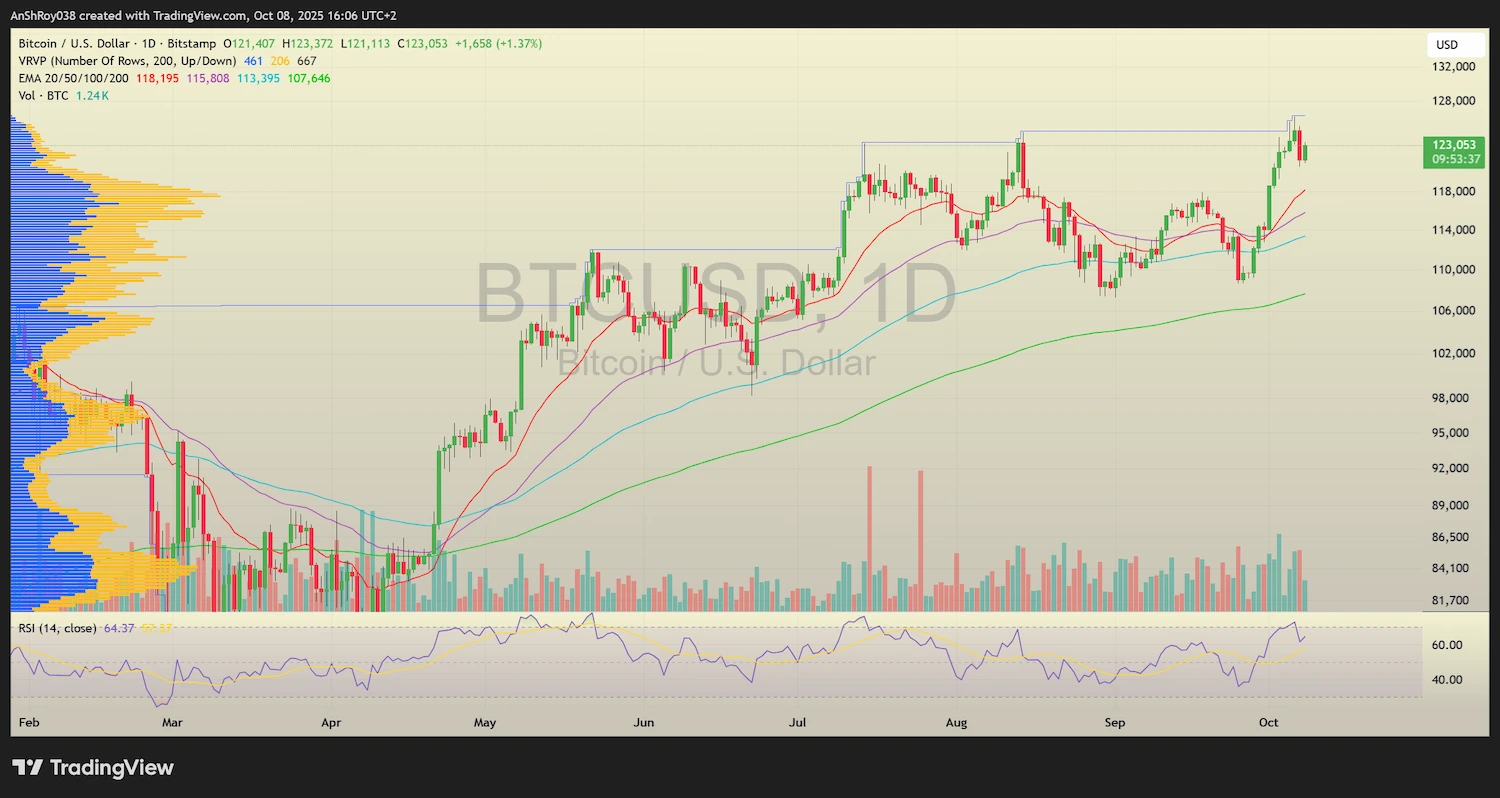

Bitcoin (BTC) price slipped after rejecting near $125,000, extending its pullback from the token’s recent all-time high. However, bulls managed to arrest the token’s fall, with BTC price climbing above $123,000 on Oct. 8.

The correction likely happened as traders locked in profits following the extended rally that started in late Sept. 2025. Market data showed renewed selling by long-term holders, hinting that whales had started distributing at higher levels.

Whale Distribution and Profit Booking Responsible for Retreat

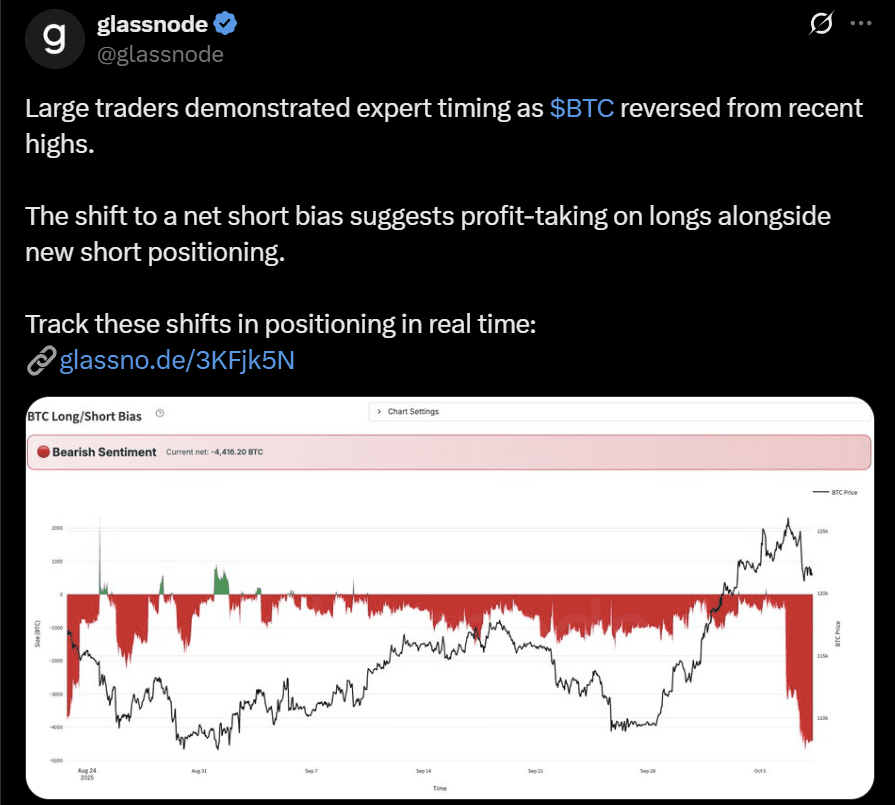

The recent downturn followed heavy activity from older Bitcoin wallets. On-chain data showed long-term holders began moving coins as prices neared $125,000. This is a pattern that has often marked profit-taking phases in past cycles. Glassnode’s long/short bias metric confirmed the shift, with traders closing longs and opening fresh shorts.

The result was a net short bias exceeding 4,000 BTC, reflecting a tactical pullback by large entities.

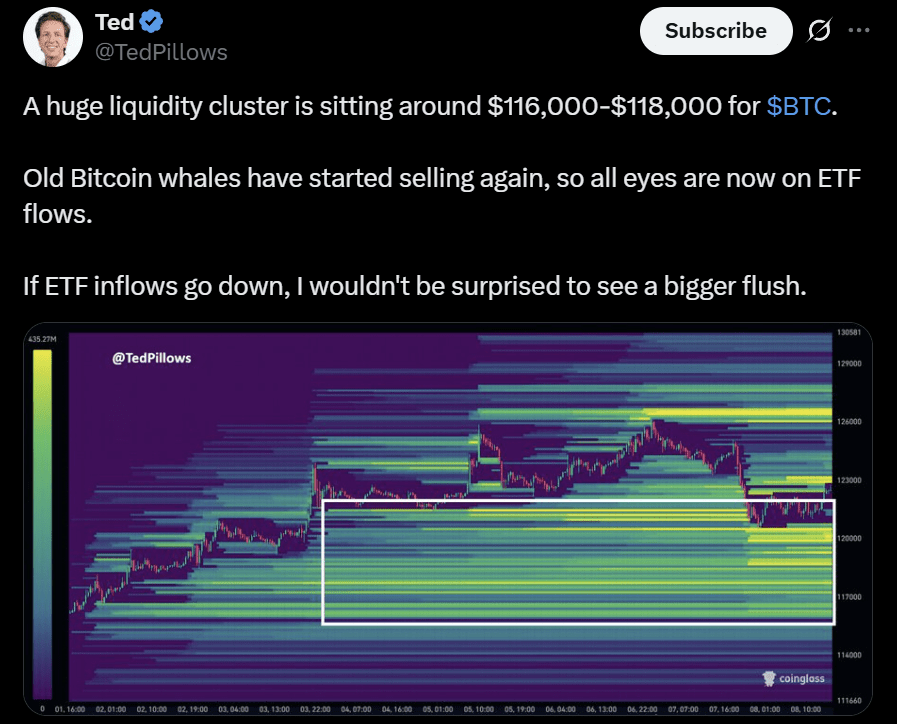

Market analysts, including Ted and Ash Crypto, pointed to the same behavior. Ted highlighted renewed whale movements and dense liquidity between $116,000 and $118,000.

The analyst noted that older coins resurfaced as spot ETF inflows cooled.

Analysts Outline Bitcoin’s Technical Path

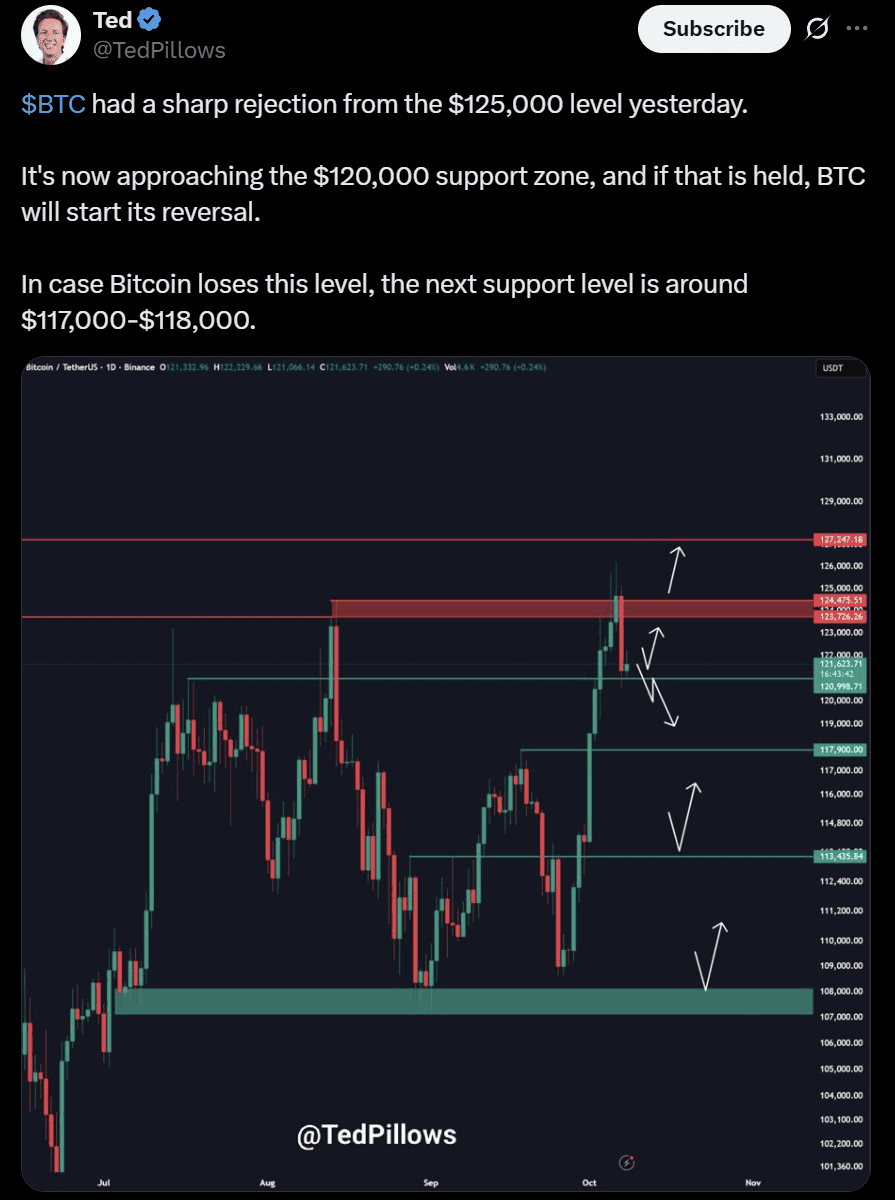

Bitcoin price’s pullback continued to shape analyst projections after the $125,000 rejection. Market analyst Ted Pillows identified immediate support near $120,000 and a deeper demand zone between $117,000 and $118,000.

Pillows’ chart also highlighted layered liquidity levels where large bids clustered, suggesting the decline could stabilize if ETF inflows held steady. Moreover, the analyst added that losing $120,000 would expose the BTC USD pair to a potential test of lower supports, though he called the move a “healthy reset.”

Meanwhile, independent market analyst Dal adopted a shorter-term view, pointing to the $120,000 zone as a likely long-entry opportunity.

Moreover, Dal’s four-hour chart outlined a clean retracement structure, with the price positioned to revisit the daily open before attempting another push toward $124,000. Draco’s projection implied that intraday sentiment favored accumulation at lower levels rather than further selling.

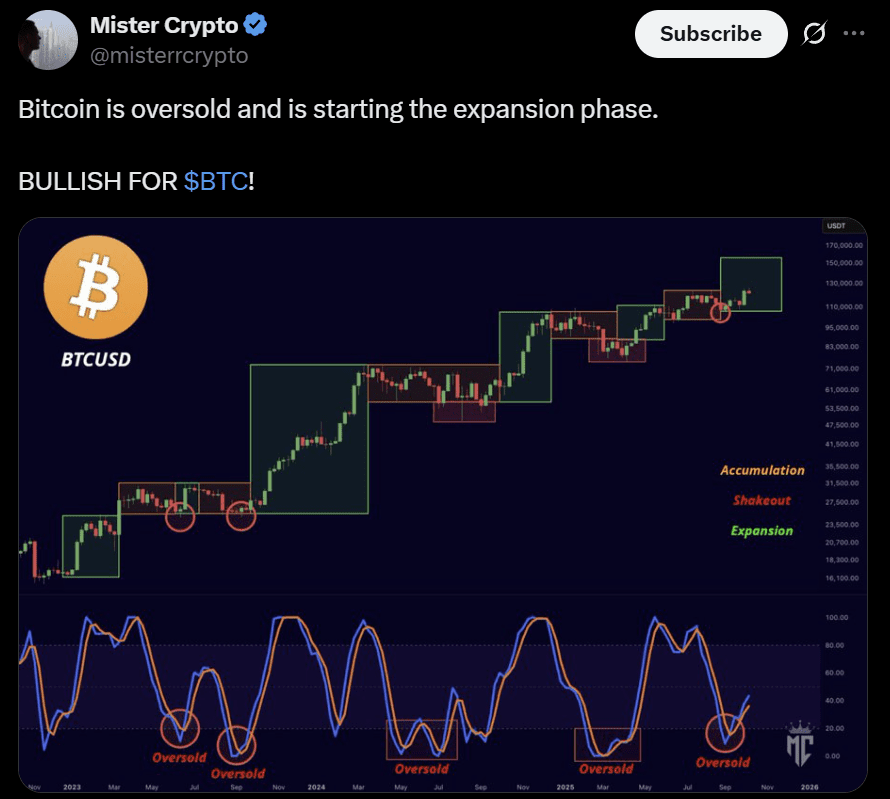

On the broader trend, Mister Crypto maintained a bullish stance. The analyst identified repeated “oversold” readings on the stochastic indicator that historically preceded expansion phases.

According to Mister Crypto’s post, Bitcoin completed its shakeout phase and was transitioning into expansion, mirroring earlier cycles that sparked sharp rallies.

Meanwhile, Ash Crypto emphasized the weekly MACD setup, where a bullish crossover was forming.

Additionally, the analyst described the current phase as a shakeout before a major breakout, noting that every prior crossover in this zone triggered multi-week uptrends. Together, the analyses pointed to a temporary cooldown inside a structurally bullish pattern, with whales’ profit-taking viewed as preparation for Bitcoin’s next expansion phase.