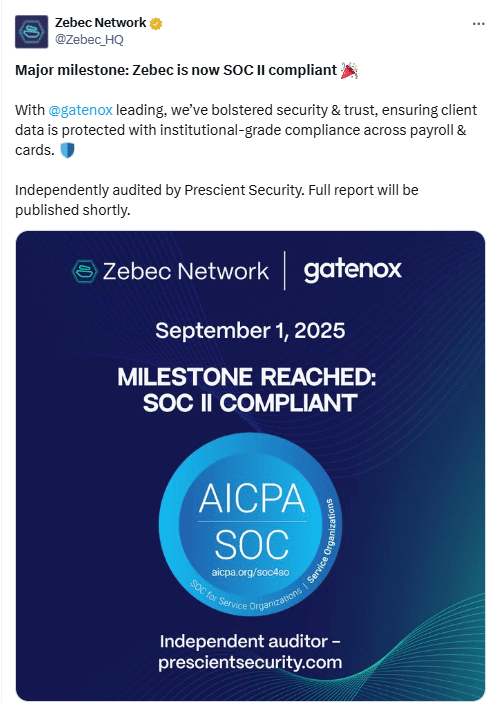

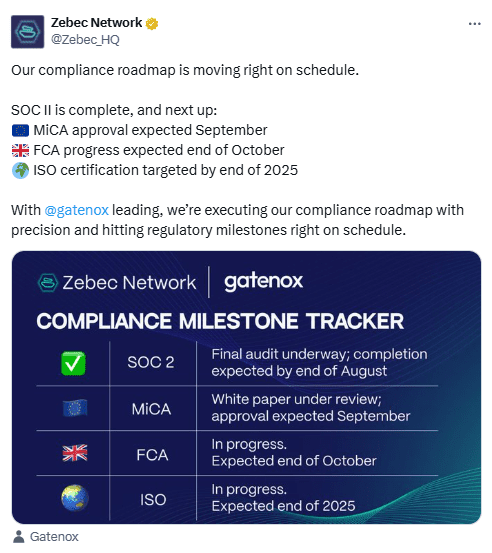

Zebec Network advanced its regulatory track in September with a completed SOC 2 audit, positioning its payroll and card stack for enterprise use. The company also said it is pursuing European Union MiCA approval and targeting ISO 27001 by year-end, signaling a broader push to operate under recognized standards.

These steps follow a June disclosure that Zebec brought identity and compliance tooling in-house by acquiring Gatenox. The move added native KYC, KYB, and AML capabilities to its Web3 payment stack as the firm prepared for more tightly regulated markets. Taken together, SOC 2, MiCA preparation, and the Gatenox deal outline a clear compliance roadmap into the fourth quarter.

The company has also communicated progress to its community through public channels. In late September posts, Zebec referenced its compliance schedule and next objectives, keeping attention on audit credentials as it rolls out products. This cadence frames the near-term narrative around trust and readiness rather than speculative features.

Payroll lending partnership extends real-time pay

Zebec expanded its payroll ecosystem on September 11 by partnering with Payro Finance to add on-demand payroll lending to its real-time stablecoin pay rails. The integration aims to let employers stream wages while employees tap short-term credit against earned amounts, tightening the link between payout and liquidity. Coverage from multiple trackers and exchanges detailed the model and timing.

This partnership follows earlier infrastructure work that placed stablecoin salaries inside payroll dashboards, creating a base for features like advances and credit underwriting. As Zebec layers lending into its settlement protocol, the company positions payroll as a programmable financial surface rather than a monthly batch event. The framing remains operational: settle continuously, account continuously, and finance against real-time accruals.

Industry coverage in late September grouped Zebec with other real-time payroll projects while emphasizing compliant rails. The emphasis on standards aligns with the firm’s September audit milestone and its EU ambitions, tying product expansion to governance and risk controls.

Card program broadens reach amid acquisition

Zebec’s card products continued to anchor its consumer footprint. Official materials highlight Silver and Black cards, with recent blog updates explaining tiers and use cases. Over the summer, ecosystem posts also noted asset additions for global spending via Zebec’s cards, keeping the program in active development ahead of further compliance steps.

Earlier in the year, Zebec acquired Science Card, a UK fintech serving students and researchers. Company statements and industry write-ups said the deal targeted campus payments and researcher funding flows, with the card footprint seen as complementary to Zebec’s payroll rails. The acquisition set a track for education-sector deployments as regulatory work progressed.

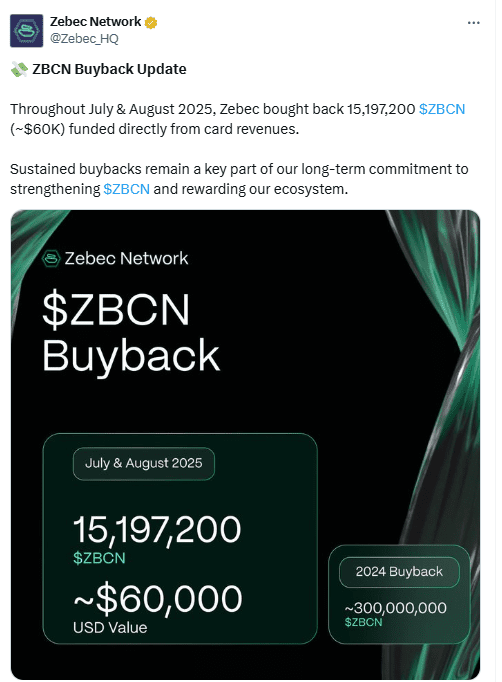

Zebec also disclosed a buyback funded by card revenues across July and August, adding a commercial note to the program’s activity. While not a regulatory event, the disclosure tied product usage to treasury actions, offering a rare view into how card throughput feeds back into the token economy.

Institutional signaling and upcoming reveals

On September 23, a widely tracked calendar flagged an “institutional partner reveal,” citing Zebec’s teaser that a major partnership would be announced. The notice did not include counterpart details, but it concentrated attention on enterprise-facing distribution for payroll and card flows. Such flags often precede formal statements or product timelines and are used by traders to mark potential catalysts.

Coverage through late September also recapped Zebec’s positioning among firms building compliant real-time salary rails. That framing keeps the institutional conversation on standards, reporting, and identity—areas Zebec has highlighted through SOC 2, MiCA preparation, and the Gatenox acquisition. The sequence sets expectations for how new partnerships might route volume under audited controls.

As the fourth quarter opens, the storyline remains anchored in execution: integrate lending, scale card usage, and complete compliance milestones. Public materials emphasize those pillars, and official pages continue to push the card suite as a practical on-ramp for everyday spending tied to streaming payouts.

Outlook anchored in standards and distribution

Recent steps suggest Zebec’s near-term focus is clear. First, it is finishing the compliance foundation needed for regulated markets, including SOC 2, MiCA, and ISO work. Second, it is extending payroll into credit with the Payro Finance tie-in, which connects streaming settlement to accessible liquidity. Third, it continues to build consumer endpoints through cards and sector-specific distribution from the Science Card acquisition.

Industry recaps in September framed this approach as part of a broader shift toward real-time, compliant value transfer. As those rails harden, announcements around institutional partnerships could define how volume enters the system. The next set of disclosures will show how much of the groundwork converts into measurable throughput across payrolls and card spend.

Zebec’s channels, meanwhile, continue to surface product explainers and program details, keeping users oriented while formal approvals and integrations move ahead. This communication cadence supports adoption without relying on speculative narratives, and it aligns with the firm’s sequence of audited and regulated rollouts.

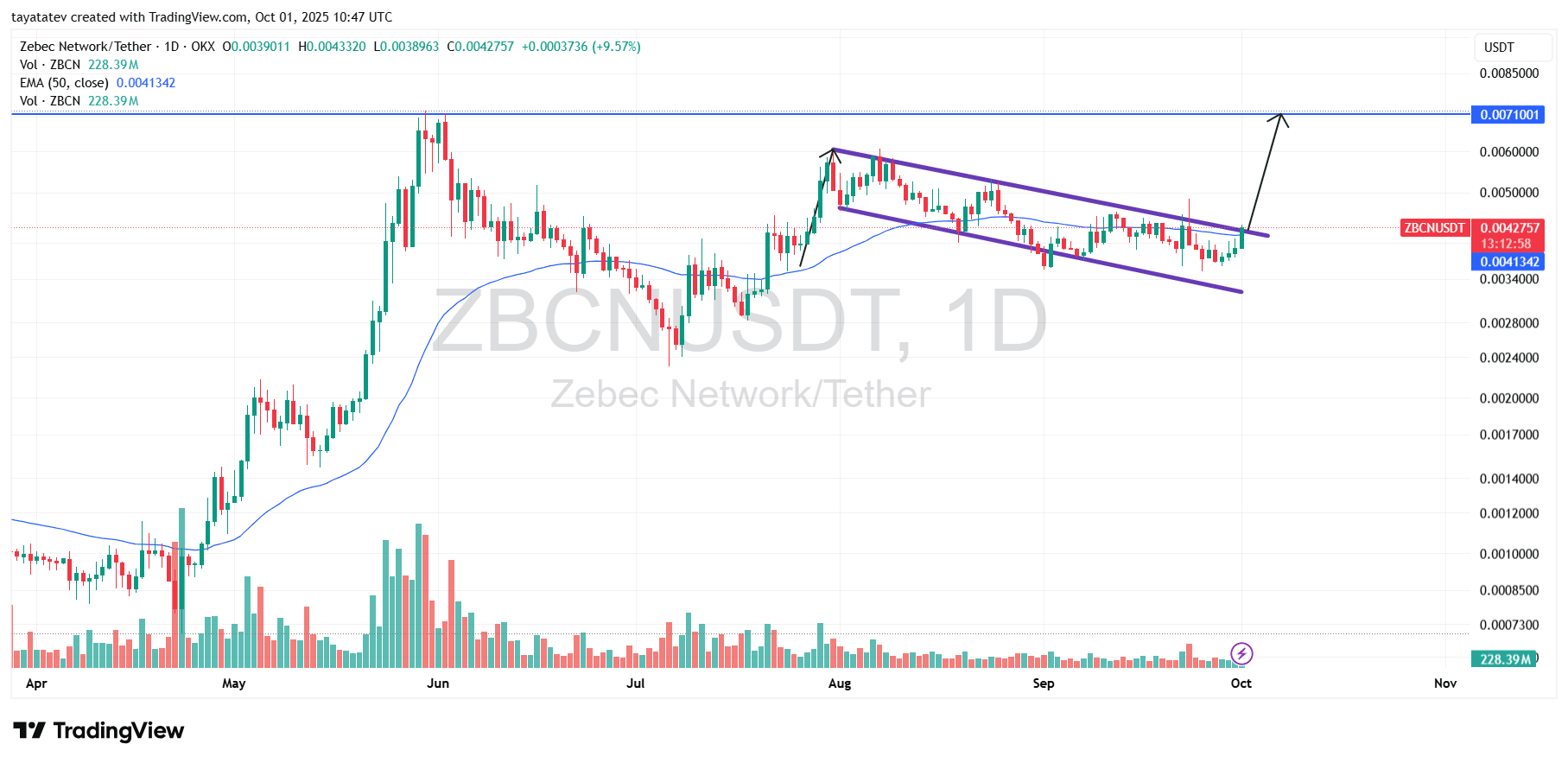

Zebec Network (ZBCN) Charts Signal Bullish Flag With 66% Upside Target

On October 1, 2025, the daily chart of Zebec Network’s ZBCN token against Tether (USDT) displayed a clear bullish flag pattern. The token traded near $0.00427 at the time of the chart, with trading volume recorded at about 228.39 million ZBCN on OKX. The pattern appeared after a strong rally earlier in the year, followed by a downward-sloping consolidation channel that respected both support and resistance lines.

A bullish flag pattern in technical analysis is a continuation structure that forms after a steep price rise and usually signals that the uptrend is likely to continue once the consolidation ends. In ZBCN’s case, the breakout from the upper boundary of the channel points toward renewed buying momentum, backed by price closing above the 50-day exponential moving average (EMA).

The projected move from this breakout suggests an upside of roughly 66 percent from current levels. That would place ZBCN’s potential target near $0.00710, aligning with the previous resistance marked in early June. The confirmation relies on sustained volume and price action holding above the channel, but the measured move calculation gives a clear technical roadmap.

This setup highlights how Zebec’s price structure remains tied to continuation patterns, with the bullish flag offering a near-term view of potential gains if market momentum persists.

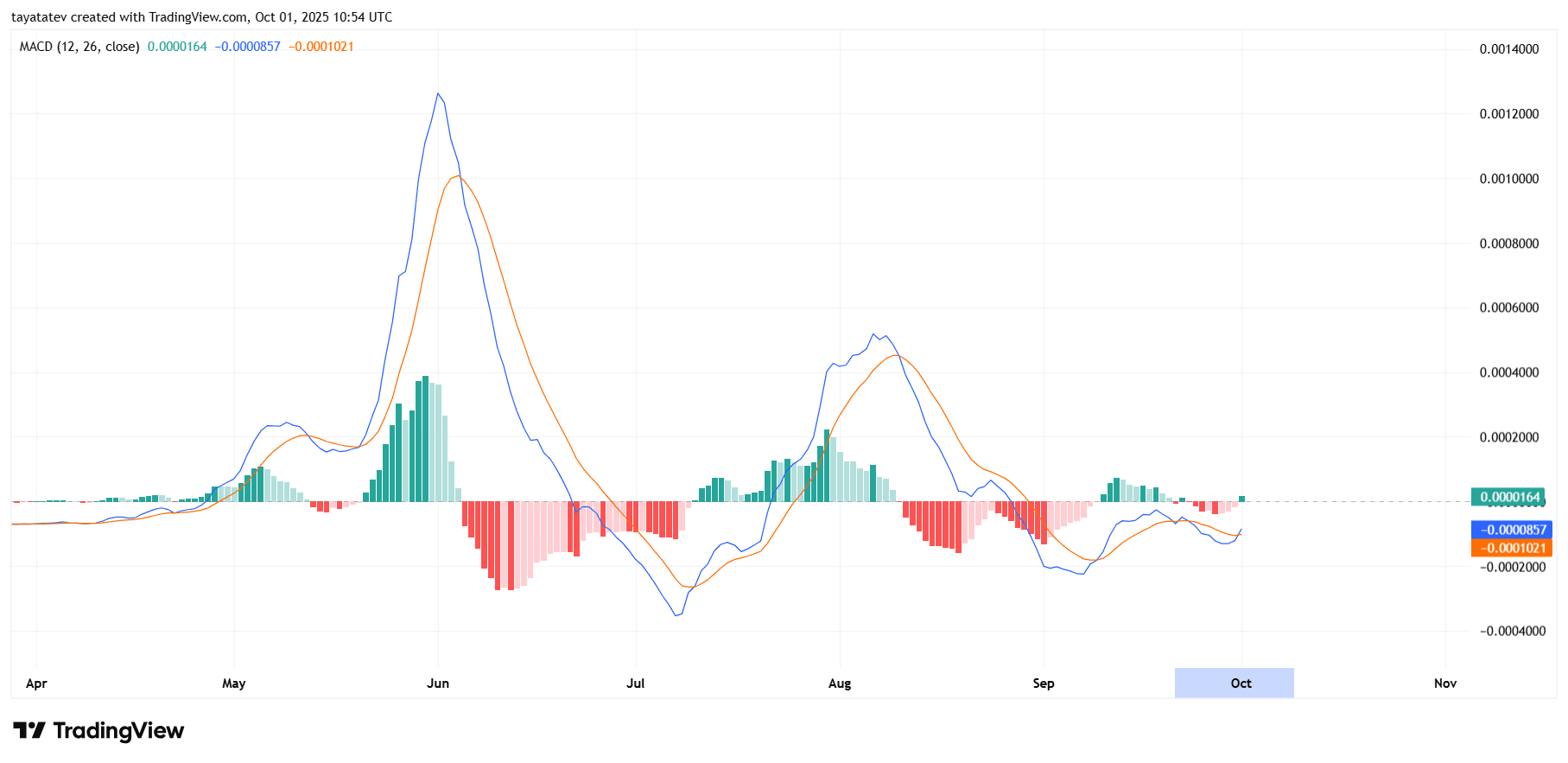

On October 1, 2025, Zebec Network’s ZBCN daily moving average convergence divergence indicator showed the MACD line crossing above the signal line just below the zero axis. The histogram printed slightly positive at about 0.000016, while the MACD and signal lines hovered around −0.000086 and −0.000102, respectively. This configuration indicates a fresh bullish impulse after September’s fading momentum.

Earlier waves on the chart show how momentum spiked in late May and early August, then cooled into negative territory through September. Now, with the crossover in place, buyers are gradually regaining control. The slope of the MACD line has turned upward, and the histogram bars have shifted from red to green, which often precedes price follow-through if volume improves.

A zero-line cross would strengthen the signal because it would mark a transition from bearish to bullish momentum on the daily timeframe. Until then, the setup remains constructive but early, and it depends on price holding recent gains and expanding participation. In short, MACD now supports the bullish-flag breakout case on the price chart, but confirmation still rests on sustained upside and a clean move above the zero line.