Seasoned crypto & stock market analyst Peter Brandt has switched his sentiment back to bullish after the horrendous $19 billion wipe-out last weekend. Indeed, the crypto sphere just came off one of the sharpest market drops in recent history, infused by the additional 100% United States (USA) tariffs on Chinese exported goods.

XLM Price Breaks Out Of Range-Bound Mode

On Saturday, Peter Brandt posted a quadruple technical crypto analysis, relevant for Ripple’s (XRP), Bitcoin’s (BTC), Ethereum’s (ETH) & Stellar’s (XLM) holders across the globe. One of the graphic draws attention to XLM’s recent closed-range structure, keeping the altcoin floating between $0.25 and $0.33, described by Mr. Brandt as “a bull waking from a nap”.

After the 3% rebound on Monday, Stellar Lumens (XLM) is approaching $0.35, so a daily close above this level would solidify the trader’s bullish manifesto. With 278% yearly gains, Stellar (XLM) remains one of the top contenders for an altcoin-based exchange-traded fund (ETF) beyond Ether (ETH). Peaking at $0.875 8 years ago, XLM is still 60.8% below this milestone.

Are Whales Backing Peter Brandt’s Theory?

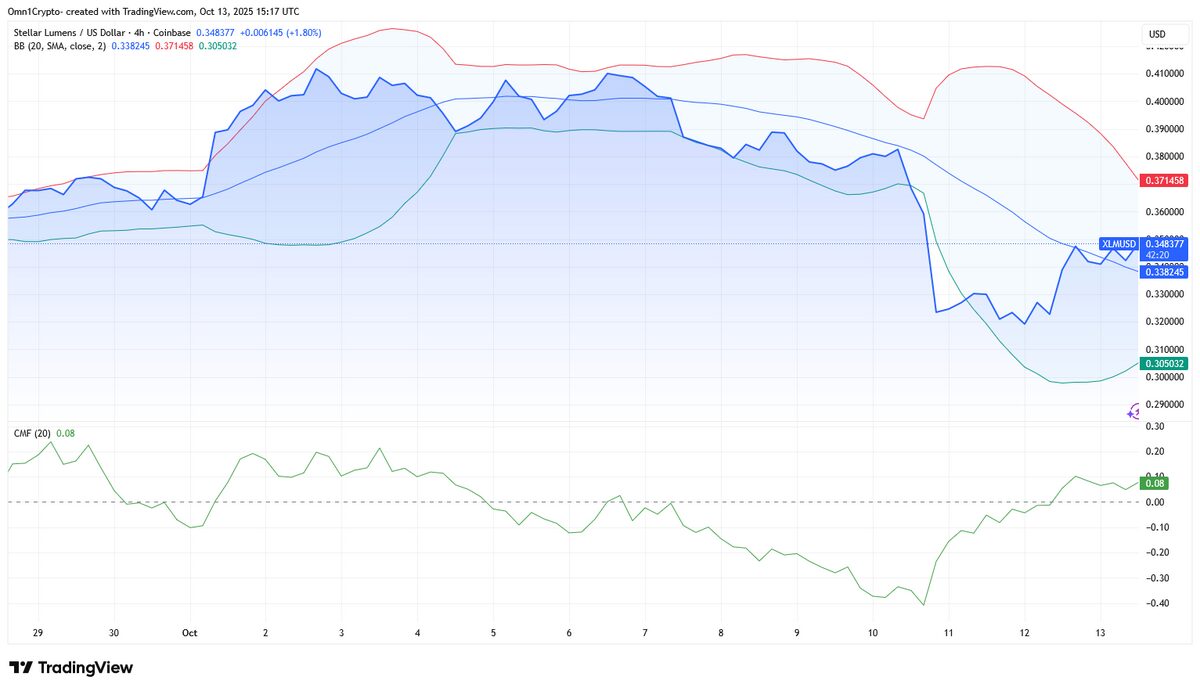

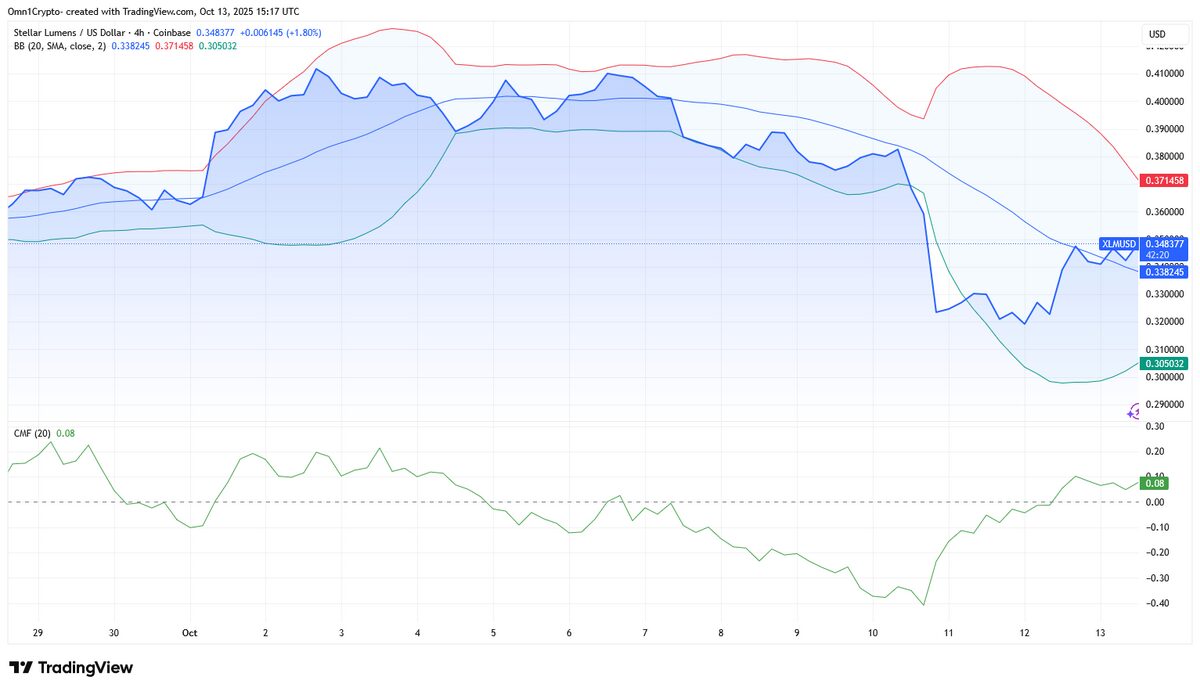

Current technical implications prove Stellar’s (XLM) ongoing rebound to some extent. Just broken through the mid-tier Bollinger Band (BOLL), XLM’s market value is clinging on $0.37 price levels for a sentimental flip back to bullish, while it’s clear that crypto whales have survived last Friday’s $19 billion liquidation tsunami. Then, XLM slumped from $0.38 to $0.29 in a mouth-dropping hourly red candle.

The Chaikin Money Flow (CMF) is back at 0.08 after two days of dwelling in negative territory, as the markets were shaken since Friday’s double-trouble dip. Not only did Donald Trump’s 100% tariffs on Chinese goods spark a bearish reaction, but Binance’s temporary service freeze added to panic, testing the resilience of major-cap coins.

Discover DailyCoin’s top crypto currency news:

Pioneers Drive Pi Coin’s Scarcity With Buy-Back Campaign

XRP Price Bounces After $19B Wipe-out Rattles Markets

People Also Ask:

Trump’s tariff threats & the $19B crypto wipe-out on October 10, 2025, create a volatile market, prompting Brandt to spot a waking bull trend in XLM at $0.33.

The altcoin dipped 12% from $0.38 to $0.29 amid the $19B wipe-out, but stabilized on Monday as institutional interest grows further.

A bullish chart pattern, including a bull flag and inverse H&S, plus a key support at $0.34, fuels Brandt’s optimism for a price surge.

XLM faces crucial resistance at $0.37, with potential to hit $0.50-$0.60 if the bullish trend strengthens.

Growing cross-border payment adoption and Brandt’s endorsement could drive XLM higher, though market volatility remains a risk.

DailyCoin’s Vibe Check: Which way are you leaning towards after reading this article?