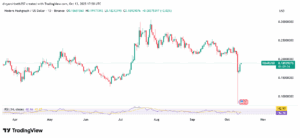

Hedera’s HBAR price fell more than 50% on Oct. 10, dropping to $0.1532, after $18 billion in forced liquidations were triggered by Donald Trump’s 100% tariff announcement on Chinese tech exports. However, HBAR has since recovered to around $0.1884, though analysts say the rebound may not mark the end of its downside phase.

Analysts Warn of Further Weakness

Crypto analyst Cosmic said the MACD indicator is “screaming” a major drop ahead for HBAR, suggesting that selling momentum remains strong despite the short-term recovery.

The MACD (Moving Average Convergence Divergence) compares short- and long-term price trends. When the MACD line moves below the signal line, it signals weakening momentum and often precedes deeper corrections.

According to Cosmic, if the bearish pressure continues, HBAR could fall as low as $0.05.

Another analyst, CryptoPulse, observed that HBAR broke below its bull flag structure, invalidating a pattern that usually signals continuation of an uptrend. Once the flag’s support failed, the same zone turned into resistance, making recovery attempts more difficult.

CryptoPulse identified $0.19 as the key resistance area. A sustained close above it, he said, could restore bullish momentum. However, failure to reclaim that level could open the door to another drop toward $0.128, which he marked as the next potential support zone.

HBAR ETF Delays Extend Market Uncertainty

The market’s decline was further weighed down by regulatory uncertainty surrounding the HBAR exchange-traded fund (ETF). The US Securities and Exchange Commission (SEC) postponed its decision on Canary Capital’s proposed HBAR ETF to Nov. 8, 2025, due to the ongoing US government shutdown, which has halted most SEC operations.

Despite the delay, the regulatory environment has grown more favorable. In September, the SEC approved generic listing standards for spot crypto ETFs, allowing exchanges like Nasdaq and Cboe to list approved digital asset ETFs without case-by-case reviews. The new framework shortened approval timelines from several months to roughly 75 days, setting the stage for faster institutional access once the shutdown ends.

ETF analysts Eric Balchunas and James Seyffart said both HBAR and Litecoin ETF filings are “at the goal line,” indicating that final approvals could follow soon after normal regulatory activity resumes.

Despite bearish signals, Hedera’s real-world integrations continue to grow. Recent milestones include Wyoming’s Frontier Stable Token (FRNT) — the first US state-issued stablecoin on Hedera — and a partnership with Qatar’s Digital Asset Lab for a Shariah-compliant digital receipt system.

Hedera also powers the Web3DORS resource management project, PwC’s Guardian sustainability platform, the Government of Maharashtra’s carbon bank initiative, and The Hashgraph Group’s TransAct system, which supports crypto-free payments for enterprises.