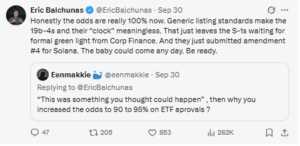

Bloomberg ETF analyst Eric Balchunas said on X that a spot Solana ETF “can come any day now.” Bitcoin surged over 60% around its ETF approval in January 2024, while Ethereum gained nearly 50% before its own launch in May 2025. Will Solana follow the same path? Let’s examine.

Bitcoin and Ethereum ETFs Sparked Big Rallies — Can Solana Repeat the Pattern?

Bitcoin (BTC) gained more than 60% amid ETF approval speculation, but when it was finally approved in January 2024, the price climbed further to a new all-time high above $73,000 by March. ETF inflows reinforced the rally, with hundreds of millions of dollars entering spot Bitcoin ETFs on peak days.

Ethereum (ETH) gained nearly 50% in the three months before its ETF approval in May 2025, reaching $4,000. After approval, ETH corrected briefly but stabilized as institutional inflows supported demand.

Solana price may rally after ETF approval as it would provide regulated access for institutions and retail investors, removing custody and wallet risks that limit adoption. Some filings include staking provisions, which could reduce circulating supply if ETF shares are backed by staked SOL. That would amplify price pressure if demand rises.

Why Solana May Not Replicate BTC and ETH

Solana’s market capitalization is close to $100 billion, compared with Bitcoin’s $2 trillion peak and Ethereum’s $400 billion levels. This makes SOL more volatile but less able to absorb institutional inflows at scale.

Bitcoin is seen as digital gold and Ethereum as the foundation of decentralized finance. Solana, known for low fees and high throughput, lacks the same long-term narrative among traditional investors.

The network has also faced several outages in recent years. Although stability has improved, risk-averse institutions may view Solana as less reliable than Bitcoin or Ethereum.

Competition adds another challenge. Bitcoin and Ethereum dominate their categories, while Solana competes directly with Avalanche, Aptos, and Sui. Institutions entering the Layer-1 space may diversify exposure rather than allocate heavily to SOL alone.

Regulatory clarity remains uncertain. Bitcoin is broadly classified as a commodity, and Ethereum has been allowed to trade ETFs on that basis. Solana was identified by the SEC in lawsuits against exchanges as a potential unregistered security, and that designation could limit inflows even if an ETF is approved.

ETF Approval Could Trigger $400–$500 Rally, Delay Risks $150 Retest

At the time of this writing, SOL to USD trades near $217, consolidating inside a rising channel that has defined its price since mid-2025. The support base lies between $190 and $200, which has held during recent pullbacks. If this range breaks, the next demand zone appears around $170, where buyers previously defended the trend.

On the upside, resistance at $215–$220 is the immediate barrier. A clean breakout above this zone, supported by strong volume, could open the way to $250–$260, which coincides with the upper band of the channel and past supply levels.

Momentum indicators remain neutral. The relative strength index (RSI) sits around 51, showing neither overbought nor oversold conditions. This leaves room for further upside without triggering exhaustion signals.

Moving averages also confirm the trend. The 50-day EMA is rising above $200, while the 200-day EMA sits near $170. Solana trading above both moving averages suggests the long-term trend remains intact. If ETF approval triggers inflows, staying above the 200-day EMA will be a key confirmation for bulls.

In a base-case scenario, ETF approval could push SOL toward $250–$300 in the short term. Sustained inflows, similar to Bitcoin’s post-ETF phase, could lift the token into the $300–$350 range. In an extended bullish case, with institutional adoption and ETF structures reducing supply through staking, Solana could stretch toward $400–$500.

On the downside, rejection or delay of approval could see Solana retest $190–$200, and if that fails, a deeper correction to $150–$170 is possible.

Return here for in-depth reporting as developments around a Solana ETF unfold.