Regulators extended the review clock for a proposed Bitwise Dogecoin ETF to November 12, while a new “Official Dogecoin Treasury” backed by House of Doge and CleanCore said it has accumulated more than 500 million DOGE and picked Bitstamp by Robinhood as its venue partner. Separately, Nasdaq’s 21Shares Dogecoin ETF filing remains under proceedings.

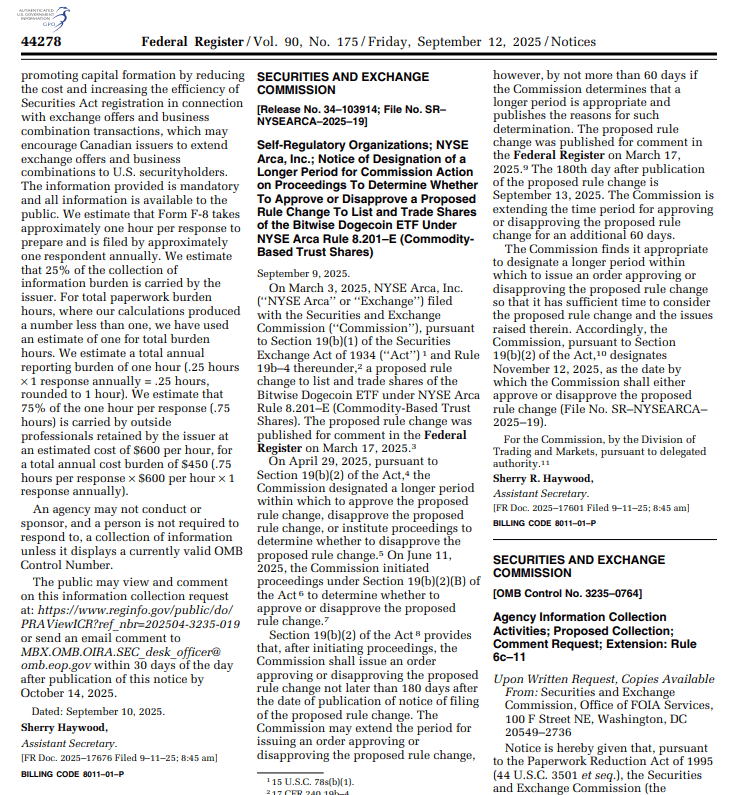

SEC pushes Bitwise DOGE ETF deadline to November 12

The Securities and Exchange Commission designated a longer period on September 9 to decide whether NYSE Arca can list the Bitwise Dogecoin ETF, setting November 12, 2025 as the new deadline. The order appears in the Federal Register and cites the need for additional time to consider issues raised by the proposal.

The extension keeps Bitwise in the spot-DOGE queue through the U.S. fall calendar. The filing—listed as SR-NYSEArca-2025-19—has progressed through the notice and comment stages, and the Commission’s move pauses any immediate approval or disapproval.

Moreover, the SEC’s docket and release show the agency using its standard Section 19(b)(2) timeline tools, aligning the Bitwise DOGE review with other crypto product deliberations. The decision date now lands after other September fund events, potentially concentrating headlines later in Q4.

House of Doge and CleanCore say “Official Dogecoin Treasury” passes 500M DOGE, selects Bitstamp by Robinhood

House of Doge—described in company materials as the Dogecoin Foundation’s corporate arm—announced a strategic partnership naming Bitstamp by Robinhood as the trading venue and custodian for the Official Dogecoin Treasury. The partners said the treasury structure aims to secure assets and support future utility initiatives.

CleanCore and House of Doge then disclosed that accumulated holdings surpassed 500 million DOGE as of September 12, marking the halfway point toward an internal 1-billion-DOGE target referenced in recent releases. Coverage from several outlets echoed the milestone and the $175,000,420 fundraising used to seed purchases.

In addition, CleanCore’s investor communications describe the longer-term objective to secure up to 5% of circulating supply via the treasury program. While the groups frame House of Doge as the foundation’s corporate arm, independent confirmation beyond partner and press channels remains limited to social and press statements.

Nasdaq’s proposal to list and trade the 21Shares Dogecoin ETF under Rule 5711(d) remains in proceedings after its May 19 Federal Register notice. The SEC’s August order opened a formal process to determine whether to approve or disapprove the rule change, keeping the application active into late summer and fall.

Meanwhile, media and issuer communications indicate that REX-Osprey’s DOJE fund is preparing for a U.S. debut under the Investment Company Act of 1940. Multiple reports flagged an expected launch window this month; however, final trading details typically depend on exchange notices published near go-live.

Taken together, the SEC’s Bitwise delay, the ongoing 21Shares review, and the anticipated DOJE listing outline a crowded product slate around Dogecoin. The activity concentrates regulatory and market-structure headlines away from price action and toward listing mechanics, custody choices, and treasury strategies.

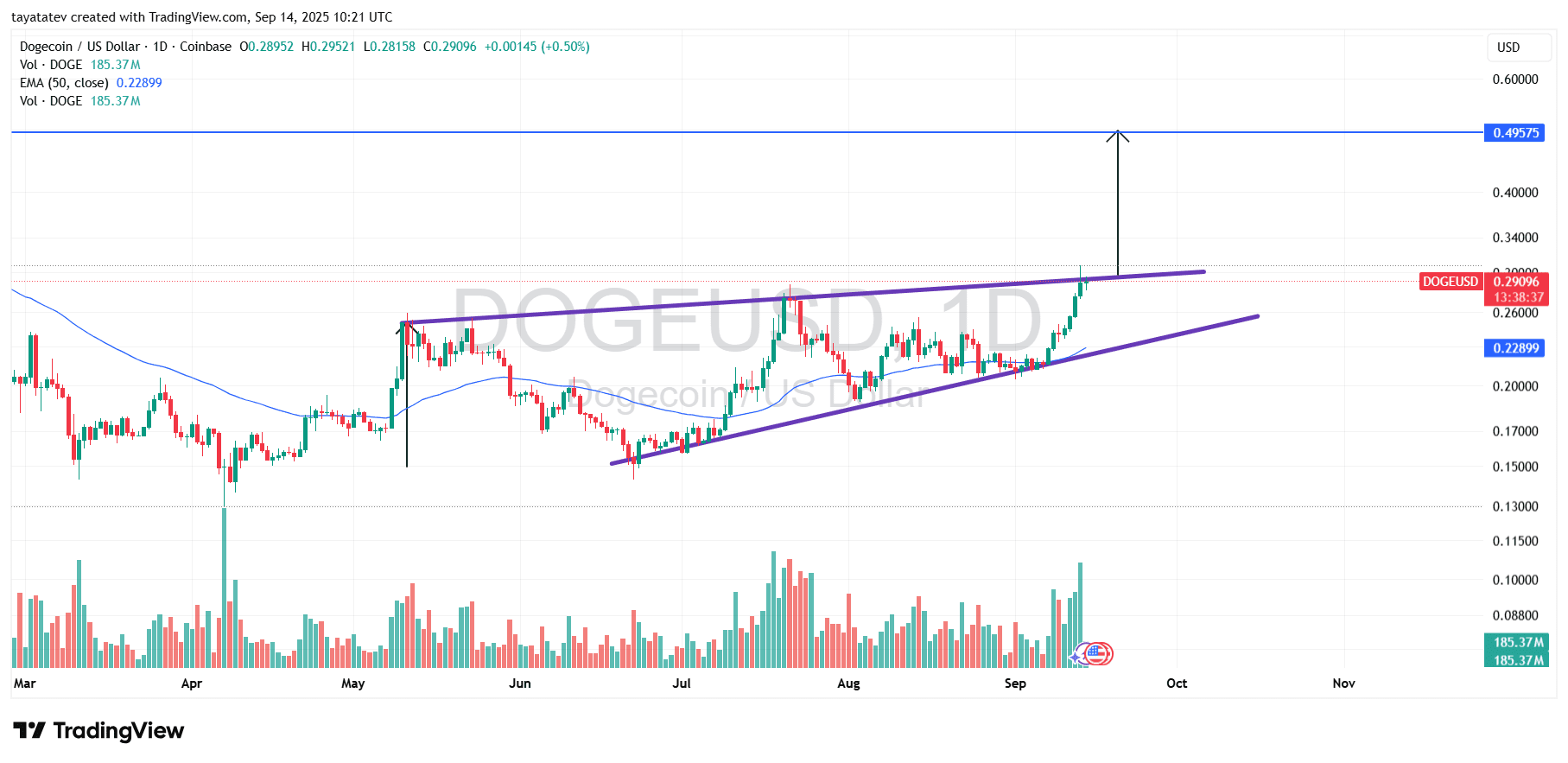

Rising wedge breakout points to 70 percent move toward 0.495

DogecoinDOGE/USD daily chart, created September 14, 2025 on TradingView, shows a clean break above the rising wedge’s upper boundary near 0.30 with the last print around 0.29096. A rising wedge is a narrowing, upward-sloping pattern where higher highs and higher lows converge into a tight range. The breakout aligns with the charted projection and shifts focus to the measured target overhead.

The measured move implies roughly 70 percent upside from the current level to about 0.49575. The math supports the annotation, as 0.29096 multiplied by 1.70 lands near 0.4946, which sits in line with the marked objective. The arrowed extension on the chart plots that destination just under the half-dollar area, keeping the target explicit on the price scale.

Trend and participation metrics back the signal. The 50-day EMA sits at 0.22899 and slopes higher, while price holds well above that dynamic support. Volume on the breakout bar prints around 185.37 million and exceeds recent sessions, which adds confirmation. If candles hold above the former wedge ceiling on any retest, the path toward the 0.49 to 0.50 zone remains intact; a sustained close back inside the structure would weaken the setup.

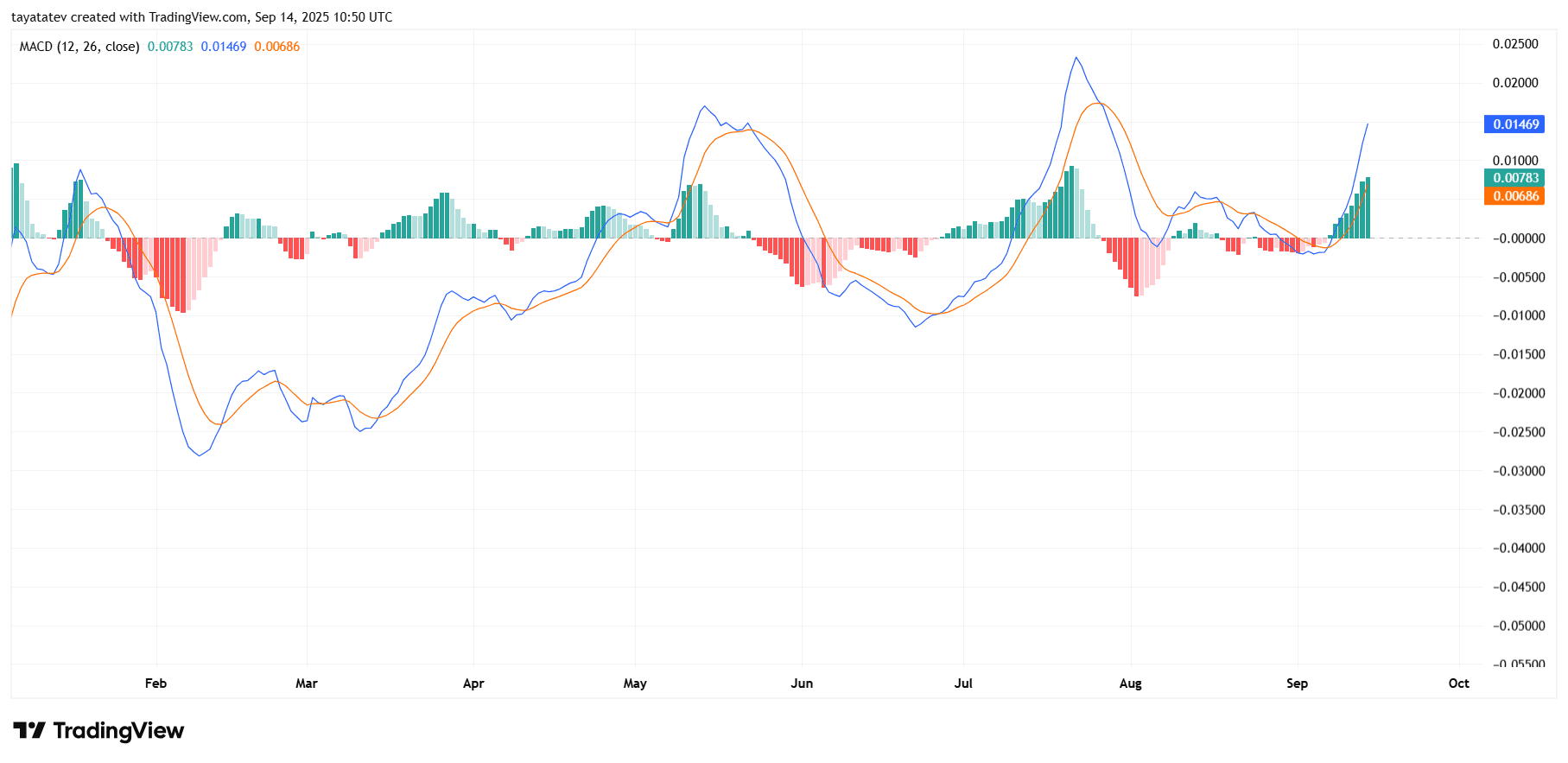

MACD turns positive as momentum accelerates

Dogecoin’s MACD (12, 26, close) on the daily chart created September 14, 2025 shows the MACD line surging above the signal line with the histogram flipping firmly positive and expanding. The move marks a momentum shift after early-September stabilization and follows a sharp upswing in the oscillator’s blue line, which now rises steeply.

In context, the oscillator’s profile resembles the July and late-August impulse phases, when a strong positive histogram accompanied upside drives before easing. This time, both lines climb while the histogram prints taller green bars, indicating increasing upside velocity rather than mere mean reversion. The setup aligns with a risk-on momentum phase on the daily timeframe.

Moreover, both MACD and signal sit above the zero line, which historically strengthens trend continuation signals on this pair. Confirmation comes if the histogram continues to build and the fast line maintains separation over the signal. Conversely, a rollover in the histogram or a fresh bearish cross would indicate waning thrust and a potential momentum pause.

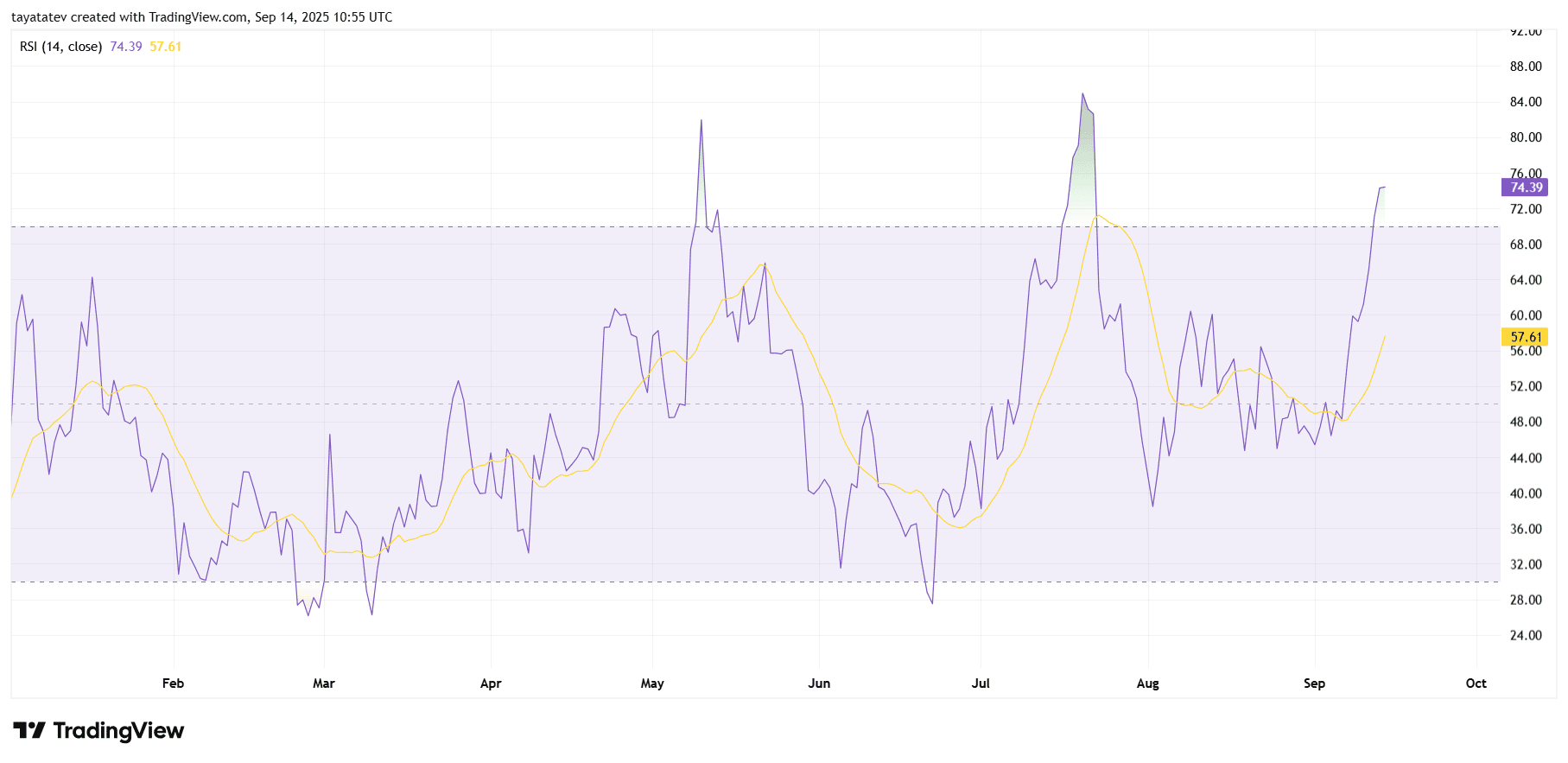

Dogecoin’s daily RSI chart, created September 14, 2025 on TradingView, shows the 14-period RSI at 74.39, pushing into overbought territory. The signal baseline plotted in yellow reads 57.61, well below the RSI line. The indicator’s slope points higher, confirming an impulse after early-September stabilization.

The RSI crossed above its baseline earlier this month and has widened the gap since. Bars remain inside the shaded 30–70 band except for the latest push, which clears the 70 threshold decisively. The move echoes prior summer surges when the oscillator advanced rapidly before easing back toward its baseline.

Sustained readings above 70 typically mark strong trend phases on this timeframe. A hold in the 60–70 zone during any pause would indicate momentum preservation, while a swift drop back below the baseline near 58 would signal fading thrust. For now, the RSI profile supports a momentum-led advance consistent with the recent breakout seen on price charts.