On-chain tracker Whale Alert reported a 26.67 million XRP transfer—worth about $58 million—from a private wallet to Coinbase. Historically, similar whale moves signaled selloffs. However, this time, the market held firm.

Despite the scale of the transaction, XRP price stayed stable, surprising traders. According to data from analytics firm Alva, XRP showed “impressive resilience” as other assets faced broader market volatility.

“This kind of stability is not what we usually expect after such a massive transfer,”

an Alva analyst said.

“It shows Ripple’s market is maturing, with enough demand to absorb large transfers without triggering panic.”

Since November 2024, XRP has gained over 300%, holding above the $2 mark even with consistent profit-taking. Glassnode data showed XRP realized gains of nearly $69 million daily in early June.

Ripple Launches XAO DAO Governance Model

Amid the whale transfer and legal uncertainty, Ripple unveiled a new governance framework for the XRP Ledger called XAO DAO on June 17. This system introduces on-chain proposals, community voting, and development grants for the XRPL ecosystem.

Unlike many DAOs, XAO DAO doesn’t use a native token. Instead, it links voting power to XRP holdings based on snapshot data, reducing the influence of large token holders.

“This structure decentralizes governance while keeping the network’s growth on track,”

said a source familiar with the project. The first round of DAO funding will support validator nodes, dApps, early-stage startups, and blockchain research initiatives.

Ripple developers view the launch as a major step toward community-driven governance. One XRPL contributor said,

“This is about putting XRPL’s future in the hands of users—not just Ripple’s leadership.”

XRP Lawsuit Still Awaits Court Ruling

While the network evolves, Ripple’s legal case with the U.S. Securities and Exchange Commission remains unresolved. Legal expert Marc Fagel, a former SEC attorney, clarified that the August 15 timeline isn’t a hard deadline. Judge Analisa Torres could issue a ruling at any time.

“The date is procedural,”

Fagel said.

“A decision could arrive within days or weeks.”

This uncertainty contrasts with Canada, where regulators approved two spot XRP ETFs on June 18. Analysts expect these products could draw $200M to $300M, adding pressure on U.S. authorities seen as lagging.

The ongoing lawsuit continues to block Ripple’s IPO ambitions and delays deeper partnerships with institutions like Ripple’s deal with Bank of America. Investors are growing impatient as the U.S. falls behind in regulatory clarity.

XRP Bearish Pennant Signals Possible 18% Breakdown Toward $1.74

The XRP/USDT daily chart from June 20, 2025, shows a clear bearish pennant pattern forming after a sharp decline earlier this month. The pattern started developing in early June and is now nearing completion.

A bearish pennant forms when prices consolidate inside converging trendlines after a strong downward move, often leading to another drop when support breaks.

Currently, XRP trades at $2.14, below the 50-day EMA of $2.23. The pennant’s lower boundary has been tested multiple times, and pressure is building. If XRP breaks below this support zone, it may confirm the pattern and trigger a decline.

The projected breakdown target sits around $1.74, which represents an 18% drop from the current price.

Volume has decreased during the consolidation phase—another typical sign of a bearish pennant setup. This declining volume often precedes a breakout or breakdown move, adding to the bearish outlook.

Traders now watch for a confirmed daily close below the support line. If that happens, XRP may lose the $2 mark and head directly toward the $1.74 target, matching the size of the prior move into the pattern.

Unless buying pressure steps in soon, the chart structure supports further downside.

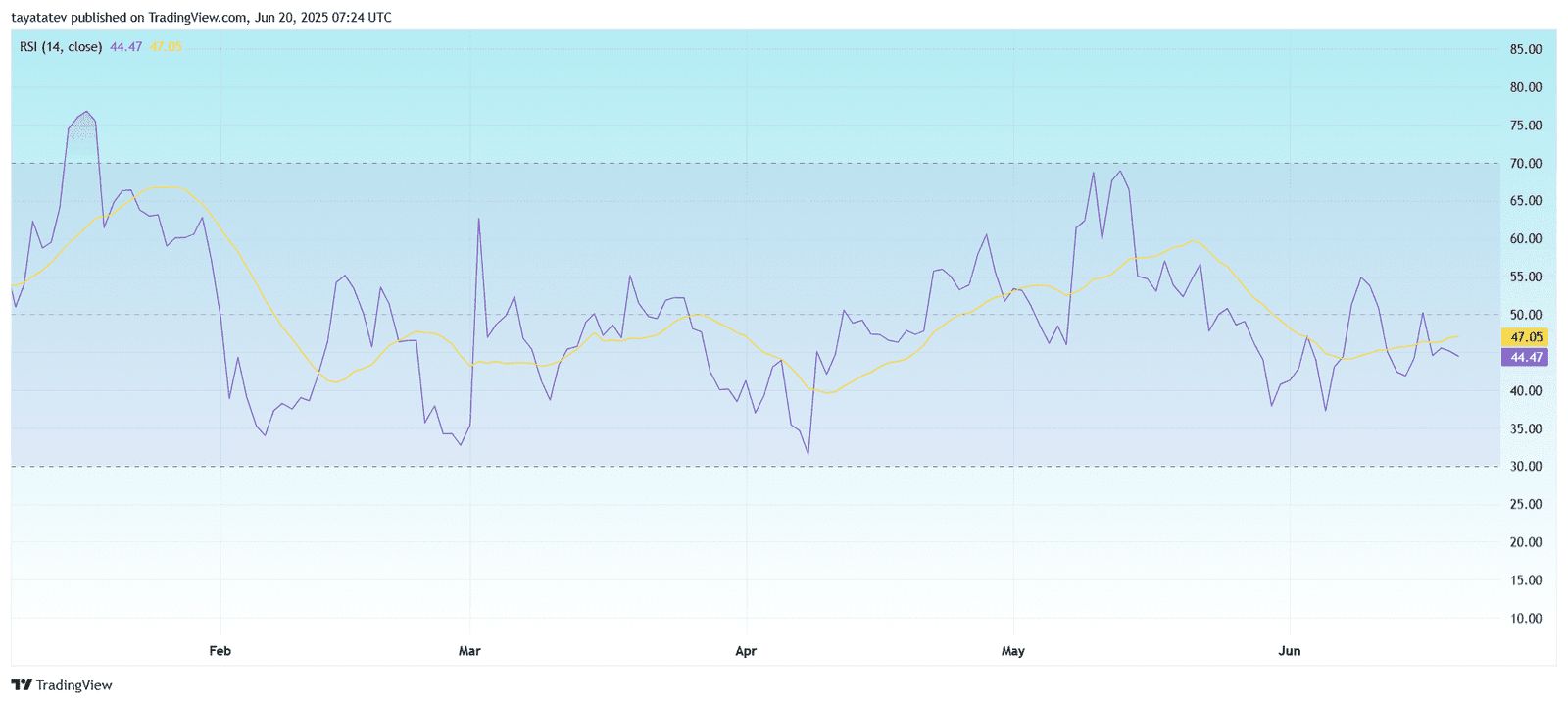

XRP RSI Signals Weak Momentum Below Neutral Zone

The RSI chart for XRP/USDT, published on June 20, 2025, shows the 14-day Relative Strength Index (RSI) at 44.47, with the RSI-based moving average at 47.05.

This setup indicates bearish momentum, as the RSI remains below the neutral 50 level and also trails its signal line. The market lacks buying strength, and the price may continue downward if RSI stays under this threshold.

Since mid-May, the RSI has consistently failed to reclaim the 60 zone, showing weaker upward pressure. The recent rejection below 50 further confirms the lack of bullish drive.

Unless RSI breaks above the moving average and pushes past 50, XRP may remain under pressure. Combined with the bearish pennant pattern on the price chart, this RSI reading reinforces the downside risk.

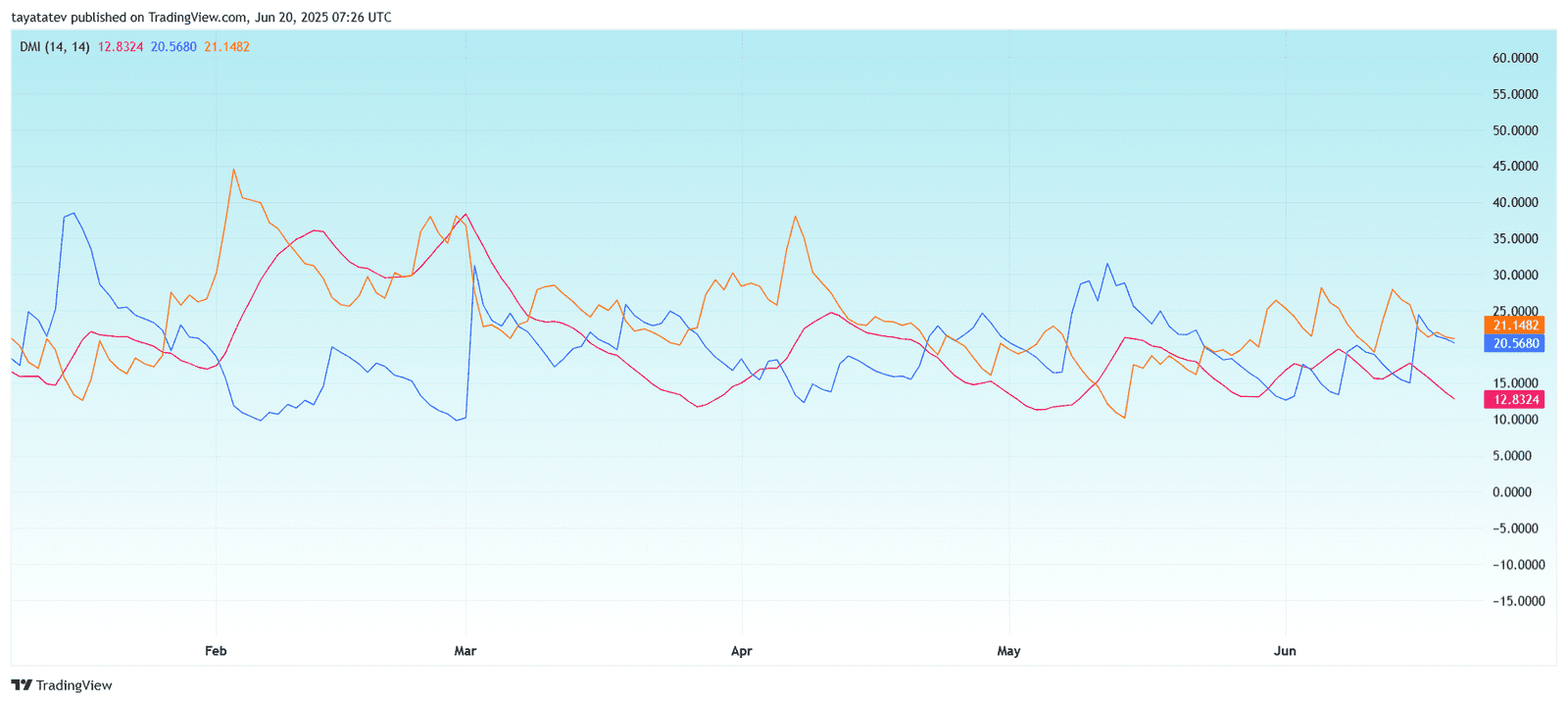

XRP DMI Shows Weak Trend Strength, Bearish Bias Builds

The Directional Movement Index (DMI) chart for XRP, dated June 20, 2025, shows the following readings:

-

+DI (Blue): 20.57

-

–DI (Orange): 21.15

-

ADX (Red): 12.83

Here’s what this setup reveals:

-

Bearish Pressure Slightly Dominates:

The negative directional index (–DI) has crossed above the positive directional index (+DI), which indicates a bearish bias. This crossover suggests that selling momentum currently outweighs buying pressure. -

Weak Trend Strength:

The Average Directional Index (ADX), which measures overall trend strength, remains low at 12.83. Typically, values below 20 show a lack of trend clarity or strength. This means the current bearish setup lacks strong conviction and may not trigger a sharp move unless ADX rises. -

Trend May Develop If ADX Rises:

If the ADX begins climbing while –DI stays above +DI, it could confirm a strengthening downtrend. For now, the market shows indecision with slight downside leanings.

In summary, the DMI points to a weak but developing bearish structure. Traders are watching closely for a stronger ADX rise that would validate the pennant breakdown and push XRP lower.