Norway opened an investigation into Polymarket bets on the Nobel Peace Prize. Officials focus on wagers placed hours before the announcement. The probe centers on winner María Corina Machado.

The Norwegian Nobel Institute leads the Norway investigation. It is checking whether confidential information leaked from the prize process. The review targets unusual trading patterns on Polymarket.

Institute director Kristian Berg Harpviken confirmed the inquiry. He said they are examining if someone “managed to steal information and made a lot of money from it.” The Nobel Peace Prize selection process is confidential.

Polymarket data shows profit cluster and a new account

Polymarket data flagged a user named “dirtycup.” The account reportedly placed about $70,000 in bets on María Corina Machado. The trades returned more than $30,000 in profit.

Two other Polymarket accounts reportedly made similar bets. Together, the three accounts gained roughly $90,000. The timing aligned with the pre-announcement window.

Reports say “dirtycup” opened recently. The profile had little prior history on Polymarket. That detail raised questions inside the Norway investigation.

Nobel Peace Prize winner María Corina Machado and the Bitcoin “lifeline”

The Nobel Peace Prize recognized María Corina Machado for work on democracy in Venezuela. The award cited her role as a rights advocate. Her public record drew global attention.

In 2024, María Corina Machado described Bitcoin as a “lifeline.” She said Venezuelans used Bitcoin during hyperinflation. People used it to protect savings and finance escape.

Coverage repeated the Bitcoin “lifeline” quote after the Nobel Peace Prize news. The remark linked digital assets to financial survival. It also underscored Venezuela’s currency controls.

Polymarket regulation, CFTC no-action letter, and ICE investment

In September 2025, the CFTC issued a limited no-action letter. It applied to Polymarket-related entities on event-contract reporting. The relief carried conditions and narrow scope.

Polymarket previously settled with the CFTC in 2022. The platform later acquired a U.S. exchange and clearinghouse. That step supported a regulated path toward U.S. access.

Last week, Intercontinental Exchange (ICE) backed Polymarket. Reports put the commitment at up to $2 billion. The ICE tie-up aligned with broader prediction markets data distribution plans.

What the Norway investigation is checking about Polymarket

Investigators compare Polymarket timestamps with internal Nobel milestones. They examine whether odds shifted during closed-door phases. They also review clustered bets near the decision window.

The Norway investigation looks at account creation patterns. New profiles with large, concentrated exposure draw attention. Fast profit realization is another focus point.

Officials stress the secrecy of the Nobel Peace Prize process. Any credible breach would be serious under Norwegian rules. The Norwegian Nobel Institute continues its review.

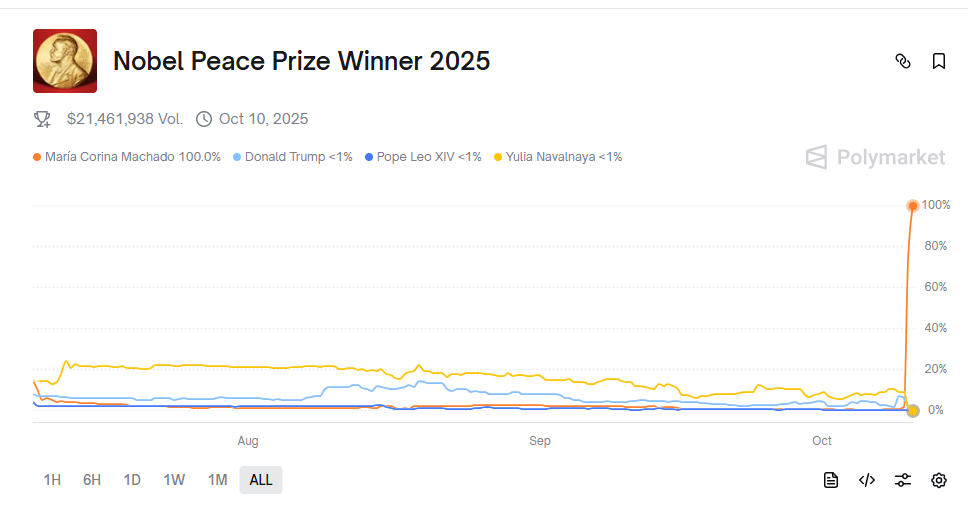

Odds pivot on Polymarket: from Navalnaya to Machado

Before the decision, Yulia Navalnaya led many boards on Polymarket. The odds pivoted toward María Corina Machado overnight in Oslo time. The move held into the morning.

A single winning Polymarket bet reportedly netted over $65,000. The figure illustrates the speed of the shift. It also shows the potential value of timely information.

Officials acknowledged a possible leak in public comments. The Norway investigation remains active. Findings will depend on data from Polymarket and internal logs.