Market attention is rotating again, and speculative capital is flowing toward AI and robotics themes, as asset managers are expanding tokenized products onto faster chains. And demand for tokenized alternatives like gold is climbing as investors hedge uncertainty.

Chainlink price predictions are now showing how LINK remains essential infrastructure, but price action has lagged as capital chases newer narratives. In contrast, DeepSnitch AI sits closer to where attention is on the up and up.

The project delivers live AI-driven risk analysis and contract auditing tools during its presale, giving early buyers access before broader market participation.

With staking active and launch intentionally delayed to refine the system, DeepSnitch AI offers exposure to functionality already. And it’s that proven credibility that could easily run it 100x in Q1 of this year, after it launches.

Capital is rotating, which means it isn’t evaporating

Speculative capital is drifting toward AI and robotics-linked crypto themes, reflecting a broader hunt for automation-driven growth. This rotation doesn’t erase the need for core infrastructure, but it does explain why attention has moved away from slower-burning narratives toward systems that promise new categories of activity.

Meanwhile, WisdomTree’s decision to expand tokenized funds on Solana highlights how asset managers are experimenting with faster, more flexible settlement layers to reach different investor bases. Tokenization is being tested in live markets, one chain at a time.

And demand for alternative collateral is rising too, as tokenized gold products have surged as investors look for assets that combine price stability with on-chain portability. It’s likely, then, that capital is preparing for volatility, not after pure growth.

As capital rotates and narratives change, the ability to spot risk, interpret flows, and avoid structurally bad trades becomes more valuable than simply picking the right sector. That is exactly the environment DeepSnitch AI is being built for.

From the Chainlink price prediction to DeepSnitch AI’s upcoming launch

1. DeepSnitch AI

DeepSnitch AI is a platform with utility so sharp it’s hard to deny its steady origins. Built by expert on-chain analysts, its set of tools is all designed to give retail traders the same intelligence that whales use to succeed in crypto the way they do.

If you’re following a Chainlink price prediction, you probably already understand the value of infrastructure. DeepSnitch AI applies that same mindset to trading intelligence, focusing on systems that prevent losses rather than chasing narratives.

Five AI agents power the platform, each covering a blind spot that retail usually misses. Among them, SnitchFeed tracks whale behavior, SnitchScan flags structural risk, Token Explorer reveals token dynamics, and AuditSnitch simplifies contract safety into actionable labels. SnitchGPT then acts as the interface, turning complex signals into answers you can actually use.

While the platform hasn’t yet launched fully, many of these tools are already live internally, so the platform is doing the unheard-of and proving its functionality (and credibility, for that matter) first and foremost.

Staking is live, tools are shipping, and pricing has climbed to $0.03755. And the team has given the system time to harden before wider exposure, with a slightly delayed launch.

Established tokens have their draw, and it’s one of stability. But DeepSnitch AI offers early-stage optionality without sacrificing logic, and that’s a rare pairing in this market, enough to make a moonshot as soon as it’s launched into the world.

2. Chainlink

The Chainlink price prediction suggests that the need for the faithful is to believe that infrastructure eventually gets priced correctly. LINK’s utility is undeniable. After all, without oracles, smart contracts can’t interact with external data. But utility and price appreciation operate on different timelines, and patient capital competes against faster-moving opportunities.

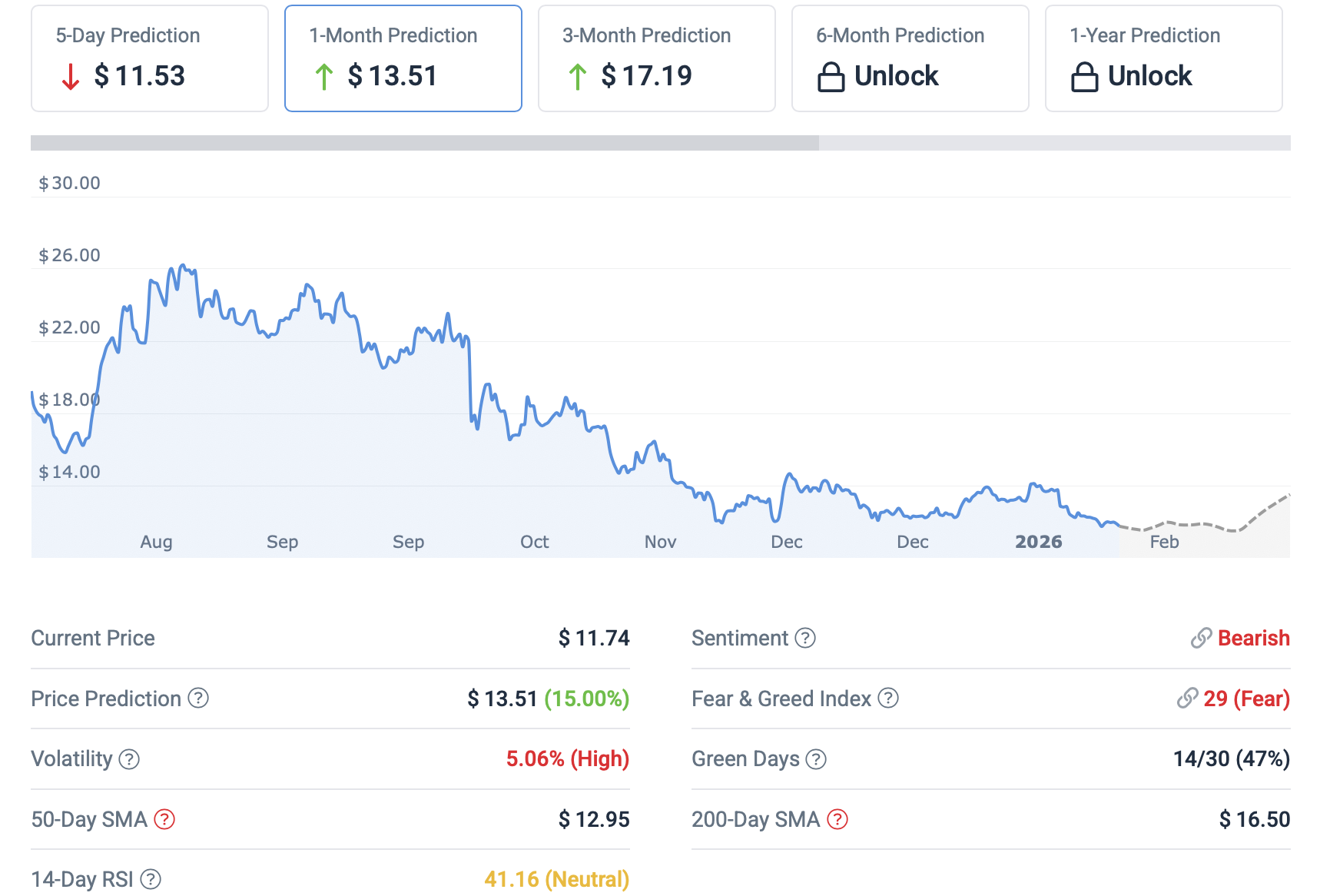

Trading around $11.75 in late January, LINK has lagged broader altcoin moves despite forecasts pointing to $31.62 by 2026, an outcome that’ll depend on continued adoption and institutional recognition.

Chainlink price forecasts have to rest on the idea that infrastructure value eventually gets priced in. The LINK outlook remains structurally sound, but within current oracle token market trends, patience often competes with faster-moving narratives elsewhere, especially among early-stage presales.

3. Ethereum

At roughly $3,000 in late January, ETH trades well below its all-time high but with clear catalysts ahead. Predictions suggest $3,878 by year-end 2026, which would put it up around 30% by then.

The 2030 target implies Ethereum captures significant value from AI integration, DeFi growth, and Layer 2 expansion.

For the Chainlink price prediction thesis to play out optimally, Ethereum needs to succeed, and LINK’s value proposition depends on smart contract platforms thriving. Owning both creates correlated exposure, though, and it’s also worth keeping in mind how earlier-stage opportunities offer comparatively far more room to run.

Last reflection

Any Chainlink price prediction analysis should acknowledge LINK’s role in enabling the smart contract economy. But essential doesn’t mean explosive.

DeepSnitch AI is at a different stage, where explosions are on the cards in no small way. Presale pricing is still here, and the platform has working tools, an imminent launch, and tiered bonuses cementing the urgency of buying before it launches.

With these codes, buying $5,000 worth of DSNT at $0.0368 delivers around 136,000 tokens. With the 50% DSNTVIP50 bonus, total exposure increases to approximately 204,000 DSNT, and so on. Combined with dynamic staking APR, these bonuses compound the advantage of early entry.

Secure your allocation through the official presale, and be sure to follow X and Telegram to stay up to date on all things DeepSnitch AI.

FAQs

What is the Chainlink price prediction for 2030?

LINK could reach approximately $33.05 by 2030, putting it at about 180% upside from current levels. The Chainlink price prediction depends on continued oracle adoption and broader recognition of infrastructure value.

Why is Chainlink underperforming the market?

Despite strong fundamentals and ETF accumulation, LINK has faced selling pressure from weak technical indicators and broader risk-off sentiment. Essential infrastructure doesn’t always correlate with short-term price appreciation.

How can I balance infrastructure exposure with higher-upside opportunities?

Pairing established tokens like LINK and ETH with presale-stage projects like DeepSnitch AI captures both stability and asymmetric potential. The Chainlink price prediction is optimistic in the long term, but presales offer compressed timelines for potential returns, and more room to run those returns sky-high.