Project-facing pages and feeds show no product, governance, or integration notice dated Oct 1, 2025. The most recent operational guidance still references user migration materials.

Public trackers and exchange info pages refreshed market data but did not add new feature notes. Those listings focus on token basics and general FAQs rather than development milestones. Therefore, today’s news cycle centers on status, not change.

Community posts and videos discuss earlier items, including withdrawals and account moves, yet they do not introduce verifiable new instructions from the project. As a result, the latest confirmed directive remains the same as prior reminders.

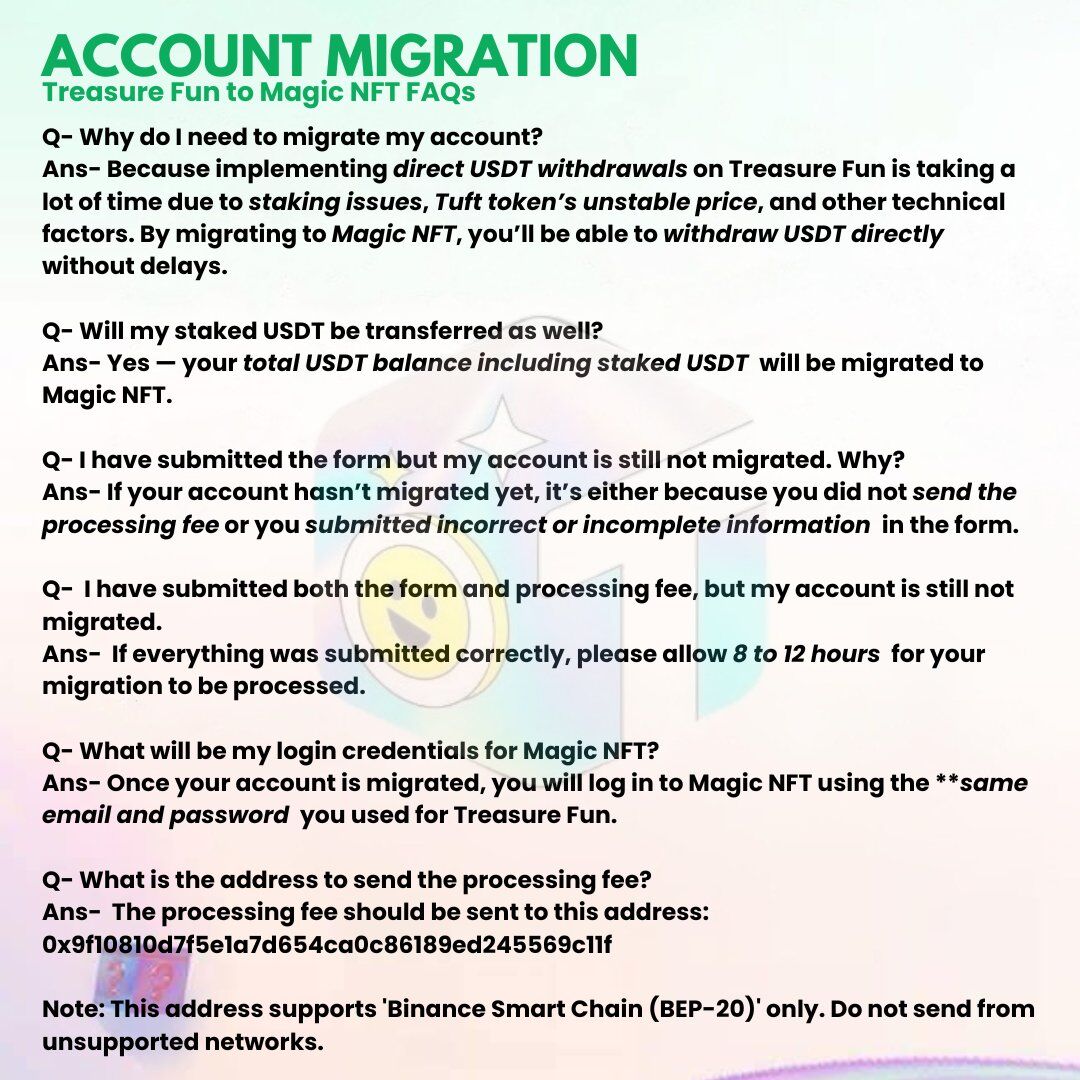

Migration to Magic NFT remains the standing directive

Prior notices continue to direct Treasure Fun users to migrate accounts to Magic NFT. The move enables direct USDT withdrawals and preserves staked balances for eligible users, according to the project’s earlier Q&A thread. That language is still visible and unchanged.

Medium posts from recent months describe the shift in branding and operations, framing Magic NFT as the successor environment. These articles emphasize that Treasure Fun/Treasure NFT activity transitions into Magic NFT. They do not add new feature dates.

A separate Medium note last week referenced “Magic NFT shut down,” but context and wording are inconsistent across posts. There is no corroborating notice on the primary feed. Consequently, the only stable, attributable instruction remains the previously shared migration path.

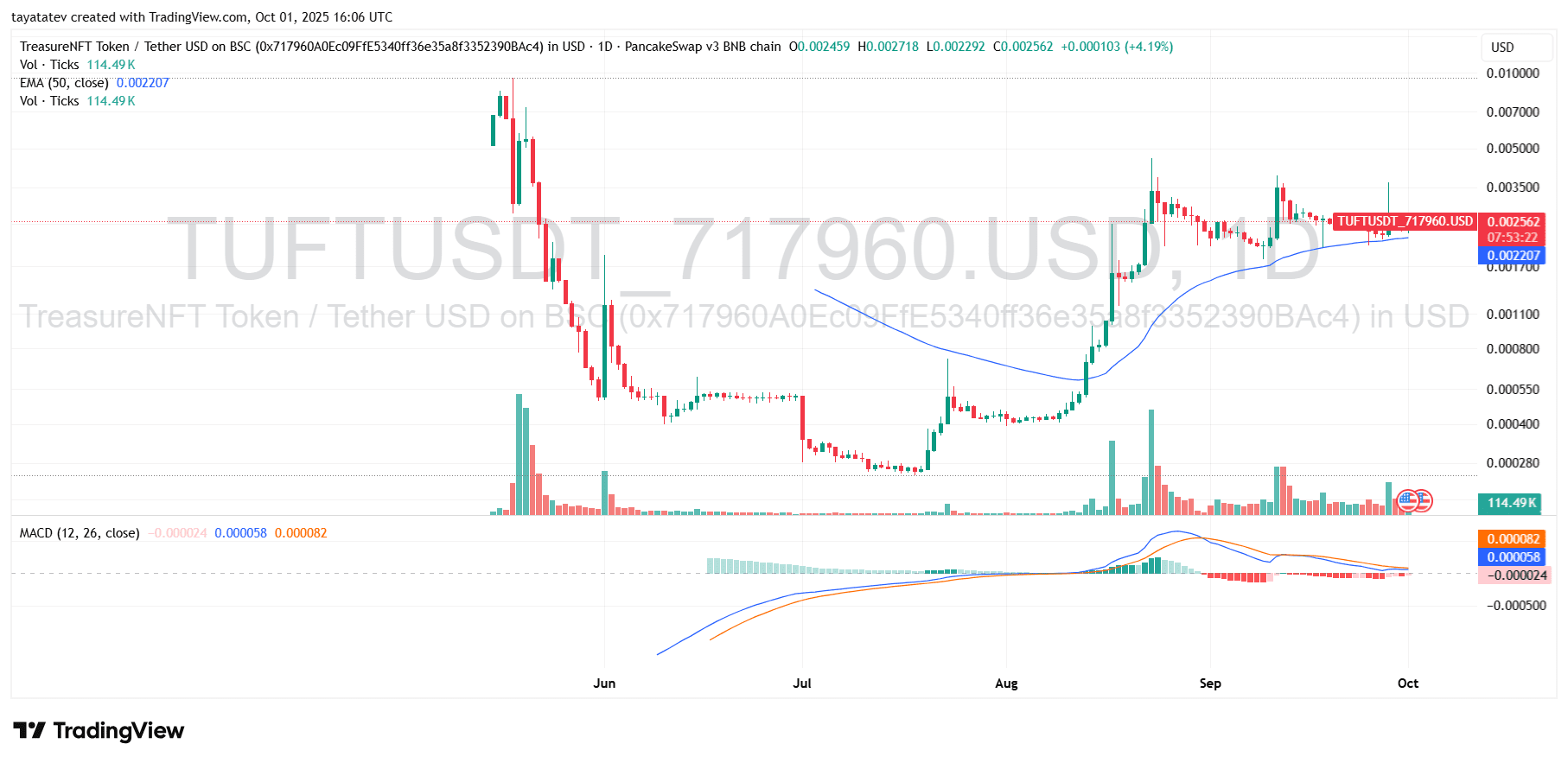

TUFT bounced off the 50-day EMA near 0.0022 and closed back around 0.0026. Buyers defended the moving average after a late-September pullback. Volume stayed moderate while candles compressed along a short rising support line.

The chart shows a narrow range between support at 0.0022 and layered resistance around 0.0029–0.0030. Since mid-September, higher lows formed while highs capped below 0.0030. This structure signals consolidation after August’s rally.

MACD sits just below the signal line with a small negative histogram. Momentum is neutral, yet the bars are flattening, which often precedes a break. Price staying above the EMA keeps the near-term bias steady.

A daily close above 0.0030 would open a move toward 0.0033–0.0036, the early-September supply zone. If that break comes with stronger volume, the prior peak near 0.0036 becomes the logical retest area. Until then, expect continued range trading.

On the downside, losing 0.0022 would weaken the setup and expose 0.0020 and 0.0017 as next supports. MACD turning down further would likely confirm that fade. Therefore, the 50-day EMA is the key line for bulls to protect in the short term.