The landmark ‘unregistered securities’ case between Ripple & the Securities and Exchange Commission (SEC) has been solved after 6 years of intense legal squabbles, contributing towards XRP’s $3.65 all-time high a few months back.

SEC Vs. Ripple Hurdles Erased, Say Lawyers

Recently, the question of any continuous stalling in the SEC vs. Ripple case had affected the altcoin’s market performance. Jake Claver enquired about this on X, receiving proof that the $125 million in Ripple coin (XRP) escrow was released last month, completing the lawsuit.

Meanwhile, another popular attorney Bill Morgan strictly exclaimed that “the lawsuit excuse has run its course for any further lack of XRP adoption or flat price action”. Does this imply that XRP coin is in for a bigger dip unless a huge breakthrough in adoption takes place?

What’s Stopping XRP’s Price Growth Now?

With the $125 million fine for Ripple Inc. settled, market watchers are expecting Ripple’s native crypto to retest these levels, but the current market dip poses a huge challenge to this narrative. Certainly, the erratic crypto market behavior on Monday has flushed the bulls away with $1.7B in 24-hour liquidations, while XRP is holding strong onto the $2.80 support levels.

The intense profit-taking by XRP’s whales is now evident on technical charts by all time frames, even though the OG altcoin took a softer blow than the leading altcoin Ethereum (ETH). This coincides with the Crypto Fear & Greed Index turning to ‘fear’ for the first time in months, while several technical points point to a further pullback this week.

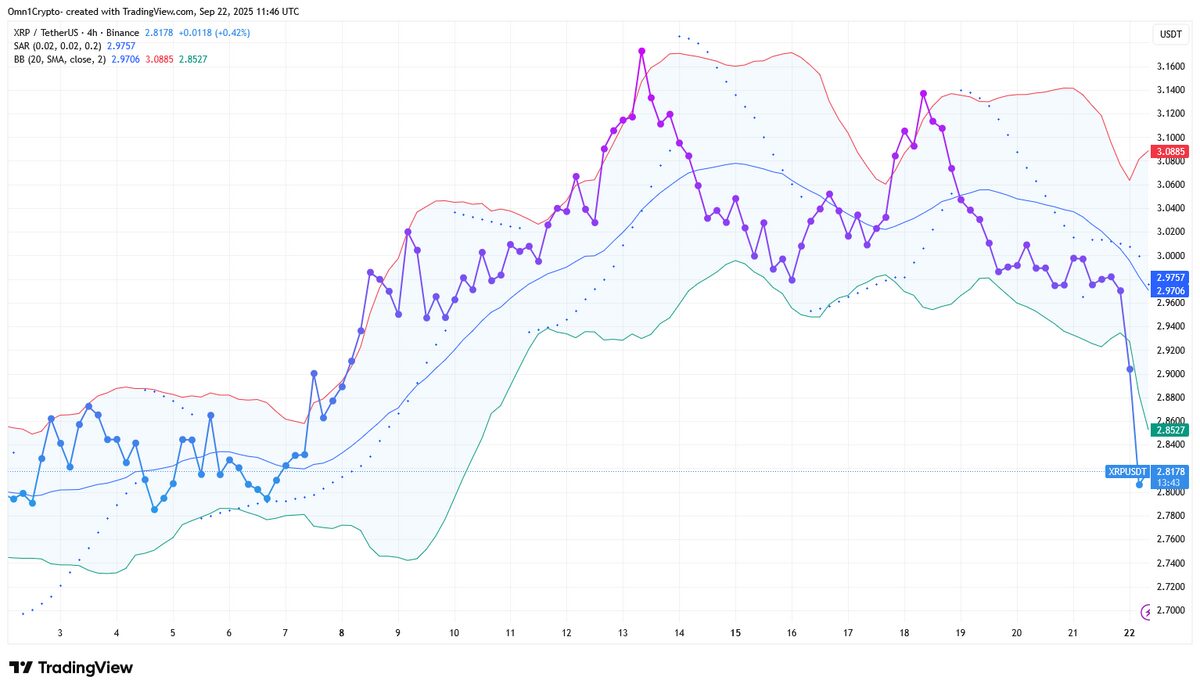

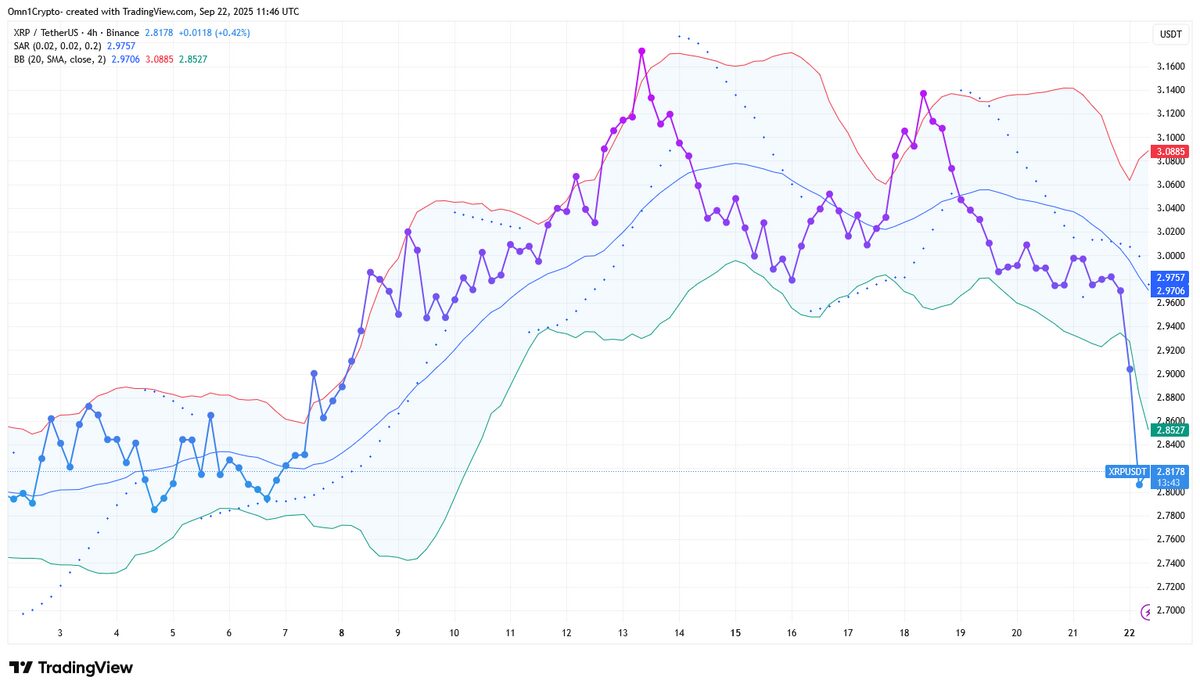

Evidently, XRP’s price performance falls out of the regular range, portrayed by the green, blue & red lines, representing the Bollinger Bands (BOLL). Considerably below the lowest-tier BOLL envelope at $2.85, this means XRP’s price is yet to find its foot amidst the harsh correction.

Paired with a ‘sell’ signal on the Parabolic Stop & Reverse (SAR) metric that’s pictured in blue dots, Ripple coin is due for a retest of the lower support boundaries unless the whales switch up the sentiment back to bullish & start gathering XRP positions at the current price range.

Dig into DailyCoin’s hottest crypto news:

Whales Dump XRP, ETH Like Toxic Cargo: $1.7B Wiped Out

When Does Optimism’s (OP) Superchain Mainnet Blast Off?

People Also Ask:

The SEC lawsuit ended in August 2025, with Ripple paying a $125M fine for unregistered XRP sales to institutions—far less than the SEC’s $2B demand. Both sides dropped appeals, closing the chapter for good.

Yes, Ripple paid it all in cash into escrow by July 2025. After settlements, the SEC kept $50M and refunded $75M to Ripple, finalizing the penalty.

Clarity helps long-term, but short-term drags include broader crypto market dips (Bitcoin’s influence), regulatory uncertainty elsewhere, and token unlocks flooding supply. XRP’s up ~5% since August but lags majors.

It’s a win: XRP isn’t a security for secondary sales, boosting exchange listings and adoption. Ripple can now focus on payments, but full growth needs pro-crypto regs and market recovery.

Hold if you’re in for utility—analysts eye $3.50+ by year-end on partnerships. Newbies: DYOR, diversify, avoid FOMO. Volatility’s high, but the fine removes a big overhang.