After gaining 14% over the week amid a broader crypto rally fueled by U.S. government shutdown fears, Dogecoin (DOGE) is now trading near $0.25. Analysts say if the token holds its $0.23 support and breaks past resistance levels, the path toward $1 could reopen. Will DOGE really reach $1 — and if so, when? Let’s examine.

Analysts See Breakout Patterns Emerging

Crypto analyst Trader Tardigrade on X argues that Dogecoin has repeated the same pattern over several years: brief breakdowns under its support trendline followed by explosive rebounds. In past cycles, these dips were temporary shakeouts before DOGE surged to new highs. According to him, the recent retest of the $0.23–$0.25 zone fits the same script, meaning a strong upward move could follow.

Ali, another analyst, describes the current range as “an accumulation phase.” His view is based on DOGE’s long-term chart, which shows the token moving sideways within a channel since 2022. In simple terms, accumulation means larger investors quietly buying while the price stays stable.

Together, both analysts argue that DOGE is at a critical juncture — if history repeats, the token could be preparing for its next leg upward.

Dogecoin Market Structure Shows Accumulation Backed by Volume

Blockchain data from Santiment shows a shift in Dogecoin’s ownership patterns. Wallets holding between 1 million and 10 million DOGE have been steadily accumulating, while very large holders in the 10 million to 100 million range reduced their positions.

This redistribution is often seen as healthy. When supply is spread among more wallets instead of concentrated in a few, the risk of one large holder crashing the price with a sudden sell-off is reduced.

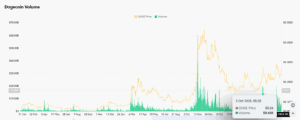

A key factor making this rally different from earlier false starts is trading volume. On Oct. 3, Dogecoin recorded $8.68 billion in daily turnover, compared with just $2–3 billion in most of September. In crypto, rallies backed by rising volume tend to last longer because they show strong participation, not just a few traders moving the market.

$2.5M Longs Wiped Out as Futures Heat Up

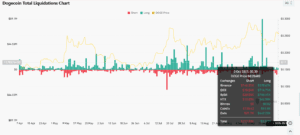

The derivatives market also signals rising interest. According to the CoinGlass data, Dogecoin’s open interest in futures contracts has reached $4.63 billion, the highest in months. Rising open interest means more money is flowing into DOGE bets.

Liquidation data shows the risks behind this surge. On October 3, more than $2.5 million in long positions were liquidated, compared with only about $217,000 in shorts. The bulk of these wiped-out longs came from Bybit, OKX, and Binance.

It means many traders who borrowed heavily to bet on DOGE’s rise lost their positions as DOGE prices briefly pulled back. While this looks negative at first glance, it can actually be healthy for the market — because it clears out weak hands and reduces the chance of a sudden collapse from overcrowded longs.

At the same time, the relatively small size of short liquidations shows that a true short squeeze has not yet taken place. If shorts pile in and DOGE breaks above resistance, forced liquidations on that side could accelerate a rally toward $0.30 and beyond.

Dogecoin’s path to $1 may ultimately depend on Bitcoin’s strength. Bitcoin trades around $120,000, moving inside a rising channel since early 2023. As long as BTC stays above $114,000 support, the broader crypto trend remains bullish.

Historically, DOGE has lagged Bitcoin’s moves but followed soon after. In 2021, Bitcoin hit record highs before Dogecoin exploded in its own rally. If BTC continues higher toward $130,000, analysts believe DOGE could benefit from renewed risk appetite across altcoins.

$1 DOGE Target Hinges on Breaking $0.30 — Not Likely Near Term

DOGE to USD chart shows the first key level at $0.23 support, which has held multiple times over the past two years. If DOGE stays above this zone, buyers remain in control. A breakdown below $0.23, however, could open the way to $0.20.

On the upside, the chart places immediate resistance in the $0.28–$0.30 range. This barrier capped rallies in both August and September. A decisive breakout above $0.30 would confirm strength and open the way for higher targets. The next zone to watch is $0.45, which lines up with past rejection points, while $1 remains a longer-term goal if momentum, volume, and Bitcoin’s trend align.

Momentum indicators support this setup. The Relative Strength Index (RSI) currently reads 55, which is neutral. For context, RSI above 70 signals overbought conditions, while below 30 suggests oversold. Sitting mid-range, DOGE still has room to climb before becoming overheated.

The next big shift for DOGE could happen fast — check back here for real-time updates and expert analysis.