Alex Thorn of Galaxy Digital said there is a “strong chance” the United States will announce a Strategic Bitcoin Reserve this year. He added that the market is “completely underpricing” that likelihood. The discussion centers on a formal US Bitcoin Reserve policy, not day-to-day price action. In the source text, BTC was cited at 115,986 dollars.

Alex Thorn says markets underprice a Strategic Bitcoin Reserve

Alex Thorn wrote on X that he “still think[s] there’s a strong chance the US government will announce this year that it has formed the strategic Bitcoin reserve (SBR) and is formally holding BTC as a strategic asset.” He followed with,

“Market seems to be completely underpricing the likelihood of such an announcement.”

The remarks set the tone for a renewed policy debate on a US Bitcoin Reserve.

Thorn leads firmwide research at Galaxy Digital. His view places the Strategic Bitcoin Reserve inside a broader conversation about official holdings and disclosures. He did not present a dollar amount or a target number of BTC for any potential US Digital Asset Stockpile.

His comments arrive as policy signals accumulate. The focus remains on whether an announcement happens this year. The statements do not describe purchase mechanics for a US Bitcoin Reserve.

Executive order and US Digital Asset Stockpile set the framework

According to the text provided, President Donald Trump signed an executive order in March referencing a Strategic Bitcoin Reserve and a US Digital Asset Stockpile. The executive order sets direction but does not finalize an operational plan. Agencies would need procedures for custody, accounting, and reporting.

The executive order on Bitcoin placed the concept on a formal footing. It did not specify acquisition methods, timing windows, or a custody venue. Therefore, the framework anticipates follow-on guidance from departments and the US Treasury.

The absence of a public strategic plan leaves room for different timelines. Agencies often align policy, budgeting, and interagency controls before purchases. That process would affect the pace of any US Bitcoin Reserve rollout.

US Treasury report bill and fresh policy signals

On Tuesday, US lawmakers introduced a bill directing the US Treasury to examine the Strategic Bitcoin Reserve and deliver a feasibility and technical report. The bill calls for analysis of custody, auditing, acquisition methods, market impact, and interagency coordination. It does not authorize BTC purchases by itself.

Additionally, on July 31, a report cited a White House crypto liaison saying the administration remains interested in a Strategic Bitcoin Reserve. The liaison’s mention was brief in a larger policy paper. Even so, it kept the US Bitcoin Reserve on the agenda.

A US Treasury report could review existing federal BTC from seizures and forfeitures as a baseline. That inventory would inform accounting and control testing for any US Digital Asset Stockpile. Reporting deadlines were not specified in the text.

Skeptics see 2026; global crypto reserve moves build

Dave Weisburger, former chairman of CoinRoutes, said 2026 is more likely for a public announcement. He added, “this administration is too smart to announce ANYTHING until AFTER they accumulate to their initial target.” His position favors accumulation before disclosure and differs from Alex Thorn’s timeline for a Strategic Bitcoin Reserve.

Samson Mow, founder of Jan3, warned in June that the United States “has to start” acquiring Bitcoin this year or risk other countries moving first. He said, “The risk is that the US is front-run by Pakistan.” The comment reflects concern about timing for a US Bitcoin Reserve.

On Wednesday, Kyrgyzstan advanced a bill to establish a state cryptocurrency reserve. On August 6, Bitcoin Indonesia said it met with Indonesian officials to discuss a Bitcoin reserve strategy and possible economic effects. These steps highlight global activity around national crypto reserves.

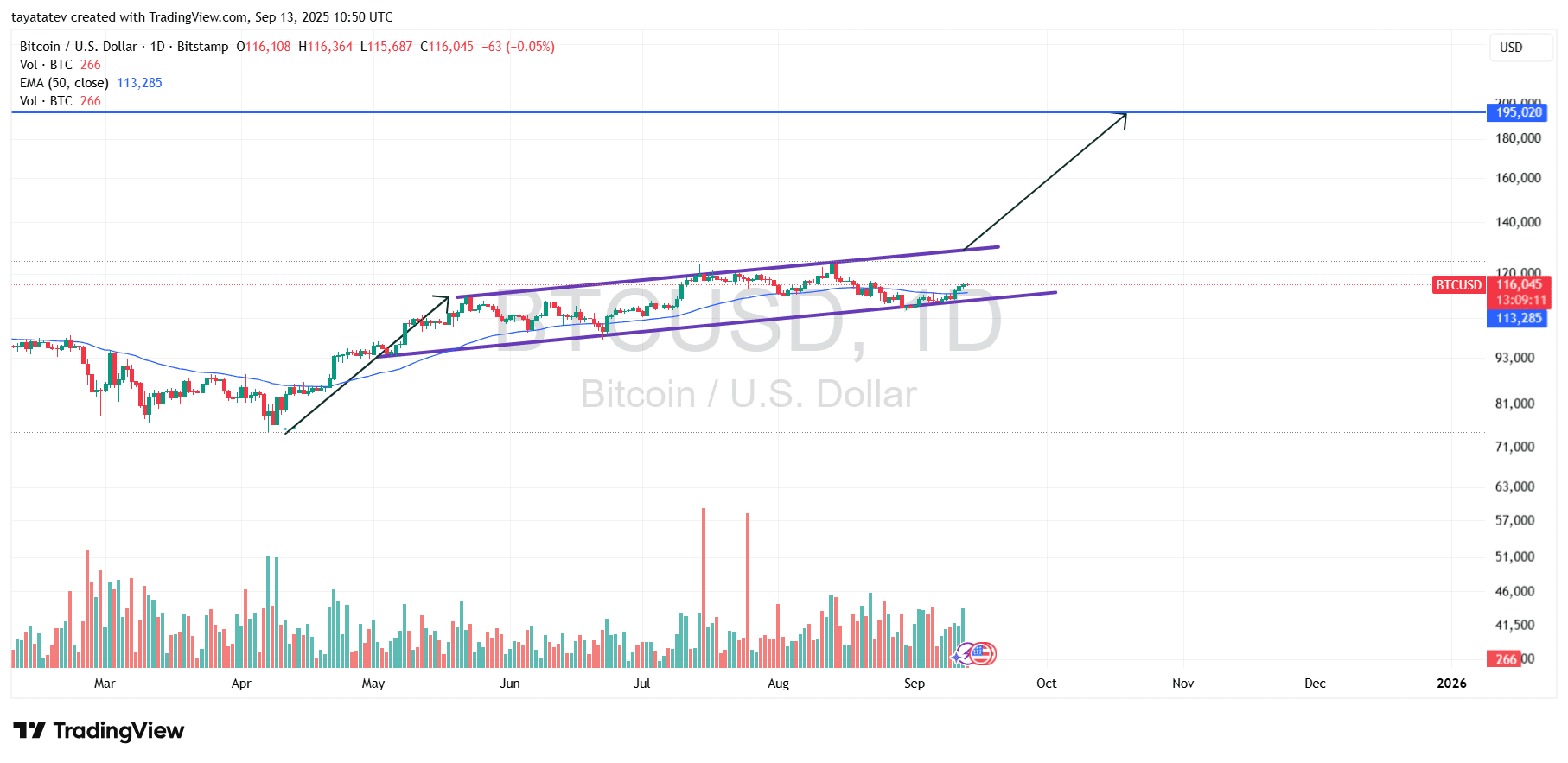

Bitcoin climbs inside a rising channel; pattern math implies ~68% upside toward ~$195,000

The daily BTCUSD chart captured on Sept. 13 shows Bitcoin trading near $116,045 on Bitstamp, riding a rising channel that has contained price since May. A rising channel is a trend pattern where price oscillates between two upward-sloping parallel lines, printing higher highs and higher lows as it advances.

Price continues to respect the channel’s lower boundary and the 50-day EMA around $113,285, while the midline acts as a pivot during pullbacks. The upper boundary sits just above recent swing highs and has capped every advance since July. Each touch has produced consolidation rather than reversal, which keeps the structure orderly and directional.

The setup now confirms a measured objective that points about 68% above the current level, aligning with the annotated target near ~$195,000. That projection derives from extending the channel’s prior impulse and adding it to the recent base. As long as Bitcoin holds above the rising lower boundary and maintains acceptance over the 50-day EMA, the channel mechanics support continuation toward the top rail and, on a decisive break, the ~$195,000 objective.

Momentum and structure remain consistent with an uptrend. Candles cluster above the average, higher lows persist along the lower rail, and shallow retracements find bids at the EMA. A clean daily close through the channel’s upper boundary would validate the next leg within this framework. Conversely, a sustained close back below the lower rail would neutralize the path and force a reassessment of the target.

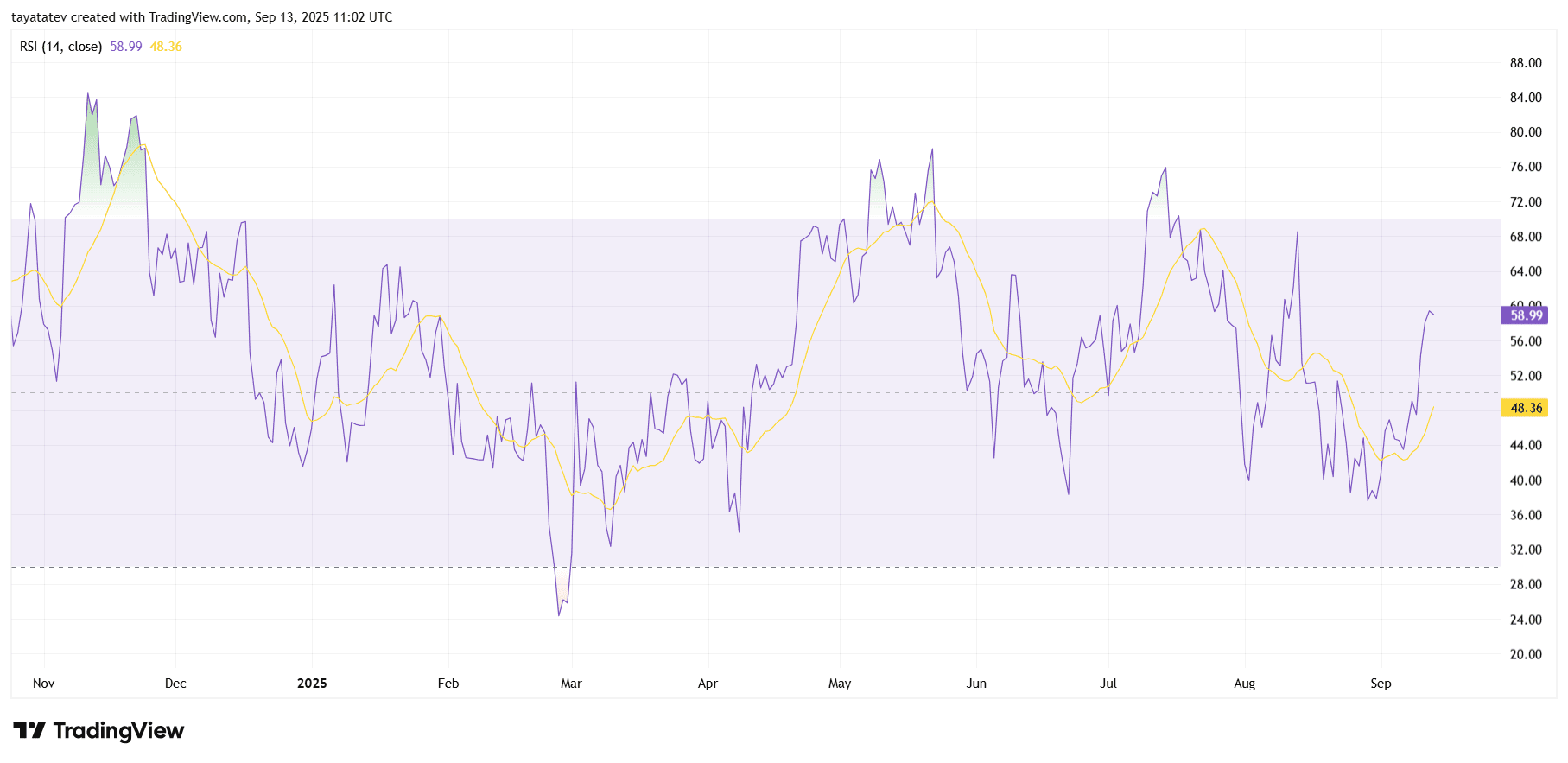

Bitcoin RSI shifts to a bullish range

Bitcoin’s daily RSI sits near 59 on September 13 and holds above its RSI moving average around 48. It reclaimed the 50 midpoint in early September and kept rising, which signals a momentum regime change in favor of buyers. The slope remains positive and the oscillator now spends more time in the upper half of its range.

The structure shows higher lows on the RSI through September without a clear bearish divergence against price. The reading stays below the overbought band near 70, so momentum has room to expand before meeting prior extremes seen in July. Because the oscillator is climbing while price trends higher, the signals align with the rising-channel advance on the candles.

Going forward, the 50 area acts as the pivot. Strong trends usually defend that midpoint on pullbacks, while a sustained drop below it would cool momentum and return the gauge to neutral. As long as RSI holds above 50 and its moving average, the setup supports continuation toward the channel’s upper rail.