Crypto.com CEO Kris Marszalek called for an exchange probe after $20B liquidations in 24 hours. He posted on X and asked regulators to review “fairness of practices.” He focused on platform slowdowns, price accuracy, and compliance controls.

The Crypto.com CEO wrote,

“Regulators should look into the exchanges that had most liquidations in the last 24 hours.”

He added,

“Any of them slowing down to a halt, effectively not allowing people to trade? Were all trades priced correctly and in line with indexes?”

The request centered on how each exchange handled extreme volatility.

This exchange probe request followed widespread $20B liquidations across major venues. The Crypto.com CEO emphasized transparency during stress. He framed the review around execution quality, index alignment, and anti-manipulation rules.

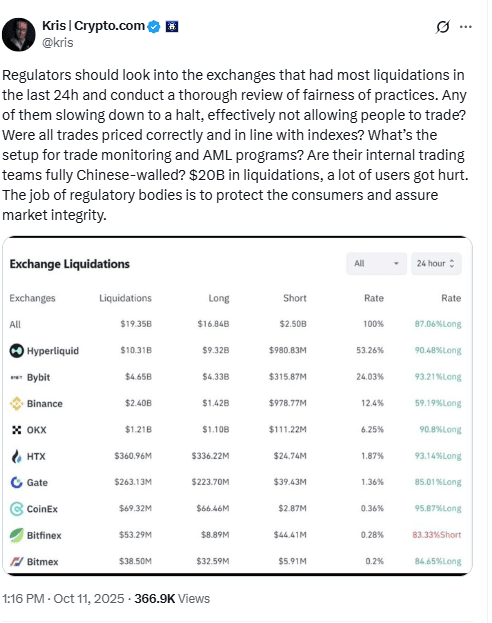

CoinGlass data: Hyperliquid liquidations lead, Bybit and Binance follow

CoinGlass data showed Hyperliquid liquidations at $10.31B. Bybit liquidations reached $4.65B. Binance reported $2.41B in liquidations over the same window.

Other venues showed smaller totals. OKX recorded $1.21B. HTX posted $362.5M. Gate saw $264.5M. These numbers placed Hyperliquid liquidations at the top by a wide margin.

Liquidations occur when leveraged positions fall below maintenance levels. Systems close positions to cover risk. In fast markets, these closures can accelerate price moves across pairs.

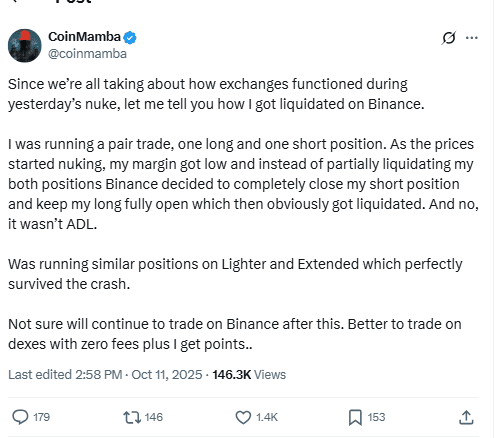

Binance depeg: USDe depeg, BNSOL, WBETH; user complaints and response

Binance reported a depeg event affecting USDe depeg, BNSOL, and WBETH. The exchange said forced liquidations hit some users. It confirmed account reviews and “appropriate compensation measures” for verified platform errors.

A user claimed Binance closed their short and left the long open. They said the loss was not related to ADL. They cited similar positions on Lighter and Extended that remained intact during the move.

Yi He, a Binance co-founder, acknowledged complaints. She cited “significant market fluctuations and a substantial influx of users.” She said Binance would compensate verified cases tied to platform errors, not to market moves or unrealized profits.

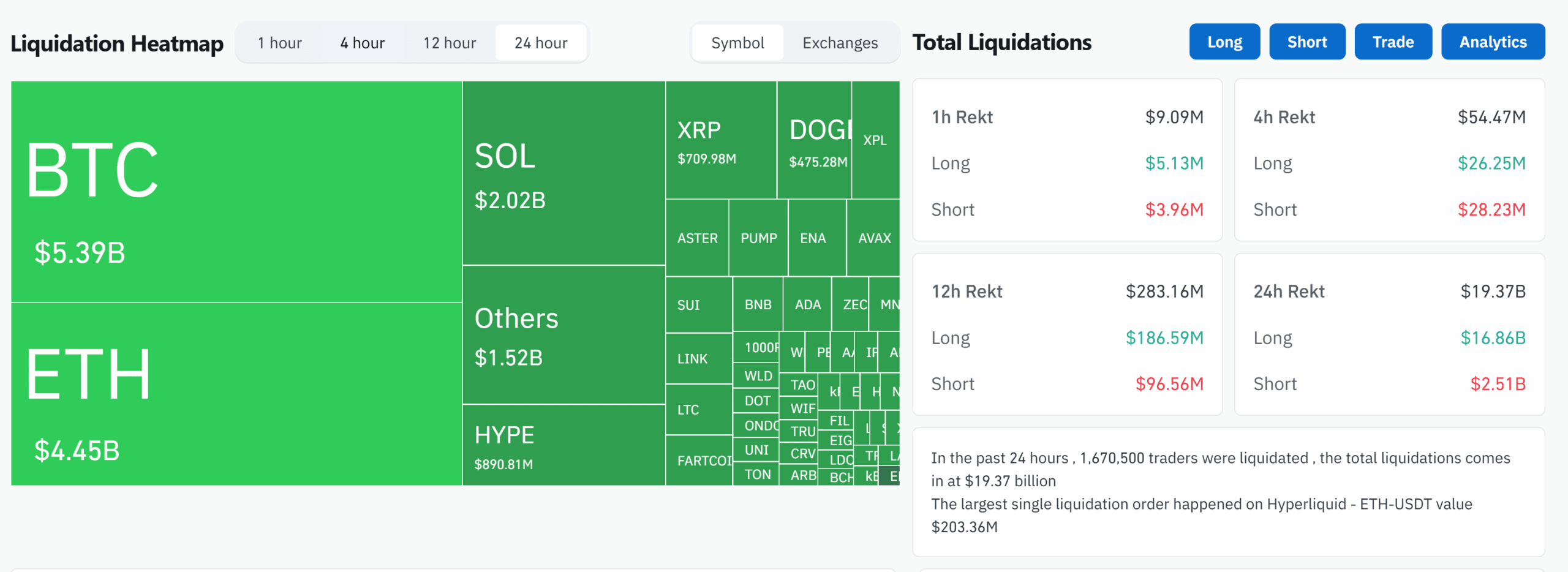

Record $19.31B liquidations vs FTX crash and COVID-19 crash

Analyst Quinten François placed total liquidations at $19.31B. That figure exceeded the FTX crash near $1.6B. It also topped the COVID-19 crash at about $1.2B.

The $19.31B number describes closed leveraged positions. It does not equal spot volume. Still, the scale of $20B liquidations highlights leverage risk during rapid price swings.

This record drawdown set a new reference point for stress events. It placed FTX crash and COVID-19 crash in a lower range. The comparison underscored how leverage magnifies outcomes when volatility spikes.

Trump tariffs: 100% levy on Chinese imports; rare earth minerals policy

U.S. President Donald Trump announced 100% tariffs on all Chinese imports starting Nov. 1. The plan followed China’s new export rules on rare earth minerals. The policy backdrop coincided with the $20B liquidations window.

China supplies about 70% of global rare earth minerals. Starting Dec. 1, any product with over 0.1% Chinese rare earths will need an export license. The new rule adds paperwork and may affect supply chains.

Trump called the Chinese policy “a moral disgrace.” He also hinted he might cancel a planned meeting with President Xi Jinping at APEC. The tariff headlines and rare earth minerals limits formed the macro context around the crypto move.