Hedera’s token HBAR has yet to recover from the recent crash triggered by Donald Trump’s renewed tariff threat to China. The token remains down 2% and 14% on daily and weekly charts respectively, hovering near $0.18. Does HBAR have the potential to reach $1 by the end of 2025? Let’s examine.

HBAR Struggles Below $0.21 as Momentum Weakens

HBAR price has been moving inside a descending price channel since mid-September, showing a gradual loss of momentum after repeated failures near the $0.20–$0.21 range. On Oct. 13, the token briefly broke above $0.19 amid higher volume but faced rejection at $0.20, resulting in an 8 % pullback the next day.

The Relative Strength Index (RSI) sits near 39, indicating weak accumulation and limited buying strength. MACD lines have flattened just below zero, showing the absence of bullish momentum. Short-term moving averages (20-day and 50-day EMAs) continue to slope downward, confirming near-term resistance.

From a chart perspective, $0.17–$0.16 remains a strong demand zone, while $0.21–$0.25 is the immediate resistance area.

A clean breakout above $0.21 with high volume could shift momentum toward $0.30, but failure to hold above this level risks a return to the $0.16 region.

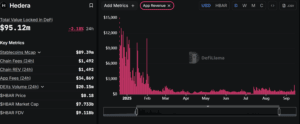

On-chain data supports this subdued outlook. Hedera’s total value locked (TVL) stands near $95 million, with $89 million in stablecoins and about $20 million in 24-hour DEX trading volume.

The network generates roughly $1,500 per day in on-chain revenue and $34,000 per day in app fees, suggesting healthy but modest DeFi activity.

What Would Need to Happen for HBAR to Reach $1

For HBAR price to move from $0.18 to $1, it would need a more than a 440% increase — a level that depends on multiple economic, regulatory, and network-specific changes.

1. A Broad Crypto Bull Market

HBAR’s previous bull runs have closely followed Bitcoin’s trajectory. In late 2024, when Bitcoin reclaimed $70,000, HBAR’s price jumped 367 % quarter-over-quarter, reaching $0.27 — its strongest rally since 2021. However, that momentum faded as global markets entered a tightening phase in early 2025.

A renewed crypto upcycle through 2025 could lift liquidity across all major altcoins, allowing capital to flow back into projects like Hedera. Without that broader recovery, a fivefold rise remains difficult, as HBAR’s performance historically depends on market-wide inflows rather than isolated adoption events.

2. Enterprise Adoption That Converts Into Revenue

Hedera’s core strength lies in its enterprise-grade use cases. The network operates on a hashgraph consensus mechanism that offers faster finality, low energy costs, and high scalability — advantages over traditional blockchains.

Recent partnerships highlight this positioning:

-

Project Acacia, the Reserve Bank of Australia’s wholesale-CBDC pilot, uses Hedera for real-world financial testing.

-

In the U.K., Lloyds Bank, Aberdeen, and Archax completed the first tokenized FX trade using Hedera.

-

The EQTYLab–NVIDIA–Accenture partnership launched a Verifiable Compute platform on Hedera, merging blockchain transparency with AI workloads.

-

The U.S. state of Wyoming selected Hedera for its Frontier Stable Token (FRNT), the first state-issued stablecoin framework.

-

Qatar’s Digital Asset Lab is testing Hedera for Shariah-compliant digital receipts, advancing blockchain transparency in Islamic finance.

Despite these milestones, on-chain revenue remains limited. Messari reports Hedera’s network revenue fell 5 % QoQ to $232,700 USD in Q1 2025, while daily active accounts dropped 33 %. For HBAR to reach $1, these partnerships need to move beyond pilots and create continuous transaction volumes that generate real network fees.

3. Spot HBAR ETF Approval

Institutional access remains a decisive factor. In October 2025, Canary Capital and Grayscale Investments submitted spot HBAR ETF filings to the U.S. Securities and Exchange Commission (SEC). Nasdaq filed an accompanying Rule 5711(d) amendment to list the ETFs, and the SEC published the proposal in the Federal Register, marking the first formal step in the approval process.

ETF approval would bring regulated exposure to HBAR, attracting long-term institutional investors and improving liquidity across exchanges. However, regulatory delays — including those tied to the 2025 U.S. government shutdown — have postponed decisions, with the next review window due in November 2025.

Until approval, HBAR remains a speculative asset with limited access to institutional capital.

5. Supportive Regulatory Environment and Global Alignment

In particular, a friendlier U.S. regulatory climate could strengthen HBAR’s position among enterprise-focused assets. The Trump administration has supported digital asset innovation. New laws like the CLARITY Act and GENIUS Act are defining stablecoin frameworks and reducing legal uncertainty.

Moreover, this environment has already helped U.S. exchanges such as Robinhood relist several tokens — including XRP, SOL, ADA, and HBAR — in late 2024, leading to a short-term price boost.

Globally, Hedera’s participation in central bank pilots, alignment with EU’s MiCA framework, and use in regulated markets like the U.K. and Australia improve its credibility. These developments signal Hedera’s readiness for institutional-scale use, though actual revenue growth will depend on the speed of enterprise integration.