Solana’s day opened with no incidents on mainnet, while client work advanced around Firedancer’s proposal to remove the block-level compute-unit cap. Builders kept momentum through two active hackathons and an APAC roadshow slated for later this month.

Protocol and clients: Firedancer targets higher headroom

Jump Crypto’s Firedancer team proposed SIMD-0370, which would lift Solana’s block-level compute-unit cap after the Alpenglow upgrade. The change shifts the limiting factor toward validator hardware and client performance rather than a protocol ceiling.

Developers frame the move as a path to higher throughput by allowing larger blocks when nodes can safely handle them. Reporting this week summarized the rationale and sequencing tied to Alpenglow.

Discussion now centers on validator incentives and propagation safety under heavier loads, with further benchmarking expected as client work proceeds. Coverage underscores that this is a proposal, not an activated change.

Network status: no incidents reported today

Solana’s official status page shows no incidents reported today, Saturday, October 4, 2025, extending a recent streak without listed disruptions. The public uptime view also shows 100% for September and the first days of October.

Operational dashboards separate mainnet from devnet; third-party monitors noted a devnet disruption on Oct. 1 that did not impact mainnet. That distinction matters for builders testing against non-production clusters.

Accordingly, user-facing activity continued as normal on mainnet while developer tooling and clients advanced in parallel. The status page remains the canonical source for production incidents.

Builders: Cypherpunk and Halloween hackathons run through October

The Solana Global Online Cypherpunk Hackathon is live with submissions due Oct. 30, offering funding and accelerator entry via Colosseum. Official channels and organizer posts confirm dates, prizes and workflow.

In parallel, the Halloween Solana Hackathon on DoraHacks runs Oct. 1–31, inviting wallet, infra, and dapp entries; organizer pages and social posts highlight the challenge tracks.

As both contests overlap, teams can ship prototypes, gather feedback, and position for Colosseum’s post-hack incubation while iterating weekly. Organizer feeds continue to post prompts and RFPs.

APAC roadshow: Accelerate APAC heads to China

Solana listed Accelerate APAC stops across Beijing (Oct. 20), Shanghai (Oct. 24), Hangzhou (Oct. 26), and Shenzhen (Oct. 28) on its events hub. Third-party calendars mirror the same dates and cities.

The series focuses on developer onboarding and product sessions, with registration links surfaced on official listings and video promos. Schedules emphasize local community engagement.

These stops follow a steady cadence of regional programs ahead of year-end conferences, keeping in-person touchpoints active alongside online hackathons.

Solana Mobile: Seeker program and builder activity

Solana Mobile’s Seeker page shows the device available and shipping, aligning with September’s “Seeker Season” kickoff and ongoing builder grants tied to the hackathon window.

Organizer posts describe grants running alongside Cypherpunk to nudge new mobile-first dapps, with updates posted on the official account. Timelines continue through October.

Consequently, mobile developers can target Seeker’s Seed Vault and dapp store while syncing deliverables with hackathon deadlines and APAC events. Official materials outline the hardware wallet integration.

Monthly structure: ascending triangle with RSI cross

Solana’s monthly chart shows an ascending triangle pressing against horizontal resistance while higher lows climb from below. Candles are compressing near the upper boundary, which often precedes a directional move when volatility resets. The pattern highlights buyers defending each dip closer to resistance, narrowing the range into a decision point.

The RSI panel adds a momentum cue. The purple RSI line has crossed above its signal line on the monthly timeframe, a “golden cross” that typically marks improving trend strength. On this chart, the last clear cross preceded a multi-month advance, and the current cross occurs with RSI in the low-60s, a zone that supports continued trend but isn’t overbought yet.

However, structure needs confirmation. A clean monthly close above the triangle’s horizontal ceiling would validate the breakout; expanding volume would strengthen the case. If that confirmation fails, price often retests the rising trendline or consolidates within the triangle until the next attempt. Invalidation would come from a decisive monthly close back below the rising base, which would weaken the bullish setup and shift focus to support tests rather than continuation.

Solana daily structure: recurring 25% dips followed by rallies

Solana’s daily chart shows a clear sequence of recurring retracements and rebounds since the second quarter. Each correction measured roughly 24% from peak to trough, followed by a sustained upward leg. The pattern has repeated three times, forming a recognizable rhythm in price action.

The first decline came in June with a 24.43% drop. Price then reversed and rallied, establishing a new higher high. The second retracement in late July showed a 24.06% pullback, again followed by a strong upward continuation. The third correction in September measured 24.70%, and the chart highlights a similar rally structure forming afterward.

This sequence reflects consistent dip-buying behavior during pullbacks of around one quarter from recent highs. While the visual projection extends the pattern into future candles, confirmation would depend on continued momentum after each correction. Traders use these repeating ranges to contextualize positioning rather than treating them as guarantees.

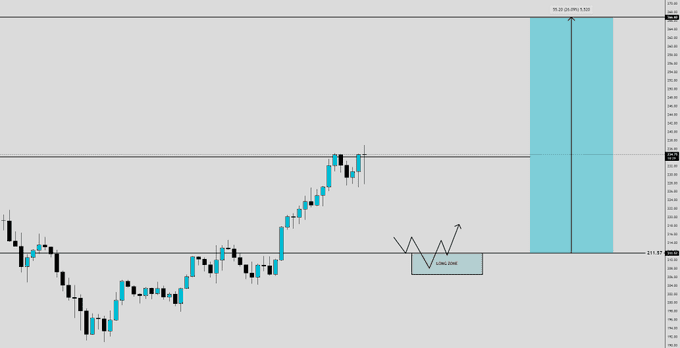

Solana setup: breakout attempt, demand retest plan, upside target

Solana tests a local resistance after a strong leg up. Candles pressed into the ceiling and left upper wicks, which signals supply at this band. The plan on the chart anticipates either an immediate breach or a pullback first.

The blueprint highlights a demand zone around the last consolidation base. A dip into that zone would complete a higher low structure. Then a bounce back above the midpoint would confirm buyers in control and reopen the topside path.

The upside box marks the measured move toward the prior range high. Confirmation needs a clean break and hold above the current resistance with expanding momentum. Invalidation comes from a daily close below the demand zone, which would shift focus to deeper supports instead of continuation.