Ripple and Securitize enabled a smart-contract flow that lets holders of BlackRock’s BUIDL and VanEck’s VBILL tokenized Treasury funds redeem shares into Ripple USD (RLUSD). The companies framed the feature as a compliant, always-on off-ramp for on-chain funds. Coverage today reiterated the September 23 announcement and its operational scope.

Industry write-ups emphasized how the mechanism provides programmable liquidity for tokenized assets without touching exchange rails. The process routes redemptions through Securitize’s infrastructure and settles into RLUSD on XRPL. That structure focuses on fund plumbing rather than secondary-market trading.

Analysts noted the move as part of a broader push to standardize cash-like settlement for tokenized instruments. Today’s mentions tied the update to ongoing experiments with tokenized Treasuries across major managers. Ripple’s own channels highlighted the integration earlier this week.

XRPL default UNL migration nears cutoff

XRPL operators were reminded to migrate servers to the XRPL Foundation’s new default Unique Node List before the old list is shut down on September 30, 2025. The Foundation’s guidance says nodes on newer configurations may already point to the correct keys and URL, while upgraded legacy nodes must change settings to avoid service issues. The full deprecation lands in January 2026.

Trade press and tracking sites repeated the deadline and warned that lagging validators could see connectivity problems. The notices describe a straightforward configuration change, yet advise operators to verify keys and sources. The timeline remains unchanged as of today.

Community alerts on X echoed the migration status and directed admins to the Foundation’s documentation. Posts today and earlier in the week circulated the same dates and the risk of running the deprecated list. No alternative extension was announced.

Flare launches FXRP for DeFi use

Flare said its FAssets system is live on mainnet with FXRP, letting XRP holders mint a wrapped asset for use across Flare-based DeFi apps. At launch, minting carries a first-week cap to throttle initial supply and stabilize integrations. Project materials list supported bridges and early liquidity venues.

Independent reports today detailed the same one-week cap and outlined where users can obtain FXRP or bridge assets. Early incentives target liquidity pools, with rewards distributed in network tokens as the rollout proceeds. The focus remains on functionality rather than market impact.

Follow-up coverage explained how FAssets convert non-smart-contract tokens into ERC-20-style assets for wider DeFi compatibility. The FXRP path adds another option for XRP holders seeking on-chain utility beyond XRPL-native apps. The cap is set to increase over time subject to network conditions.

Institutional DeFi roadmap frames the week

Ripple this week outlined an institutional DeFi roadmap for XRPL, pointing to a native lending protocol and confidentiality features on the ledger. The company said compliance tools such as Credentials and Deep Freeze are already available to issuers and developers. The plan positions XRPL for regulated tokenization and credit workflows.

Specialist outlets summarized the roadmap’s components and timing, including transaction simulation and a multipurpose token standard. Coverage places these tools alongside the RLUSD fund off-ramp as building blocks for institutional adoption. The materials do not address secondary-market pricing.

Together, today’s updates center on infrastructure: settlement rails for tokenized funds, validator hygiene on XRPL, and wrapped-asset access via Flare. Each aims to reduce operational friction for institutions and developers. No changes to previously announced dates were reported.

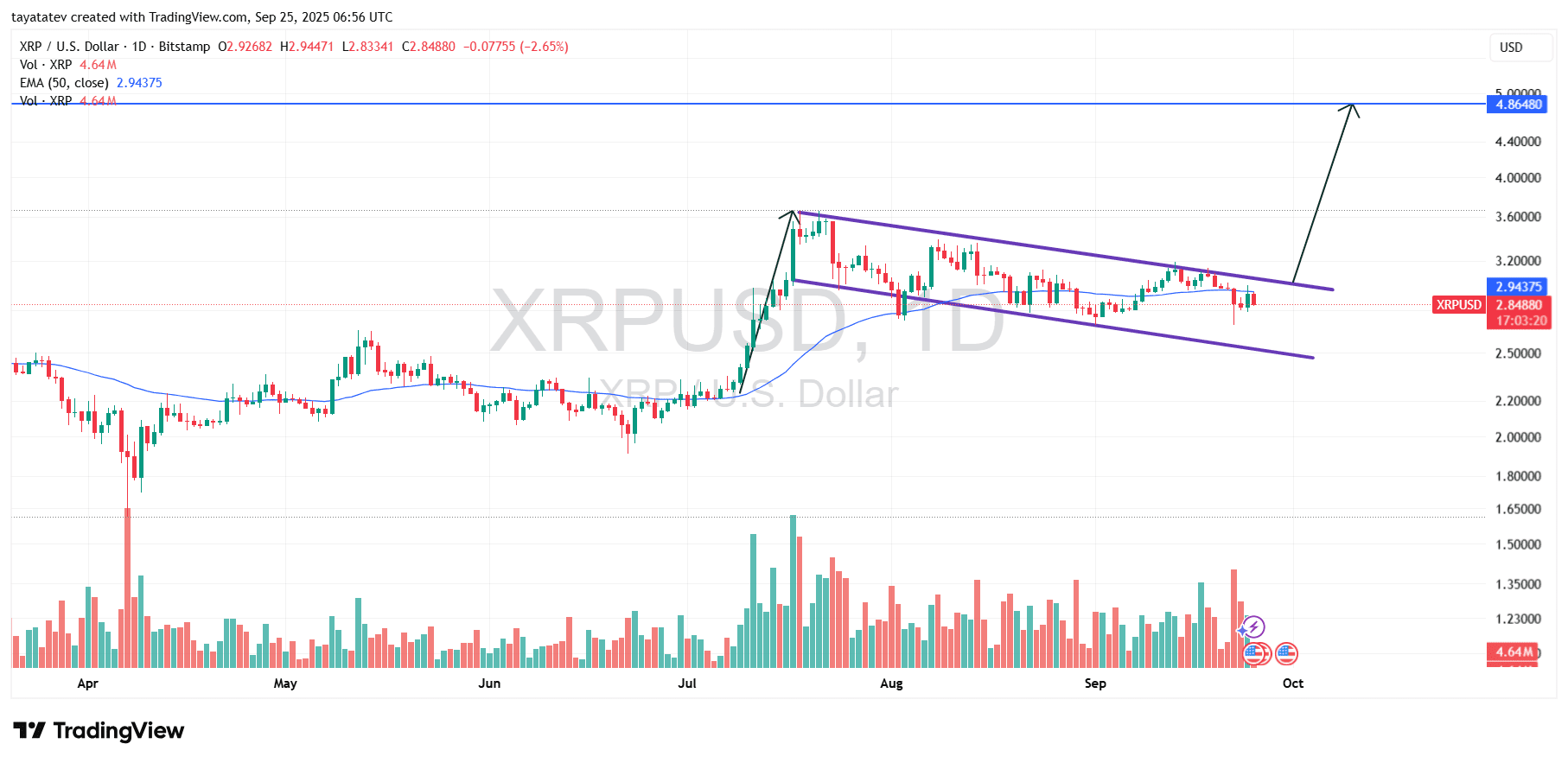

Bullish flag forms on XRP daily chart (Sep 25, 2025)

XRP/USD daily chart (Bitstamp) dated September 25, 2025, trading below the 50-day exponential moving average (EMA) near $2.9438 and coiling inside a downward-sloping channel. The structure follows a steep July surge that created a clear “flagpole,” then a controlled pullback bounded by parallel trendlines. A bullish flag is a continuation pattern where a strong advance pauses in a tight, downward-tilted channel before the prior uptrend resumes.

If buyers confirm the pattern with a decisive breakout and daily close above the flag’s upper trendline, the measured objective points markedly higher. Using a 71% extension from the current price of $2.8488 projects a target near $4.87. The chart also marks resistance into the upper boundary around the low-$3 area, while support aligns near the channel base in the mid-$2.50s and the 50-day EMA around $2.94.

Momentum and volume now matter for validation. A breakout accompanied by expanding volume and a sustained hold back above the 50-day EMA would strengthen the continuation case toward the $4.87 projection. Conversely, failure to reclaim the moving average and a close back toward the channel’s lower rail would keep the consolidation in place until new information arrives.

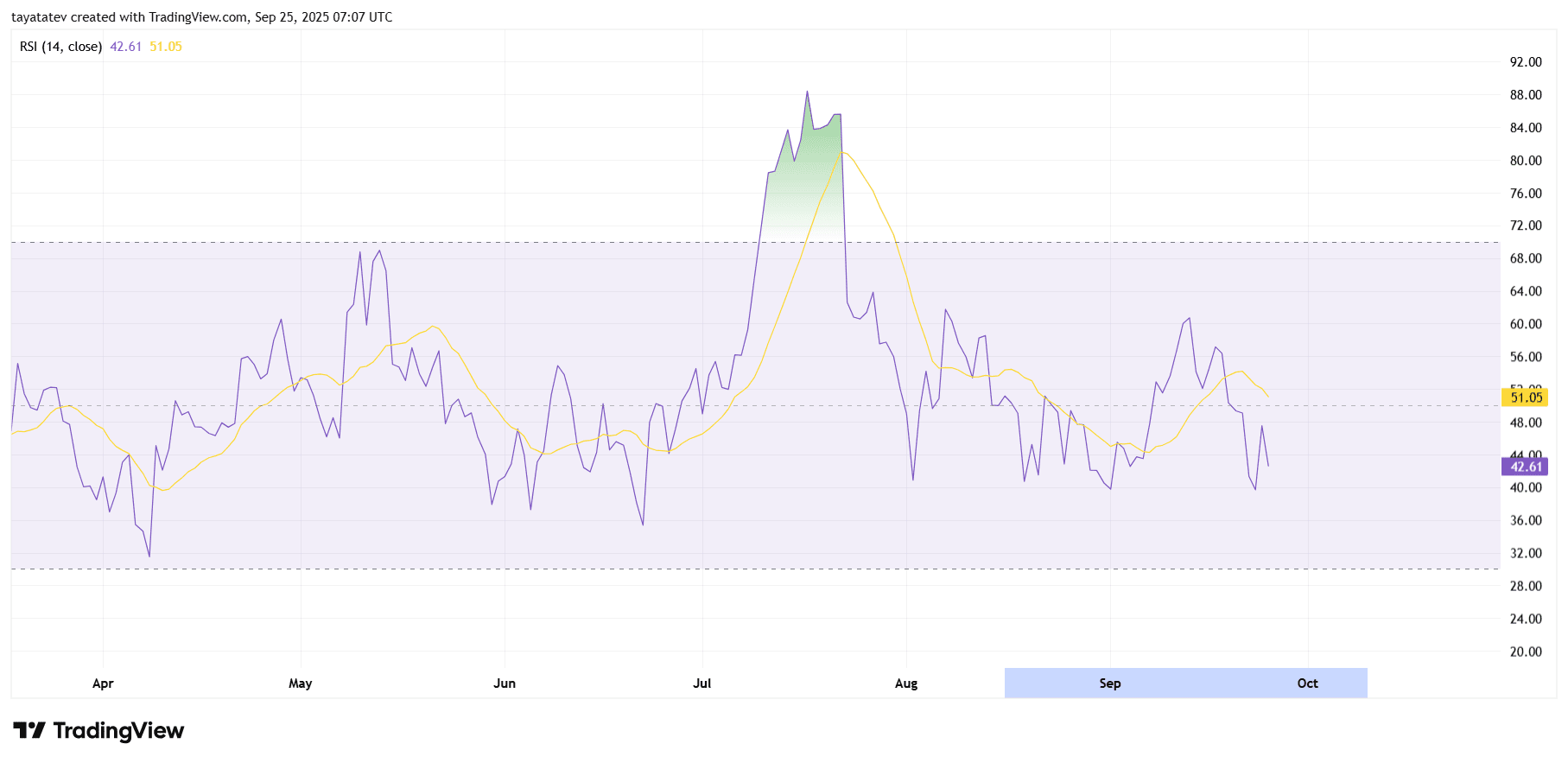

XRP daily RSI points to soft momentum (Sep 25, 2025)

The Relative Strength Index (14) reads 42.61 on the daily chart, while its signal line sits near 51.05. Momentum remains below the neutral 50 line, which indicates sellers keep a slight edge. The oscillator stays well under the overbought zone at 70 and above the oversold band at 30, so conditions look neutral-to-weak rather than stretched.

Recent structure shows a July–August momentum spike followed by a sharp fade through 50 in mid-August. Since then, RSI printed lower highs into September and failed to sustain above its signal line. This sequence confirms a cooling trend where bounces fade before regaining control of the upper half of the range.

For improvement, RSI needs a decisive move back above 50 and a cross over its signal line with follow-through. That shift would align momentum with any upside break on price. Conversely, repeated rejections near 50 or a slip toward the mid-30s would argue for continued consolidation. This reading pairs with the earlier bullish-flag setup: price can break higher, yet momentum still must confirm.