Catizen’s public channels do not show a fresh maintenance notice for Oct. 16. The announcement feed and the project’s X profile remain silent on any new downtime window today. I checked both sources before publication.

Earlier maintenance messages exist on the channel archive. However, those posts predate today and do not mention an Oct. 16, 08:00 UTC window. Therefore, today’s status remains normal unless a later post appears.

Readers should treat screenshots or quotes circulating elsewhere with caution. The absence of a same-day post on Catizen’s owned feeds is decisive for newsroom verification.

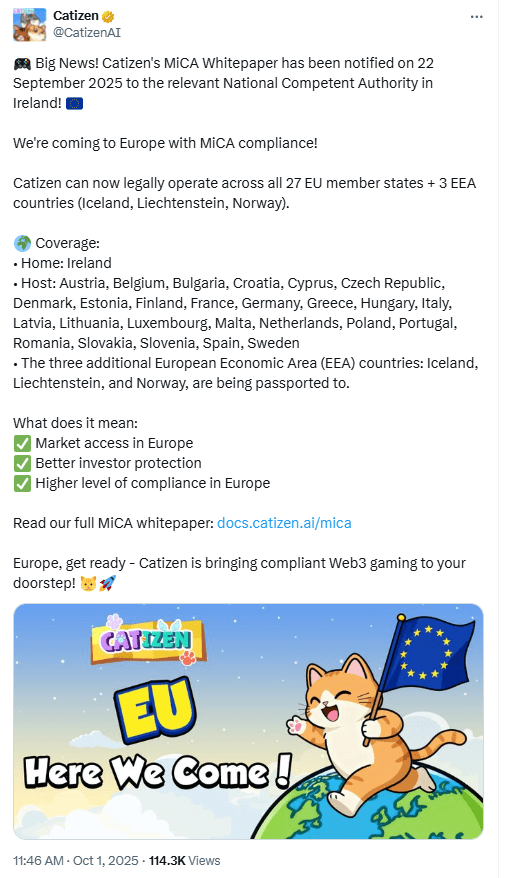

MiCA whitepaper notification remains the lead regulatory item

Catizen says its MiCA whitepaper was notified on Sept. 22, 2025 to Ireland’s competent authority. The team published that statement on X, giving a specific date. This remains the most concrete regulatory step on record.

The whitepaper site lists the MiCA framework and formal sections required under EU rules. It positions the document as a Title II notification rather than an approved prospectus. That distinction matters under MiCA.

Irish and EU pages explain that MiCA requires issuers to notify a national authority before public offering or admission to trading. They also note that notification is not approval. This aligns with Catizen’s wording.

HASBi RUN tie-in stays active across Catizen channels

Catizenconfirmed a collaboration with HASBi RUN, the Hasbulla-branded endless runner, as part of its TON push. The team posted the tie-in on X. The Telegram channel also introduced the partner game to its audience.

The posts frame HASBi RUN as an ecosystem addition rather than a trading event. Catizen’s language stresses building on TON and cross-game exposure. That emphasis keeps the item squarely in product news.

Hasbulla’s own social profiles have promoted the game’s Telegram launch. Those posts reinforce the identity and timing of the brand partner. Together, they substantiate the collaboration.

Catizen 2.0 messaging and Game Center growth continue

Catizen continues to highlight its “2.0” shift, focusing on Virtual World Assets and a TON-based stack. The idea centers on verifiable ownership and faster settlement for in-game items. The announcement feed points to this direction.

The team also recapped mid-year platform growth to roughly 30 games in the Game Center. That update, shared on X, outlines new releases added since January 2025. It underscores ongoing product cadence.

Additionally, Catizen’s feed reiterates broad payment support in the Game Center. It references TON, CATI, USDT, Stars, and standard cards. These notes describe user flows rather than market moves.

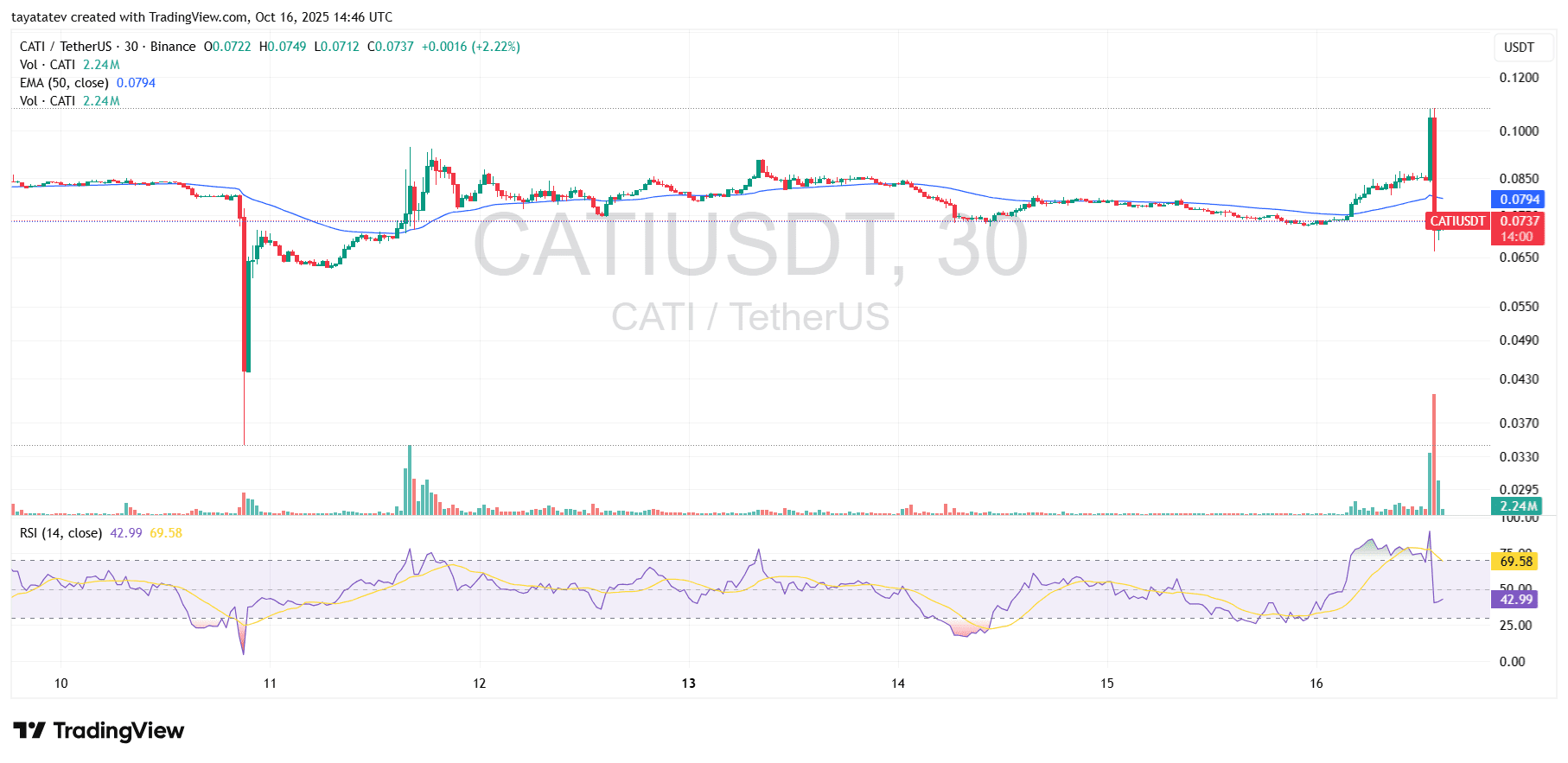

CATI/USDT on Binance printed a sudden upside spike, then an immediate reversal. On the penultimate 30-minute candle, price jumped to ~$0.11 on a volume surge, marking the session’s largest bar. RSI pushed to ~70, signaling short-term overbought conditions. The move also broke above recent intraday highs that had capped advances for days.

Next, the following candle flipped red and erased the entire burst. Price fell to an intrabar low near $0.066 before stabilizing around $0.073–$0.074 into the close. Volume stayed elevated during the selloff, confirming heavy two-way trade. RSI cooled quickly to ~43, which reset momentum to neutral from overbought.

Finally, the retrace left CATI below the 50-EMA (~$0.079) on this timeframe. The sequence created a long upper wick into ~$0.11 and a fast snap back below the average. Intraday structure now shows a failed breakout with a wide range and strong participation.

CATI prints 1-hour bullish flag breakout attempt

CATI/USDT on Binance shows a classic flag structure on the 1-hour chart. Price rallied from the Oct. 11 low and then drifted lower inside a tight, downward-sloping channel. That channel formed the flag while the prior vertical advance set the flagpole. This morning, candles pushed through the flag’s upper trendline near $0.086 and closed just above it.

Next, the setup implies a measured move toward the height of the flagpole. On this chart, the dotted guide points roughly into the $0.10–$0.14 zone, which aligns with prior intraday supply around $0.10. For confirmation, bulls need sustained closes above the breakout band and improving volume. A brief retest of the broken trendline would keep the pattern intact if buyers defend it.

However, the pattern fails if price slips back inside the flag and loses nearby support. Watch the former resistance area around $0.084–$0.086 as first defense. Below that, the short-term line in the sand sits near the recent moving average cluster around $0.079–$0.081. A decisive break under those levels would turn today’s push into a false breakout and reset the structure.