Analysts maintained a cautiously bullish stance on Cardano’s native token, ADA, as its structure improved after weeks of consolidation. Several market analysts, including Ali and MarketMaestro, pointed to patterns that could drive ADA toward the $1–$1.10 range if momentum sustains.

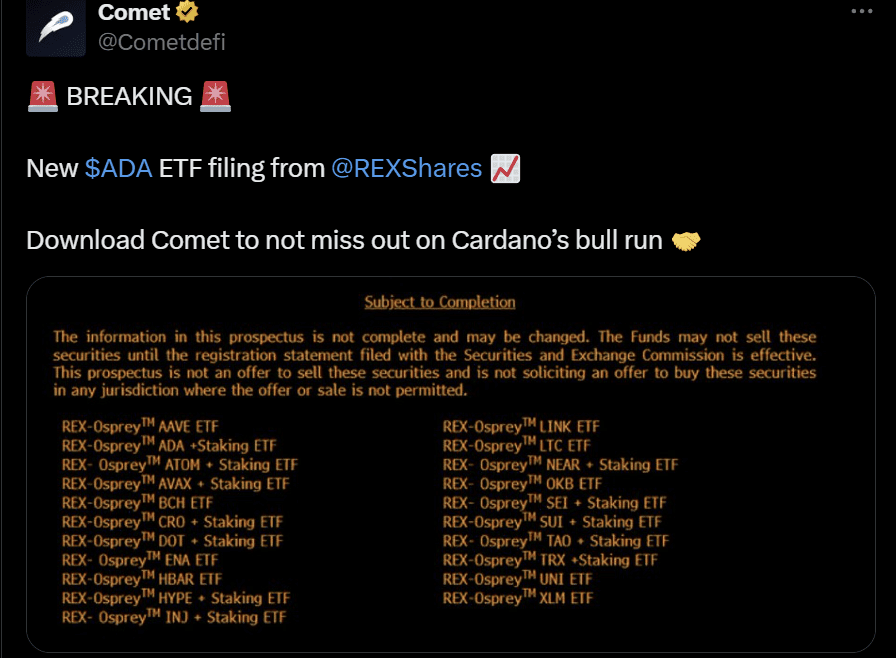

Additionally, the token attracted renewed attention to REX Shares and Osprey Funds’ pending spot ADA ETF filings, which stirred speculative optimism across the market.

Meanwhile, ADA price climbed nearly 6% on Oct. 6, bringing the Cardano token close to a multi-week descending trendline.

Breaking above the descending trendline would bring ADA price into the supply zone between $0.88 and $0.93, which could help the token realize the analysts’ predictions.

Analysts Outline Bullish Structures Amid ETF Hype

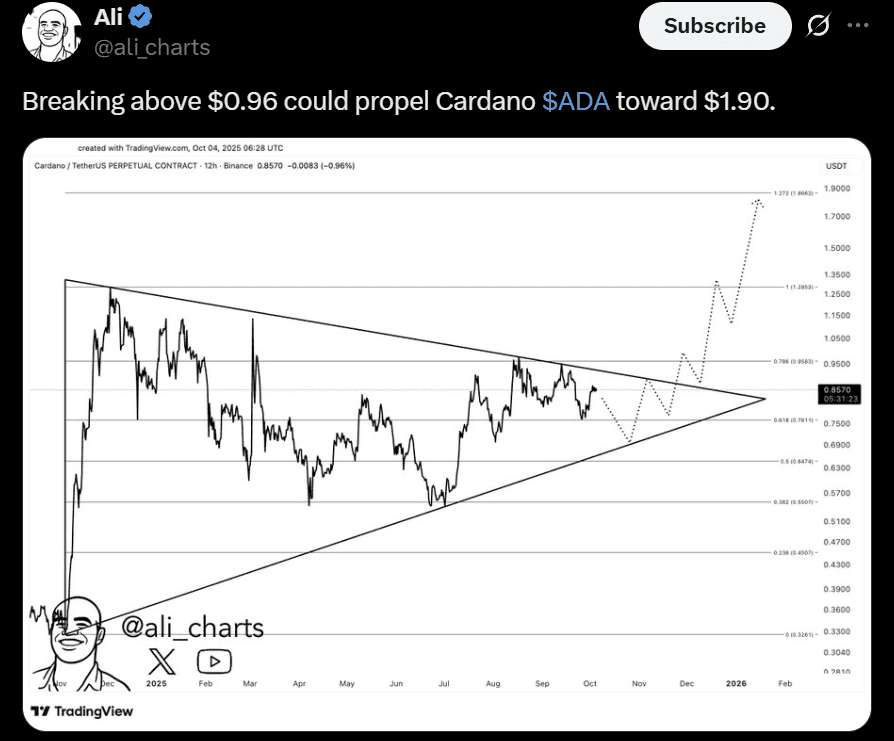

Ali noted that Cardano had been trading inside a symmetrical triangle since early 2024, a structure often preceding sharp moves. The analyst said that a breakout above $0.96 could propel ADA toward $1.90, but stressed that confirmation required stronger volume.

Ali’s chart showed the token pressing against the upper boundary of the formation, where most rejections had previously occurred. The setup aligned with renewed market optimism, as traders monitored whether the ETF narrative could provide enough momentum to break resistance.

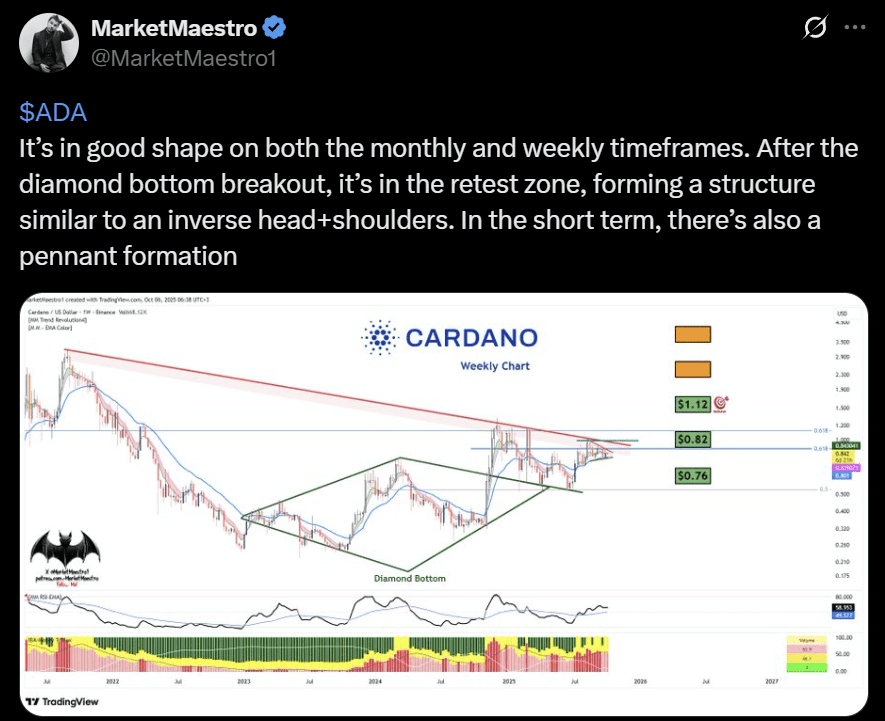

Moreover, MarketMaestro’s weekly chart supported the same outlook, identifying a broader recovery pattern within a diamond-bottom formation.

The ADA USD pair’s recent retest near $0.82 held firm, suggesting that buyers aggressively defended the mid-range zone. The analyst highlighted an inverse head-and-shoulders pattern building on the weekly timeframe, with neckline resistance around $1.12. He added that holding above $0.82 kept the bullish case intact, while any drop below $0.76 could invalidate the setup.

Analysts Agree That ADA Projections Hold A Lot of Interest

Other analysts echoed similar near-term projections. Man of Bitcoin mapped ADA’s move through an Elliott Wave count, suggesting that the token was completing its fourth wave and could push toward the $0.89 region in wave five.

The analyst’s model placed critical support near $0.81, underscoring the same range MarketMaestro tracked. Additionally, independent market analyst Roma offered a more aggressive long-term outlook. The analyst framed ADA’s cycle through a parabolic projection and claimed that ADA prices could eventually reach $3.

Yet even in Roma’s chart, the immediate focus remained the $1 level. Beyond that, projections turned speculative, with the higher figures reflecting hopium rather than measured technical analysis. Despite the enthusiasm, most agreed that sustained movement beyond $0.96 would determine whether ADA’s structure had truly shifted bullish.

Fundamentals Add Fuel To ADA’s Rebound Narrative

That cautious optimism around Cardano’s chart carried into broader discussions about its fundamentals. The new ADA ETF filings by REX Shares and Osprey Funds attracted traders’ attention.

The filings outlined staking features built into the proposed products, a detail that caught traders’ attention for its potential to blend yield generation with regulated exposure. The market participants did not predict inflows or assign allocations but emphasized that such filings could expand institutional participation if approved.

Meanwhile, market participant Mintern pointed to Coinbase reserve data, showing a steady buildup of ADA over recent months. The analyst avoided sweeping claims, noting that reserves had grown meaningfully alongside rising on-chain activity. They treated the accumulation as reflecting improved confidence rather than confirmed institutional buying.

Together, these updates served as bullish cues, not definitive catalysts. They also set a cleaner narrative for ADA if the price broke above nearby resistance. If approvals advance, the interest in the Cardano token could deepen. If delays stretched, ADA’s price momentum would rely on technical follow-through.

Will ADA finally break through the $1 barrier? Stay tuned here for the latest analysis and ETF filing developments.