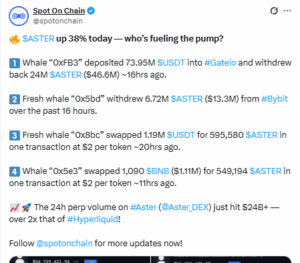

Blockchain analytics platform Arkham Intelligence reported that a whale withdrew 24 million ASTER from the exchange Gate.io. The transaction was valued at more than $46 million. The address, identified as 0xFB3B…, is now the 12th largest holder, controlling around 0.3% of the circulating supply.

This withdrawal is part of a wider wave of accumulation. In the past 24 hours, Arkham tracked three wallets that together acquired 31.26 million ASTER, worth about $61.64 million. One newly created wallet purchased nearly $14 million worth of tokens on Bybit. Another shifted funds from Binance Coin into ASTER. A separate whale sold about $8.9 million in Hyperliquid’s native token HYPE and used the proceeds to buy ASTER.

Large withdrawals from exchanges often indicate that investors intend to hold rather than trade immediately. When tokens are moved into private wallets, fewer are available on the open market. This can put upward pressure on prices if demand stays strong.

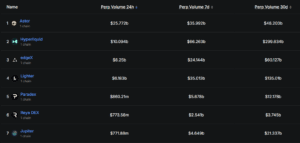

ASTER Surges Past Hyperliquid in Derivatives Markets

Alongside whale buying, ASTER has overtaken Hyperliquid in derivatives trading activity. The token’s open interest — the total value of outstanding derivatives contracts — climbed from $3.7 million to $1.25 billion in less than a week. Its 24-hour perpetual trading volume reached $24.7 billion, surpassing Hyperliquid, which had been the leading decentralized derivatives exchange.

Data from DeFiLlama shows ASTER’s total value locked (TVL) has risen sharply as well, jumping from $625 million to $1.85 billion within days. In one 24-hour period, ASTER generated more than $7 million in trading fees. This made it one of the most profitable protocols in the sector. These rapid increases show that traders are committing significant liquidity to ASTER’s ecosystem and that the platform is attracting heavy speculative interest.

The surge in whale accumulation and trading activity has pushed ASTER’s price to new highs. The token climbed above $2.20 this week before retreating slightly on profit-taking. Over the past seven days, ASTER has gained more than 2,500%, ranking among the best performers in the market.

Part of this growth comes from the APX – ASTER token swap, which allowed holders of the older APX token to convert into ASTER. The migration expanded circulating supply, boosted visibility on exchanges, and gave whales the depth they needed to make large purchases without overwhelming the market.

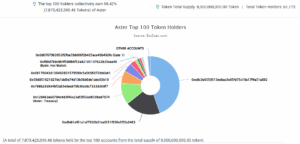

Ownership Concentration Raises Concerns

Despite its rapid rise, ASTER’s ownership distribution raises risks. Data from BscScan shows that the top 100 wallets hold 98.42% of the supply, with the top two addresses controlling nearly 65%. Such heavy concentration means a small group of holders can strongly influence price direction.

With billions of dollars now tied up in leveraged positions, a large-scale sale by even a few whales could trigger cascading liquidations. While accumulation has supported ASTER price’s rally so far, the same holdings could create sharp volatility if moved back onto exchanges.