The Cardano Foundation published a new roadmap on Sept. 23 that concentrates on six focus areas, led by support for stablecoin liquidity and standards work. The plan outlines near- to mid-term priorities while emphasizing programs that channel resources to builders.

Moreover, the roadmap signals reduced direct Foundation control in favor of community-driven execution. It frames contributions through standards, education, and infrastructure so external teams can ship faster on Cardano.

Coverage and explainers today highlight the liquidity thrust, stating the Foundation aims to inject significant ADA into stablecoin initiatives to strengthen DeFi plumbing and on/off-ramps. This stablecoin focus appears across multiple summaries of the roadmap.

Intersect, Cardano’s member-based organization, opened voting for its 2025 Board of Directors and pushed a GovTool update to support the window. The election follows last year’s first full-scale vote and sets leadership for the next phase of community governance.

Additionally, Intersect positioned the election as part of a broader budget and operations cadence, with regular public development updates. The organization reiterated its role in coordinating open development around Cardano governance.

As voting proceeds, Intersect directs members to participate through its portal and public channels on X, maintaining transparency around process and timelines.

Earlier this month, Cardano finalized the first fully community-elected Constitutional Committee, replacing the interim body on-chain. Seven members were elected by stake-based representatives to uphold the Cardano Constitution and review governance actions.

The election formalizes constitutional checks inside Cardano’s governance system. Intersect’s recap details how the vote worked and why the committee is central to future decision-making.

Cardano.org’s notice places the milestone on Sept. 7 and underscores the transition from interim arrangements to a durable governance layer bound by the Constitution.

Weekly dev reports track Leios, Plutus, Mithril; developer portal rebuilt

Recent weekly reports list work on the Leios scaling CIP draft, ledger features, and tooling across Plutus and Mithril. The Sept. 5 report also notes ecosystem updates alongside core engineering items.

In parallel, Essential Cardano’s trackers continue to publish incremental progress snapshots that detail commits, issues closed, and component-level changes across teams. These posts provide the running log of implementation activity.

Furthermore, the Cardano Foundation rebuilt the Developer Portal with refreshed docs, tooling entry points, and standards resources to lower onboarding friction for builders. The update rolled out in late August and is now live.

Berlin Summit program set with headline speakers in November

Cardano Summit 2025 will run in Berlin on Nov. 12–13, with headline speakers including investor Tim Draper and ecosystem leads. The Foundation announced the lineup on Sept. 16 and continues to add program details.

The public speaker list features names from payments, venture, and gaming, alongside Cardano leadership. The page remains the reference for the confirmed roster.

As preparations continue, organizers frame the event as a venue for enterprise and developer tracks, coinciding with the governance and roadmap steps outlined this month.

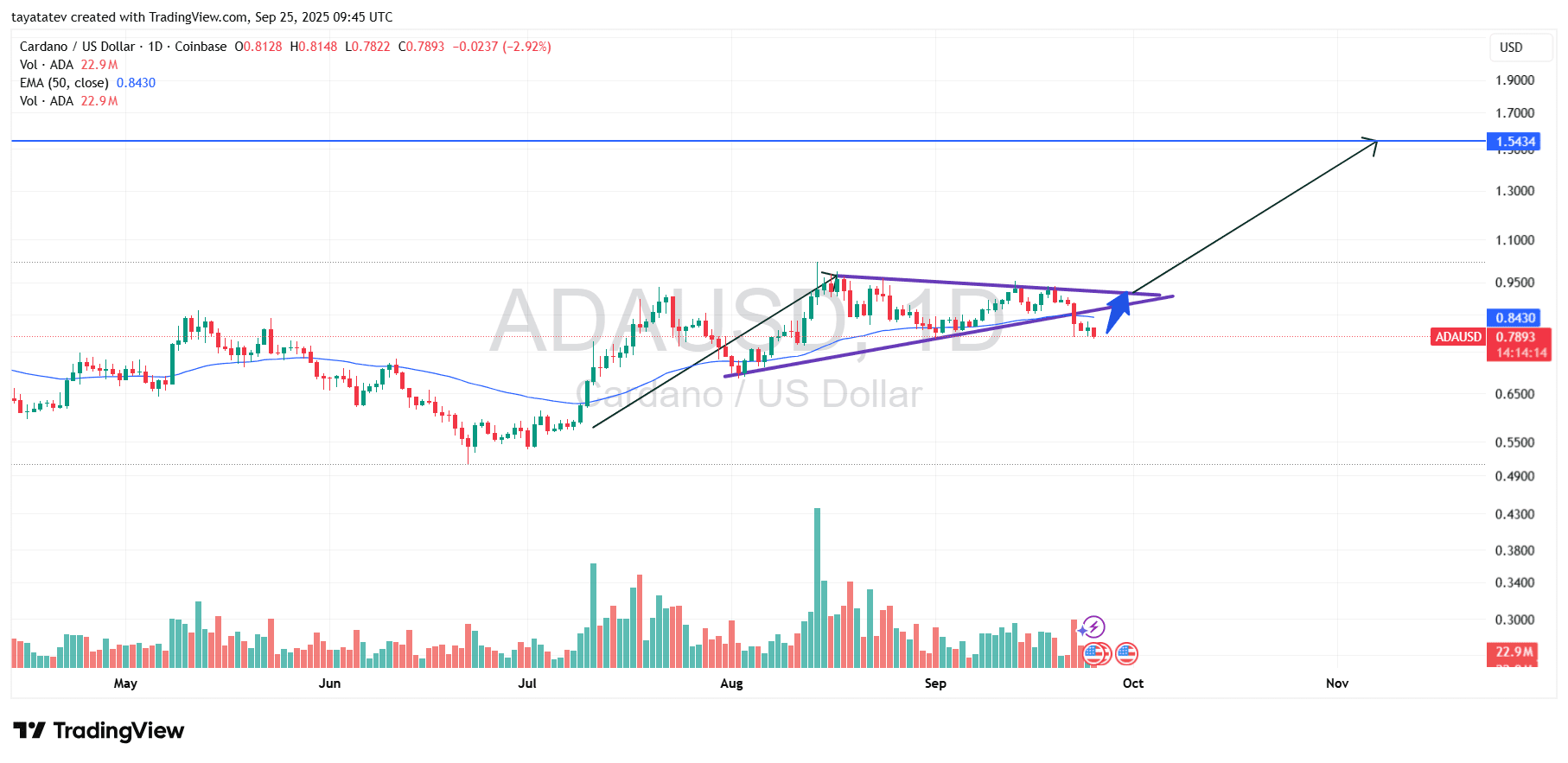

ADA forms rising wedge; conditional 95% upside points to $1.54

Cardano’s daily ADA/USD chart (Coinbase) dated Sep. 25, 2025 shows an ascending structure that matches a rising wedge. A rising wedge is a pattern of higher highs and higher lows that converge into a narrowing channel. The plot also shows volume near 22.9 million and the 50-day exponential moving average around $0.843, while price prints near $0.789.

Moreover, the chart indicates price has dipped just below the wedge boundary. The slip arrives amid broader market inconsistency today, so the rejection appears driven by cross-market pressure rather than a clean technical failure. Even so, the setup still tracks a maturing wedge whose apex sits just overhead, keeping the pattern in focus.

Furthermore, if traders confirm a bullish resolution with a decisive close back above the wedge line and the 50-day exponential moving average, the measured move on this chart implies a sharp advance. From the current $0.789 area, a 95% projection calculates to roughly $1.539, which aligns with the drawn target zone near $1.54. Consequently, confirmation would shift near-term bias to the upside, while failure to reclaim the wedge and the 50-day exponential moving average would keep momentum muted.

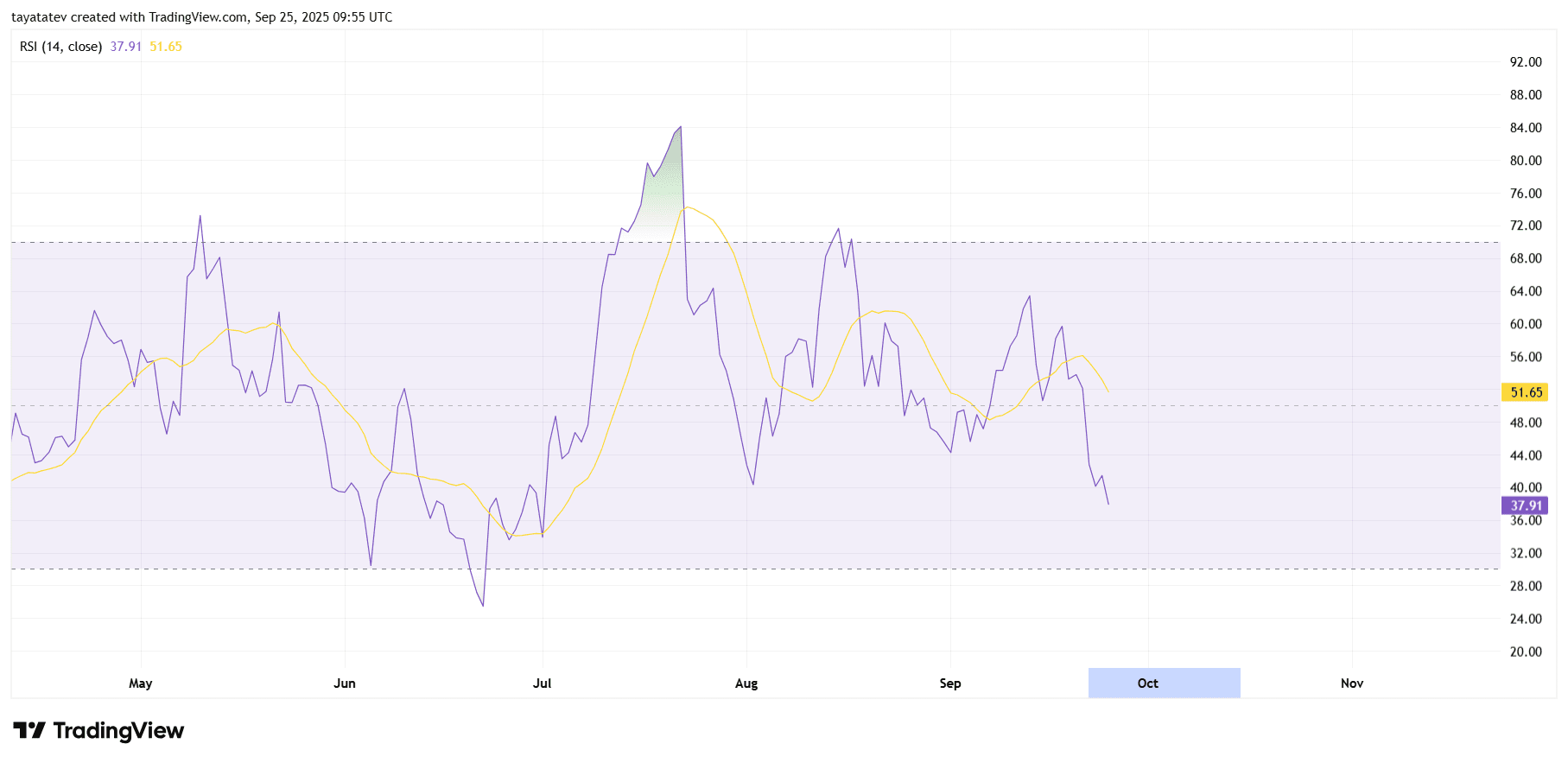

ADA momentum weakens on daily RSI; not oversold yet

Cardano’s daily Relative Strength Index prints near 37.9, below the neutral 50 line and under a downward-sloping signal line around 51.7. This placement shows bearish momentum, yet it stays above the 30 oversold threshold. Therefore, conditions point to pressure without a capitulation signal.

Moreover, the indicator shows a sequence of lower highs from August into late September while price largely moved sideways. That pattern confirms negative momentum divergence carried into this week. Until RSI reclaims the 45–50 band, rallies will face resistance from sellers fading bounces.

However, the setup still allows for a rebound if RSI stabilizes above the 35 zone and turns up. A sustained close back through 45 and then 50 would flag improving momentum and open room for trend repair. Conversely, a decisive break toward 30 would indicate growing downside force and raise the risk of a deeper retest before any durable recovery.

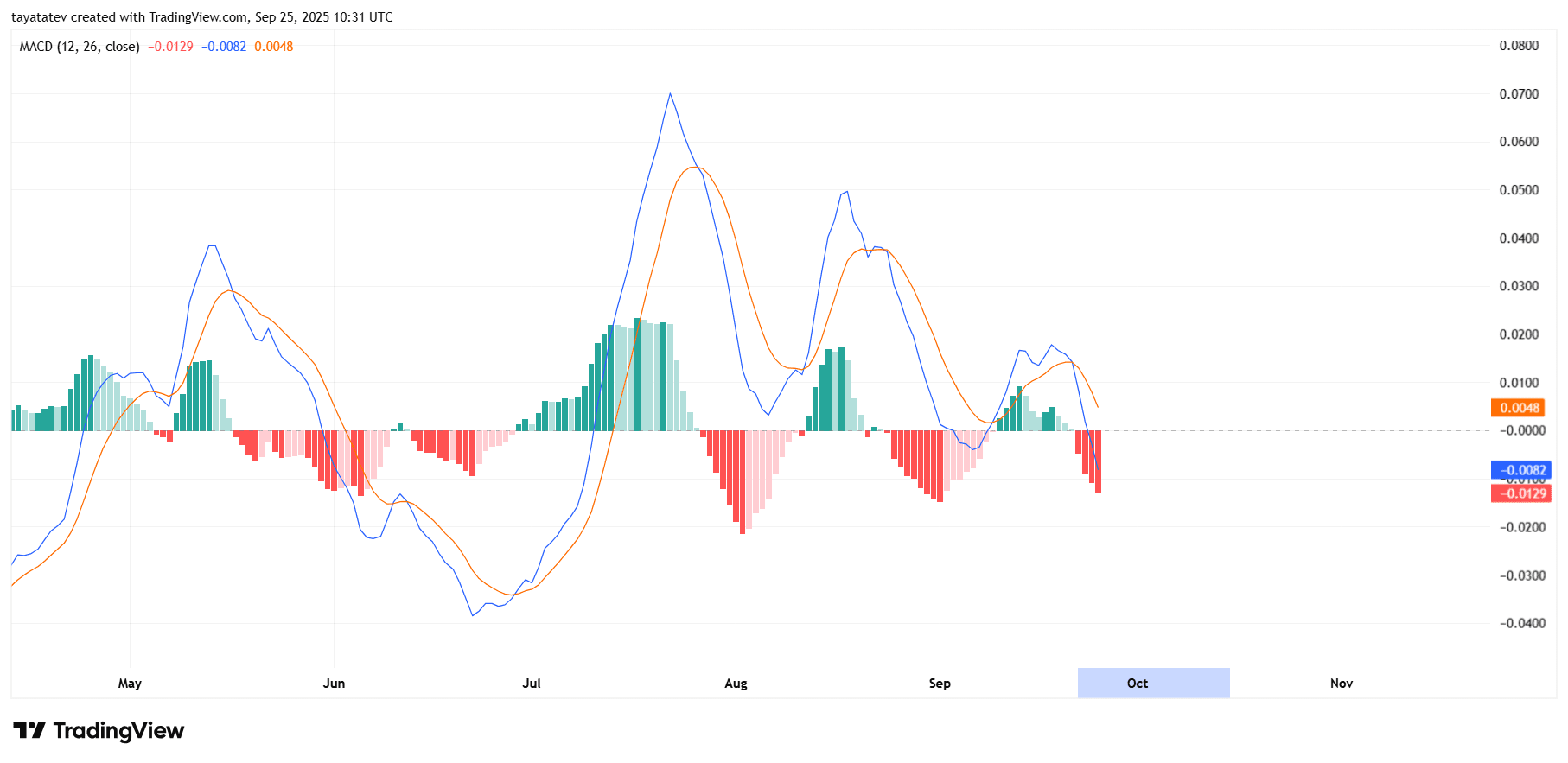

ADA daily MACD turns bearish at the zero line

Cardano’s daily Moving Average Convergence Divergence shows a fresh bearish turn. The MACD line sits near -0.008 while the signal line holds around 0.005, leaving the histogram at about -0.013 and growing. This placement confirms a bearish cross below the zero line, which signals downside momentum rather than neutral drift.

Moreover, the indicator rejected an early-September attempt to hold above zero and has since rolled over with lower MACD highs. The red histogram bars have expanded over the past few sessions, so momentum is accelerating to the downside. Until the MACD flattens and the histogram contracts toward zero, rallies will face pressure from weakening trend strength.

However, conditions can stabilize if the histogram starts printing smaller red bars and the MACD line curls back toward the signal line. A bullish recross above the signal and a move back over the zero line would mark momentum repair and would align with any price reclaim attempts visible on the chart. Absent that repair, the MACD continues to argue for caution on upside follow-through.