Binance reaffirmed that Yei Finance (CLO) is live on its Alpha venue and that the CLOUSDT perpetual contract opened on October 14. Today’s notices and recap posts keep the operational details front-and-center, including Alpha eligibility and the synchronized futures start that followed thirty minutes later. The emphasis remains on availability, instruments, and user flows rather than price.

Coveragethis morning summarized the Alpha schedule and the futures launch window, matching the exchange’s original timing. Third-party roundups also reiterated that Binance Alpha was first to feature CLO, and that Binance Futures listed CLOUSDT with up to 50x leverage. These items align across official support pages and industry trackers.

Project channels echoed the same logistics to help users find the correct pages quickly. The Yei Finance X account pointed back to Binance notices so traders could verify start times, airdrop criteria, and product scope from source. That cross-posting keeps today’s reference points consistent as more venues add support.

Binance Alpha and Futures: status, timing, and who is eligible

Binance’s Alpha post sets the trading start at October 14, 11:00 UTC, with the CLOUSDT perpetual contract at 11:30 UTC. Today, those times remain the operative anchor for where CLO trades on Binance products, and they frame how users enter via spot exposure or derivatives. The two-step rollout reduces gaps for users who hedge or seek non-spot execution from day one.

Alpha eligibility also matters because it governs a small, first-come airdrop tied to Alpha Points. The exchange described a threshold that can step down hourly while the event is live, letting more users qualify as the window progresses. Practically, that means today’s latecomers may still meet the bar if capacity remains.

Binance’s Square and announcement pages mirror these mechanics so users can confirm details without relying on reposts. As a result, the Alpha listing, the futures market, and the airdrop all reference a single set of timestamps and criteria that are unchanged as of October 15. That consistency is what users need for clean onboarding.

KuCoin and BitMart: staged spot access and operational windows

KuCoin’s “world premiere” listing established a clear cadence: deposits live immediately on BSC, a call auction from 12:00 to 13:00 UTC, and spot trading at 13:00 UTC on October 14, with withdrawals starting today, October 15, at 10:00 UTC. Those steps give market makers and regular users distinct checkpoints to move funds and place orders. The exchange also enabled trading-bot hooks for CLO/USDT to support different execution styles.

The listing runs alongside a campaign that KuCoin scheduled through October 24 under a defined rewards pool. Because the campaign spans beyond launch day, users who did not participate yesterday still have time to engage under the posted rules. The extended window is operational, not promotional in tone, and it remains current as of today.

BitMart staged its own “primary listing,” splitting deposits, trading, and withdrawals across October 14–15. That timetable creates predictable handoffs between funding the account, getting initial trades done, and finally moving assets off-exchange. For users coordinating across venues, the precise UTC cutovers reduce settlement friction.

Additional venue signals and ecosystem context

Industry trackers and venue feeds continue to flag CLO availability and airdrop references, which helps map where liquidity and access features exist today. Roundups from data and news sites list the same Alpha start and futures timing, keeping the cross-venue picture aligned on October 15. These items are useful for verification even if you trade on a single platform.

Some education and “what is” posts appeared today that explain the product scope without focusing on price. They describe Yei Finance as a cross-chain money-market and liquidity layer centered on Sei, with middleware that extends to other ecosystems. While editorial tone varies, the core function descriptions track with Yei’s stated design.

Social posts from exchange accounts continue to promote the same dates and product names, which serves a narrow purpose: it helps users confirm whether a venue actually supports deposits, spot trading, or a convert feature today. Because these posts point back to official notices, they remain a reliable breadcrumb trail on October 15.

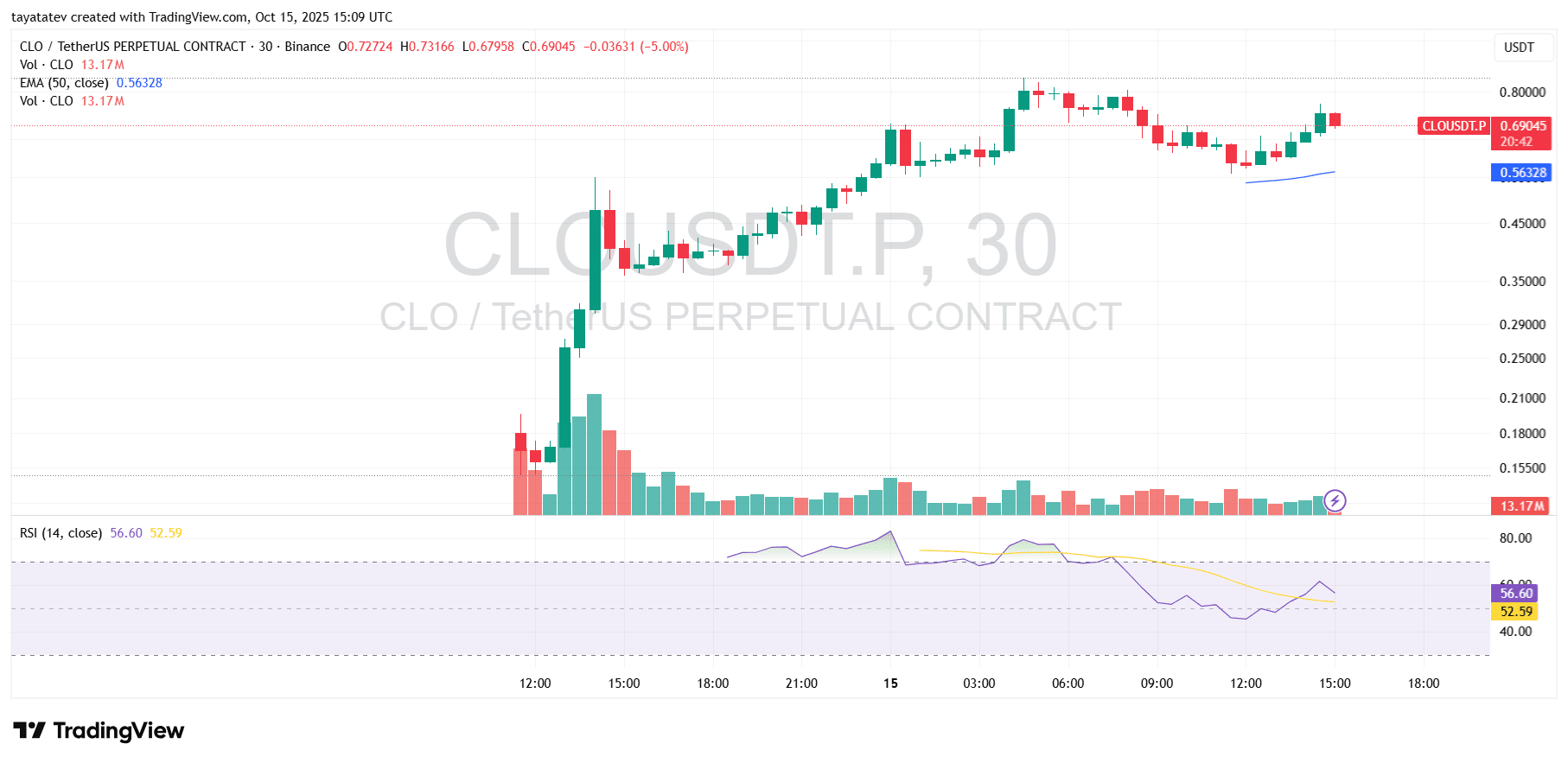

CLO perpetual contract shows early surge, pullback, and stabilization signs

Yei Finance’s CLOUSDT perpetual contract on Binance opened with a sharp upside move followed by a notable pullback and moderate stabilization by mid-October 15. The 30-minute chart shows an initial breakout from the sub-$0.20 zone into the $0.70–$0.80 range during the first major trading window. Volume surged to 13.17 million CLO at the peak of the move, signaling aggressive early participation on the derivatives market as the listing window unfolded. This first wave produced a steep green cluster, confirming concentrated buying pressure in a short timeframe.

The momentum cooled quickly after the initial thrust. Candles narrowed and volume tapered through the evening session, showing that traders shifted from aggressive entries to profit-taking or positioning. The pullback formed after topping near $0.80, with a low print around $0.68. RSI, which had briefly pushed above 70 during the breakout, fell back into the 50–56 band, indicating the fade of short-term overbought conditions. This sequence is typical of a listing-phase move where initial liquidity spikes are followed by order-book rebalancing once early buyers lock in gains.

As of the latest 30-minute bar, price trades around $0.69, above the 50-period Exponential Moving Average at $0.56. This positioning suggests the market is still in a constructive phase rather than deep reversal territory. If the EMA holds as dynamic support, the structure can base out around current levels before any follow-up direction emerges. If price breaks below that EMA with volume, short-term momentum would flip bearish. Traders now watch whether this stabilization turns into sideways accumulation or a second impulsive leg, depending on liquidity and futures positioning over the next sessions.