Kadena announced it will cease all business operations and end active maintenance of the blockchain, effective immediately, on Oct. 22, 2025. The team posted the decision on X and said “market conditions” made continuation impossible. Independent outlets confirmed the announcement shortly after it went live.

Core team exits; network continues

Kadena emphasized that the blockchain is not owned or operated by the organization and will remain online. The network’s proof-of-work design relies on miners and community node operators, who will keep validating blocks and securing the chain. Coverage reiterated that ledger operations are separate from the company’s business functions.

The team said a small transition group will publish a node update to support continuity as maintenance winds down. This step aims to smooth the hand-off from the foundation to independent operators. Reports described the plan as a shift from corporate oversight to community stewardship.

As a result, applications and protocols built on Kadena remain governed by their own developers. Smart contracts, once deployed, continue to execute so long as miners produce blocks and nodes stay in sync. The organization’s closure, therefore, affects staffing and official support rather than the ledger’s ability to process transactions.

What users and builders should expect

Users should see the chain remain reachable while operators align on software versions. The transition team’s binary will guide this near-term phase. Node runners will monitor stability during the organizational wind-down.

Developers retain control over their contracts and front ends. Teams can continue to deploy and maintain dApps provided the network’s consensus and infrastructure keep functioning. Documentation and existing tooling remain available for now.

Ecosystem communications will shift from a centralized cadence to project-level updates. Media summaries indicate further notices about governance, repositories, and technical stewardship as the hand-off proceeds.

Recent activity frames the context

One week earlier, Kadena announced a testnet partnership with Brickken to deliver compliant real-world-asset infrastructure on Chainweb EVM. The collaboration targeted institutional tokenization workflows and positioned Chainweb EVM for enterprise pilots. Those efforts now depend on community and partner leadership rather than the foundation.

Industry posts highlighted a goal to tokenize assets during the test phase before a potential mainnet rollout. The timeline, stated before today’s shutdown, will likely require updated guidance from the participants. Observers will watch for project-level statements on continuity.

Kadena’s move places operational responsibility on miners, node operators, and builders. The immediate question is execution: shipping the transition binary, aligning clients, and keeping apps available while official maintenance ends.

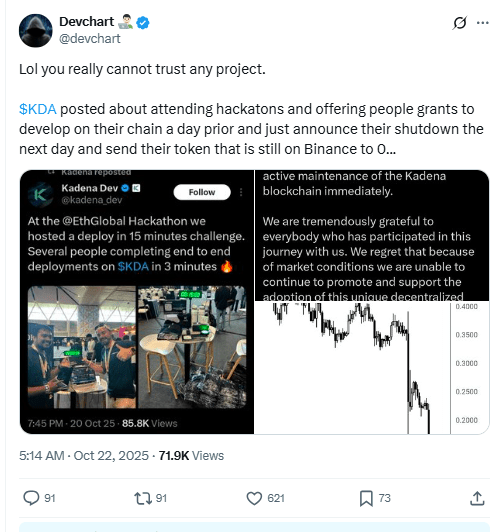

Hackathon push, then shutdown: why this erodes developer trust

Devchart flags a sharp sequence: Kadena promoted hackathon activity and grants, then—within a day—announced it would cease business operations and active maintenance. That timing creates a credibility gap. Builders who engaged at the event expected continuity; instead, they woke up to a wind-down. Consequently, confidence in roadmap signals and grant promises takes a hit.

Furthermore, the post highlights a core risk in crypto ecosystems: information asymmetry. Public posts about growth can coexist with private runway stress. When shutdowns arrive without clear advance guidance, developers and partners feel blindsided. Therefore, teams may now demand stronger disclosures, contingency plans, and escrowed grants before committing resources.

Finally, Devchart’s “send their token to 0” line is rhetorical, yet it captures perceived damage. Even if networks keep running under miners, governance and tooling support still matter for dApp teams. In practice, trust recovers only with transparent transition steps, maintained repos, and reliable support from whoever takes stewardship next.

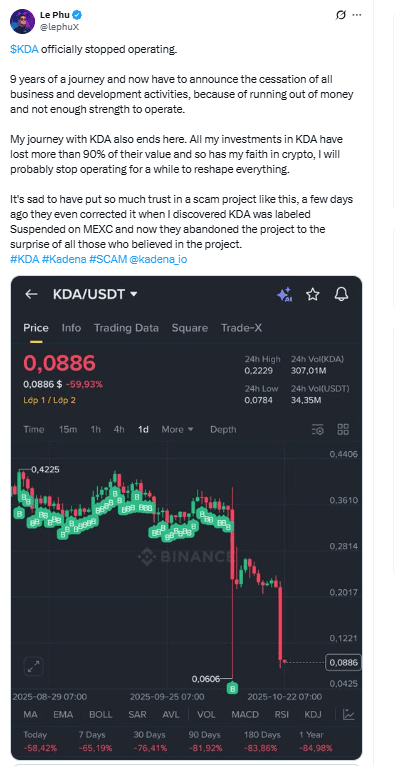

Investor says Kadena ceased operations; cites exchange flags and heavy losses

Le Phu states that Kadena has “stopped operating,” attributing the decision to a lack of money and insufficient strength to continue. He says his nine-year journey with KDA ends here and that his holdings lost more than 90% of their value. Moreover, he signals a personal pause from crypto while he “reshapes everything,” underscoring how sudden shutdowns can drain confidence across retail investors.

He also points to recent exchange signals. According to the post, MEXC labeled KDA as suspended days earlier, which he says preceded the project’s abandonment. While exchange tags often change for technical or compliance reasons, investors read them as early warnings. Therefore, the timeline he outlines—label first, official halt later—amplifies the perception that public risk cues arrived before the announcement.

Context matters for users and builders. Even if the underlying chain continues under miners and community operators, the end of organizational maintenance still removes a central support layer. Consequently, token venues, wallets, and dApps must decide whether to keep integrations live, adjust messaging, or disable routes. Until transition details settle, participants are likely to prioritize operational continuity checks, repository status, and clear communication from whoever assumes stewardship.

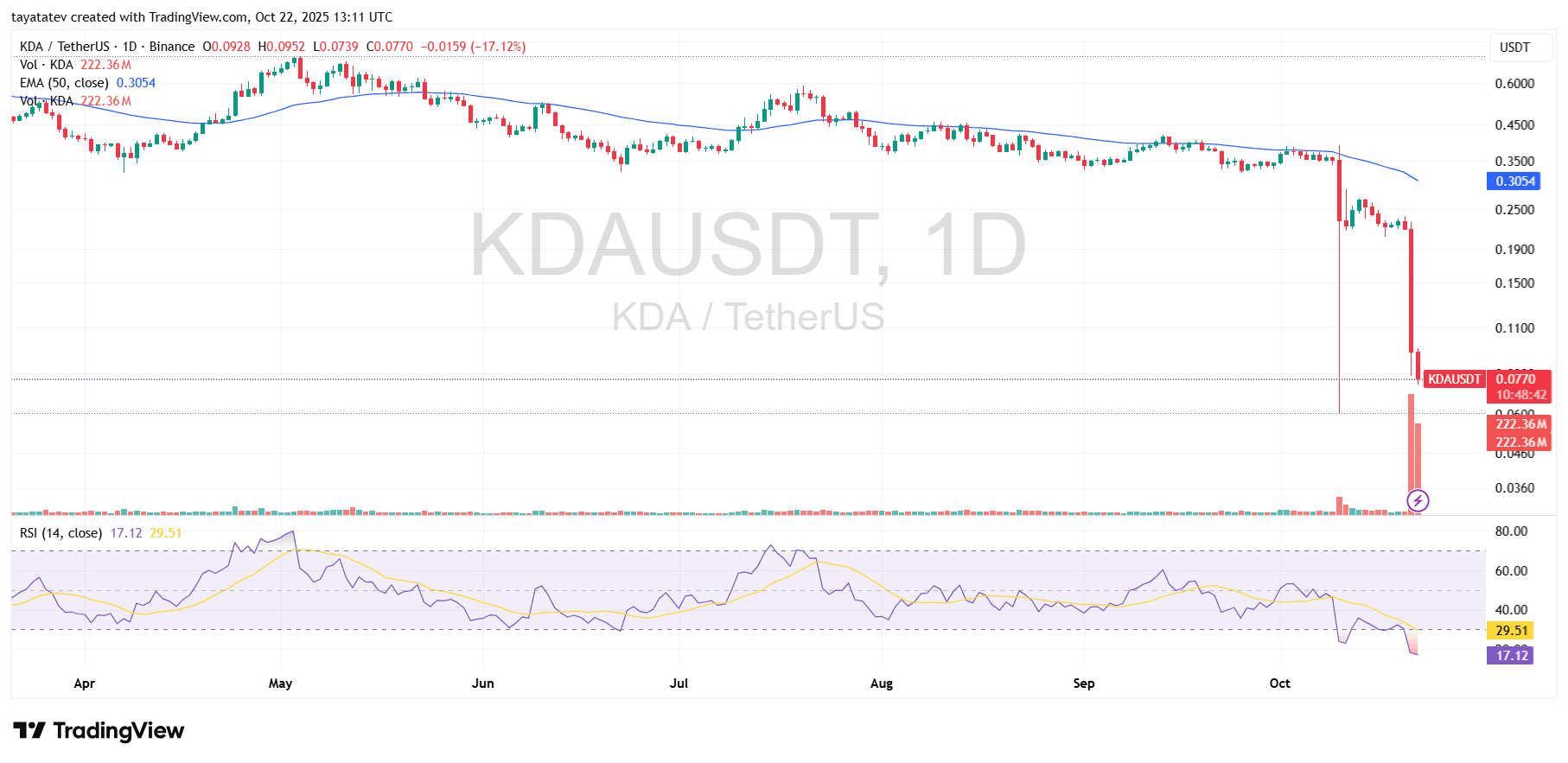

KDA’s daily chart on Oct. 22, 2025 shows a collapse, volume climax, and extreme oversold readings

On Oct. 22, 2025, 13:11 UTC, the KDA/USDT daily chart on Binance captured a vertical breakdown to roughly $0.077. Price fell in back-to-back long red candles after weeks of steady decline, leaving a visible “air pocket” below $0.20. Intraday prints show a deep lower wick toward the mid-$0.03s before buyers pulled it back, which signals forced selling and aggressive volatility rather than orderly trend action.

At the same time, momentum flipped to extremes. The 14-day RSI sits near 17, well beneath the 30 oversold threshold, while its signal line hovers around 29.5. Such readings often follow capitulation-style sessions when liquidity thins and market orders cascade. Yet, the slope of the move and the size of the candles indicate that any stabilization attempt still needs evidence—smaller bodies, higher closes, and reclaimed levels on retests.

Moreover, the 50-day EMA near $0.305 tracks far above current price, underlining how far the market has dislocated from its recent trend baseline. Volume spiked to ~222M on the day, confirming heavy participation during the dump and subsequent wick. Consequently, former support in the $0.20–$0.30 zone now turns into immediate overhead resistance, and participants will watch whether today’s wick marks a temporary exhaustion or just a pause inside a stressed downtrend.