Bitcoin (BTC) price broke past $114,000 for the first time since Aug. 24 earlier this year. The U.S. Producer Price Index (PPI) slipped 0.1% in August, defying expectations for a 0.3% rise and reversing July’s sharp 0.7% increase. The decline pulled the annual PPI down to 2.6% from 3.1% and signaled easing pressure in the supply pipeline. Core PPI, which excludes food, energy, and trade services, rose 0.3% month-over-month and 2.8% year-over-year, roughly in line with forecasts.

Markets viewed the surprise drop in headline PPI as dovish for Federal Reserve policy. Futures traders quickly priced in a near-certain 25-basis-point cut at the next meeting, adding momentum to risk assets like Bitcoin.

Analysts flagged a tightening setup around $112,000–$113,000, where a breakout could swing sentiment sharply.

Analysts Cite On-Chain And Macro Cues For Potential Bitcoin Rally

With the PPI data and other macro developments setting the backdrop, market watchers dug into on-chain data and technical signals to gauge Bitcoin’s next move.

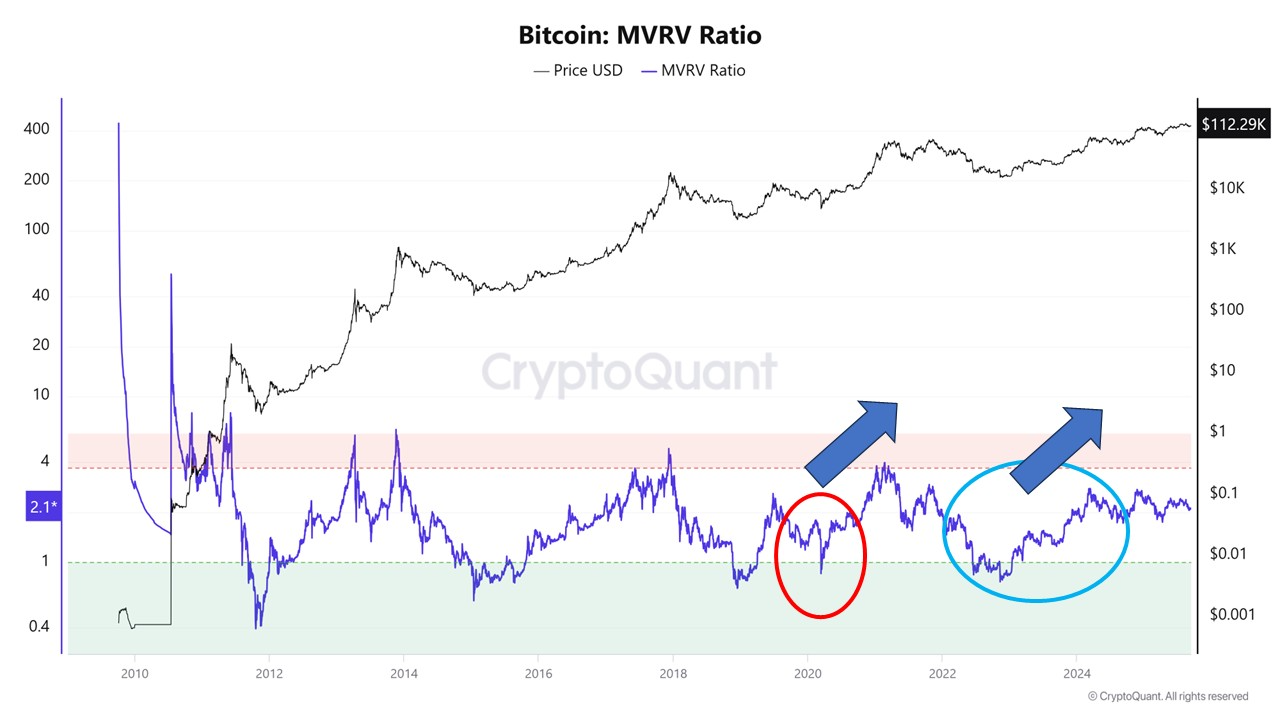

Bitcoin’s on-chain backdrop remained constructive. CryptoQuant data placed the MVRV ratio at 2.1, a mid-range level that historically preceded rallies when liquidity improved. Analysts at XWIN Research Japan recalled that the ratio collapsed to 1 during the 2020 panic, then surged once Fed stimulus hit markets.

They noted a similar pattern unfolded in late 2024, with the ratio steadying near two before the prime crypto restarted its rally.

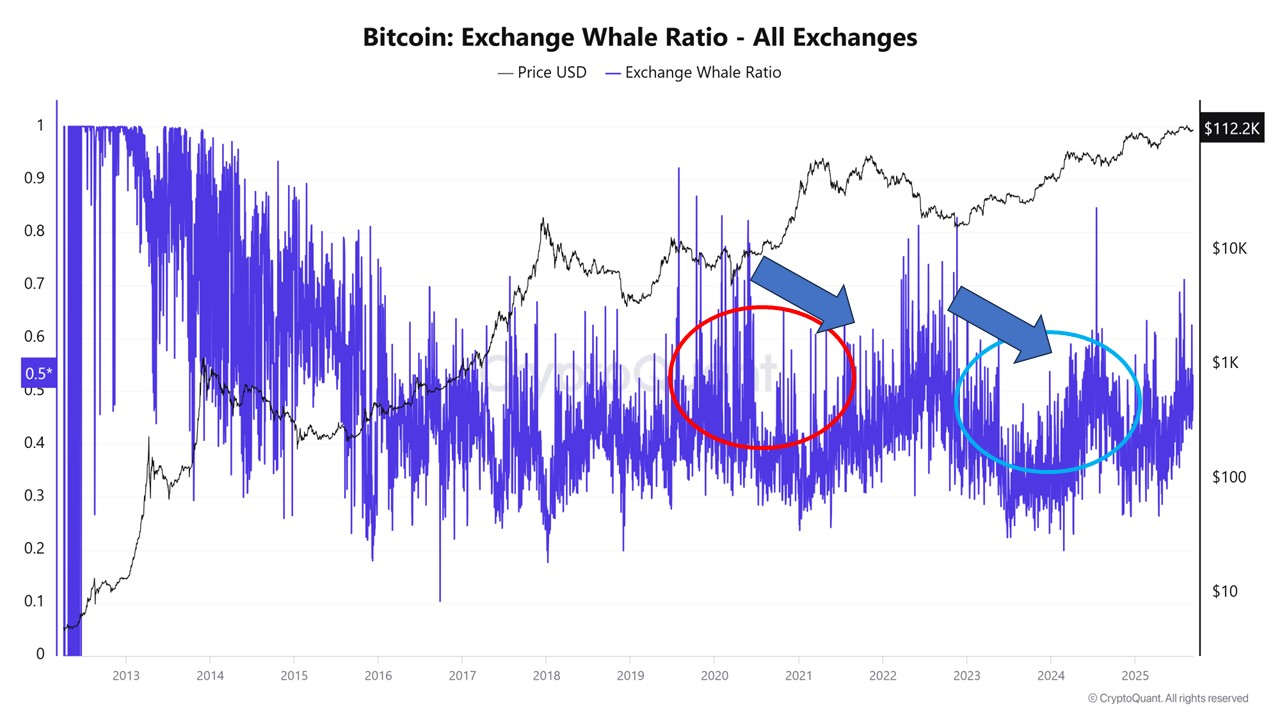

Exchange Whale Ratio Spikes During Volatility

The same note emphasized the Whale Ratio. It spiked during volatility as whales pushed coins to exchanges, but later eased when accumulation returned.

Recent figures showed a similar decline, pointing to large holders pulling supply back into wallets. The pattern suggested reduced selling pressure and aligned with institutional inflows into ETFs. Together, the signals framed a structure where valuation remained neutral and whales showed signs of confidence.

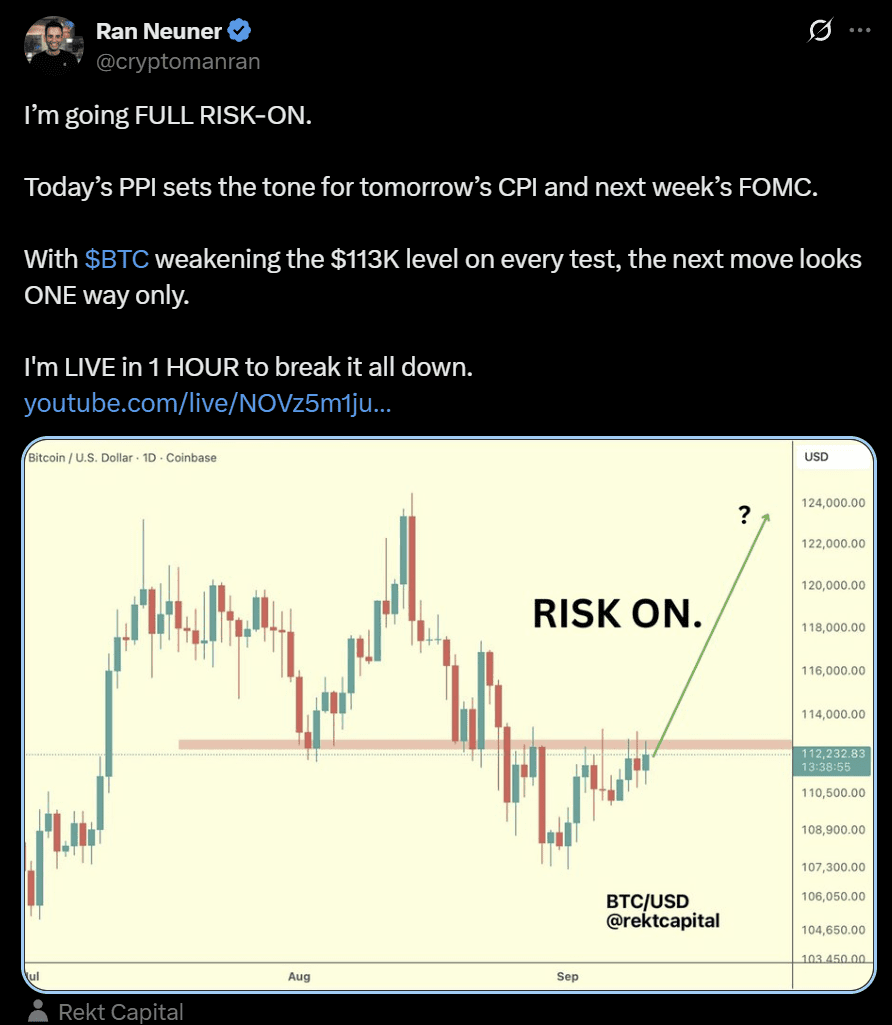

Technical voices linked these fundamentals to visible resistance. Ran Neuner argued that the BTC USD pair‘s repeated attempts to clear $113,000 had steadily eroded the barrier. The analyst said every rejection carried less force, indicating buyers were absorbing supply and narrowing the range. He tied his outlook to the US PPI, CPI, and FOMC events, framing them as the catalysts that could decide whether Bitcoin finally broke higher.

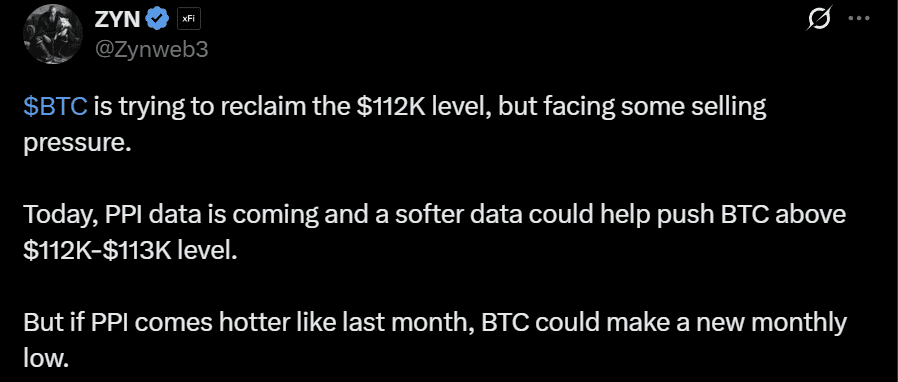

ZYN emphasized the same levels but underscored the importance of immediate macro triggers. The analyst noted that the prime crypto had already reclaimed $112,000, but warned that holding the range depended on the August PPI release. ZYN stated that softer wholesale prices would fuel a breakout through $113,000, while a hotter reading risked flipping sentiment back toward new monthly lows.

Capital B Extends its Bitcoin Treasury Push

The structural signals in Bitcoin coincided with corporate activity in Europe. French-listed Capital B, formerly The Blockchain Group, raised about $5.9 million through a series of share issues earlier this month. The company framed the move as part of its ongoing effort to expand its Bitcoin Treasury Company model.

The raise included three tranches. An “ATM-type” capital increase with TOBAM generated roughly $1.8 million. A reserved issue for TOBAM’s Bitcoin Alpha Fund added another $2.5 million. Fulgur Ventures subscribed to a discounted tranche, bringing in about $0.7 million.

Together, the injections bolstered Capital B’s balance sheet while allowing the firm to continue accumulating Bitcoin. Company statements indicated that the latest raise could finance the purchase of about 60 additional coins, pushing its potential total holdings beyond 2,260 BTC.

The developments tied back into the broader market context. While traders dissected whale flows and macro triggers, Capital B underscored how listed firms were still using equity issuance to convert fiat into digital reserves. The combination of ETF inflows in the United States and corporate accumulation in Europe reflected a dual channel of institutional demand, reinforcing Bitcoin’s current setup.