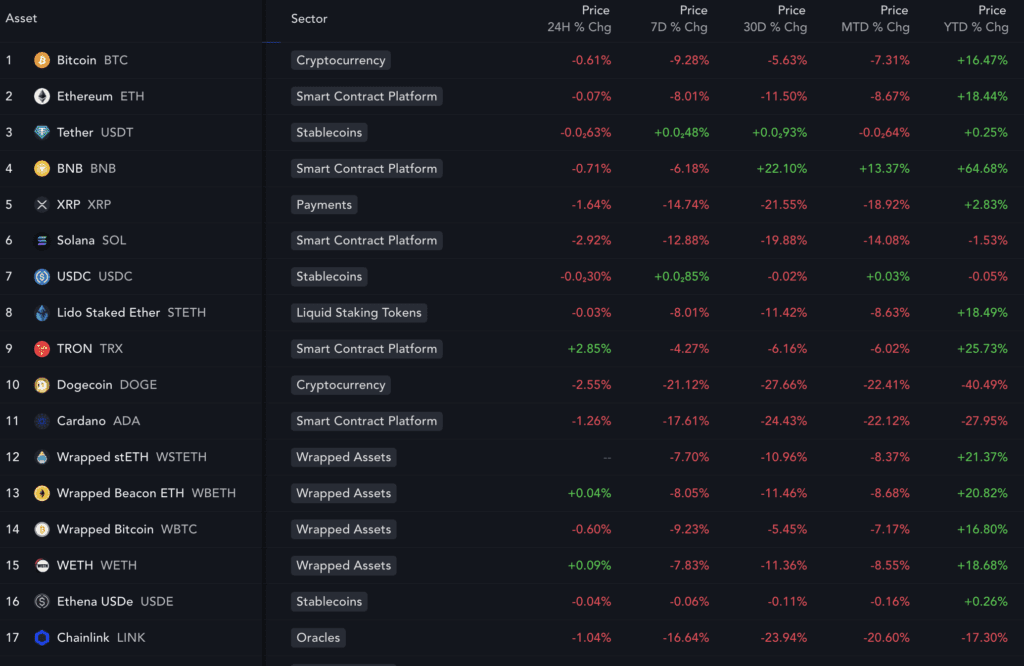

Chainlink (LINK) has underperformed XRP (XRP) so far this year, recording 17.30% losses versus the latter’s 2.30% gains as of Oct. 16. From a market’s point of view, it shows that LINK is not better than XRP. But can it do better by the year’s end? Let’s examine.

XRP: Cross-Border Payments

Ripple aims to make cross-border payments faster and cheaper through the XRPL, the parent blockchain. In it, XRP serves as a bridge currency, aiming to connect different national currencies in global transactions.

For this vision to work, institutions, such as banks and similar financial companies, must either adopt the XRPL or use XRP itself for settlements. That dependence makes XRP’s success contingent on institutional choices. If banks build their own systems or use competing networks, the token gains little by default.

However, institutional adoption of XRP remains limited.

Ripple’s payment network has partners like Santander and SBI, but most use RippleNet’s fiat-based rails, not the XRP token itself. Regulatory uncertainty, volatility concerns, and integration costs have deterred banks from relying on XRP for settlements, favoring stablecoins or private blockchain solutions instead.

Despite the SEC lawsuit, regulation is no longer the key obstacle. Other projects, including Ethereum, faced similar scrutiny and still expanded. XRP’s real challenge is proving that its technology offers clear advantages over in-house or alternative blockchain solutions.

Chainlink: Universal Service Layer

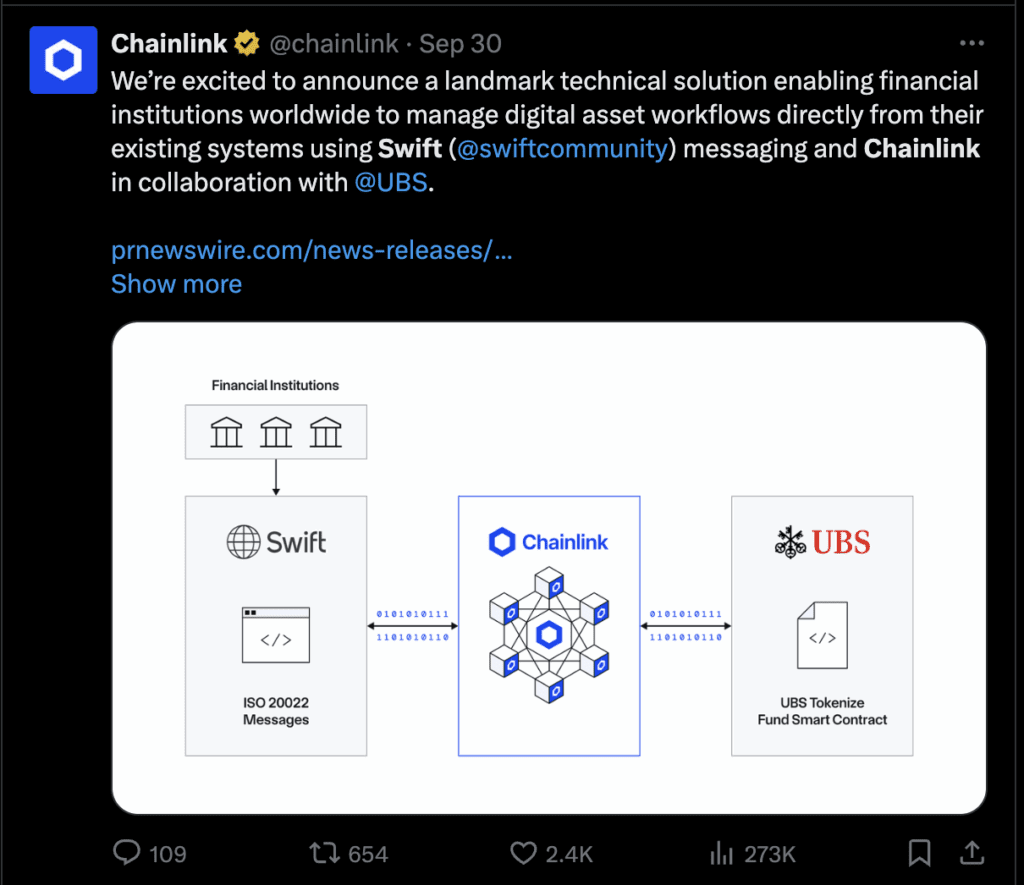

Chainlink’s technology, notably its crosschain Interoperability Protocol (CCIP), is actively being used to bridge traditional finance (TradFi) and the crypto ecosystem, with a significant focus on integration with SWIFT, the interbank messaging system.

For instance, Chainlink has partnered with SWIFT to connect traditional and digital assets for TradFi institutions. SWIFT is using Chainlink’s CCIP as a proof-of-concept to enable SWIFT messages to instruct onchain token transfers, making the SWIFT network interoperable across various blockchain environments.

These initiatives demonstrate how Chainlink is leveraging its secure, scalable onchain data and compliance solutions to combine SWIFT’s extensive network with blockchain technology, paving the way for a more integrated and efficient capital markets ecosystem.

Conclusion

Despite XRP’s better price performance, Chainlink appears stronger as a project. Its technology powers key infrastructure for both crypto and traditional finance, including SWIFT integration and institutional data flows. Chainlink’s role as a universal interoperability layer gives it broader, long-term utility, while XRP’s success still hinges on limited institutional adoption.