Pi Network advanced its phased Protocol v23 rollout on Testnet while launching “Fast Track KYC,” which lets eligible newcomers activate a Mainnet wallet before completing the 30-session mining threshold. The team says the upgrade path remains Testnet1 → Testnet2 → Mainnet, with limited service interruptions as needed.

Protocol v23 status

Testnet1 has moved through versions 19–22 and reached v23, the final Testnet step before promoting changes to Testnet2 and then Mainnet. Reports describe the v23 track as aligning Pi’s stack with the current Stellar Core release family for throughput and stability improvements. Pi’s blog frames the work as a phased network-wide upgrade.

Pi has not posted a date-certain Mainnet cutover. However, the August 27 engineering note set expectations that Testnet1 upgrades would proceed first, followed by sequential promotions after stability checks. The same note introduced a Linux Node release intended to standardize operator environments ahead of protocol changes.

Third-party trackers and news desks echoed incremental progress across the week, with some stating that v23 on Testnet1 is complete. Those accounts remain secondary to the project’s blog and channels for timing.

Fast Track KYC opens earlier wallet activation

On Sept. 18, Pi Network introduced “Fast Track KYC,” an AI-assisted flow that allows new users with fewer than 30 mining sessions to verify identity and activate a Mainnet wallet earlier. The feature appears inside the Pi Wallet app for eligible users. Pi says this expands access to apps and local commerce without changing migration rules.

Fast Track KYC activates a wallet but does not enable Mainnet migration. Users still need to meet standard eligibility—including at least 30 mining sessions—and complete the Mainnet Checklist before balances can move. The team emphasizes that faster screening does not relax KYC standards; applications that fail regular criteria will be rejected.

The announcement follows external coverage noting the feature’s use of additional AI checks and its role in easing onboarding bottlenecks. Pi positions the tool as a native alternative to third-party onboarding while maintaining compliance and network integrity.

Why the Linux Node release matters to the upgrade

Pi’s Aug. 27 post packaged the Linux Node release with the protocol-upgrade roadmap. Standardized node software aims to reduce configuration drift and streamline automated updates as protocol versions advance. The team presented this as groundwork for the v23 sequence and future Mainnet reliability.

Industry roundups highlight Linux Node as a prerequisite for service providers and exchanges that prefer Linux environments. They also point to smoother rollouts as operators rely less on custom setups. These notes align with the project’s aim to move upgrades through Testnet tiers without broad disruption.

Pi’s public channels reiterated that upgrades start on Testnet and proceed in phases, with notices if downtime is required. That remains the operative plan as of today.

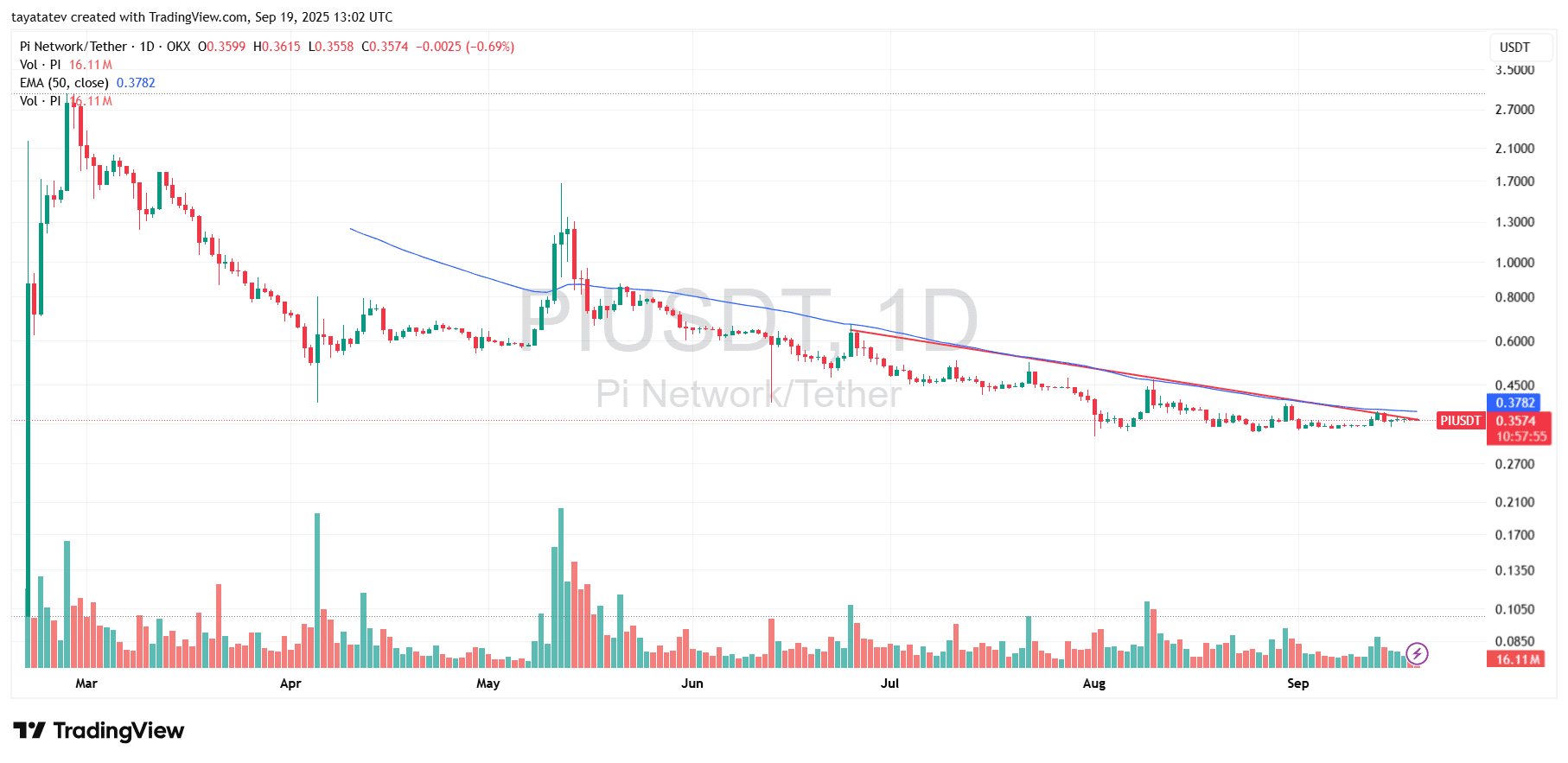

PIUSDT — Sept. 19, 2025: downtrend tests the 50-day EMA and descending trendline

Price trades at $0.3574 today after months of lower highs. It sits just under the 50-day EMA at $0.3782 and the descending trendline that has capped every bounce since spring. Volume remains light at ~16.1M, which confirms limited conviction on both sides. Earlier sessions formed a tight base between ~$0.33 and ~$0.37 as sellers lost momentum but buyers failed to reclaim the moving average.

However, the setup now turns binary at this confluence. If bulls close a daily candle above both the trendline and the 50-day EMA—preferably on rising volume—price can target the $0.40 area first and then $0.43–$0.45 where prior supply sits. Momentum would then flip from distribution to repair, and the base could extend into a short squeeze toward the mid-$0.40s.

Otherwise, rejection at the EMA and trendline keeps the primary downtrend intact. In that case, expect another drift inside $0.33–$0.36, with risk of a retest near $0.31 and then $0.27 if volume expands on red candles. Until price decisively clears ~$0.38, the path of least resistance remains sideways to lower.

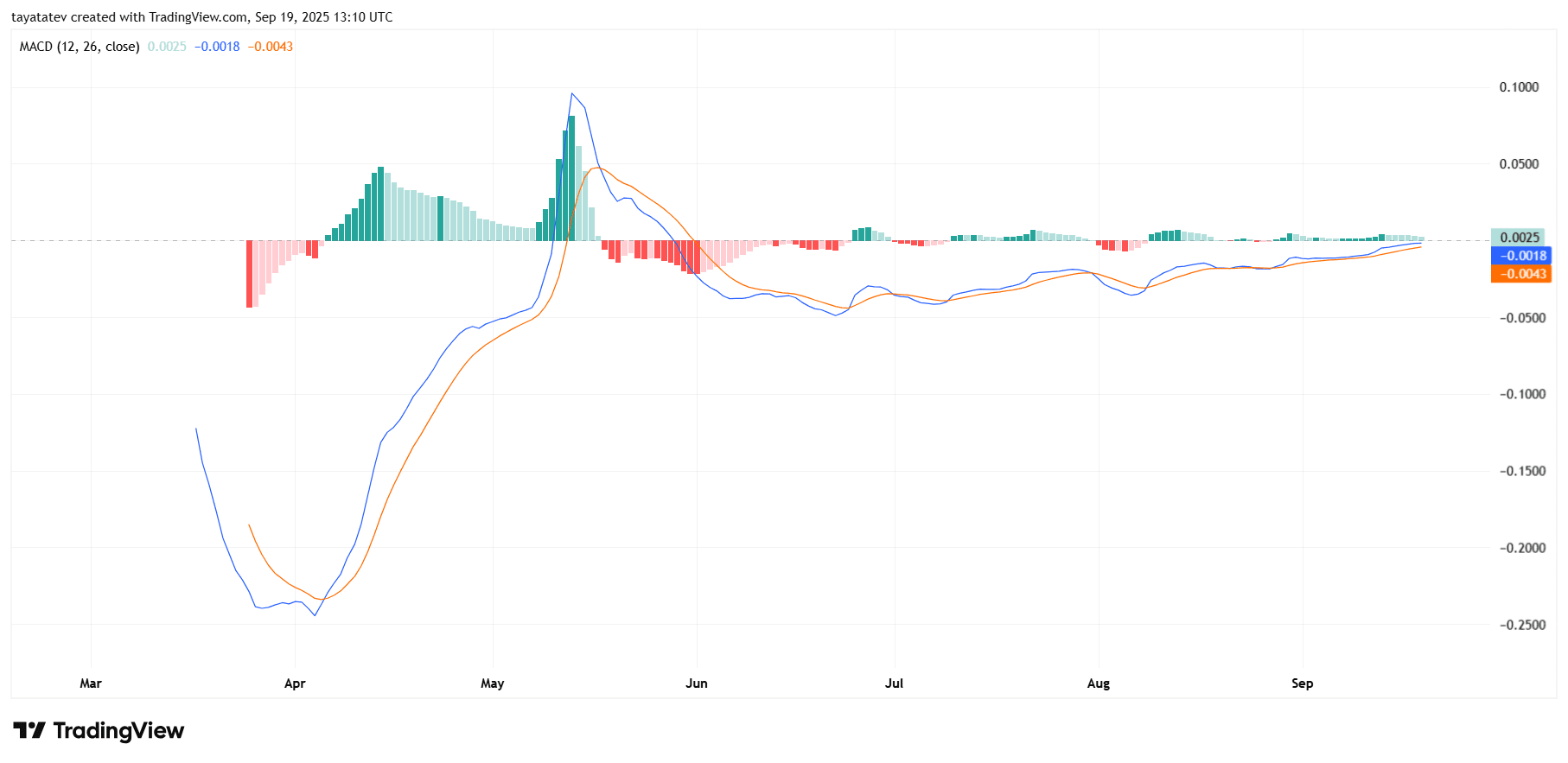

PIUSDT MACD — Sept. 19, 2025: momentum tilts up at the zero line

Today the daily MACD hovers around zero after months of flattening. The MACD line just nudged above the signal line with small, light-green histogram bars. This crossover follows a long squeeze in volatility and indicates improving short-term momentum, not a confirmed trend change.

If the histogram expands above zero for several sessions and the MACD lifts decisively into positive territory, buyers can press a push toward the price barrier discussed near $0.38–$0.40. Sustained separation between the MACD and signal would validate follow-through and often precedes range breaks.

However, a quick fade back below the signal at the zero line would mark a bull trap. In that case, momentum likely reverts to neutral-to-negative and aligns with a price drift inside $0.33–$0.36. Therefore, watch for continuity: rising, consecutive positive histogram bars and a clean MACD > signal > 0 structure to support upside; a flip back under the signal to warn of another sideways-to-lower leg.

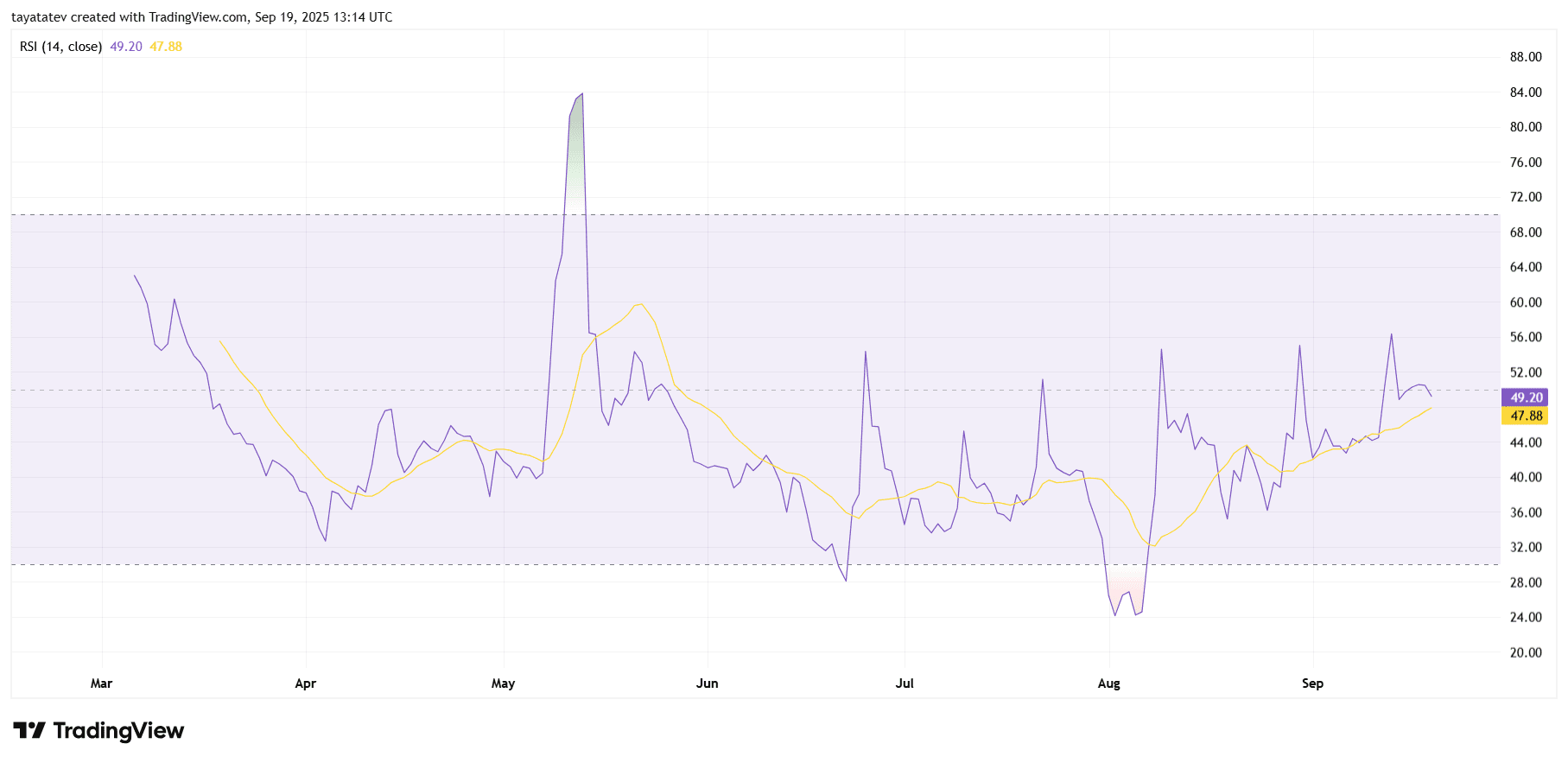

PIUSDT RSI — Sept. 19, 2025: momentum edges neutral-to-positive

The 14-day RSI prints 49.2 today with its signal near 47.9. RSI has climbed from early-August oversold readings below 30 and now rides a steady sequence of higher lows. Price stayed range-bound while RSI rose, which shows improving momentum under the surface.

Now the gauge sits at the 50 line, where trend often decides. If RSI holds above 50 and pushes into 55–60 with the signal following, momentum turns bullish and supports a break toward the $0.38–$0.40 barrier flagged on price. Sustained closes with RSI > 55 would confirm control shifting to buyers.

However, if RSI slips back under 45 and the signal crosses above it, momentum fades and the market likely chops inside $0.33–$0.36 again. A drop toward 40 would warn of another leg lower. Therefore, watch the 50 band for confirmation and the slope of both lines for follow-through.