World Liberty Financial burned 7.89 million WLFI worth about 1.43 million dollars. The project executed the burns on BNB Smart Chain and Ethereum, according to onchain records. The team said the step followed a market buyback.

The buyback totaled about 1.06 million dollars across multiple chains. Data shows the team repurchased 6.04 million WLFI on the open market before sending tokens to burn addresses. The project framed the action as part of its previously approved plan.

A further 3.06 million WLFI valued near 638,000 dollars remains unburned on Solana. The team said it will decide next steps for that tranche. Until then, the Solana amount continues to sit outside the burned supply.

Onchain data and sources Lookonchain and CoinGecko

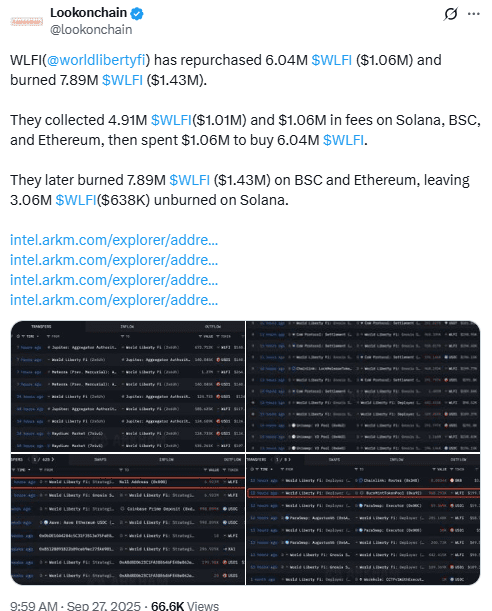

Onchain analytics account Lookonchain compiled the flows behind the operation. Its review shows the project collected 4.91 million WLFI worth roughly 1.01 million dollars from DeFi activity. It also shows 1.06 million dollars in fees and liquidity earnings routed toward buybacks.

The team then spent about 1.06 million dollars repurchasing 6.04 million WLFI. Afterward, it burned 7.89 million WLFI on Ethereum and BNB Smart Chain. The numbers align with the amounts later cited by the project.

Price tracking site CoinGecko listed WLFI near 0.2049 dollars on Saturday. The token gained a little over 6 percent on the day. Over the past month, it fell about 33 percent and remains more than 38 percent below its all time high.

WLFI governance vote approves burn plan

A community governance vote earlier this month cleared the buyback and burn program. The tally showed 99 percent approval from participating wallets, the team said. The vote authorized the use of DeFi proceeds to repurchase tokens and remove them from circulation.

Under the plan, only fees from WLFI controlled liquidity pools qualify for buybacks. The team stated that community and third party liquidity pools do not feed the program. The goal is to focus on revenue directly managed by the project.

Onchain commentators have floated potential burn pace scenarios. Some said the program could remove about 4 million WLFI per day, near 2 percent of supply per year. The project has not confirmed a fixed schedule, so the exact burn rate remains unclear.

The project website names DT Marks DEFI LLC and family members Donald Trump Jr, Barron Trump, and Eric Trump among the initial holders. It lists 22.5 billion WLFI as the initial combined allocation for those parties. The disclosure appears on the site’s holder section.

Following the unlock, the WLFI price briefly printed around 0.40 dollars. It later traded near 0.21 dollars, according to price trackers. Those prints frame the market context around the new buyback and burn activity.

WLFI buyback mechanics and remaining supply questions

The team described a straightforward flow for the mechanism. It gathers fees from WLFI managed pools, converts proceeds into WLFI, and retires purchased tokens via burns. The intent is to reduce circulating supply over time.

The current round shows that method in action across three chains. Tokens were bought and burned on Ethereum and BNB Smart Chain, while the Solana tranche remains pending. The project did not announce a date for the remaining Solana burn.

As of the latest update, 7.89 million WLFI are confirmed burned, with 3.06 million WLFI still unburned on Solana. Lookonchain provided the compiled onchain evidence for these amounts. CoinGecko supplied the spot price and performance figures referenced above.

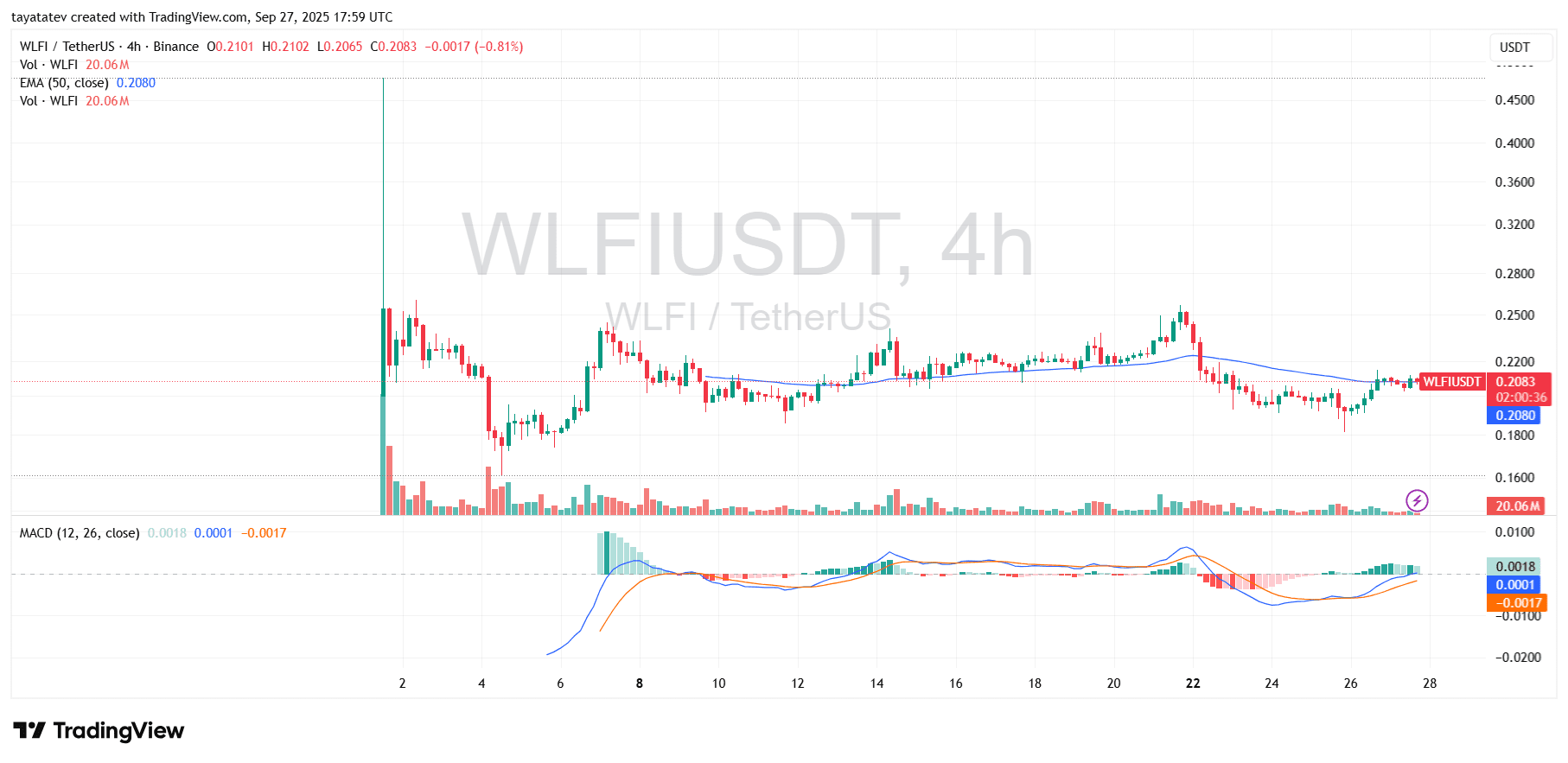

WLFI four hour chart holds the 50 EMA while momentum turns

WLFI trades near 0.208 and rides the 50-period EMA at 0.208 on the four hour chart. After the sharp selloff on the 22nd, candles based along the 0.20 to 0.21 band and then inched higher. Volume over the visible range reads about 20.06 million, which matches the quieter grind since the spike.

The MACD now presses back toward the zero line. The histogram flipped from deep red to a mild green, and the lines are curling up. This structure signals recovering momentum, although confirmation needs follow-through on price, not only an oscillator turn.

Overhead, the first layer of supply sits around 0.22, where the last bounce failed. A clean close above 0.22 would reclaim the breakdown area and put 0.24 to 0.26 back in view from the prior swing. Until that happens, the tape remains range-bound and reactive.

On the downside, immediate support sits at the 0.20 handle, with a stronger shelf near 0.18 from the chart’s guide line. A loss of 0.20 would return WLFI to the recent distribution zone and keep pressure on the moving average. As a result, the 0.20 to 0.22 corridor defines the next directional cue.

In short, buyers defended the 50 EMA and momentum ticked up, but resistance has not broken. Therefore, watch for acceptance above 0.22 to validate strength, or a slip back through 0.20 to signal renewed supply.