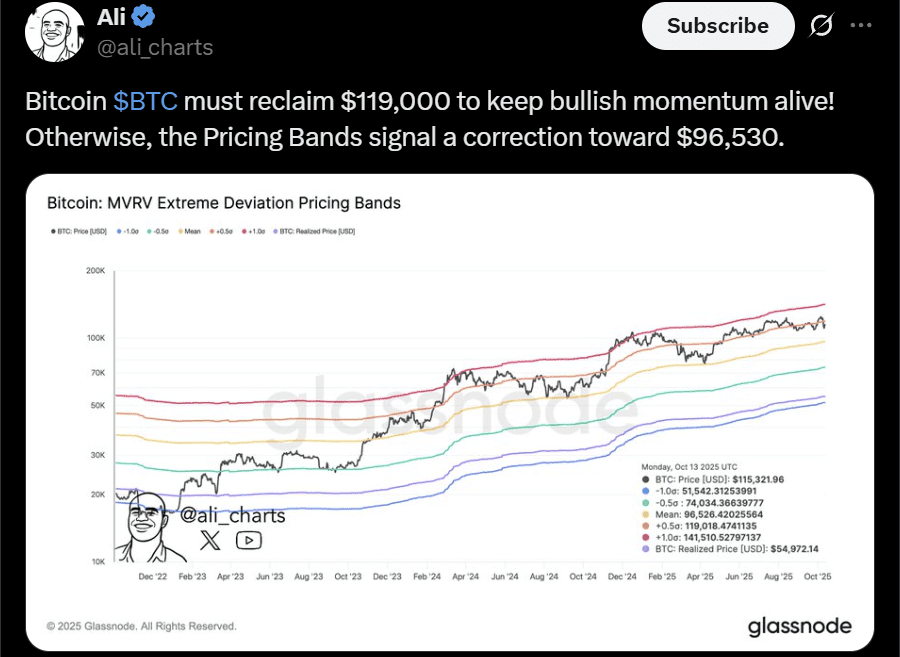

Bitcoin’s slide below $115,000 placed renewed focus on key technical levels highlighted by multiple market analysts. The analysis followed a turbulent week dominated by institutional selling and trader uncertainty over policy direction.

Ali Martinez emphasized that the BTC USD pair needed to reclaim $119,000 to maintain its bullish trajectory.

Martinez’s Glassnode-based MVRV deviation bands showed the token nearing overextension territory, suggesting a possible correction toward $96,500 if price failed to stabilize. The metric’s lower deviation zone coincided with past cycle midpoints, often marking strong reaccumulation areas when broader sentiment turned risk-off.

Technical analyst BitBull reinforced the mid-cycle perspective, noting that Bitcoin still traded inside a large ascending channel visible since June.

The analyst’s structure mapped the current pullback as a test of the channel’s lower boundary near $100,000–$103,000. Each prior rebound from that level had produced a fresh leg higher, making it a crucial zone for buyers to defend. A breakdown below it, BitBull warned, would confirm a medium-term shift from consolidation to correction.

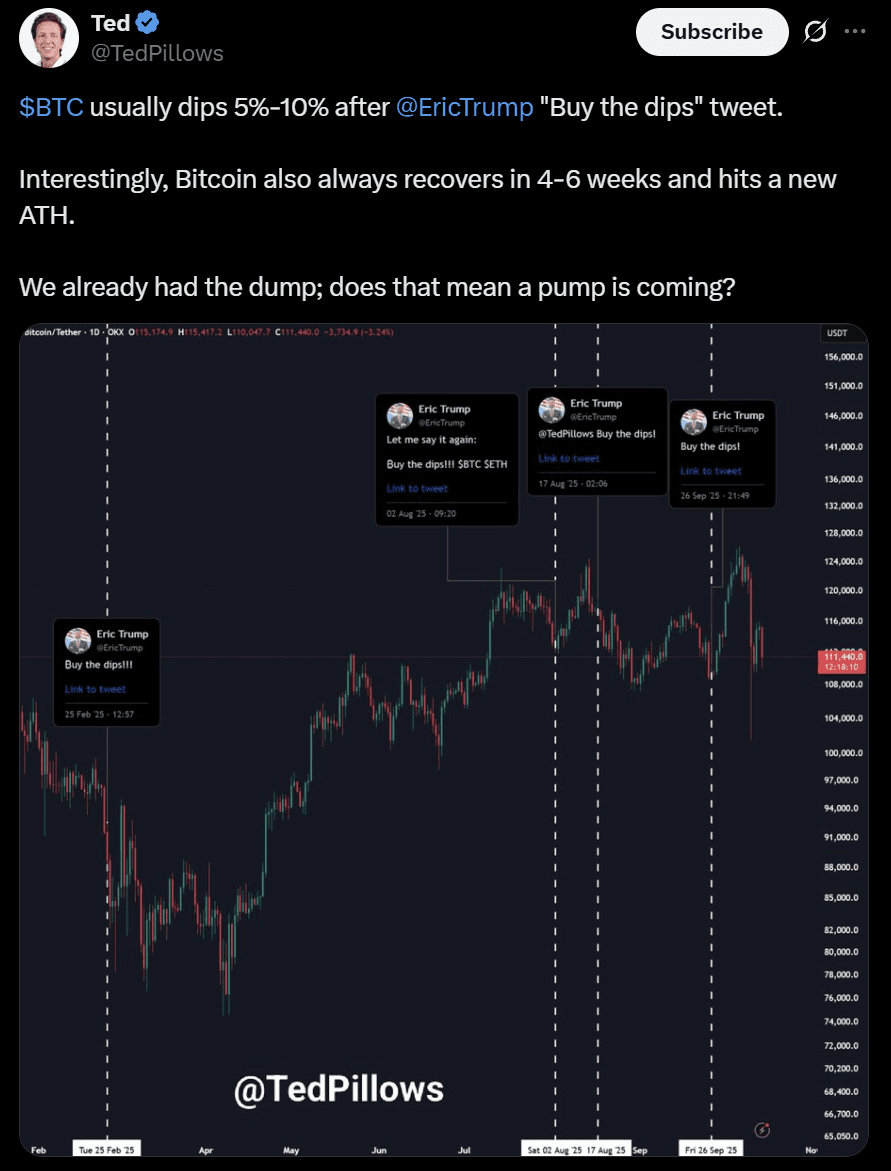

Meanwhile, Ted analyzed Bitcoin’s recent declines alongside Eric Trump’s “buy the dip” tweets. The analyst data showed that each of Trump’s posts preceded short-lived selloffs of 5–10%, followed by recoveries within four to six weeks.

The latest pullback matched that sequence, hinting that sentiment-driven positioning, not fundamental deterioration, drove the current weakness. Together, the analyses outlined a fragile yet technically coherent structure dependent on Bitcoin’s ability to reclaim the $119,000 level.