As the crypto market prepares for another major cycle, investors are increasingly comparing well-established large-cap tokens with emerging early-stage projects that offer greater upside potential. Dogecoin (DOGE) remains one of the most recognizable names in the industry, thanks to its strong community and meme-driven history. However, Mutuum Finance (MUTM), a decentralized lending protocol, is attracting growing attention for its utility-based model and low entry price.

Both tokens appeal to different types of investors, but their growth profiles couldn’t be more different. DOGE represents a mature, sentiment-driven asset, while MUTM offers a utility-backed, early-stage opportunity in a rapidly evolving sector of the crypto industry.

Dogecoin (DOGE)

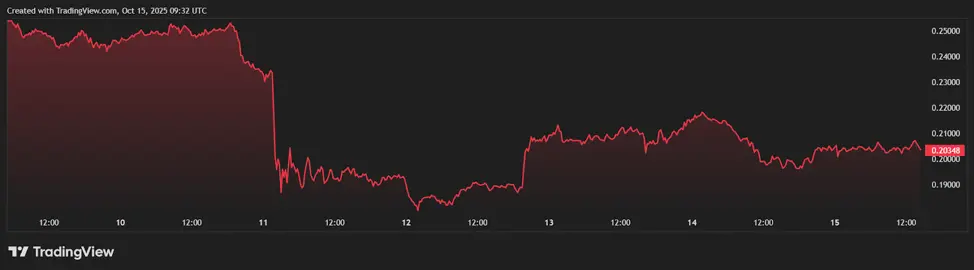

Dogecoin (DOGE) is currently trading around $0.20–$0.21, with a market capitalization between $30 and $33 billion. It has consistently encountered strong resistance between $0.25 and $0.28, with an even more significant breakout zone near $0.30. According to several analysts, if DOGE can overcome these resistance levels and sustain bullish momentum, its price could rally to $0.30–$0.35.

It’s important to understand the scale involved. DOGE’s market cap means that for every significant percentage gain, a massive amount of capital must flow in. Unlike its early days, when small waves of buying could double the price, DOGE now requires billions in new inflows to break key resistance zones.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) offers a very different proposition. It is a decentralized lending and borrowing protocol built on Ethereum, designed to create more efficient, secure, and scalable on-chain markets. The platform operates through dual lending markets, combining pooled liquidity for major assets like ETH and USDT with isolated lending markets for niche tokens.

This structure allows Mutuum Finance to serve both everyday users, who can supply and borrow mainstream assets with predictable yields, and institutional players, who often require isolated risk environments. Borrowing rates are set automatically based on pool utilization: when liquidity is abundant, borrowing costs remain low to encourage activity, and when liquidity tightens, rates rise to attract new deposits.

On the lending side, APYs increase as utilization grows, creating natural incentives for liquidity providers. For example, if a user supplies $10,000 worth of ETH to a pool with a 75% utilization rate, they could earn a competitive variable APY, which adjusts upward as more borrowers enter the pool. This structure ensures capital is put to work efficiently while rewarding those who supply liquidity early, laying the groundwork for a self-sustaining credit ecosystem.

Presale Data

Mutuum Finance’s presale has entered Phase 6, marking a key moment in its early growth trajectory. Tokens are now priced at $0.035, a significant rise from the $0.01 Phase 1 starting point, reflecting growing investor demand and steady momentum. The sale follows a fixed-price, limited-allocation structure, which means that each stage has a predetermined supply of tokens. Once that supply is fully allocated, the price automatically increases in the next round, creating a transparent and step-based appreciation model.

The response so far has been strong. $17.4 million has already been raised, with over 17,200 holders securing their allocations, and 66% of Phase 6 tokens already sold. When this stage concludes, the price will increase by almost 20%, moving closer to the $0.06 launch price that has already been set. This structure provides clear incentives for those entering early, offering an advantage before the token lists on exchanges.

For those who joined during the earliest rounds, the difference is substantial. Buying at $0.01 and holding until launch could represent a fivefold increase, while even at today’s $0.035 level, there’s a notable upside at listing, especially as key product milestones and exchange integrations approach. This model has attracted both retail participants and larger investors, many of whom are taking early positions.

DOGE vs MUTM

Dogecoin’s limitations are clear. It has a large market cap, no distinctive utility, and an inflationary supply, which collectively make explosive growth difficult. Its price depends on sentiment cycles, and even optimistic predictions are capped at around 130–145% upside in the near term.

Mutuum Finance, on the other hand, is still at an early stage, with real protocol utility underpinning its token. A central feature of its design is the mtToken and buy-and-distribute mechanism. When users supply assets, they receive mtTokens, which accrue yield over time. Meanwhile, a portion of platform revenue is used to buy MUTM on the open market and redistribute it to mtToken stakers, creating a self-reinforcing loop of demand tied directly to lending activity.

To illustrate the difference, imagine a $900 investment. Allocating it to DOGE at roughly $0.21, and assuming a rally to $0.30–$0.35, would bring the position’s value to approximately $1,285–$1,500.

If the same $900 were invested in MUTM at $0.035, and the token reached analysts’ projected range of $0.20–$0.40 post-launch, that position could grow to between $5,140 and $10,285. The contrast shows how early-stage utility tokens can offer asymmetric upside compared to large, mature meme coins.

Launch and Security Measures

Mutuum Finance has also been taking tangible steps to build confidence ahead of its launch. The team confirmed through an X statement that Version 1 of the protocol will launch on the Sepolia testnet in Q4 2025, introducing core components like liquidity pools, mtToken issuance, debt tokens, and liquidation mechanisms, with ETH and USDT supported from day one.

On the security side, Mutuum Finance underwent a CertiK audit, earning a 90/100 token score, and introduced a $50,000 bug bounty to encourage independent review of its smart contracts. These measures are designed to strengthen trust as the platform approaches its next development stages.

Future Plans and Presale Momentum

Looking forward, Mutuum Finance’s roadmap outlines several major milestones. The team plans to launch an over-collateralized stablecoin, designed to provide predictable borrowing conditions while feeding a portion of protocol revenue back into MUTM buybacks. There are also plans for Layer-2 network integration to reduce costs and improve scalability, and expanded oracle infrastructure to ensure accurate real-time pricing.

Meanwhile, Phase 6 of the presale is selling out quickly, and once completed, the token price will move closer to the $0.06 listing level. For early investors, this phase represents a crucial entry point before major product launches and broader market adoption begin.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance