Cardano enters a packed governance window this month. Intersect will open Board election voting on September 15 at 12:00 UTC, while the committee elections follow in October.

In parallel, the Cardano Foundation narrowed its role in Project Catalyst Fund 14 and developers advanced the Leios scaling proposal, KES agent integration, and LSM tree support.

Intersect Board Elections Begin

Intersect members will elect four Board directors out of seven seats in a vote that runs from September 15 through September 26, both opening and closing at 12:00 UTC. The documentation outlines application, eligibility, and the publication of results on September 30. Intersect frames the September Board vote as the first step in a two month election cycle that completes with committee ballots in October.

The organization’s election explainer sets expectations on roles and term lengths. The two top polling candidates receive two year terms, while the next two serve one year to preserve continuity. Intersect also discloses a stipend of 35,000 dollars per year for elected members.

Intersect’s update cadence has tracked the run up to voting, including candidate registration in late August and reminders that registration closed on September 12. The schedule confirms a tight handover to October’s committee ballots once the Board results are posted.

Foundation Narrows Catalyst F14 Participation

The Cardano Foundation will limit its Fund 14 voting to a single wallet of about 20 million ADA and restrict that voting to one track titled Cardano Use Cases: Partners and Products, which has an eight point five million ADA budget. The Foundation says the move shifts emphasis toward community expertise rather than institutional vote weight.

Catalyst’s current timeline places the Fund 14 voting window from September 22 to October 6, following the September 11 registration snapshot. Community posts this week reiterated the dates and the steps between snapshot and the opening of ballots.

Consequently, the Foundation’s narrowed remit will apply during that two week voting period. The change also arrives alongside a Representative Pilot that invites community submissions and formalizes a pathway for indirect participation.

Developers Advance Leios, KES Agent, and LSM Trees

Cardano’s weekly report dated September 5 highlights work on the first public draft of the Ouroboros Leios Cardano Improvement Proposal, along with KES agent integration and LSM tree enhancements within consensus. The update also references a released library version and cleanup work that reduces open handles during queries.

Intersect’s consensus status page echoes the same priorities. It says engineers spent the last two weeks on the Leios draft, LSM tree support, and the KES agent audit and integration. These items sit within the broader Ouroboros roadmap that targets higher throughput and more resilient node operations.

Earlier reports through August tracked steady progress on Leios prototyping and the new mini protocols, while the KES agent repository documents the forward security goals around key storage and rotation. Together, these threads point to incremental mainnet readiness for the next intra era upgrades.

Ecosystem Metrics Hold Steady

As of the September 5 development report, Cardano lists 2,009 projects building on the network and 1.34 million delegated wallets. The same report shows 10.90 million native tokens across 220,944 token policies and notes 320 GitHub commits for the week. These figures indicate consistent participation across builders, governance delegates, and code contributors.

The report also covers tooling and service updates, including a Daedalus release compatible with node version 10.2.1 and a rebuilt Developer Portal. Those items sit alongside Hydra and Mithril milestones that continue to mature off chain scaling and signature diffusion.

Project activity continues to surface through community channels, where teams announced fee payment experiments, audits, and user interface milestones. The weekly cadence provides a consolidated view of these releases.

Constitutional Committee Seated Under New Framework

Cardano.org’s governance page and recent posts recap the first fully community led Constitutional Committee election with seven members selected to uphold the Cardano Constitution. Intersect’s analysis explains how DReps and stake pool operators ratify actions alongside the Committee to move protocol changes forward.

Intersect’s election note outlines thresholds and ratification mechanics that governed the transition from the interim committee to the newly elected body. The post places the outcome within Cardano’s multi branch governance structure.

With the Committee seated and Board elections opening,the next governance block is the October committee vote that will refresh membership across Intersect’s working bodies. These steps close a multi quarter migration to a community directed model.

Summit Adds Day Zero Builder Program

Meanwhile, The Cardano Foundation introduced Day Zero, a free builder focused kickoff for Cardano Summit 2025 in Berlin. The event runs on November 11 at w3 hub Berlin and precedes the November 12 to 13 enterprise program at the Gasometer Schöneberg venue.

The Day Zero agenda includes a governance session, lightning talks, demos, and a Battle of the Builders pitch track. A Layer Up hackathon runs online from November 3 to November 10 and concludes with a showcase in Berlin.

The Foundation’s event hub and social channels position the format as a bridge between grassroots development and enterprise adoption. Registration details and the broader Summit schedule remain live on the official site.

ADA Falling Wedge Points to $1.09 — September 14, 2025

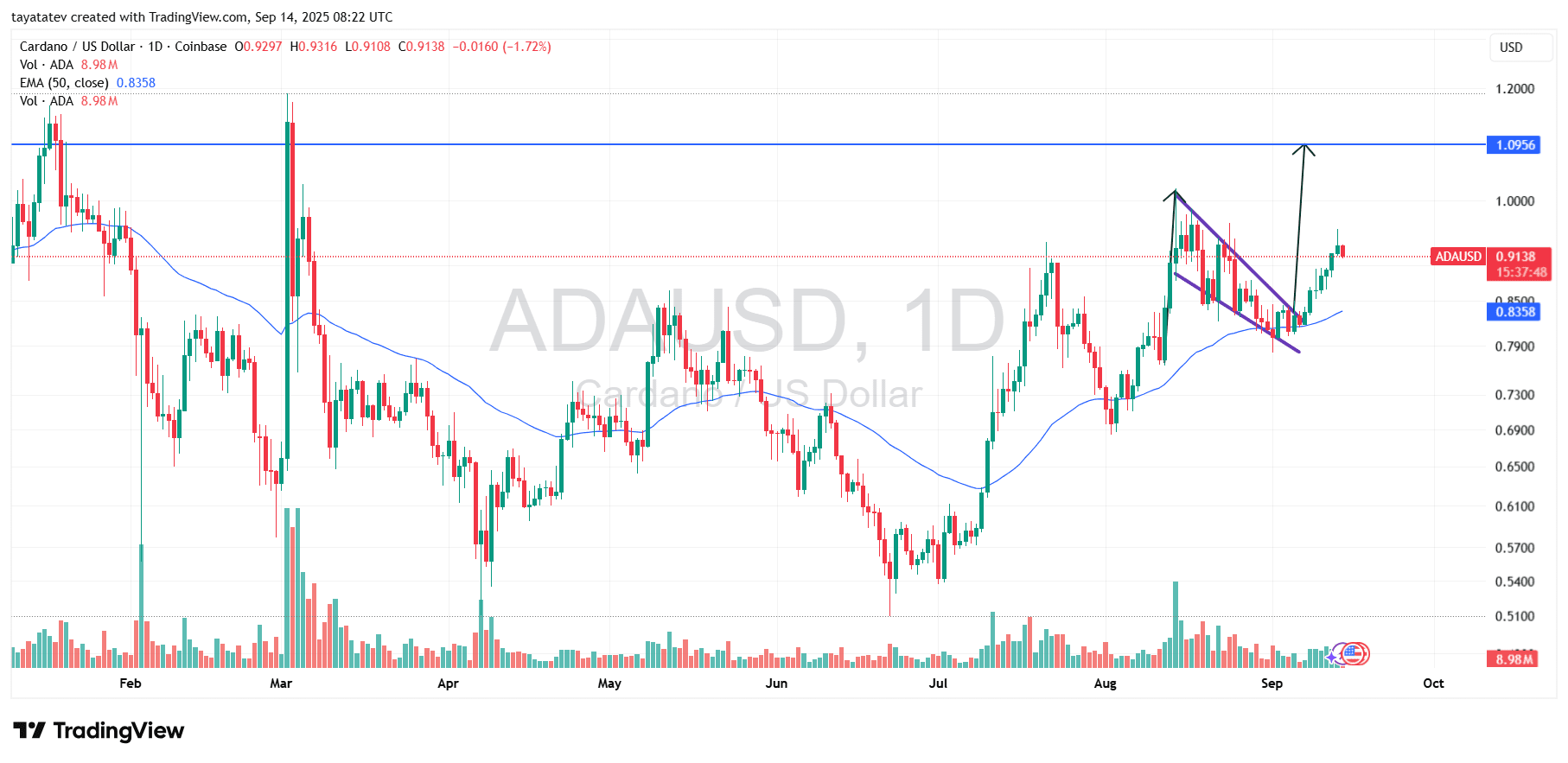

Cardano’s daily ADA/USD chart shows a completed falling wedge and a clean break above the upper trendline. A falling wedge is a bullish pattern where price makes lower highs and lower lows inside converging lines, then typically breaks higher. After the breakout, ADA has already gained about 20% from the wedge low. From the current price near $0.9138, the measured move implies roughly 19% more upside to about $1.0956, which matches the horizontal resistance drawn on the chart.

The wedge took shape through late August and early September as the swings narrowed and momentum compressed. Price then punched through the top of the pattern and began printing higher highs and higher lows. The 50-day EMA near $0.8358 now acts as first support and anchors the advance. The prior pullback also formed a short flag that resolved higher, which strengthens the breakout signal and keeps the focus on the $1.07–$1.10 zone.

For confirmation, a daily close above $1.00 would clear the psychological round number and leave little overhead before the $1.09 objective. If ADA instead closes back below $0.85—near the EMA and the wedge apex—the breakout would weaken and invite a deeper retest. Until that happens, the pattern, the moving-average alignment, and the follow-through favor continuation toward the $1.09 resistance.

ADA MACD Turns Positive — September 14, 2025

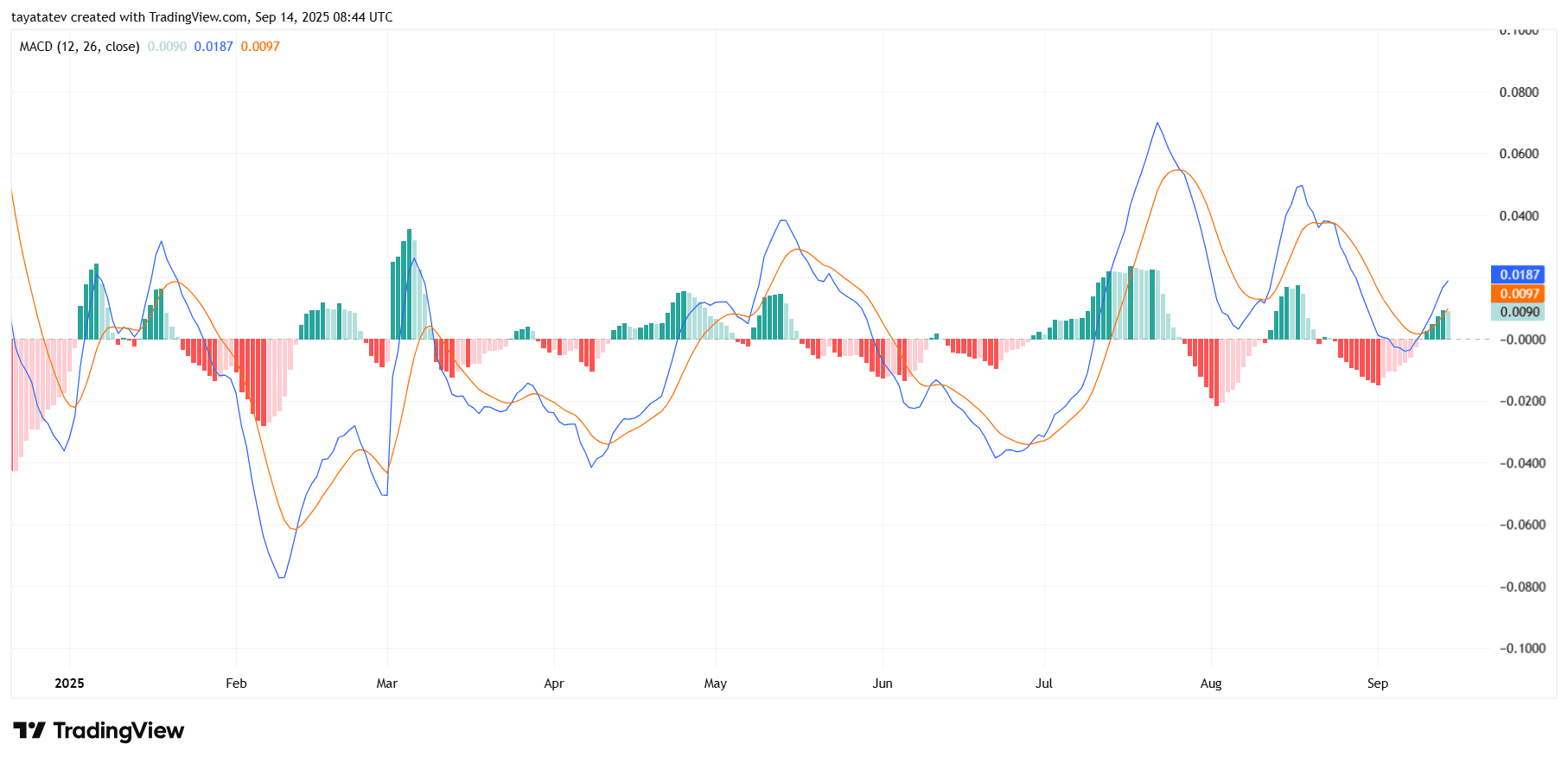

Cardano’s daily MACD has flipped bullish. The MACD line sits around 0.0187 above the signal near 0.0097, while the histogram prints a positive read near 0.0090. This alignment shows upward momentum returning after the early-September inflection.

Momentum improved in stages. The July–August downswing drove MACD to deep negatives, but each subsequent dip printed a higher low and then reversed faster. As the lines crossed to the upside this week, green histogram bars expanded, confirming a shift from contraction to acceleration.

From here, the focus stays on durability. If MACD holds above the zero line and the histogram continues to build, buyers keep control and trend strength improves. However, a roll over in the histogram followed by a bearish cross of the MACD back below the signal would flag fading momentum and raise the risk of a deeper pause. Until that reversal appears, the indicator continues to support a constructive bias on the daily timeframe.

ADA RSI Reclaims Bull Zone — September 14, 2025

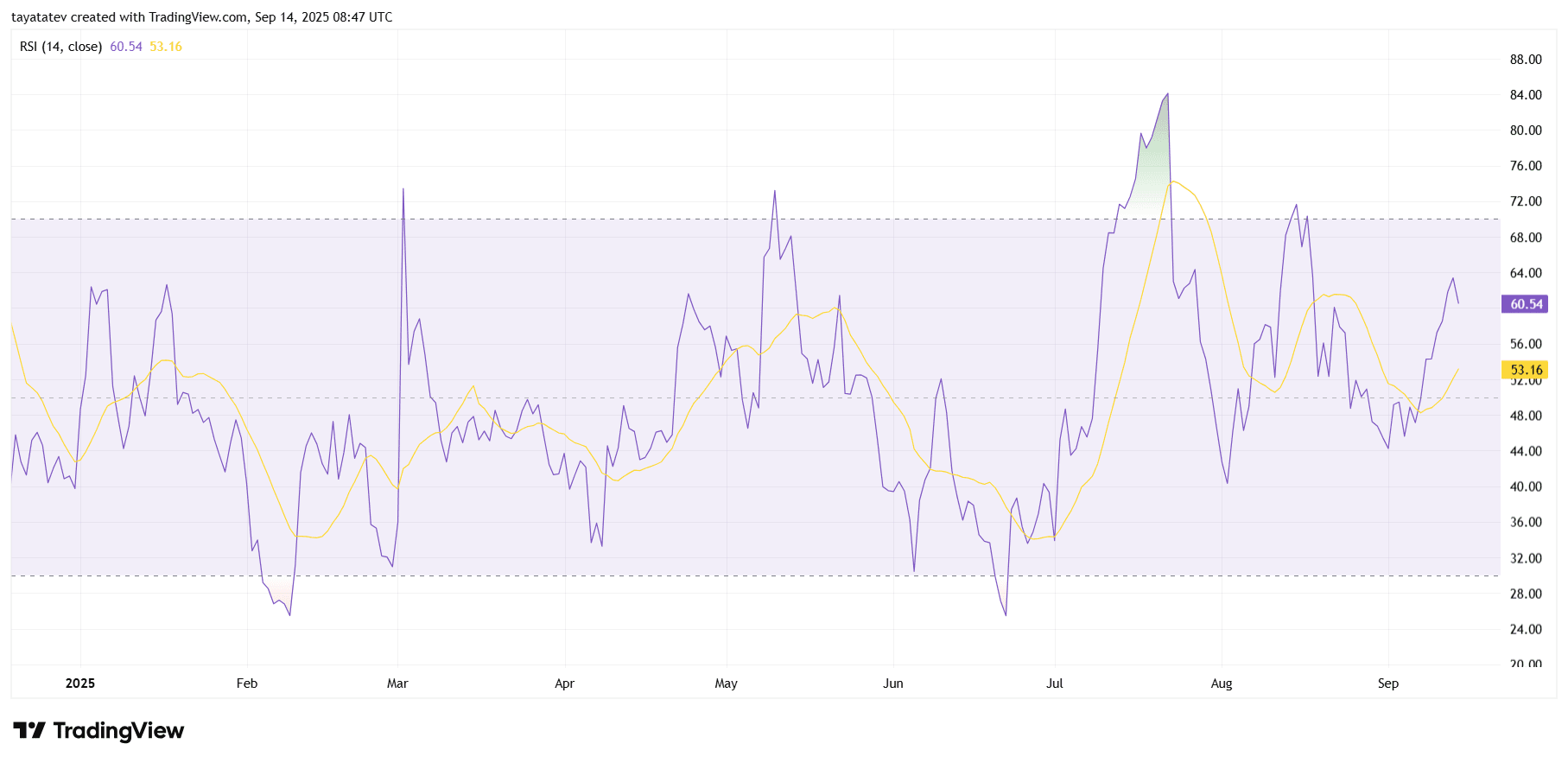

Cardano’s daily RSI sits at 60.54, above its RSI moving average at 53.16 and above the 50 midpoint. This alignment signals positive momentum on the daily timeframe. The RSI turned up from late-August lows, crossed its average in early September, and has kept rising, which confirms improving trend strength without entering overbought territory.

Moreover, the oscillator remains below 70, so momentum has room before it reaches an extreme. As long as RSI holds above 50, the bias stays constructive on this timeframe. A decisive drop back below 50 would mark waning momentum and would weaken the current push.

The pattern across the summer shows higher RSI lows into September, matching the chart’s series of stronger daily candles. That sequence supports the broader breakout narrative already visible on price and MACD. Until the RSI rolls over or loses the 50 line, the indicator continues to back a steady trend rather than a stretched spike.

ADA Balance of Power Flags Near-Term Supply — September 14, 2025

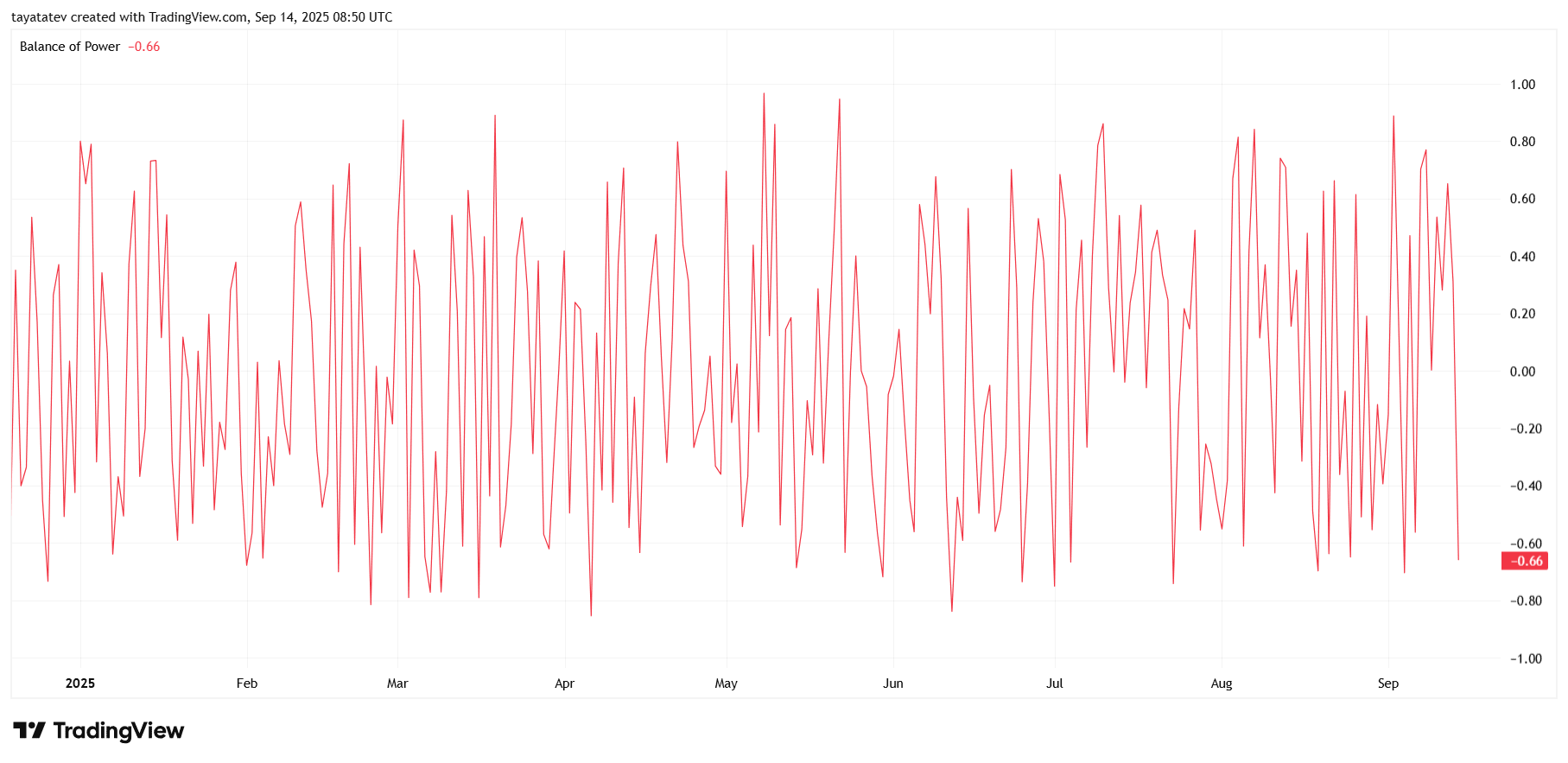

Cardano’s daily Balance of Power (BOP) prints about -0.66, which signals sellers hold the short-term initiative. BOP measures who controls the session—buyers above 0, sellers below 0—and it ranges between -1 and +1. Today’s deep negative read follows several volatile swings this quarter and contrasts with the recent bullish signals on RSI and MACD, so it highlights a near-term tug-of-war rather than a clean trend.

However, context matters. During prior rallies this year, BOP often dipped below zero for a day or two while price consolidated, then snapped back above the midpoint as momentum re-engaged. If BOP climbs toward -0.1 and then crosses above 0.0 on expanding volume, it would confirm that buyers have reclaimed control and would align the indicator set with the breakout narrative visible on price, RSI, and MACD.

Until that recovery, the risk is simple: persistent reads below roughly -0.30 over multiple sessions tend to mark distribution phases and invite deeper retests of nearby supports. Therefore, watch whether BOP stabilizes and flips positive on the next few daily closes. A swift mean-reversion would frame today’s print as a brief supply burst; a prolonged negative stretch would warn that sellers still press their advantage.