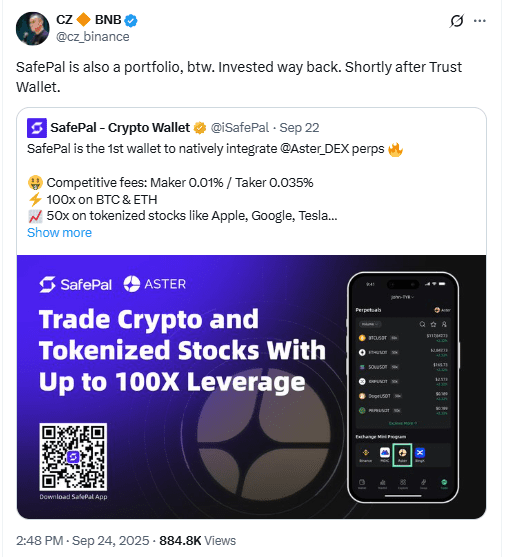

Binance founder Changpeng “CZ” Zhao said he invested in SafePal “way back,” posting that SafePal “is also a portfolio” shortly after referencing Trust Wallet. His comment surfaced in a short update on X from his personal account. The post did not disclose terms or timing of the investment.

The remark placed SafePal back in focus for traders who track CZ’s historic seed bets in crypto tooling. Although Binance and Trust Wallet have public ties, CZ’s line clarified that SafePal also sits in his early-stage portfolio. The note did not indicate any current business relationship between Binance and SafePal.

Consequently, market watchers linked the comment to renewed attention on SafePal’s token, SFP. The post operated as a catalyst for discussion across trading chats and news feeds. However, CZ did not comment on token economics or future plans.

SafePal confirms native Aster perps integration

SafePal stated it is the first wallet to natively integrate Aster DEX perpetuals. The team highlighted self-custody connectivity that routes to derivatives trading while keeping keys in a user-controlled wallet. The message framed the addition as an in-app path to onchain perps.

Moreover, SafePal listed fee terms of maker 0.01 percent and taker 0.035 percent, alongside leverage tiers. The post specified up to 100x on BTC and ETH and up to 50x on tokenized stocks such as Apple, Google, and Tesla. It positioned the experience as comparable to centralized-exchange performance but with a self-custody front end.

The update arrived with creative showing the Aster entry inside SafePal’s Exchange Mini Program. It pointed users to the SafePal download page for access. The team did not publish a separate white paper or documentation thread in the announcement.

Market reaction: SFP price and volumes move

Following the posts, SFP saw a swift uptick in attention on major spot venues. Traders circulated screens of accelerating volumes and sharp candles. The sequence aligned with typical “headline-impulse” flows after high-profile mentions.

At the same time, liquidity concentrated around top pairs as market makers repriced spreads. Order books reflected wider ranges during the initial burst before settling into tighter quotes. This pattern matched prior episodes in which wallet or infrastructure tokens reacted to product news.

Still, neither CZ nor SafePal referenced the token’s market activity. Price action remained a secondary effect driven by trader positioning and momentum. Data vendors and exchange dashboards captured the move as the story traveled across social feeds.

What the Aster perps route enables inside a wallet

The Aster integration places derivatives access next to standard wallet actions such as swap and transfer. Users can connect their self-custody to trade perpetual futures without moving keys to a hosted account. Therefore, the flow reduces context switching for active users who operate onchain.

In practice, the wallet acts as an interface that hands off to Aster’s contracts and matching logic. The design keeps private keys at the user level while exposing leverage, order types, and markets. Consequently, execution relies on Aster’s backend while custody remains local.

Risk controls still apply. Leverage up to 100x on BTC and ETH requires margin discipline, liquidation thresholds, and funding payments. The wallet surface does not change those mechanics; it only embeds access to them.

Context: SafePal’s role among self-custody wallets

SafePal operates as a self-custody suite that includes mobile, browser extension, and hardware options. Its positioning targets users who want to keep keys off centralized servers while interacting with multiple chains. The Aster step extends that scope to derivatives connectivity.

Historically, wallets began with transfers, swaps, and staking. Over time, they added dapp browsers, cross-chain bridges, and now perp routes. SafePal’s move follows that arc by bringing more execution surfaces into a self-custody environment.

Comparisons with Trust Wallet surfaced because CZ referenced both in one note. Still, the two products ship different feature sets and roadmaps. Today’s development highlights SafePal’s push into derivatives access from within the wallet shell.

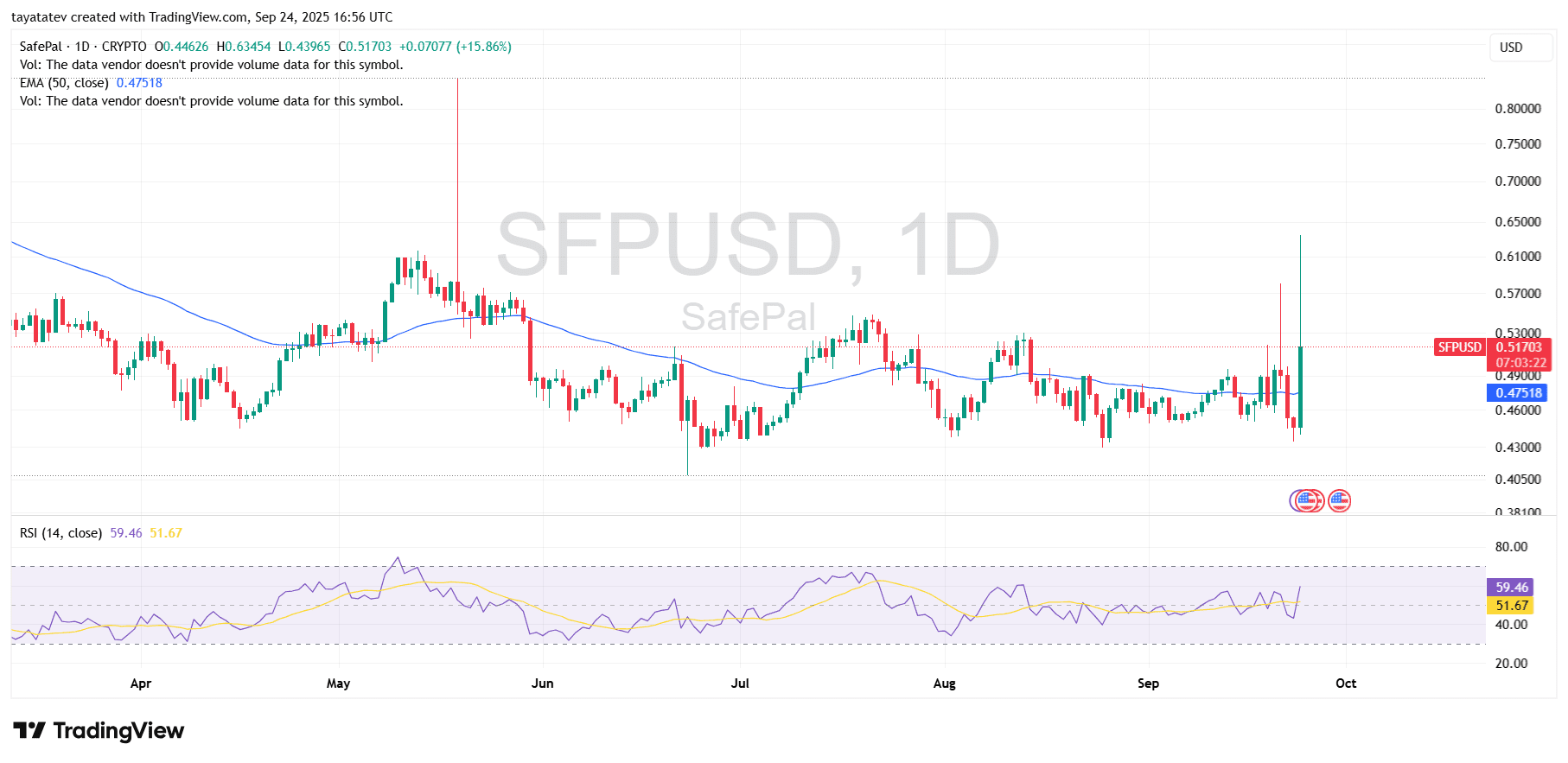

On September 24, 2025, the SFPUSD daily chart printed a strong session. The candle shows open 0.4463, high 0.6345, low 0.4397, and close 0.5170, up +15.86% on the day. A tall upper wick marks rejection above 0.63 before price settled near 0.52.

Technically, price reclaimed the 50-day EMA (exponential moving average), shown at 0.4752. That reclaim turns 0.47–0.48 into first support on dips. The RSI (relative strength index) at 59.5 rises above its signal average near 51.7, which indicates improving momentum without entering overbought territory.

Context matters. The impulse followed two social updates: CZ stated he invested in SafePal “way back,” and SafePal announced native Aster perpetuals with up to 100x leverage on Bitcoin and Ether and 50x on tokenized stocks. The chart reflects the headline burst with a volatility spike and a fade from intraday extremes.

Price move and what’s next

First, here is what happened with price. SFP bounced from the 0.44 area, ripped to 0.63, and then pulled back to close above 0.51. The session pierced recent range highs from early September and flipped the 50-day EMA into support. The wick shows profit taking near 0.60–0.63, where supply emerged.

Now, here is what the chart suggests next, strictly as levels. If buyers defend 0.47–0.48 (50-day EMA) and 0.49–0.50 (round-number shelf), momentum can re-test 0.53 first, then the wick zone at 0.60–0.63. A daily close above 0.63 would expose 0.66–0.70 from prior congestion, while RSI has room before 70.

However, if price loses the 50-day EMA on a daily close, the move risks reverting to 0.46 and 0.43–0.44 supports. Below that, the summer pivot near 0.41 becomes the next magnet. Until volume data confirms follow-through, the base case is a headline spike consolidating above the moving average with a wide 0.48–0.60 range.