Grayscale reopened private placement for its Zcash Trust on October 1, giving accredited investors another institutional route into ZEC exposure. The company announced the move on X and pointed prospective subscribers to its standard product lifecycle, where shares start as restricted placements before any secondary quotation. The step adds market access without changing Zcash’s protocol or supply mechanics.

The reopening matters because it restores an off-exchange channel that many funds and family offices use for compliance and custody workflows. Private placements allow allocations through familiar paperwork, while secondary liquidity—if pursued later—follows separate approvals. Grayscale’s structure, therefore, fits investors who cannot or will not hold native assets directly but still want exposure within policy constraints.

Moreover, the announcement coincided with renewed attention on Zcash’s fundamentals and governance calendar, creating a narrative that blends access with ongoing upgrades. While price action sits outside today’s focus, the access point itself can influence how allocators plan exposures around upcoming protocol changes and grant votes. In turn, the trust’s reopening becomes a practical data point for desks tracking institutional demand signals rather than exchange volumes.

The Zcash Foundation reported fresh engineering progress toward retiring the legacy zcashd node in 2025, steering operators toward the Zebra full node and the Zallet wallet. Its latest forum update highlights work on non-finalized-state backups, additional explorer endpoints, and continued transaction object improvements. The post also confirms completion of an external audit for the NU6.1 changeset, which includes a one-time lockbox disbursement.

Official support pages reiterate the deprecation plan and note that some JSON-RPC methods will map cleanly to Zebra or Zallet while others will need adjustments. That guidance helps exchanges, custodians, and explorers plan migrations without service interruptions. The page also serves as the canonical status log for the deprecation program as teams ship incremental releases.

Furthermore, NU6.1 sits at the center of Zcash’s next governance phase. The upgrade, endorsed by both ECC and the Foundation, formalizes a funding model where the community and coinholders hold distinct voices in deciding any development grants. Community threads outline an October review window and a November coinholder vote, placing procedural checkpoints on the near-term roadmap. Consequently, infrastructure work and governance scheduling now move in lockstep as the ecosystem prepares for 2025 operations on newer codebases.

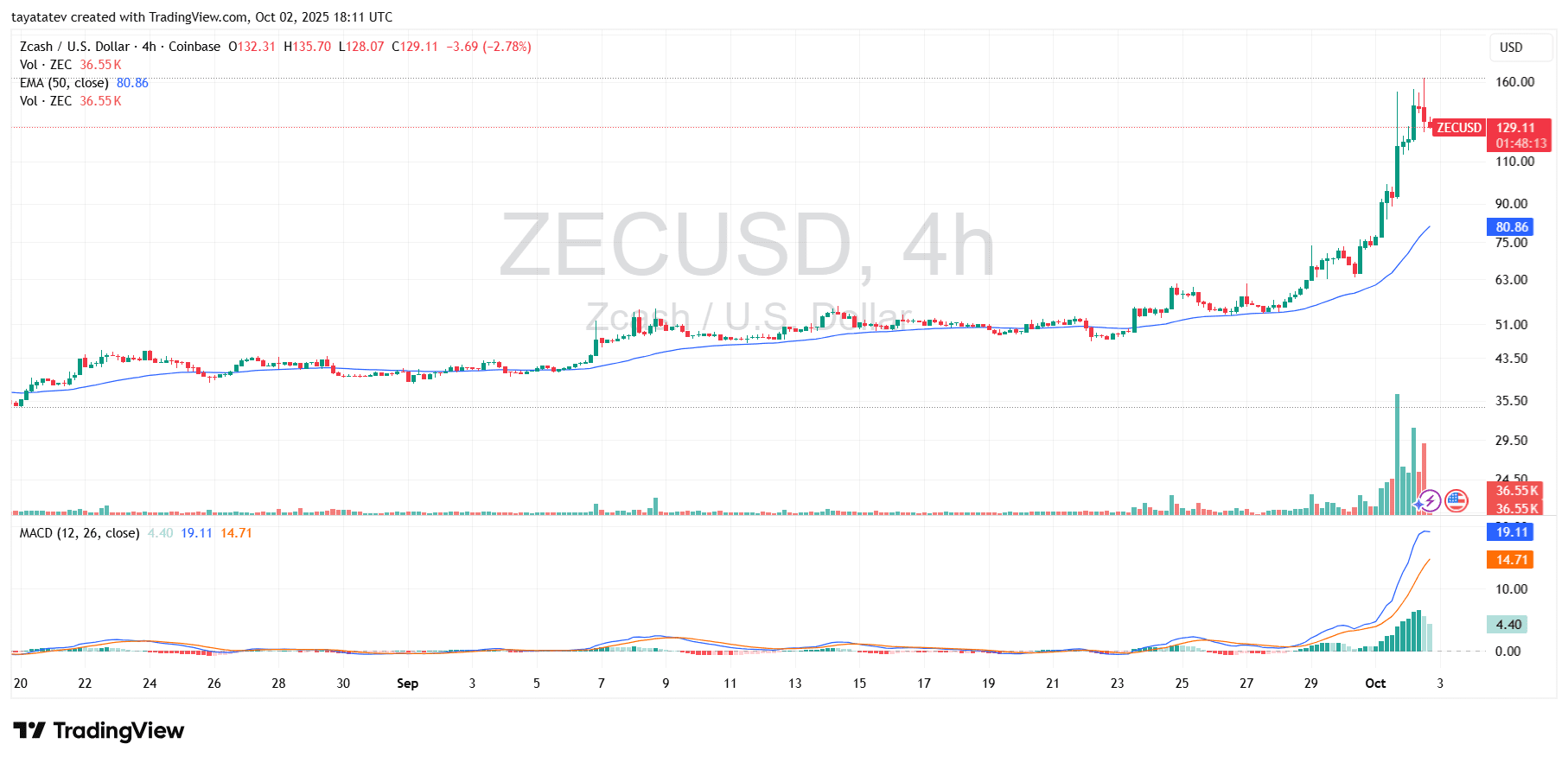

Zcash erupts on 4-hour chart, then cools off into support retest

ZEC/USDT surged on the 4-hour Coinbase chart through late September and into October 2, lifting from a flat September range to a vertical advance that topped near the mid-$150s. Volume expanded sharply during the breakout, and price rode well above the rising 50-EMA, which now sits near $80.86 on the chart. After peaking, ZEC faded quickly and settled around $129, handing back a chunk of the parabolic gains while still holding well above the moving average and prior range highs.

Momentum indicators confirm the shift. The MACD lines spread decisively higher. The histogram printed tall green bars. That action signals strong upside impulse. Then the pullback began. The histogram started to contract. That change often means cooling momentum, not a full reversal. The fast line still slopes up. Bulls keep the benefit of the doubt. The structure still shows higher lows above the breakout zone.

Structure and context guide the next steps. The rally stretched far from the mean. A pause is normal. A retest is common. If ZEC forms a higher low above late-September highs, momentum can return. If price then reclaims intraday highs with rising volume, the trend likely resumes. The 50-EMA should act as dynamic support. However, if bounces fade on weak volume, momentum usually stalls. Price then drifts toward the mid-range for a deeper test. For now, the chart shows a clean impulse and an orderly cooldown. Buyers must defend the new support area above the former range.

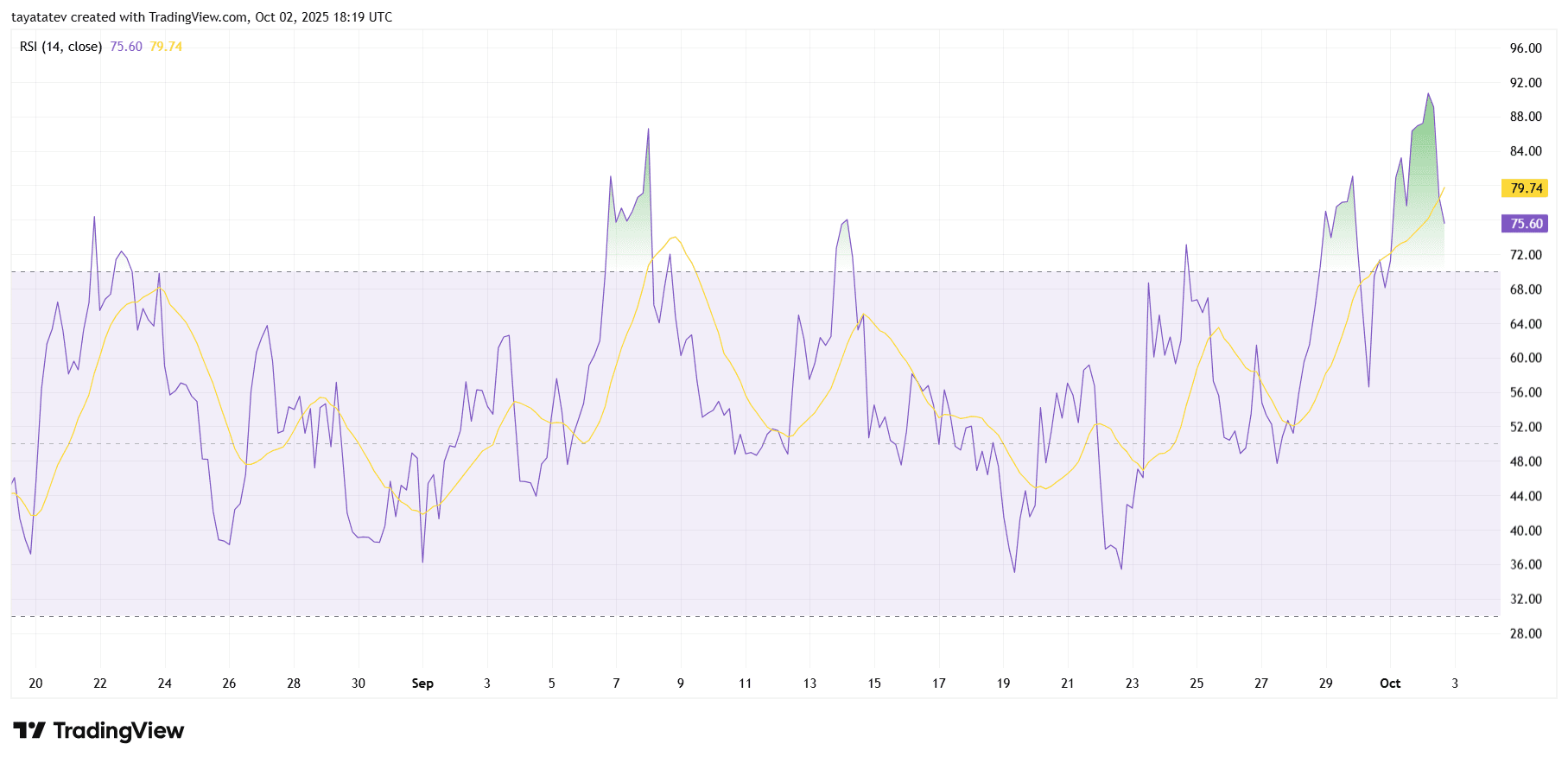

Zcash RSI flashes sustained overbought as momentum stretches into October 2, 2025

Zcash’s 14-period RSI on the 4-hour chart sits in overbought territory, printing around 75–80 at 18:19 UTC after spiking near the low 90s earlier in the session. The RSI moving average tracks just below 80, which shows that momentum has stayed hot for several candles rather than peaking on a single wick. Because the oscillator measures the size of recent gains versus losses, this zone signals strong upside pressure that often precedes either a cooldown or a sideways pause.

The structure also matters. After a multi-day acceleration, RSI crossed above its signal line and never meaningfully retested it, which indicates persistent buying. However, the latest bars show minor downticks from the intraday extreme, so momentum is easing even as the reading remains elevated. In similar runs on this chart, momentum cooled first through time—by chopping sideways—before price decided on its next directional leg, which keeps the door open to consolidation rather than an immediate trend break.

Therefore, the next cues are predictable. If RSI holds above 70 and the signal line curls higher again, momentum typically reasserts and price attempts another push. If RSI slips back through the signal line toward 60–55, the market usually transitions into digestion with shallow pullbacks toward prior breakout zones. In short, the RSI confirms a stretched but intact impulse; follow-through or fade will hinge on whether buyers defend overbought conditions or allow momentum to normalize.