Bitcoin (BTC) price traded near $109,000 on Sept. 26, extending a losing streak that began earlier in the week. BTC price is down nearly 6% WTD on Sept. 26, sparking fears of a deeper correction in the token’s prices.

The decline deepened as selling pressure accelerated across major tokens, with Ethereum (ETH), Solana (SOL), and Cardano (ADA) recording double-digit weekly losses. The broader market mirrored the weakness, though stablecoins held steady, and Hyperliquid’s HYPE stood out with sharper declines.

Analysts pointed to a convergence of triggers behind the move. Market participants highlighted the expiration of more than $20 billion in Bitcoin and Ethereum options as a key reason for the sudden slide. That expiry, strong U.S. economic data, and the risk of heavy liquidations in overstretched altcoin positions left markets vulnerable. The overlapping macro stress and derivative positioning set the tone for another volatile session.

Bitcoin Options Expiry and Liquidations as Triggers

Bitcoin’s latest drop extended the weakness outlined in the intro, and analysts agreed on the main culprits. Ash Crypto highlighted the expiration of $23 billion in Bitcoin and Ethereum options as a significant drag on sentiment.

Analyst Ted echoed the same view, noting that more than $21 billion in options came due on Sept. 26, forcing positions to unwind. Both crypto analysts argued that whales often use expiry to push prices toward “max pain” levels, leaving retail traders on the losing side.

The expiry’s timing coincided with stronger U.S. economic data, which reduced expectations for early rate cuts and fueled anxiety about upcoming PCE inflation prints. That macro backdrop added pressure to a market already on edge. Liquidity thinned, and slippage worsened the drop across majors.

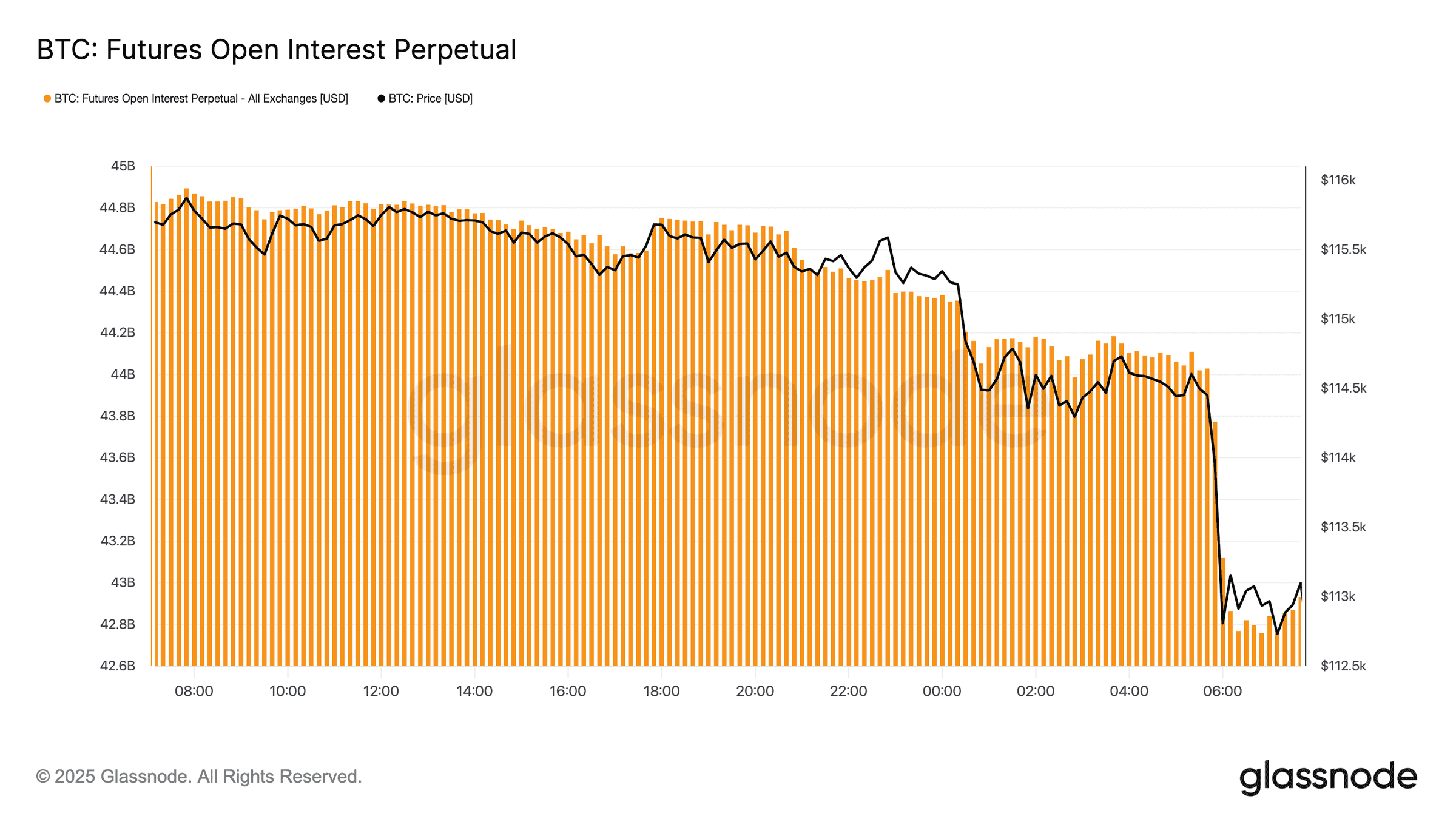

A Glassnode report framed the move as a shift “from rally to correction,” with leverage expansion during Sept. 2025’s climb leaving the market top-heavy.

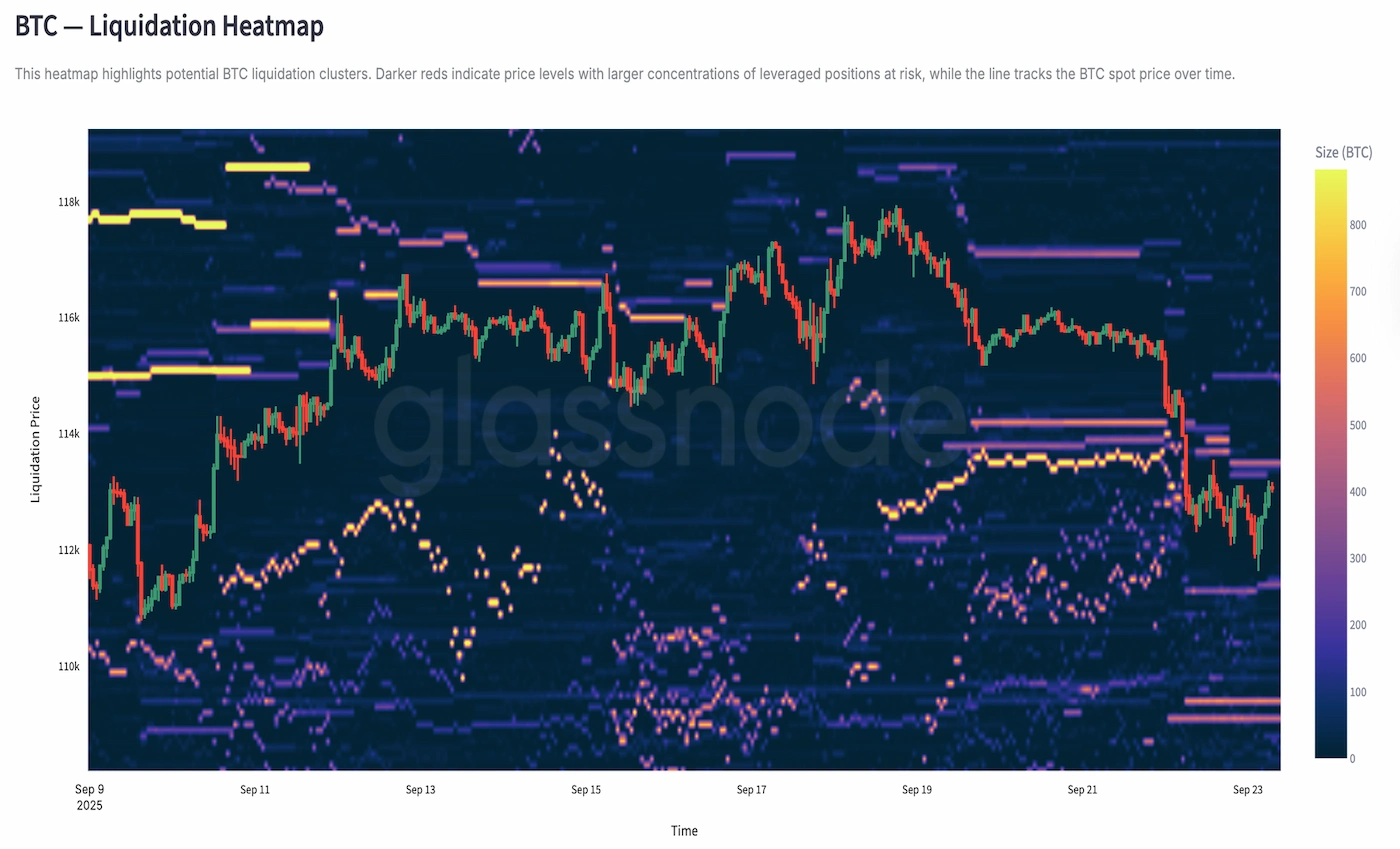

The report showed futures liquidations rising in lockstep with the downturn, consistent with a broad deleveraging after crowded longs built up into expiry. It also flagged a spot-versus-derivatives imbalance that made prices more sensitive to macro shocks and flow shifts.

Larger Holders’ Moves Weaken BTC Price

Behavior among larger holders reinforced the weakness. Glassnode pointed to profit-taking after the early-September advance, which reduced the cushion that long-term conviction usually provides on sharp down days.

The expiry-driven pullback found less passive demand with that buffer lighter, so forced sellers dictated the tape. The chain of long liquidations then accelerated as the token lost key levels, completing a classic reset into quarter-end.

The combination explained the day’s move. Expiry pressure set direction. Macro headlines removed confidence. Elevated leverage supplied fuel for liquidations. The Glassnode report showed a market that rallied on derivatives, not spot, and cracked when those derivatives unwound.

The outcome matched Ted’s and Ash Crypto’s core point about expiry’s role, while the on-chain lens clarified why the fall ran fast once it started.

Analysts Expect Downside Tests Before Potential Recovery

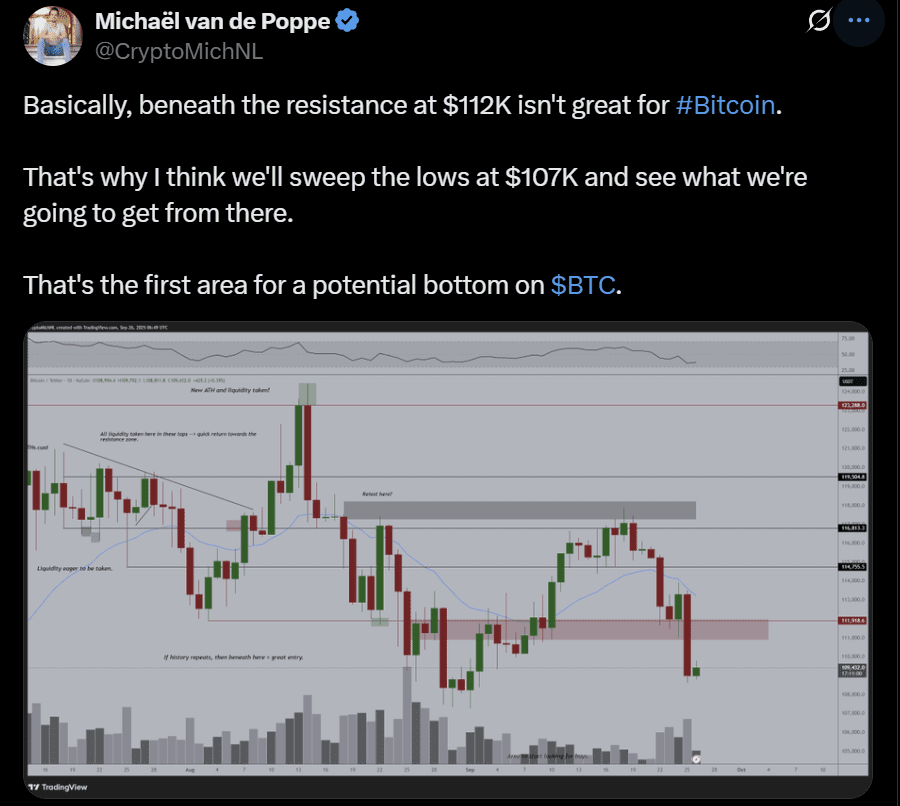

The liquidation-driven selloff left traders debating Bitcoin’s next path. Analyst Michaël van de Poppe argued that rejection below $112,000 created space for a deeper downside.

The market veteran said the market would likely sweep the lows near $107,000 before attempting to form a bottom. His chart pointed to that zone as the first realistic area for buyers to step back in.

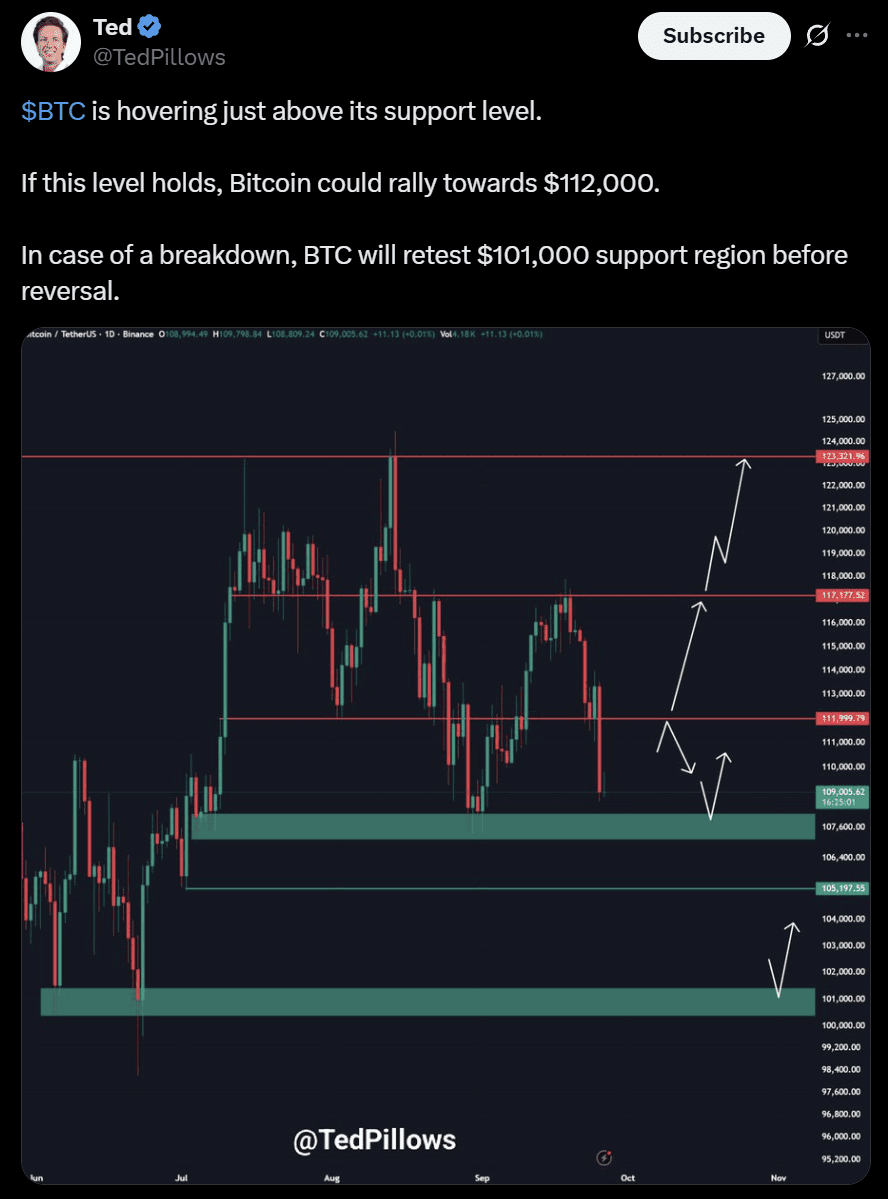

Ted highlighted a more conditional structure. The analyst noted that Bitcoin price hovered above a support region that could open the door to a rebound.

If the level held, the analyst expected the BTC USD pair move toward $112,000. If not, Ted outlined a potential retest near $101,000, marking the lower end of the current structure. His view reflected the uncertainty left behind by heavy liquidations, where any recovery attempt risked being capped by renewed selling.

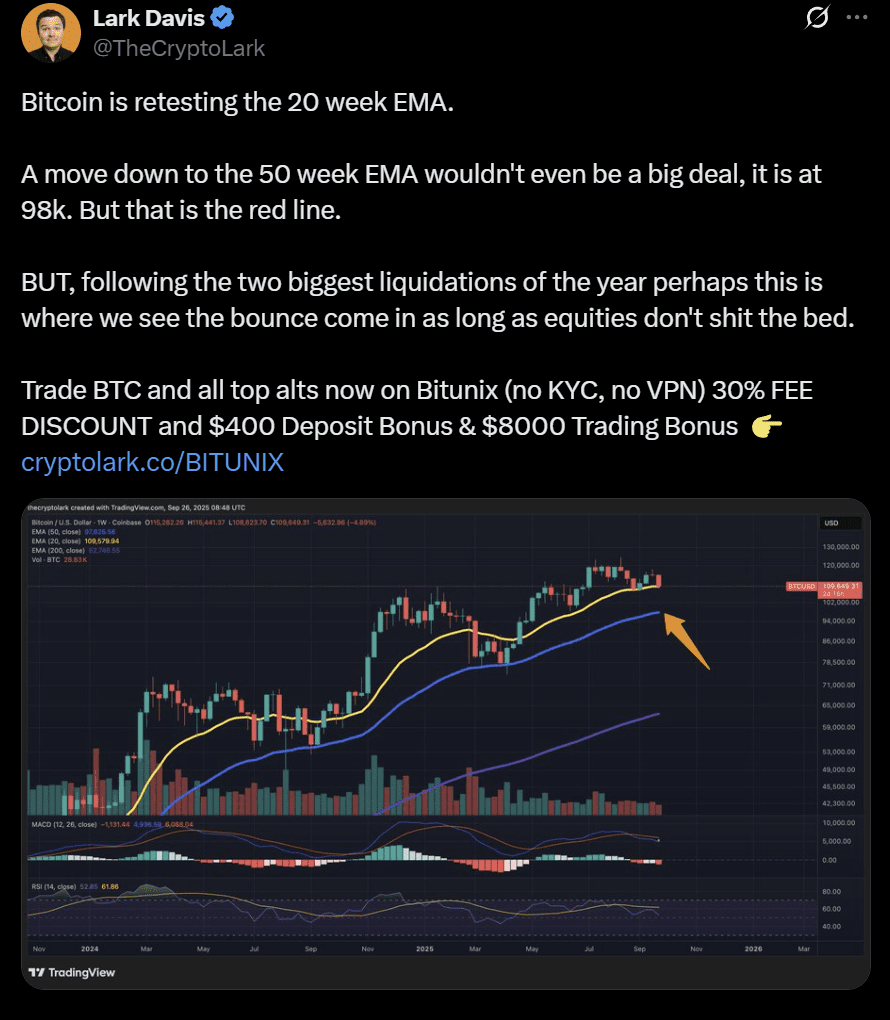

Lark Davis took a broader stance, pointing to the 20-week EMA as the pivot.

Davis said a drop toward the 50-week EMA near $98,000 would not disrupt the longer-term cycle. That argument placed the latest decline within the framework of a market reset rather than a breakdown.

These outlooks converged on one theme: Bitcoin’s structure weakened after cascading liquidations but had not yet signaled a complete trend reversal. The rejection beneath resistance levels confirmed the fragility flagged in the earlier subsection, while support zones around $107,000 to $101,000 became the market’s focus.

The longer-term moving averages continued to define the cycle’s guardrails, suggesting that the current phase reflected more of a structural shakeout than an outright collapse.

Here’s why stablecoins caused a clash in Washington. Read Here