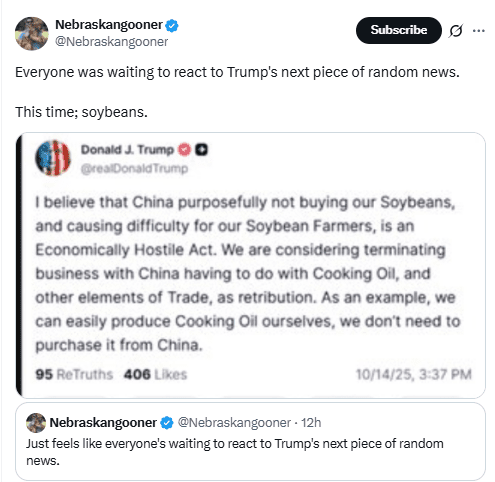

Donald Trump posted a late-afternoon message on Truth Social accusing China of “purposefully” halting U.S. soybean purchases. He called the move an “Economically Hostile Act” and said the U.S. might retaliate by terminating trade on cooking oil and “other elements of Trade.” He claimed the U.S. could produce its own cooking oil and avoid relying on Chinese imports.

The message landed at 3:37 p.m. ET, and political accounts immediately began amplifying it. Commentators pointed out that Trump’s trade messaging has often preceded sharp market swings, especially during his previous administration. This time, the target wasn’t tech giants or tariffs on EVs, but soybeans and cooking oil.

The framing of agricultural commodities as a geopolitical weapon came amid an already tense economic environment. Markets were watching for signals on tariffs, supply chains, and broader U.S.–China relations. Trump’s tone left little ambiguity: retaliation was on the table.

Risk Assets React Fast, Crypto Joins the Panic

Minutes after the post spread, crypto markets turned sharply lower. Bitcoin led the drop, slipping below key intraday levels, followed by steep declines across Ethereum and major altcoins. Analysts tied the reaction to renewed trade war fears that sent investors toward safer assets.

Futures and spot markets showed synchronized moves. Liquidation trackers recorded hundreds of millions in long positions flushed out within an hour. Exchanges reported a clear rise in trading volumes as traders adjusted to the unexpected trade rhetoric.

This wasn’t the first time Trump’s statements have rattled digital assets. During his presidency, similar trade pronouncements caused sudden volatility in equities and crypto alike. The pattern repeated: one post, rapid headlines, then market sell-offs.

Soybeans as Trade Ammunition, Again

Soybeans have long been central to U.S.–China trade disputes. In 2018 and 2019, Chinese import cuts hit U.S. farmers hard, prompting subsidies and escalating tariff battles. Trump’s latest comments revived that playbook almost word for word.

The post described China’s action as deliberate, framing it as an economic attack on U.S. soybean farmers. He presented retaliation in agricultural and related trade sectors as a simple fix, emphasizing domestic production. The language echoed earlier tariff threats that led to months of negotiations.

For markets, the mention of soybeans was more than symbolic. Agricultural disputes have historically triggered wider trade escalations, often spilling over into manufacturing, technology, and financial markets. Traders interpreted the message as the first volley in a potentially broader trade shift.

From Cooking Oil to Bitcoin Sell-offs

The cooking oil reference added a strange but telling layer. Trump framed cooking oil as an example of trade self-sufficiency, but markets heard “potential escalation.” Analysts noted that even a narrow sector threat can signal a wider protectionist turn.

Crypto traders, sensitive to macro shocks, didn’t wait for policy follow-through. The drop reflected expectations that a renewed trade conflict could weaken global growth, strengthen the dollar, and dampen risk appetite. Those factors typically push crypto lower in the short term.

While no official policy has been enacted, the speed of the market’s reaction showed how a single political statement can trigger automated responses and herd behavior. Soybeans and cooking oil might sound provincial, but traders treated the post like a macro headline.