Two rails went live this week for real-world finance on XRPL: redemptions from tokenized Treasury funds into RLUSD and a validator list cutoff that lands in four days. Both change operations now.

RLUSD becomes a live redemption rail for tokenized funds

Ripple and Securitize now let holders of BlackRock’s BUIDL and VanEck’s VBILL redeem fund shares directly into Ripple USD (RLUSD). The flow runs by smart contract and settles on XRPL and Ethereum. It targets 24-7 liquidity without exchange order books.

Moreover, today’s coverage reiterates that RLUSD launched earlier this year with monthly reserve attestations and backing in cash, short-term Treasuries, and deposits. Those details frame RLUSD as a cash-like asset for settlement rather than a trading token.

In practice, this link plugs tokenized funds into a programmable off-ramp. It also removes bespoke integrations at the fund level since the redemption logic sits in Securitize’s contracts. Therefore, institutions can wire proceeds into RLUSD and move them across chains.

UNL migration deadline hits September 30

XRPL’s default Unique Node List (UNL) moves to the XRPL Foundation on Monday, September 30, 2025. Nodes that still trust the legacy publisher must switch keys and the list URL to avoid trust-list loading failures. The docs flag this as a required change for most upgraded mainnet servers.

Additionally, community alerts this week emphasized the cutover window and the consequences of missing it. Operators that fail to migrate risk disconnections and consensus issues until configs match the new default list.

The legacy list is not only switching off next week; it is also on a full deprecation path. The old publisher’s support ends on September 30, with complete retirement scheduled for January 18, 2026. Plan changes before the final stop date.

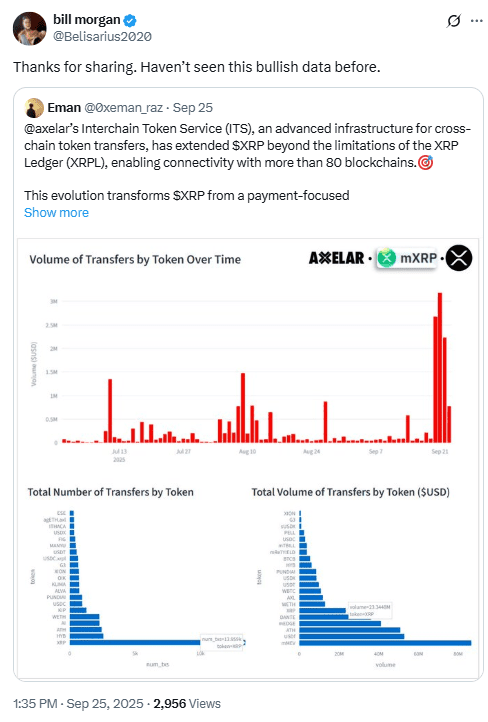

Cross-chain momentum: mXRP and Axelar transfers

Separately, Axelar and partners introduced mXRP, a yield-bearing representation of XRP aimed at interchain DeFi routes. The launch materials and event posts tie mXRP to simplified cross-chain movement and staking-style strategies for XRP holders.

Furthermore, fresh trackers today cite XRP as leading Axelar’s recent interchain transfer volumes at roughly $23.3 million and nearly 14,000 transfers in the period measured. That points to non-exchange utility growing outside the base ledger.

As these routes expand, they complement RLUSD’s settlement role. One side handles programmable cash-like redemptions, while the other moves XRP-denominated exposure across chains. Together, they widen XRPL’s institutional and developer surface.

Core software status ahead of the cutoff

XRPL’s reference server “rippled” remains on version 2.5.1 after a rollback from 2.6.0. The 2.5.1 build fixes a consensus-stall detection issue and is the recommended target before next week’s UNL switch.

Release notes on the XRPLF repository confirm the bug-fix scope and the September 2025 tag. Operators who paused upgrades during the rollback window should complete the move now to minimize operational risk.

In short, keep nodes on 2.5.1, update UNL configs, and verify the new publisher keys. With those steps, services stay aligned as the default list changes over.

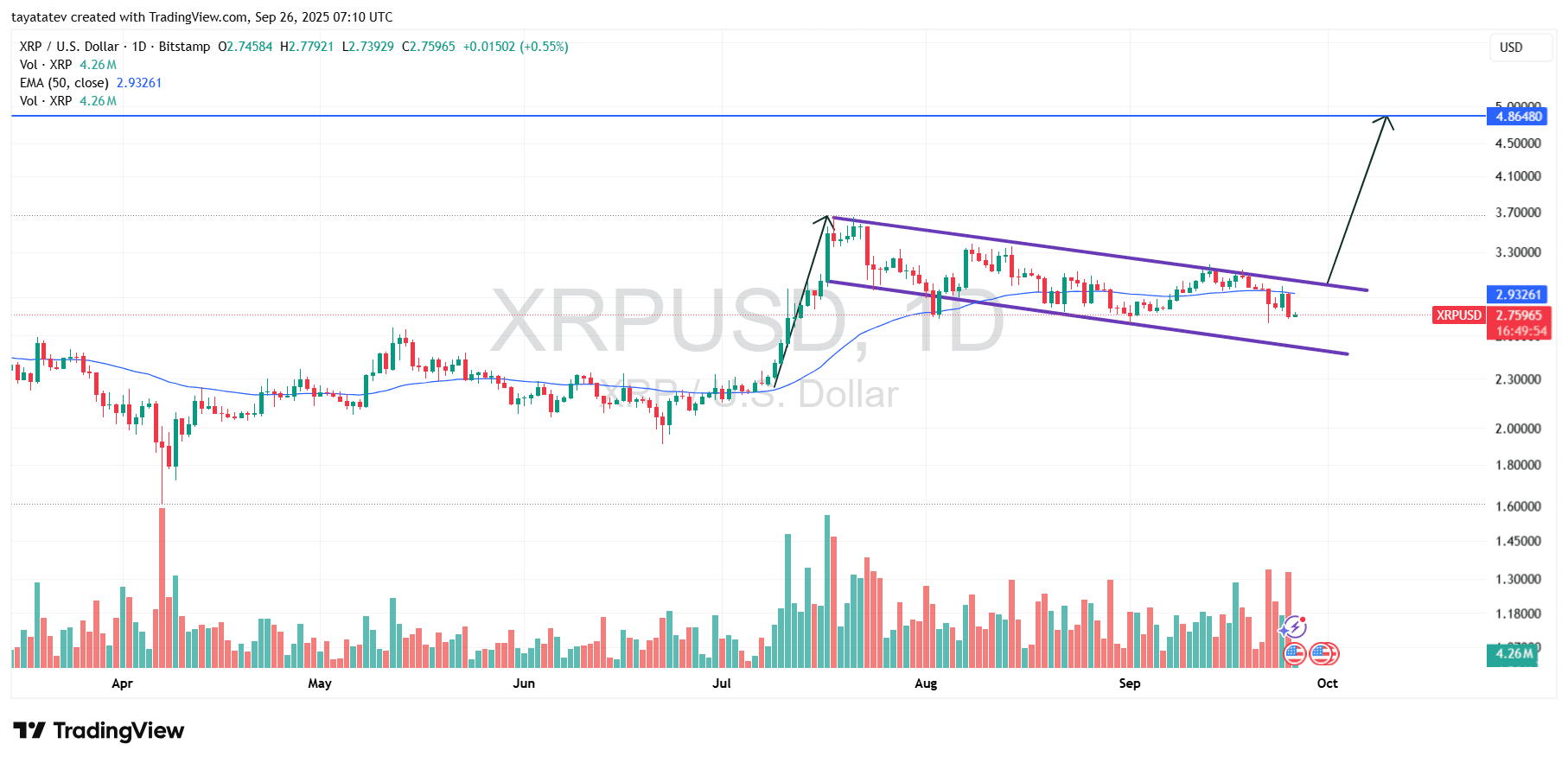

XRP forms a bullish flag on Sep 26, 2025; a confirmed breakout implies a 77% move toward $4.88

XRP/USDT daily chart captured at 07:10 Coordinated Universal Time on Sep 26, 2025 shows a clear bullish flag forming after July’s vertical advance. A bullish flag is a brief, downward-sloping consolidation that follows a sharp rally, contained by near-parallel trendlines, and it typically resolves higher in the direction of the prior move. If price breaks and closes above the flag’s upper boundary with rising volume, the pattern points to continuation.

The setup begins with the flagpole — July’s impulsive upswing — and continues with a tidy, falling channel stretching through August and September. Candles respect both the upper and lower purple rails on the chart, which indicates orderly consolidation rather than distribution. Volume contracts through the pullback, which often precedes expansion on a breakout as trend participants re-enter.

At the time of the snapshot, XRP trades near $2.76, sitting just under the 50-day exponential moving average around $2.93. Consequently, the trigger is straightforward: reclaim the 50-day average and punch through the flag’s descending resistance near the low-$3.00s. If that breakout confirms, the measured move — stated as a 77% advance from the current price — projects to roughly $4.88, aligning with the overhead reference line plotted on the chart. Until then, the lower channel rail near the mid-$2.00s acts as support within the consolidation, while the upper rail remains the level to beat for confirmation.

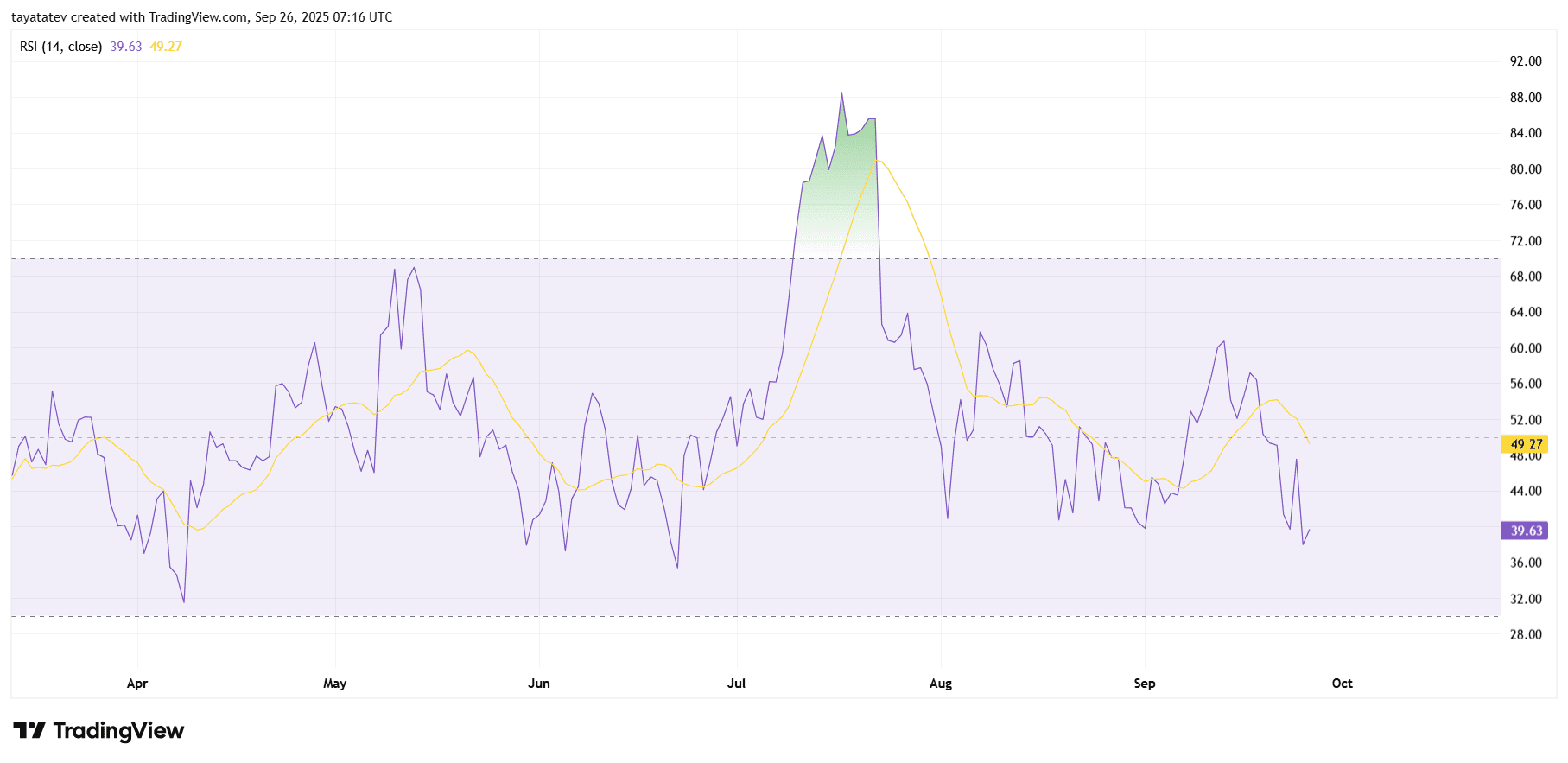

XRP daily RSI points to fading momentum on Sep 26, 2025

XRP’s 14-period Relative Strength Index prints 39.63, below the neutral 50 line, while its RSI moving average sits higher at 49.27. Momentum therefore tilts negative in the short term. The oscillator last peaked well above 70 in late July before sliding through August and September.

Moreover, the RSI now trades under its own average after a failed attempt to reclaim the 50–55 band earlier this month. This configuration reflects sellers in control and a market that has not yet regained trend strength. Until RSI recovers above 50 and the RSI line crosses back over its average, upside attempts may lack follow-through.

However, the indicator still holds above the oversold threshold near 30, which signals cooling rather than capitulation. A basing sequence would start with RSI stabilizing in the 40–45 area, then pushing back over 50 alongside a rising average. Conversely, a decisive drop toward 30 would confirm continuation of downside momentum.