Litecoin (LTC) price spiked on Oct. 1 and 2, briefly reclaiming momentum with over 12% gains before selling pressure and regulatory uncertainty pumped the brakes early on Oct. 3. The token’s rally met resistance near recent highs, though bulls made their presence felt near $118.

Traders likely reacted to uncertainty around the delayed ETF decision, which resulted in Litecoin price halting its rally. Despite the pullback, analysts like Javon Marks, Captain Fabik, etc. remained bullish on LTC’s price potential, with some, like Marks, even handing out LTC price targets past $300.

Analysts Outline Diverging Litecoin Targets

After Litecoin’s brief spike lost steam, market participants turned to social media to shift through to analyst projections. One analyst, Alex Clay, highlighted a bullish flag within a long accumulation range, arguing that consolidation below resistance positioned LTC for an eventual breakout.

Clay set conservative targets near $280 and $386, framing them as realistic if LTC price action continued rallying. However, realistically, the analyst’s chart sets a more plausible target near the channel’s upper boundary in the $175-$200 range.

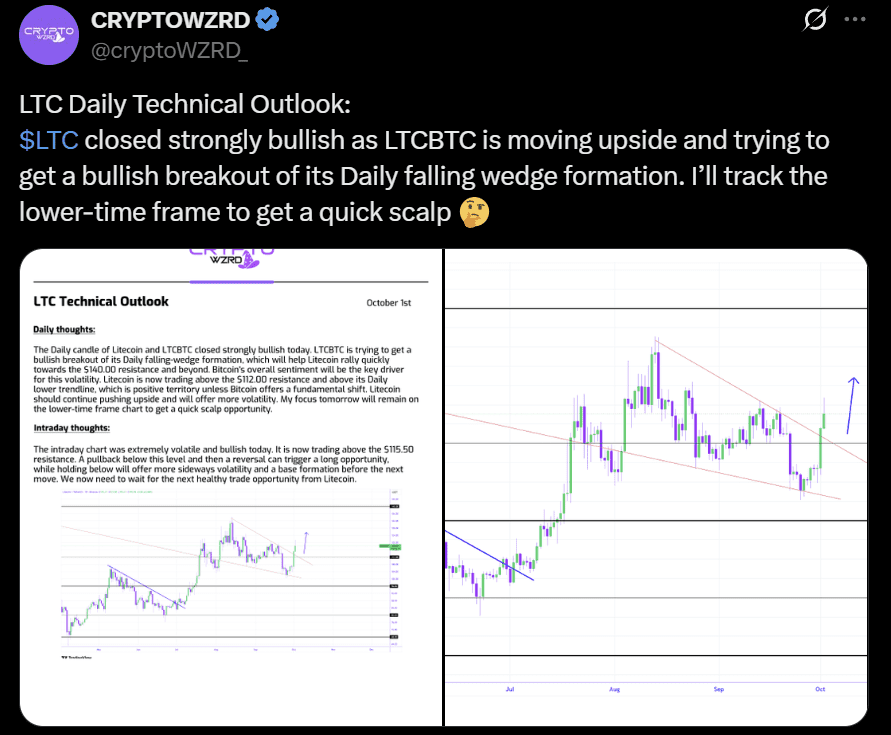

Short-term traders tracked the same rally through different structures. Cryptowzrd pointed to a falling wedge breakout on the daily chart, with price reclaiming $112 support and eyeing $140 as the next barrier.

The analyst described the move as volatile but still favorable while Bitcoin sentiment stayed stable.

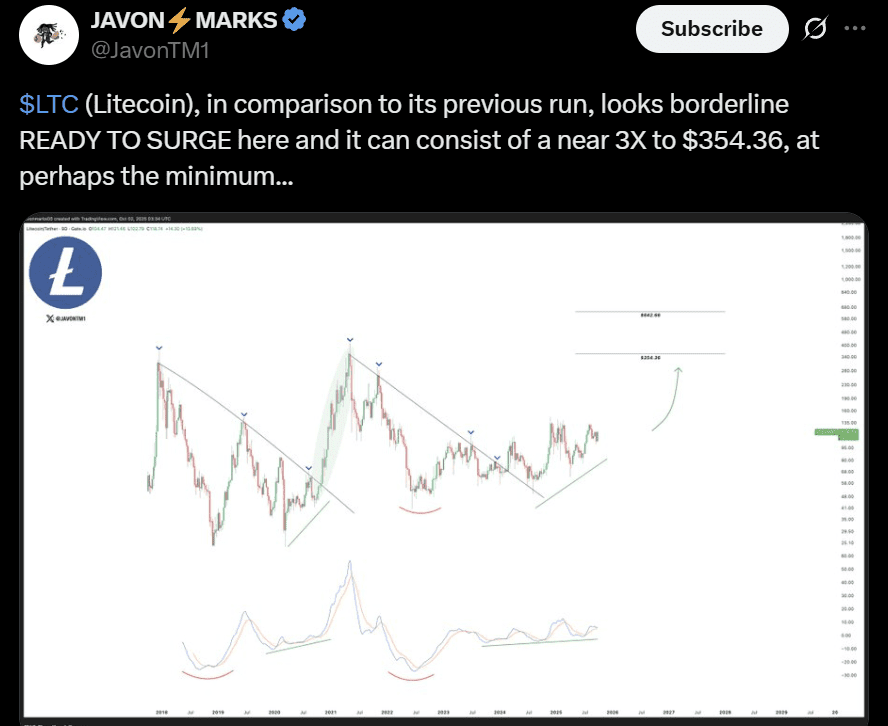

Others leaned toward long-term patterns. Independent market analyst Captain Faibik emphasized a multi-year symmetrical triangle and suggested Litecoin could climb more than 500 percent toward $780. Javon Marks added similar optimism, comparing the setup to previous cycles and projecting gains near $354, with a potential extension to $642.

A climb toward $780 or even $642 for the LTC USD pair requires extended market conditions unlikely to materialize in the short term. More immediate ranges reflected the resistance zones shown by recent volume clusters near $140 and $170. Traders largely recognized these levels as decisive before any attempt at broader rallies.

While technical structures signaled recovery potential, their execution depended on sustained demand and macro stability.

ETF Decision Adds to Market Strain

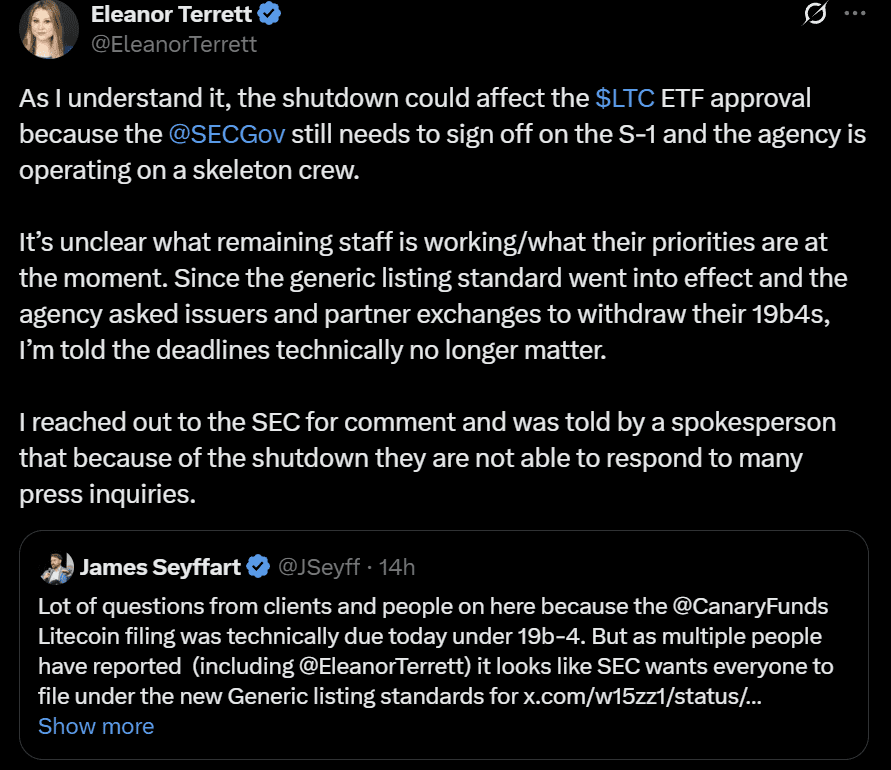

The optimism around Litecoin’s charts collided with regulatory uncertainty. The SEC was expected to decide on Canary Funds’ Litecoin ETF on Oct. 2, but the deadline passed without action due to the U.S. government shutdown. Issuers had already withdrawn 19b-4 filings after the agency pushed for the new generic listing standard, leaving the old timelines in doubt.

Eleanor Terrett noted the shutdown left the SEC operating with limited staff, raising questions about priorities. Terrett said S-1 approvals still required signatures, a process stalled by reduced capacity. James Seyffart added that the government freeze only compounded the confusion, since the agency’s shift in procedure had already blurred filing deadlines.

The absence of clarity came as traders weighed whether technical signals could carry enough strength without a clear regulatory path. The pullback on Oct. 3 reflected that hesitation. Investors had expected a decision to validate market momentum, but the silence instead fed caution.

However, Bloomberg ETF expert Eric Balchunas stated that it was a “rain delay,” stating that there was nothing anyone could do about it. Still, the lack of immediate approval placed near-term optimism under pressure. The stalled regulatory movement could weigh heavily on the market’s enthusiasm about Litecoin’s future.

The story isn’t over — check back with us for the latest twists on the SEC’s ETF approval delays and what a government shutdown could mean for crypto markets.