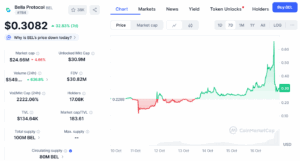

Bella Protocol (BEL) is trading near $0.31 after recovering 32% over the past week from the market crash triggered by Donald Trump’s renewed tariff threats on China. Its competitor Aave (AAVE) fell 13% during the same period. So does BEL have the potential to grow further and reach $1 by the year end? Let’s analyse.

DeFi Sector Posts 41% Q3 Growth, But Bella’s TVL Remains Low

The total value locked (TVL) across all DeFi platforms grew 41% in Q3 2025, reaching a three-year high. This rebound signals a slow but steady return of liquidity into decentralized lending, staking, and yield protocols after more than a year of stagnation.

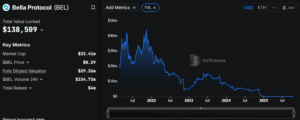

However, Bella Protocol’s TVL remains small — at $210,396, according to DeFiLlama. That figure is a sharp drop from its $40 million peak in 2021, showing that the project has yet to regain significant user deposits despite broader sector recovery.

At the time of this writing, BEL trades just below its 200-day exponential moving average (EMA) at $0.33, which continues to act as a key resistance level.

Shorter EMAs — 20, 50, and 100-day — are clustered between $0.25 and $0.27, creating a strong support base.

The Relative Strength Index (RSI) stands around 62, suggesting moderate bullish momentum. If BEL price closes decisively above $0.33, the next upside targets are $0.50 and $0.70. A failure to hold $0.28 could trigger a correction back toward $0.25.

Historically, BEL token traded above $1 several times, peaking near $9.75 in 2020 during the early DeFi boom. Since then, both trading volume and network participation have declined sharply.

Bella Expands AI, Cross-Chain Partnerships in Fall 2025

Bella Protocol has expanded its focus beyond yield optimization to integrate artificial intelligence and cross-chain infrastructure. In its Fall 2025 Progress Report, the project announced several active initiatives designed to enhance product scalability and developer collaboration.

The updates included enhancements to Signal Bot and Research Bot, two AI modules that analyze market data and on-chain activity.

Bella also launched a Uniswap V3 Simulator, a quantitative research tool for testing liquidity strategies.

The development roadmap highlights ongoing integrations with zkLink, Fraction AI, and GAIB, aimed at expanding cross-chain compatibility and building a foundation for more autonomous DeFi agents.

In September 2025, Bella partnered with ARPA Network to launch a University Crypto Research Alliance, connecting blockchain teams with academic institutions to promote applied research in AI and DeFi.

Additionally, Bella entered a technical partnership with Solidus AI Tech, aimed at enhancing the computational efficiency of its AI products by using high-performance cloud infrastructure. This collaboration is expected to accelerate Bella’s AI model training and improve its predictive analytics layer across supported protocols.

Can BEL Reach $1 by 2025?

For BEL to reach $1, its market cap would need to climb from $24 million to roughly $80 million, a 3× increase.

That scenario depends on several measurable factors:

-

TVL must recover above $10 million through renewed deposits or partnerships.

-

Daily trading volumes should stay above $100 million.

-

The 2025 DeFi cycle must sustain its Q3 momentum and attract new liquidity to smaller protocols.

A move toward $0.70 is possible if market conditions stay favorable, but $1 remains an aggressive target that would require a combination of sector-wide expansion and visible user growth within Bella’s ecosystem.