Bitcoin (BTC) price rose above $117,000 on Sept. 18, likely due to increased buyer influx following the recent Fed rate cut announcement. The U.S. Federal Reserve cut its benchmark rate by 25 basis points to 4.00-4.25%, its first reduction since Dec. 2024. BTC price spiked about 1% immediately after the announcement before falling back toward $115,000. Momentum hit resistance in the mid-$117,000s. Volume rose as bulls pushed, but shorts and profit-taking capped upside.

Meanwhile, analysts turned bullish on Bitcoin price action, though some risks remained.

Critical Levels Shape Bitcoin’s Path

The rate cut briefly lifted optimism, but analysts focused on structural levels that could decide Bitcoin’s next move.

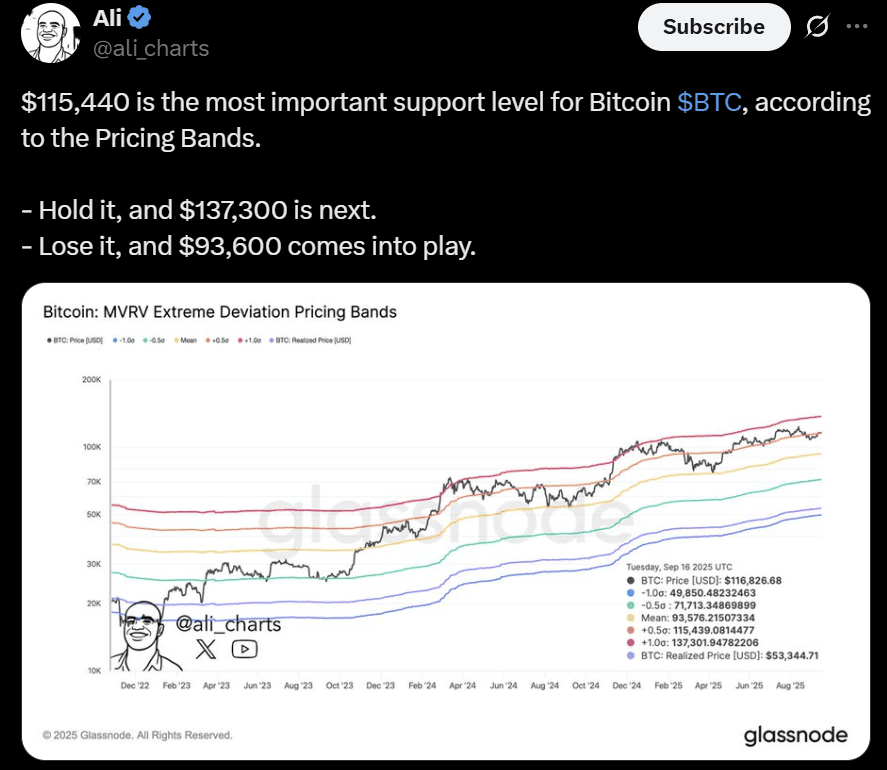

Independent analyst Ali shared an X post that tracked on-chain pricing bands that showed the BTC USD pair‘s rally potential hinged on defending support near $115,440. The analyst noted that holding the zone could open room for an advance toward $137,300. However, Ali warned that if BTC price failed to protect the support, it risked sending the token lower, with the next major support emerging near $93,600.

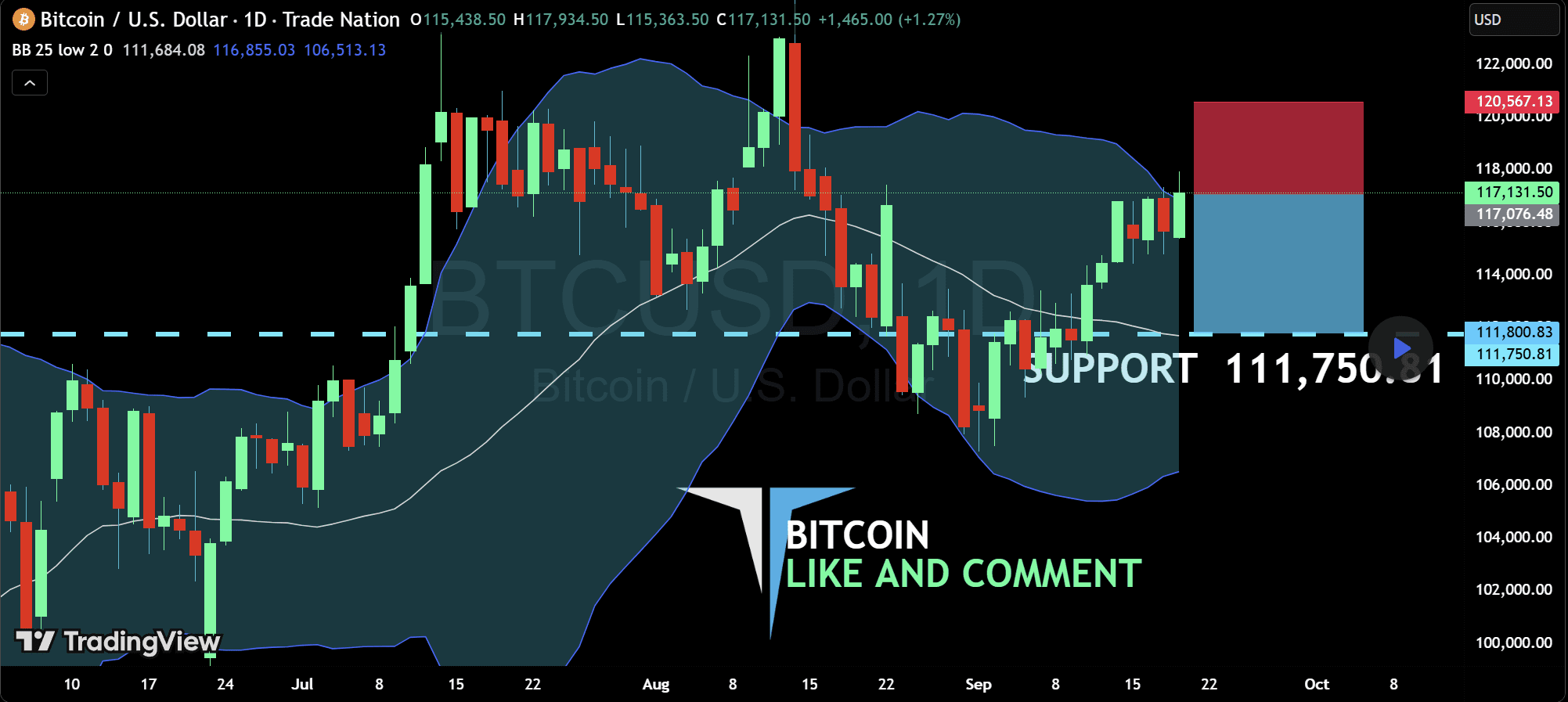

That binary structure placed the current market at a crossroads. Analysts from EliteTradingSignals shared a post on TradingView that reinforced the pressure, highlighting setups that targeted the $111,000 region as the next test for bears. Those calls aligned with Ali’s warning, where losing mid-range support could deepen the slide before any recovery attempt.

The overlap between on-chain bands and tactical trading signals underscored how fragile sentiment had become after the Fed decision.

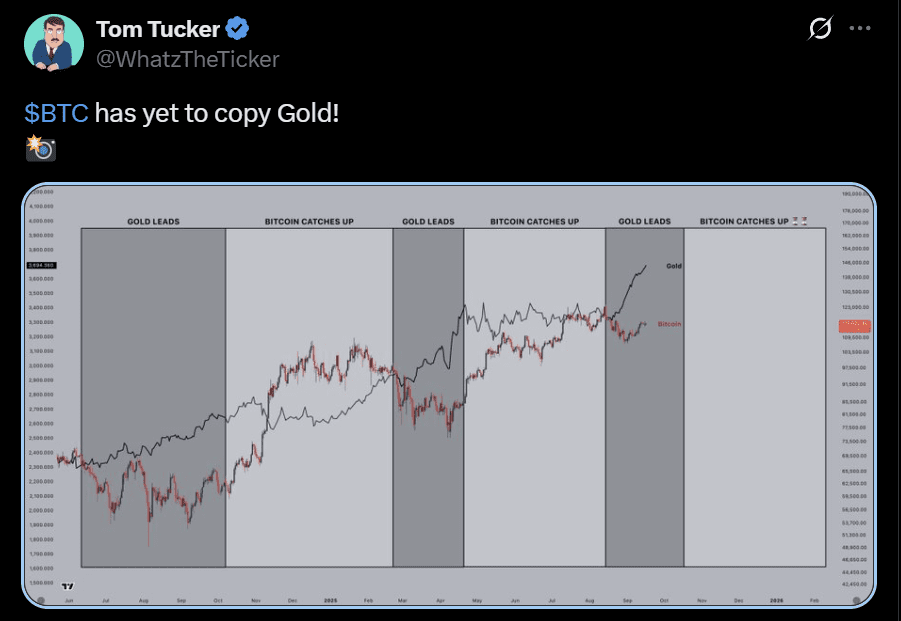

Meanwhile, another perspective framed Bitcoin’s potential rally in relation to gold. Analyst Tom Tucker posted a correlation between Gold and BTC price movements. Historical patterns suggested that gold often moved first, with Bitcoin catching up in a delayed fashion. Recent charts showed gold had already broken higher, while Bitcoin remained stuck near the $115,000 pivot.

Bitcoin could eventually follow gold upward if that relationship holds, but only if its current support zone survives the retest. Together, the views shaped a split outlook. The downside carried weight in the near term, yet the upside remained plausible if structural levels held.

Corporate Demand Adds Weight to Outlook

The debate over support and resistance extended beyond technical charts as corporate actions entered the picture. While Ali’s pricing bands and Tucker’s gold-Bitcoin correlation highlighted structural thresholds, new treasury moves from listed firms added another layer of influence.

GD Culture Group agreed to acquire Pallas Capital’s assets, including a treasury of 7,500 Bitcoin. The share-exchange deal issued 39.19 million GDC shares in return, valuing the acquisition at $875 million. The transaction placed GD Culture among the largest public Bitcoin holders, ranking within the top 15 globally. Investors approved the issuance under Nasdaq requirements and Nevada law, signaling compliance with key corporate thresholds.

In parallel, smaller firms also moved to expand their Bitcoin exposure. LQwD Technologies raised $1.8 million through a private placement, earmarking proceeds for direct Bitcoin purchases. The sum was modest compared to GDC’s acquisition, but it underscored how companies at different scales continued to treat Bitcoin as a reserve asset.

These actions tied back to the technical backdrop. If Bitcoin defended support near $115,440, corporate demand could magnify an eventual rally toward $137,000. However, the GDC sell-off reminded markets that sentiment remained fragile, and structural support had to hold before treasury allocations could translate into higher BTC prices.