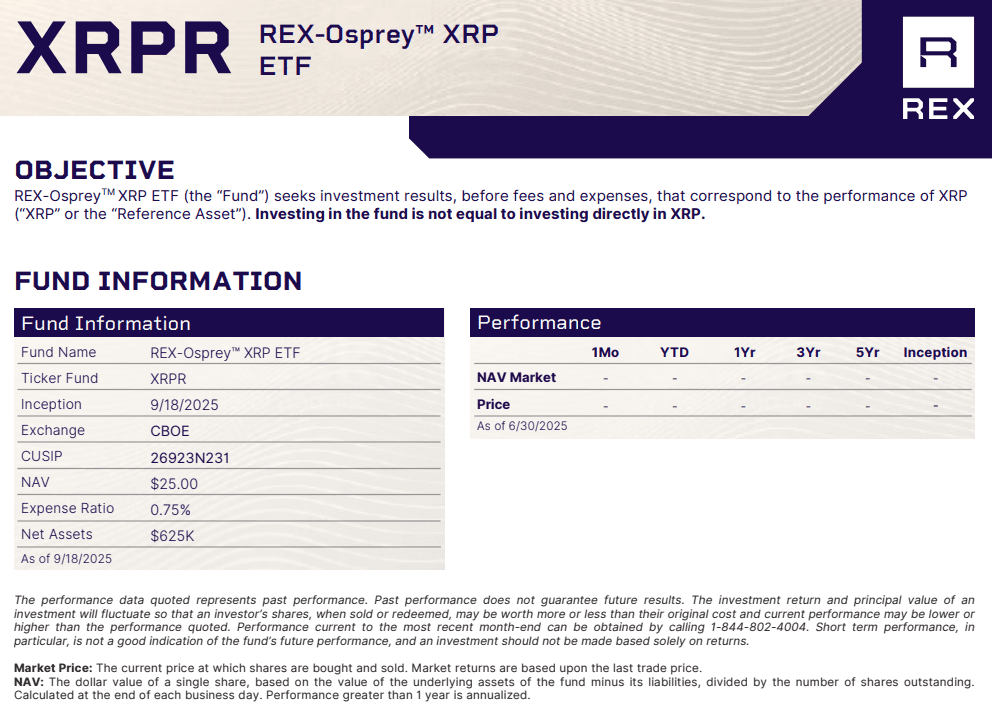

Cboe BZX listed the REX-Osprey XRP ETF under the ticker XRPR on Thursday, Sept. 18, 2025. As of Sept. 19 the fund is available to trade during regular U.S. market hours.

The Cboe new-issue notice shows first trade on Sept. 18 alongside the Dogecoin fund DOJE. The notice lists XRPR’s CUSIP 26923N231 and confirms BZX as the listing venue.

Issuer materials also state “XRPR is now trading,” and provide fund metadata including inception on Sept. 18 and listing on Cboe BZX.

What the fund tracks and how it’s structured

XRPR seeks results that correspond to the performance of XRP, before fees and expenses. The issuer fact sheet and prospectus spell out that investing in XRPR is not the same as holding XRP directly.

Coverage of launch day emphasizes that the Cboe-listed XRP and DOGE products provide exposure to the tokens but are not “pure” spot trusts in the traditional commodity-grantor-trust mold. They can use additional instruments permitted under the fund documents.

The prospectus further details the structure, including an XRP subsidiary and the Investment Company Act considerations that govern how the fund aggregates positions for compliance.

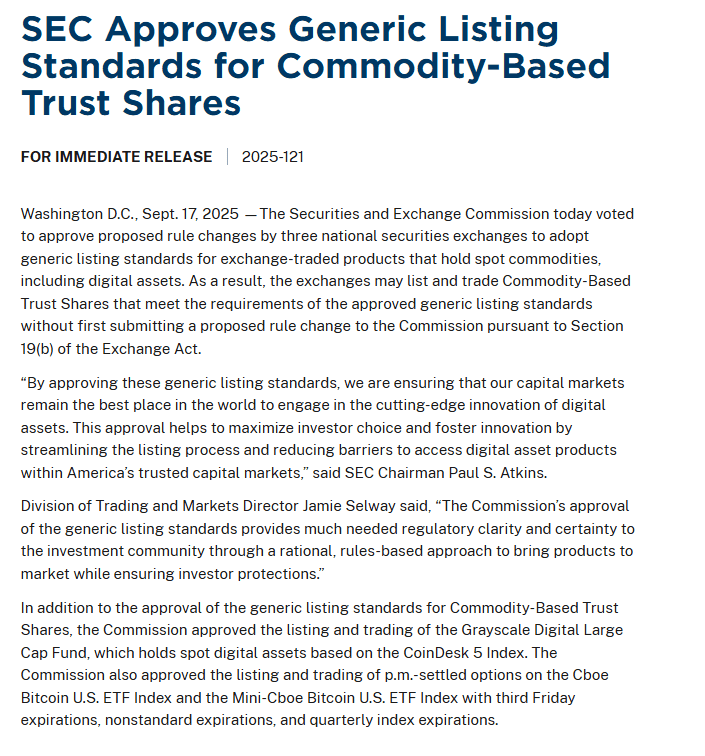

New SEC framework enables faster listings

The ETF debut follows the U.S. Securities and Exchange Commission’s approval of generic listing standards for spot-commodity ETPs across Cboe, Nasdaq, and NYSE Arca on Sept. 17. Exchanges can now list qualifying products without filing new 19b-4 rule changes case by case.

Industry reports confirm the rule change and describe how it shortens timelines and broadens the menu beyond Bitcoin and Ether. This framework set the stage for rapid listings such as XRPR and DOJE.

SEC materials and commissioner statements outline the policy rationale and point to additional crypto-linked approvals adopted the same day.

Wider context: multi-asset approval and pipeline

Alongside the framework, the SEC cleared Grayscale Digital Large Cap Fund for U.S. trading. The multi-asset product includes XRP among its five constituents, signaling broader acceptance of diversified crypto exposure.

Launch-day coverage also noted CME’s roadmap for XRP derivatives and framed the ETF rollouts as part of a larger build-out of XRP market infrastructure.

Meanwhile, other “pure trust” XRP proposals remain on the docket using traditional approval paths, even as generic standards accelerate listings that meet exchange criteria.

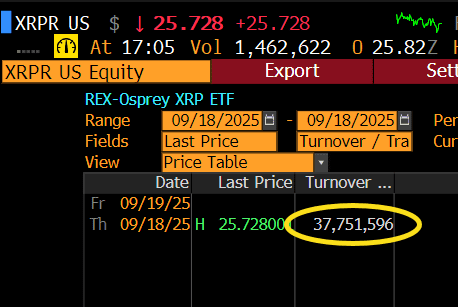

XRPR closes Day One at $37.7 million; DOJE prints $17 million, per Balchunas

REX Osprey’s XRP ETF XRPR finished its first session with $37.7 million in dollar volume, Eric Balchunas reported on X on September 19, 2025. He said XRPR edges IVES for the largest Day One natural dollar volume of any 2025 launch. He also noted DOJE traded $17 million, which ranks Top 5 this year out of 710 launches.

A Bloomberg terminal capture shows $37,751,596 in XRPR turnover for September 18, a last price of $25.728 at 17:05, and 1,462,622 shares in volume, confirming the updated tally.

The data indicate firm initial liquidity for XRPR and keep its debut well ahead of prior XRP futures ETF starts in simple trading value.

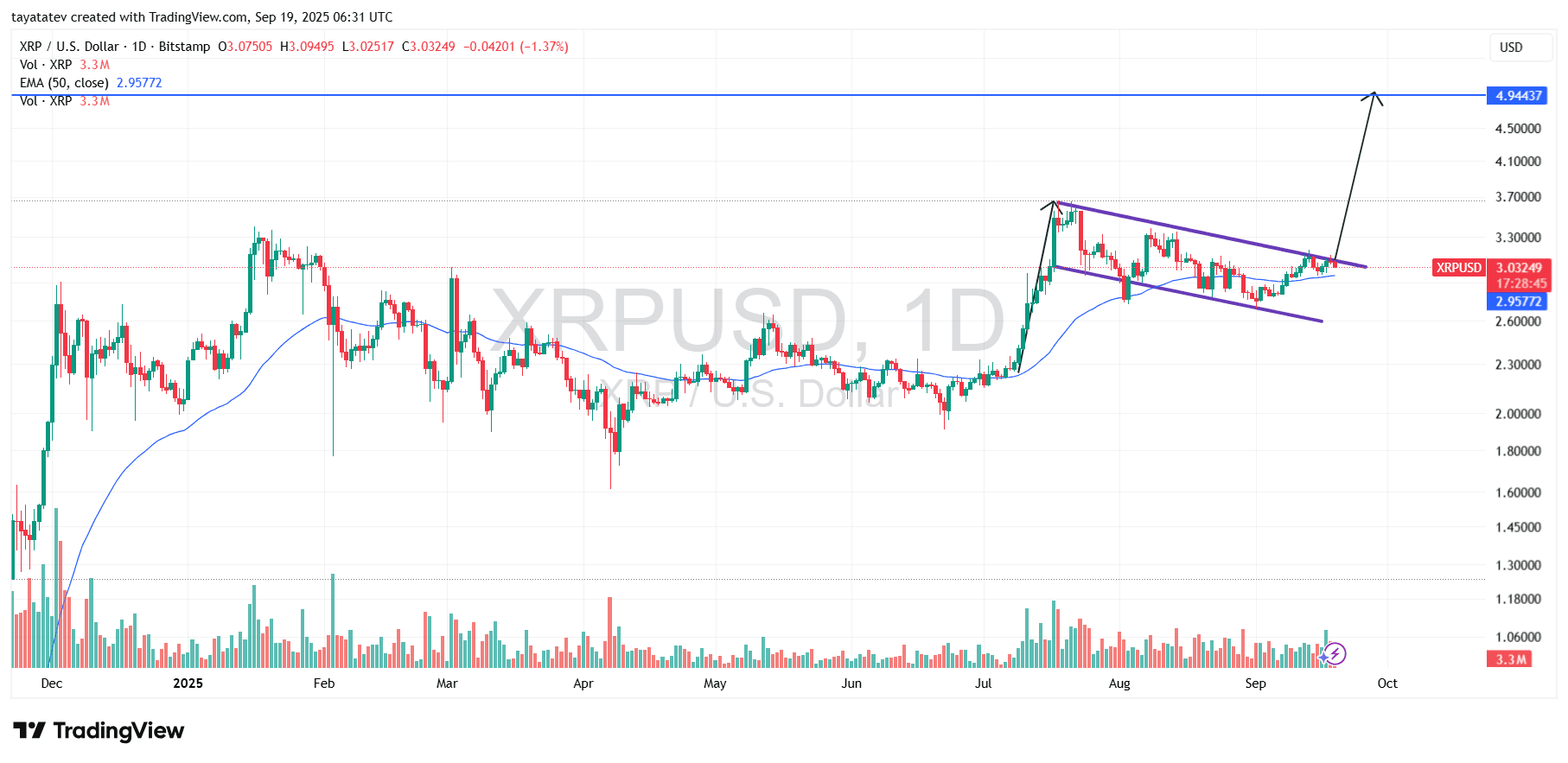

XRP daily chart shows bullish flag; breakout would imply ~63% toward ~$4.94

On September 19, 2025 the Bitstamp XRP/USD daily chart prints a clear flag below ~$3.30. Price trades near $3.03 and holds above the 50-day exponential moving average (EMA) around $2.96. Meanwhile, session volume reads about 3.3 million XRP, and the consolidation slopes gently downward inside parallel lines.

A bullish flag is a pattern where a sharp advance (the flagpole) pauses in a tight, downward-tilting channel before continuation higher.

However, the setup is not confirmed yet. A daily close above the flag’s upper trendline near $3.25–$3.30, with rising volume, would mark confirmation. If that break prints, the measured move calls for roughly a 63% advance from the current $3.03, targeting about $4.94. Moreover, holding above the breakout band would keep momentum constructive, while a drop back under the EMA or the lower flag rail around the high-$2.70s would weaken the pattern’s edge.

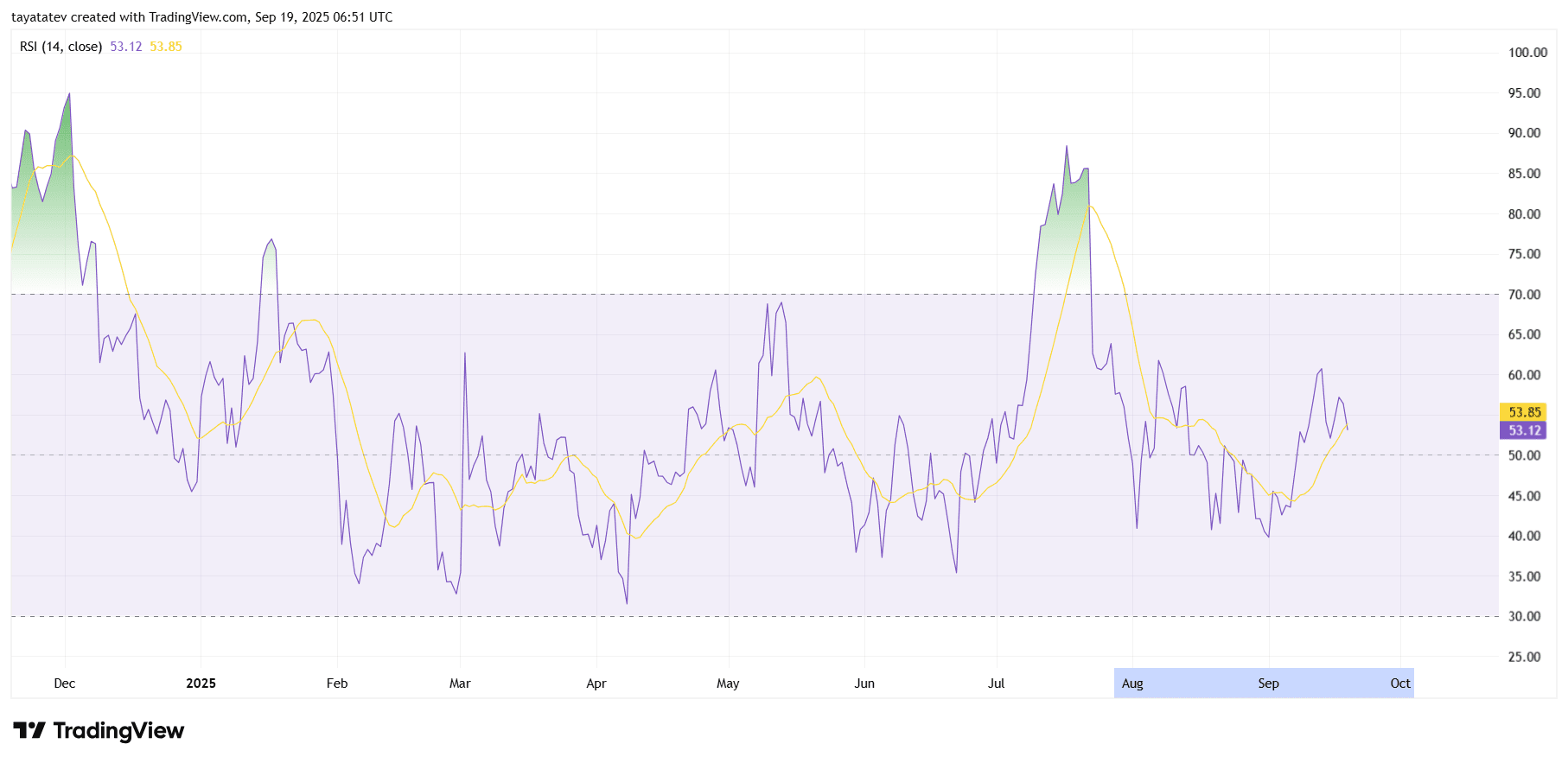

XRP RSI turns positive above 50; momentum improving on Sept. 19, 2025

The 14-period Relative Strength Index reads 53.12, while its signal average prints 53.85. The oscillator has recovered from early-September lows in the 40s and now trades above the 50 midpoint, which marks a shift from neutral to positive momentum.

The RSI crossed up through its signal average this week and holds inside the typical bullish regime band of 40–90. As long as RSI stays above 50 and the signal line, momentum supports upside follow-through on price. Immediate resistance sits near 60–65 on the oscillator, then the 70 overbought threshold that capped August.

However, a drop back below 50 would neutralize the signal, and a slide under 40 would put downside momentum back in control. No clear bearish or bullish divergence versus price is visible on this daily timeframe; the indicator largely confirms the recent recovery.

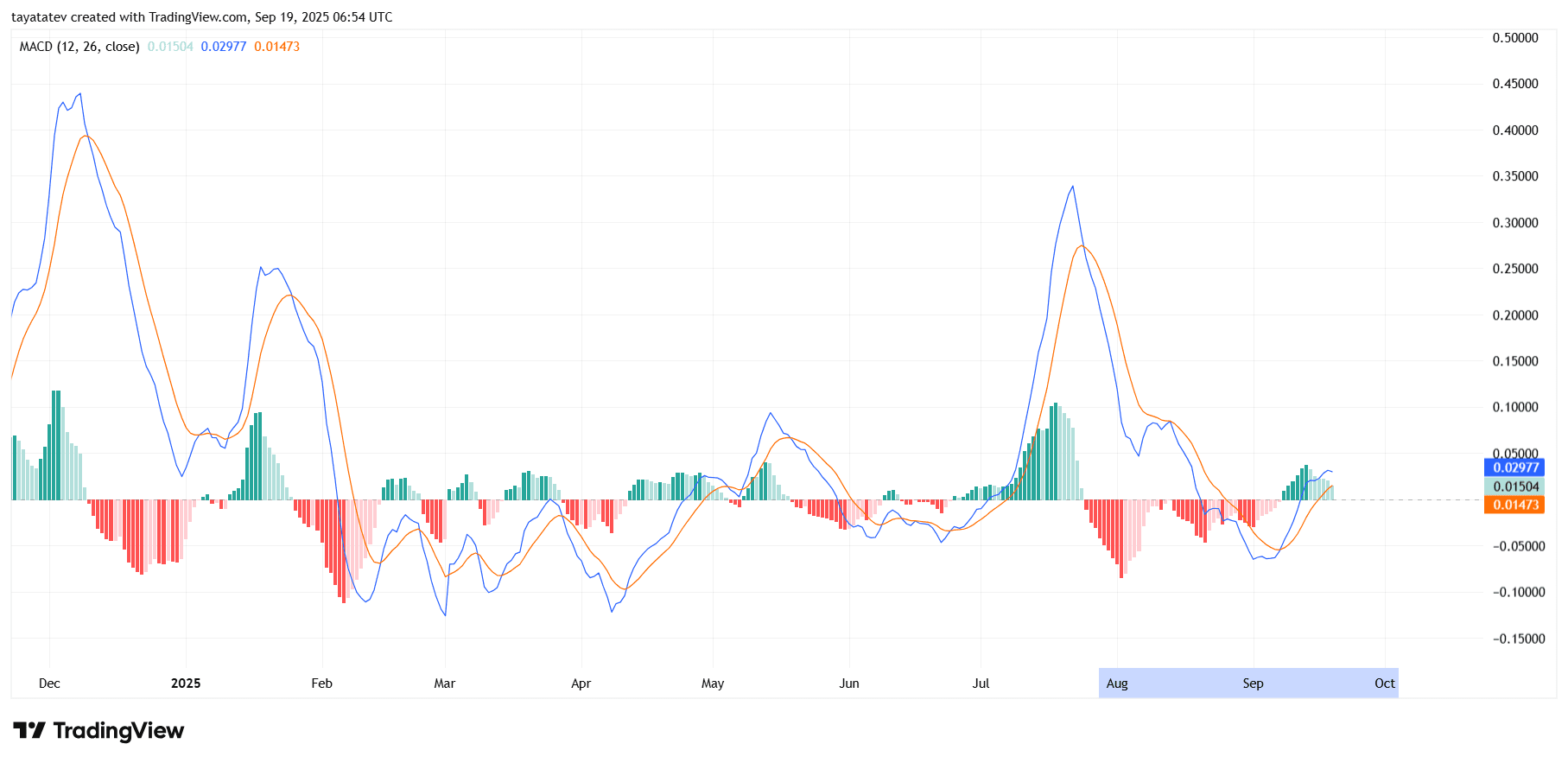

XRP MACD shows sustained turn-up; momentum builds above zero line

The Moving Average Convergence Divergence on September 19, 2025 reads MACD 0.02977, signal 0.01473, histogram +0.01504. The bullish cross occurred earlier this week, and the histogram has expanded for several sessions, which indicates acceleration rather than a one-bar flip.

The gauge now holds above the zero line, a regime shift from early-September negatives. In August, MACD peaked far higher during the sharp rally, then rolled over; today’s slope turns up again and points to rising momentum, though absolute levels remain below August extremes. As long as the MACD line stays above the signal and the histogram prints higher highs, upside pressure persists.

Price context supports the read. XRP trades near $3.03–$3.10 with a developing bullish flag and a 50-day exponential moving average around $2.96 underneath. If price closes above the flag top near $3.25–$3.30, the MACD should typically expand further positive, confirming trend continuation. Conversely, if price slips below the EMA and the histogram shrinks toward zero, the cross risks whipsaw.

Watch these confirmations and failsafes:

-

Continuation: MACD > signal, histogram rising, and a daily close above $3.30.

-

Cooling: Histogram flattens for 2–3 days or MACD hooks down toward the signal.

-

Inversion: Bearish cross (MACD < signal) and a close below ~$2.90–$2.95 would negate the momentum turn.

In brief, MACD momentum improves and persists, aligns with RSI > 50, and backs the chart’s constructive setup while key levels define the risk.