Sei advanced non-price initiatives this month, adding institutional custody, PayPal’s PYUSD distribution, low-latency oracle feeds, an Etherscan explorer, native USDC with CCTP v2, and new builder funding tied to its trading layer. The updates target regulated workflows and developer usability across Sei’s EVM stack.

Crypto.com integrated its institutional-grade custody with the Sei Network on September 19, enabling qualified clients to hold SEI within Crypto.com Custody. The companies presented the move as a way to meet security and compliance requirements for institutions operating on Sei.

Moreover, third-party coverage echoed the integration details and framed the step as part of broader market infrastructure progress around custody and access. This external confirmation underscored the institutional focus of the update.

Taken together, the custody addition reduces operational friction for funds and corporates that require segregated, auditable storage before deploying onchain strategies. It also aligns with Sei’s push to support higher-throughput use cases on its EVM.

PYUSD distribution comes to Sei via LayerZero

LayerZero announced “PYUSD0,” a permissionless distribution that extends PayPal USD across additional chains, including Sei. According to the rollout plan, PYUSD and PYUSD0 remain fully fungible and interoperable across supported networks.

Sei separately confirmed that PYUSD0 will connect to its network, positioning PayPal’s dollar stablecoin for native use in payments and settlement flows on Sei EVM. This addition broadens fiat-linked liquidity sources for builders.

Meanwhile, industry outlets summarized the expansion and highlighted the cross-chain mechanism underpinning the distribution. As a result, developers can plan PYUSD integrations without relying on wrapped assets.

Chainlink Data Streams goes live as preferred oracle

Sei integrated Chainlink Data Streams as its preferred low-latency oracle. The deployment provides high-frequency market data with features such as liquidity-weighted bid-ask spreads and sub-second performance aimed at trading applications.

Additionally, Chainlink-focused coverage placed the integration within a broader expansion of Data Streams to traditional assets and ETFs. This context signals an emphasis on standardized data inputs for tokenization and execution use cases.

With Data Streams available, builders on Sei can source uniform feeds for matching engines and risk systems while retaining verifiability. This approach supports the network’s stated objective of enabling sub-second workflows.

Etherscan deploys “Seiscan” for Sei’s EVM

Etherscan launched “Seiscan,” a dedicated explorer for Sei’s EVM environment. The tool delivers the familiar Etherscan interface for addresses, transactions, contracts, and APIs, reducing onboarding friction for developers.

Independent reports confirmed the launch date and summarized Seiscan’s feature set for users migrating tooling from other EVM chains. Consequently, teams can standardize monitoring and analytics across multi-chain stacks.

By aligning with an industry-standard explorer, Sei narrows the tooling gap and improves support workflows for exchanges, wallets, and auditors that depend on Etherscan-style endpoints.

Native USDC and CCTP v2 now available

Circle announced in July that native USDC and Cross-Chain Transfer Protocol (CCTP) v2 were coming to Sei, and later confirmed they were live on July 24 with Circle Mint support. This activation enables direct mint/burn flows and standardized transfers across supported networks.

Sei’s update added that institutional access to native USDC is available, while ecosystem partners drafted migration paths from prior bridged variants. Thus, liquidity can consolidate on the canonical asset.

Further coverage noted that developers can now move USDC across more than a dozen chains without wrappers, simplifying treasury and settlement designs for multi-chain applications.

Monaco RFP program targets sub-second trading apps

The Monaco trading layer opened an RFP program to fund builders targeting <1ms execution and sub-second settlement on Sei EVM. The program focuses on high-frequency order flow, matching, and risk tooling that align with Sei’s performance profile.

External summaries described the initiative as a structured call for proposals that pairs technical capabilities with funding to accelerate exchange-grade primitives onchain. This structure aims to shorten the path from prototype to production.

With a formal RFP track in place, teams can pursue grants for components such as market data adapters, clearing logic, and liquidity mechanisms designed for the Monaco environment.

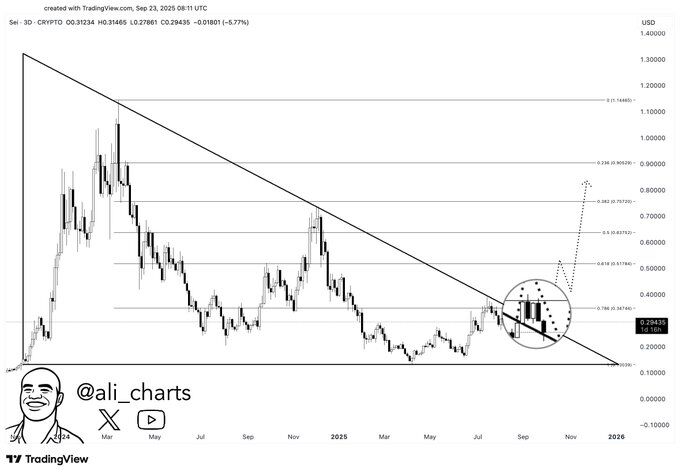

Analyst flags bullish retest on SEI

Crypto analyst Ali Martinez said SEI is undergoing a “bullish retest,” adding that if the token reclaims 0.35 dollars as support, it could open a path toward 0.90 dollars. He posted the view with a chart on X, outlining the setup and the key threshold.

He illustrated a retest zone around the 0.35 level and mapped a potential advance that reaches 0.90 if buyers hold that support. The chart showed prior resistance turning into support as the condition for further upside, keeping the focus on confirmation rather than momentum alone.

Martinez framed the scenario as contingent. Therefore, the technical call hinges on a firm close above 0.35 and sustained holding of that area, while failure to secure it would invalidate the path he outlined.

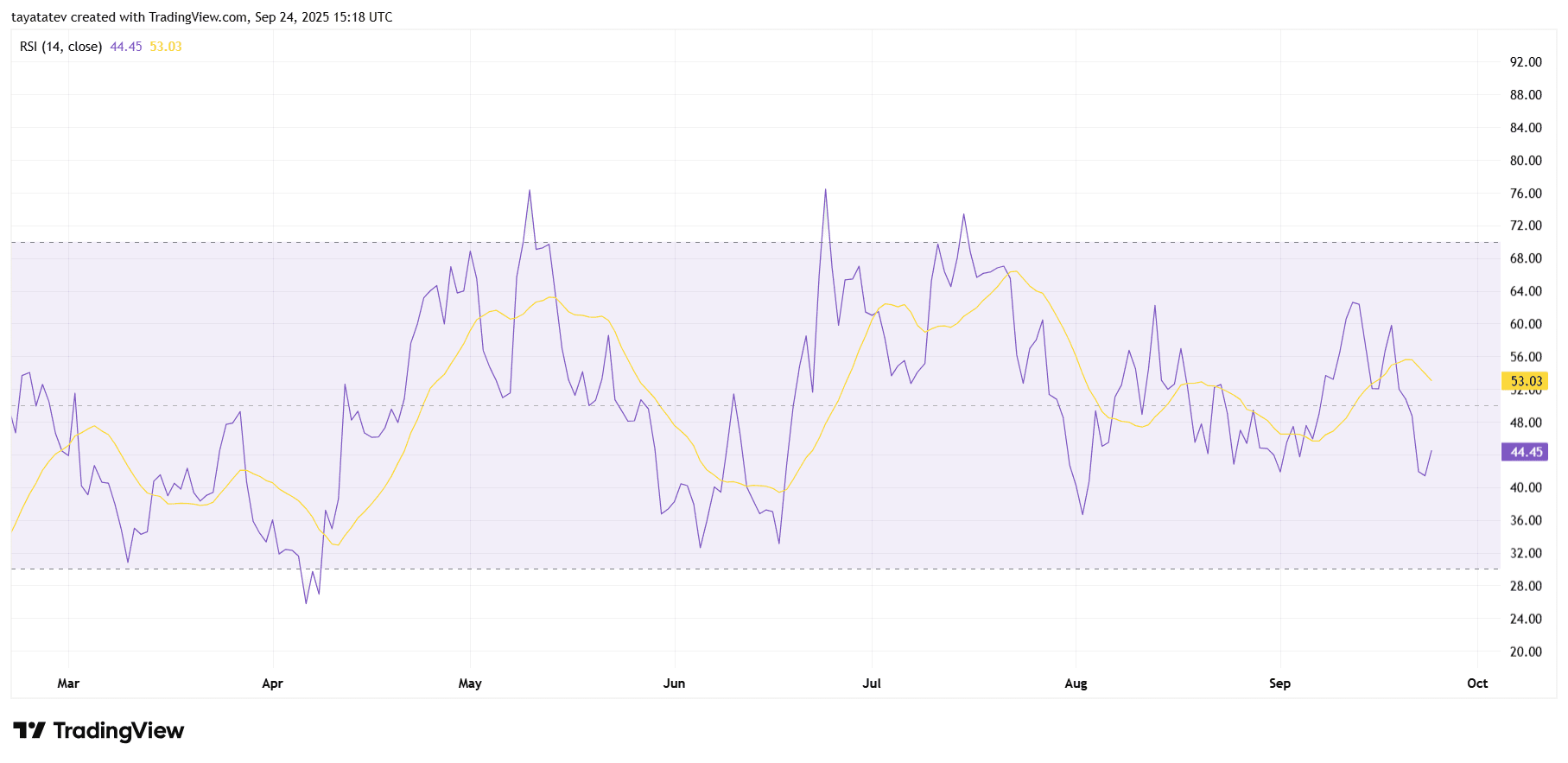

RSI signals neutral-to-bearish momentum

The 14-period RSI reads 44.45, below the neutral 50 line, while the signal average sits higher at 53.03. This positioning shows momentum leaning soft and confirms sellers hold a slight edge.

Since late August, RSI highs have stepped down from the mid-60s toward the low-50s. At the same time, pullbacks repeatedly found a floor around 40–45, which now acts as a soft support zone for momentum. However, the latest dip under the signal average underscores fading upside pressure.

Looking ahead, a firm reclaim of the 50–55 band would mark improving momentum and a reset above the signal line. Conversely, sustained prints below 40 would signal growing downside risk toward the 35–30 area. No clear bullish or bearish divergence appears on this view, as RSI broadly tracks price direction.