Reuters reported that internal documents show the Reserve Bank of India (RBI) urging caution. Officials warn that full crypto rules could legitimize digital assets. They also flag potential systemic risks.

The materials say containing crypto risks through regulation would be difficult. The RBI adds that recognition through licensing may expand market scale. That, in turn, could increase links to the wider financial system.

The document reportedly notes an outright ban could curb several dangers. However, a ban would not stop peer-to-peer transfers or activity on decentralized exchanges. Therefore, risk channels would persist outside formal venues.

India Crypto Rules and Taxes — Where Policy Stands

India still has no comprehensive crypto law. Yet the country enforces several measures that shape activity. These steps focus on taxation, registration, and financial surveillance.

A 30% tax applies to digital-asset gains. The regime includes no offset for losses. It aims to separate speculative crypto income from other capital treatment.

Foreign exchanges serving Indian users must register locally. Late 2023, the Financial Intelligence Unit (FIU) sought blocks on non-registered platforms. The list named Binance, KuCoin, Huobi, Kraken, Gate.io, Bittrex, Bitstamp, MEXC Global, and Bitfinex.

FIU Enforcement and AML — Exchange Access and Returns

The FIU actions targeted platforms operating without approval. Authorities framed the step as a compliance move. They tied it to anti-money-laundering oversight.

In 2024, both Binance and KuCoin returned after FIU approval. Their reinstatement followed local registration steps. Other platforms faced continued restrictions pending compliance outcomes.

India also enforces AML rules on domestic crypto businesses. Firms must monitor transactions and report suspicious activity. These requirements bring crypto entities under financial-crime controls already used in banking.

India Crypto Adoption Data — Chainalysis and Public Holdings

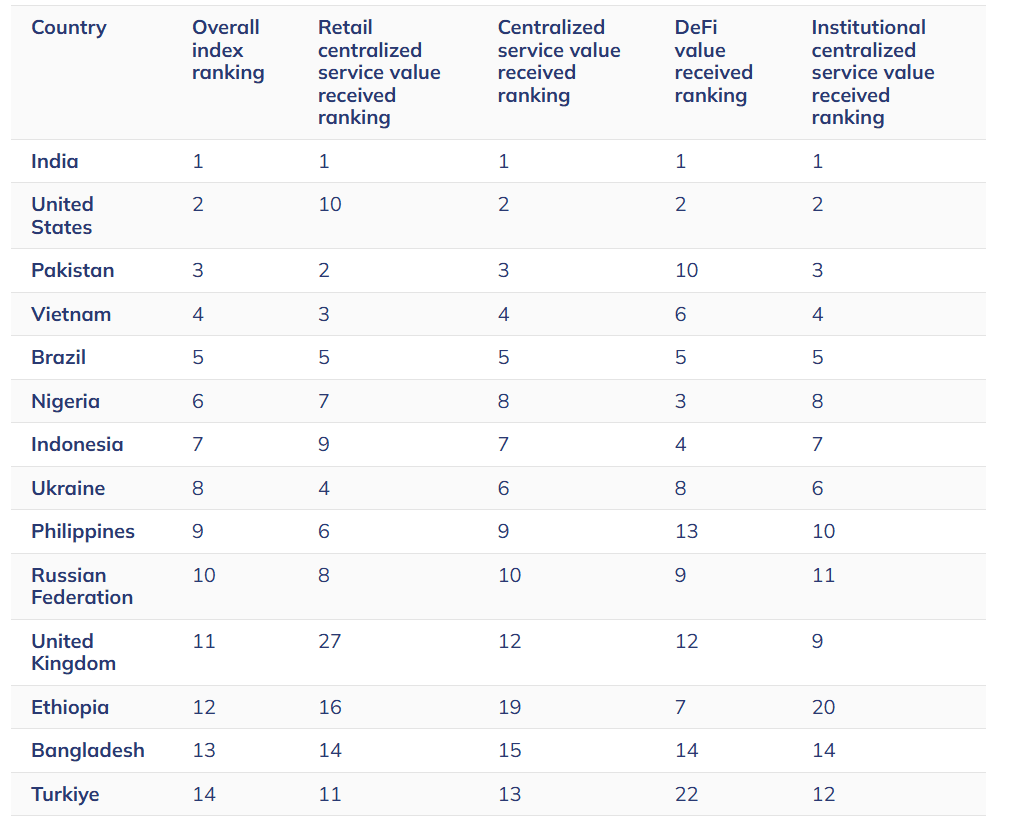

Despite policy caution, usage remains high. The 2025 Geography of Crypto Report by Chainalysis places India at the top in crypto adoption. The ranking covers multiple activity categories.

Officials have disclosed personal holdings. Minister Jayant Chaudhary said his crypto portfolio rose 19% to about $25,500. The disclosure underscores participation among public figures.

Industry leaders still see gaps between metrics and real-world use. Mithil Thakore, CEO of Velar, said,

“The fact that metrics say one thing, and reality presents a contrasting image, suggests that India stands at a paradoxical crossroads.”

The comment points to differences among access, utility, and sustained engagement.

RBI vs. Regulation Debate — India Crypto Policy Path

The RBI materials, as cited by Reuters, favor restraint. Officials stress that regulating crypto may confer legitimacy. They also warn that rules could make the sector systemic.

The same materials outline limits of a ban. Even strict prohibitions cannot halt person-to-person transfers. Nor can they stop activity on DEXs, which operate without central intermediaries.

For now, India relies on taxes, registration, and AML controls. The government has not set a timeline for comprehensive legislation. The policy stance reflects active supervision without full statutory recognition.