The U.S. Securities and Exchange Commission (SEC) has delayed its decision on the 21Shares Spot SUI ETF. This ETF would allow investors to buy shares tied directly to the price of SUI, a cryptocurrency, without needing to hold the coin itself.

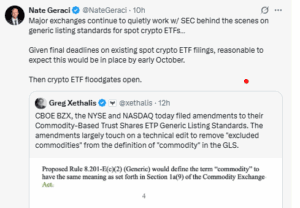

The delay happened because the SEC is still working with major exchanges like Nasdaq, NYSE, and CBOE to create a clear set of generic listing rules for crypto ETFs. These rules are meant to ensure all spot crypto ETFs follow the same standards before being approved.

SEC Extends Review Until December

Nasdaq filed an application with the SEC on May 23 to list and trade the SUI ETF. On July 22, the SEC extended its review period. Now, instead of giving a quick decision, the commission has started a more detailed process to decide whether to approve or deny the application.

The SEC has also asked the public to submit comments on the proposal. Anyone can send their views, data, or arguments regarding whether the ETF should be approved.

At present, the final deadline for the SEC to make a decision is December 21, 2025. However, analysts believe that if the generic rules are ready in time, the SEC might approve the SUI ETF—and possibly other altcoin ETFs—by October 2025.

The exchanges have filed amendments to change the definition of “commodity” under the existing ETF rules. This removes some earlier restrictions that blocked crypto assets from fitting into the framework.

Nate Geraci, co-founder of ETF Institute, said he expects these generic listing standards to be finalized by early October, since many spot ETF applications already face deadlines around that time.

SUI Holds $3.30 Support as Traders Eye $4.20 Retest

SUI’s price has struggled during the prolonged wait. On September 5, the token traded near $3.39, rebounding slightly after testing support around $3.28, a level that has acted as a floor several times in recent months.

The uncertainty around ETF approval has kept SUI below key resistance zones. The token faces immediate hurdles near the 50-day EMA ($3.44) and 100-day EMA ($3.49), while the broader resistance area lies between $4.20 and $4.40, where sellers previously capped rallies.

The Relative Strength Index (RSI) stands at 47, showing neutral momentum. Importantly, the token recently broke out of a falling wedge pattern. This is a setup that often signals the possibility of upward moves.

If SUI price holds above $3.30, analysts see room for a push toward $3.80 and possibly the $4.20–$4.40 zone. However, a breakdown below $3.30 could drag the price toward $3.00 or even $2.80.