While protocol teams obsess over validator counts and

geographic distribution, they ignore accountability through identity. The top

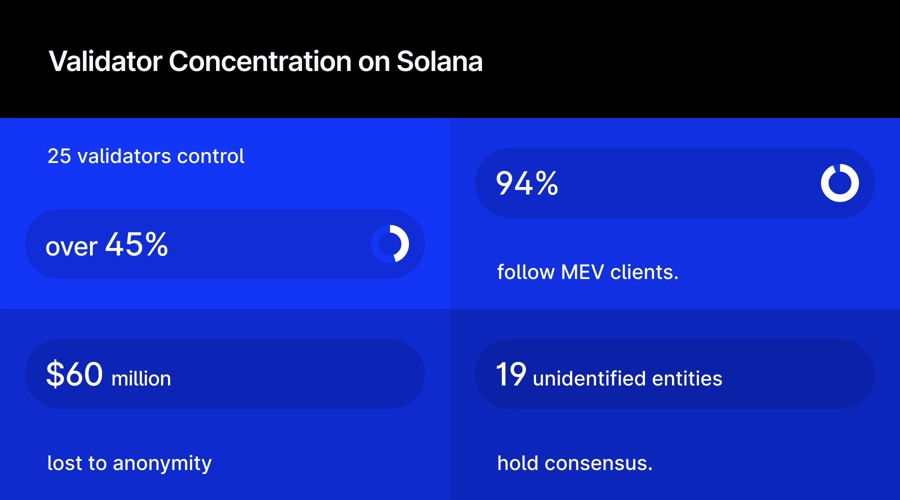

25 Solana validators control 45.5% of all stake, yet users delegating billions

cannot identify them or assess alignment with network values.

One anonymous

validator extracted $60 million through MEV attacks with impunity, and networks

like Aleph Zero show how critical disputes escalate when users cannot

distinguish leadership factions.

The Fundamental Flaw in Faceless Validation

The blockchain industry has conflated technical

decentralization with meaningful decentralization, creating systems that appear

distributed while operating with concentrated, unverifiable power structures.

Digital

assets meet tradfi in London at the fmls25

Anonymous validation enables “accountability

arbitrage,” where validators capture economic benefits of network

participation while avoiding reputational costs for their decisions. When 94%

of Solana validators adopt MEV-optimized clients without community

consultation, it demonstrates how obscurity enables coordinated behavior that

undermines stated network values.

[#highlighted-links#]

This produces networks with the worst characteristics of

both centralized and decentralized systems: the opacity of traditional

institutions combined with the coordination challenges of distributed

governance.

What does it mean to have Lunar as a validator?At Lunar we have been in the space since 2019, we have worked with many of the leading ecosystems in various parts of their growth stages. As a validator we contribute with: Top devops teams and hardwareHosting events,… pic.twitter.com/WKmXumGrcP

— Tim Haldorsson (@TimHaldorsson) September 23, 2025

The Illusion of Stake-Weighted Democracy

Current validator selection mechanisms optimize for capital

allocation rather than governance capability, creating systems where economic

power translates directly into political control without corresponding

accountability. Solana’s 19-validator Nakamoto Coefficient exemplifies this: 19

unidentified entities can control consensus despite thousands of validators

participating.

Users delegate billions in assets to validators they cannot

identify, effectively recreating the trust assumptions of traditional finance

while stripping away its regulatory protections. This represents centralization

disguised as decentralization, concentrating power among entities that

explicitly avoid building community trust through transparency and public

verification.

Building Networks with Validator Authority

Smart networks will distinguish themselves through validator

curation strategies that align individual reputation with collective network

health. This requires treating validators as ecosystem partners whose brands

and capabilities complement strategic objectives. Figment’s institutional

success demonstrates how branded validators become ecosystem multipliers: their

relationships, expertise, and reputation create network effects beyond

consensus security.

Rethinking Solana’s validator client paradigm 💻On the latest @ValidatedPod, @Austin_Federa is joined by @1ultd, CEO @Syndica_io. They dive into Sig, a new Solana validator client being built in Zig that optimizes for reads & aims to make running validator nodes more… pic.twitter.com/1Pz2mtGfhP

— Solana (@solana) March 26, 2024

When validators have public brands, their success becomes

tied to ecosystem success in ways anonymous operations cannot replicate. They

become natural content creators and thought leaders who expand ecosystem

mindshare through their audiences.

During governance decisions, they provide

distributed expertise that improves decision quality while building community

confidence in network evolution. Most importantly, validators with public

reputations create market-based accountability mechanisms, where poor

performance carries reputational costs that extend beyond individual

operations.

What’s the problem with the crypto ecosystem’s growth? ↓Since 2017, our marketing campaigns have had a huge tangible impact in the space.Our contribution to various crypto ecosystems, including Polkadot, ICP, Rose, and others, has received positive feedback from project… pic.twitter.com/qVVKcKMZTX

— Lunar Strategy (@LunarStrategy) January 31, 2024

The Market Evolution Towards Transparency

Faceless validation represents a transitional phase in

blockchain evolution, a primitive attempt to solve coordination problems

without understanding human incentives. Market dynamics increasingly favor

transparency, with institutional demand flowing toward verifiable

infrastructure providers.

Networks that recognize this evolution early will

build sustainable competitive advantages through validator authority. Those

treating obscurity as a feature will find themselves competing for a shrinking

market of users willing to accept opacity in exchange for marginal yield. The

future belongs to networks where technical excellence combines with human

responsibility—where you know who secures your assets and why they deserve that

trust.

This article was written by Tim Haldorsson at www.financemagnates.com.

Source link