Intersect opened voting for its 2025 Board of Directors, confirming a window through late September for members to choose four of seven seats. The election follows an August application period and a September candidate slate finalization. Materials stress member governance and continuity around constitutional workstreams.

Moreover, Intersect highlighted the role of committees and the vendor smart-contract program in recent updates. The development note on September 12 detailed metadata conventions and listed active items ahead of the election window. These posts frame a month focused on process and delivery.

In practice, the board vote sets the agenda for 2026 planning. Intersect’s channels direct paid members to the voting portal and explain timing against the Cardano epoch schedule. The organization positions the ballot as a routine, yet central, governance step.

Input Output launches Asia Tour

Input Output announced a 2025 Asia Tour with stops aligned to regional headline events. The route features Seoul for Korea Blockchain Week, Ho Chi Minh City for a community day, Singapore during Token2049, and Osaka for governance and builder sessions. The newsroom post and forum itinerary provide dates and RSVP links. IOHK+1

Additionally, Korea Blockchain Week’s program places Cardano sessions inside the IMPACT conference on September 23–24. Organizers present AI–crypto, stablecoins, and infrastructure as key themes, offering context for Cardano’s presence. Public listings corroborate timing and venues. Korea Blockchain Week+2Eventbrite+2

As the tour progresses, the team plans workshops and meetups tailored to local communities. The forum thread aggregates sign-ups and agenda changes, creating a single reference for traveling stakeholders. The cadence mirrors prior regional swings by the company.

Cardano Days set for University of Wyoming

The University of Wyoming confirmed “Cardano Days” for September 26–27 as part of the Wyoming Blockchain Stampede. The university’s schedule describes two days of instruction on Cardano and smart contracts, with registration open. The listing emphasizes practical learning goals over market narratives.

Furthermore, event pages provide venue details and separate registration for each day. Organizers note an immersive format and wallet-based verification for certain sessions. The materials aim to streamline on-site logistics.

Consequently, Cardano extends its education track into the fall calendar in the U.S. Mountain West. The Stampede programming situates the network among broader policy and enterprise topics hosted on campus. The structure supports newcomers as well as builders.

Foundation content spotlights digital identity

The Cardano Foundation’slatest “Let’s Talk Cardano” episode focuses on Veridian, a digital-identity wallet that uses the KERI protocol on Cardano. The article outlines how decentralized identifiers anchor to the chain and how custody models differ from traditional sign-in flows. The piece frames Veridian as an example of standards-based identity on public infrastructure.

In addition, the Foundation continues to publish event and program notices tied to its enterprise push. The Summit site confirms Berlin as the flagship venue in November, with a strong emphasis on business use cases. These channels establish a consistent theme around adoption and compliance.

Readers can trace identity and enterprise topics across Foundation posts and the Summit agenda. The narrative keeps attention on deployable primitives rather than speculative roadmaps. As schedules firm up, the Foundation cross-links resources for attendees.

Summit 2025 adds “Day Zero” builders program

Summit 2025 will run in Berlin on November 12–13, with a free “Day Zero” event on November 11 at w3.hub. The Cardano Foundation’s announcement describes a builder-focused program ahead of the main conference. It invites developers and partners to preview demos and workshops.

Moreover, the Summit site lists regional programming alongside the flagship event. The materials underscore an enterprise theme and promise regulators, founders, and technologists on stage. The messaging sets expectations for content breadth across three days.

As planning advances, the Foundation will publish speaker updates and logistics. For now, the schedule anchors mid-November dates and location, allowing teams to align travel and showcases. Public pages remain the authoritative sourc

Release cadence: node 10.5.1 remains current

Cardano’s official release notes show node version 10.5.1 as the latest as of July 22, 2025. The page lists companion components and their most recent versions, including Rosetta Java updates from September. Documentation consolidates versioning and dates for operators.

Furthermore, Intersect’s GitHub release post details fixes in 10.5.1. The notes cite a corrected slotsMissed_int metric, Windows socket improvements, shorter DNS error caching, and a switch to --start-as-non-producer-node. Operator guides reflect upgrade steps.

In effect, the network proceeds with incremental updates rather than major protocol shifts this week. Public repos and docs provide the definitive technical record for node operators and tooling teams. The posture indicates stability heading into Q4.

Whale cohort offloads 160 million ADA in four days

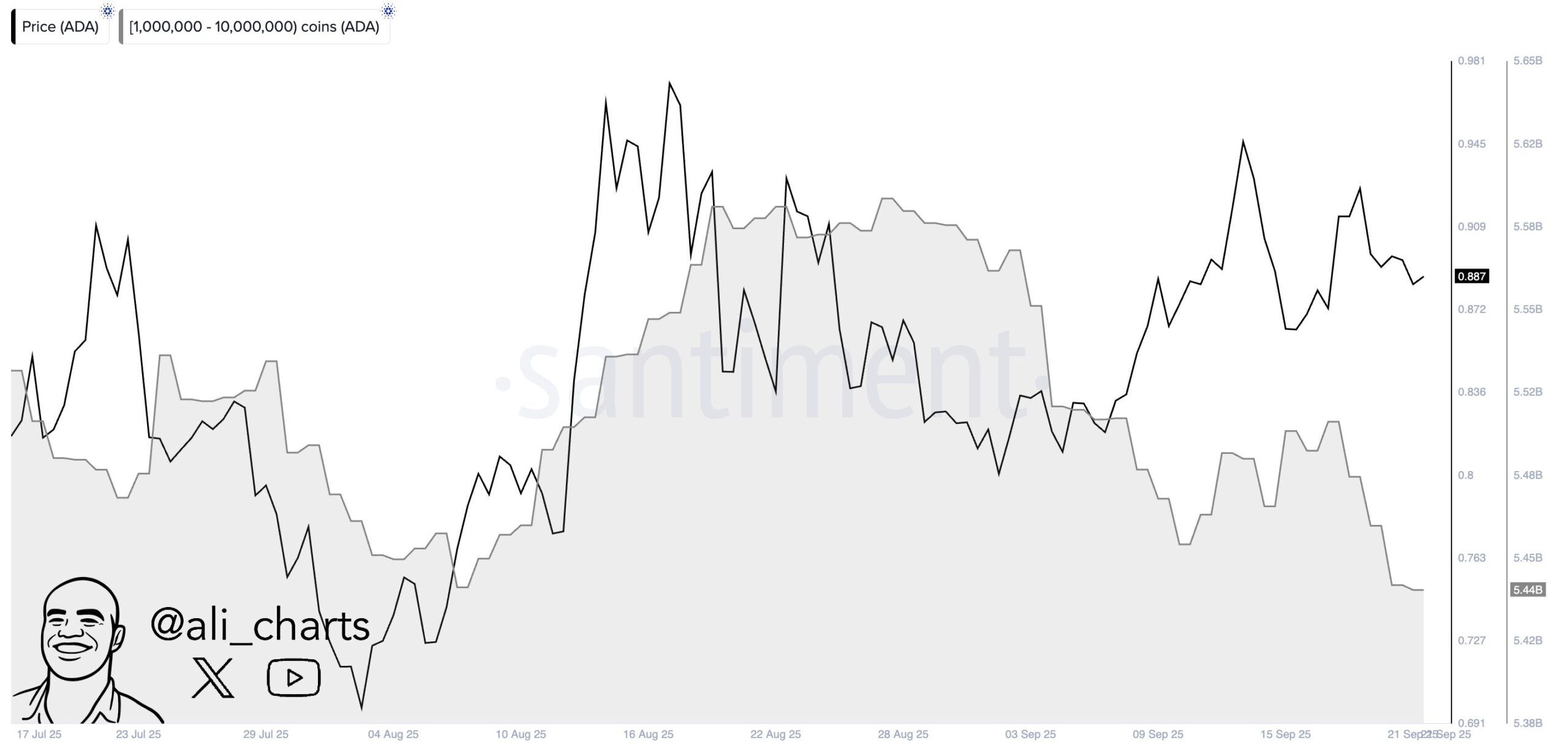

Addresses holding 1–10 million ADA reduced their balances by about 160 million ADA over the past 96 hours, according to a chart shared by analyst Ali using Santiment data. The cohort’s holdings slipped from roughly 5.60 billion ADA to 5.44 billion ADA, a decline of about 2.9% during the period.

The visualization overlays price with the cohort’s supply, showing a steady distribution trend since late August that accelerated this week. While the metric focuses on one bracket of large holders, it captures a meaningful slice of circulating supply and highlights near-term shifts in ownership concentration.

Taken together, the data points to active distribution by mid-sized whales rather than accumulation. As always, cohort flows describe supply dynamics; they do not, by themselves, determine forward moves.

ADA daily RSI shows neutral momentum after August peak

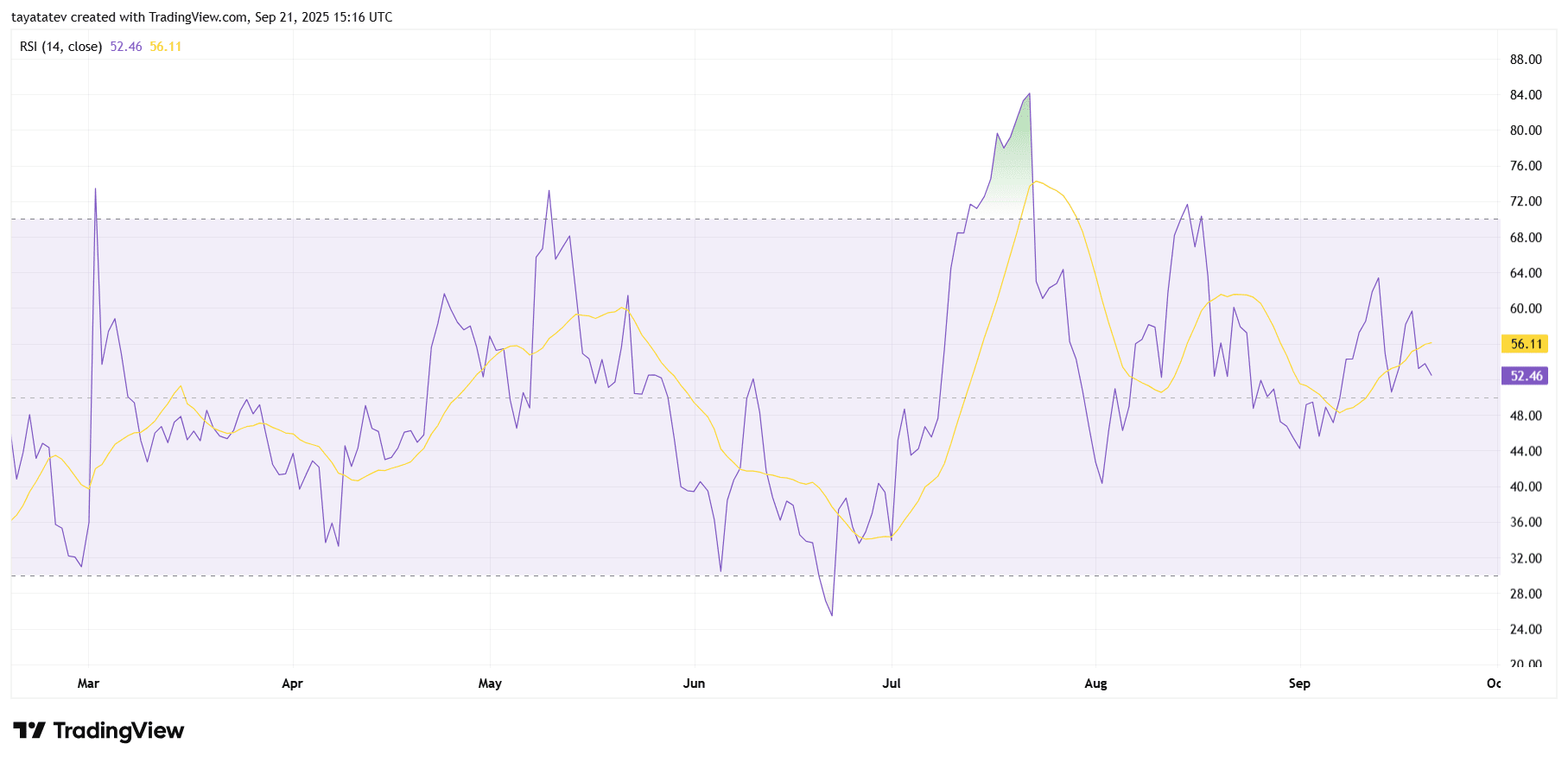

ADA’s 14-day RSI sits near 52 while its RSI moving average hovers around 56. Momentum cooled from the early-August overbought spike above 70, then slipped back into the 40–65 band through September. Today, RSI holds below its MA, which signals a mild bearish bias but not a trend shift on its own.

Recently, RSI bounced from the mid-40s and failed to clear the low-60s. That action maps a range: resistance near 60–62 on the RSI and support around 45–48. Until RSI breaks either side of this corridor, conditions imply consolidation rather than strong directional pressure.

Looking ahead, a sustained push back above 60 with an RSI-over-MA cross would indicate improving momentum. Conversely, a drop under ~45 would show weakening demand and raise the risk of a deeper momentum pullback. For now, the indicator reads neutral.