Pi Network will appear as a Gold Sponsor at TOKEN2049 in Singapore on October 1–2, 2025. The event’s partners page lists the project among this year’s Gold tier.

The placement puts Pi Network alongside prominent Web3 firms on one of Asia’s largest conference stages. The listing confirms brand presence across the venue and official materials.

Moreover, the schedule timing positions the team to engage investors, developers, and exchanges ahead of the fourth quarter news cycle. The partners page carries the event dates.

Founder set to speak in Singapore

Co-founder Dr. Chengdiao Fan is confirmed as a TOKEN2049 speaker. The official Pi blog says she will focus on real-world utility and practical Web3 adoption.

Additionally, the post notes she will analyze current challenges and outline solutions aimed at meaningful use cases. The team will share session details closer to the event.

Consequently, the appearance gives Pi Network a platform to frame its Open Network progress and developer roadmap before a global audience. The confirmation came on September 8.

Linux Node release and protocol upgrades

The Core Team released a Linux Node build as part of broader infrastructure work. The announcement highlights compatibility for desktops and servers.

Furthermore, the team is preparing protocol upgrades adapted from Stellar’s version 23. The post flags phased rollouts and possible planned service outages during transitions.

Consequently, node operators can standardize across Windows, macOS, and Linux while the protocol advances toward added functionality and control layers. The upgrade work remains ongoing.

Hackathon 2025 enters build phase

Pi Hackathon 2025 is underway in the Open Network era. The official blog states the competition runs through October 15, 2025.

In addition, organizers invite teams to ship Pi Apps that deliver real-world utility. A prize pool of up to 160,000 Pi is available across categories.

As a result, developers can align launches with TOKEN2049 visibility. The timeline encourages releases that demonstrate utility to a broader audience.

The .pi Domains Auction closes on September 30, 2025. Pi extended the window to give builders more time to finalize functional apps before bidding. Additionally, the blog describes .pi domains as Web3 identifiers for apps, services, and storefronts across the ecosystem. The extension came with the Pi2Day updates.

Therefore, teams shipping during the hackathon can still secure matching names for production deployments. The deadline now sits two days before TOKEN2049.

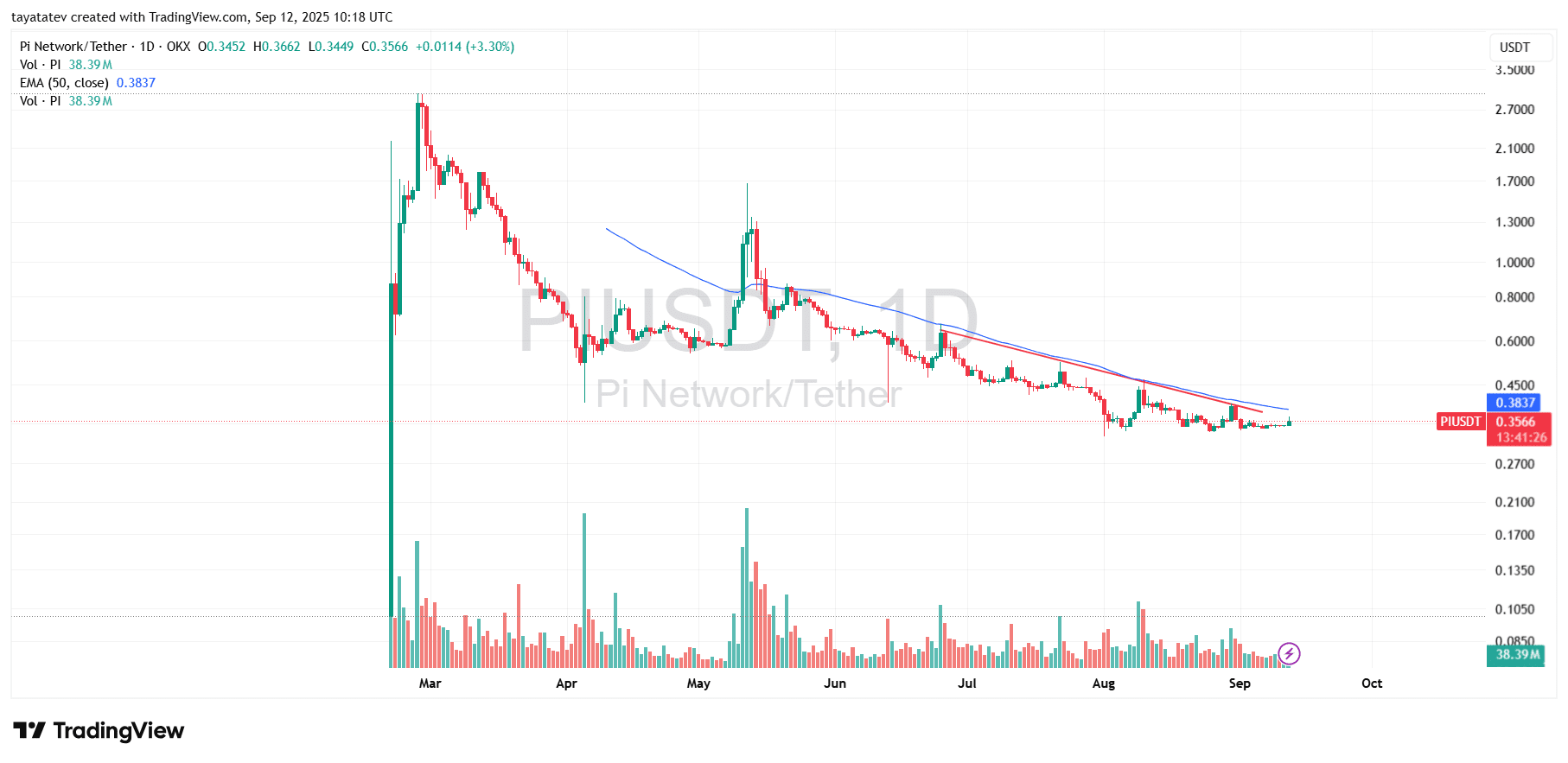

PI price edges higher but stays below 50-day EMA

On September 12, 2025, PI/USDT on OKX closed at 0.3566, up 3.3% on the day, after trading between 0.3449 and 0.3662. The session opened at 0.3452 and saw exchange volume of about 38.39 million units on the daily chart. The 50-day exponential moving average printed at 0.3837 on the same timeframe.

Since March, the chart has traced a series of lower highs, and a downward trendline still caps rebounds. As a result, price continues to trade below the 50-day EMA, which keeps the broader bias negative. Moreover, repeated intraday attempts near the EMA have faded before gaining momentum.

Meanwhile, recent weeks show tight consolidation between roughly 0.33 and 0.37, with volatility easing and volume stabilizing. Sellers have defended the 0.38–0.40 area where the trendline and EMA converge, while buyers have shown up on dips toward the low 0.30s. In summary, price ticked up today, yet the chart still reflects a controlled range under the 50-day EMA.

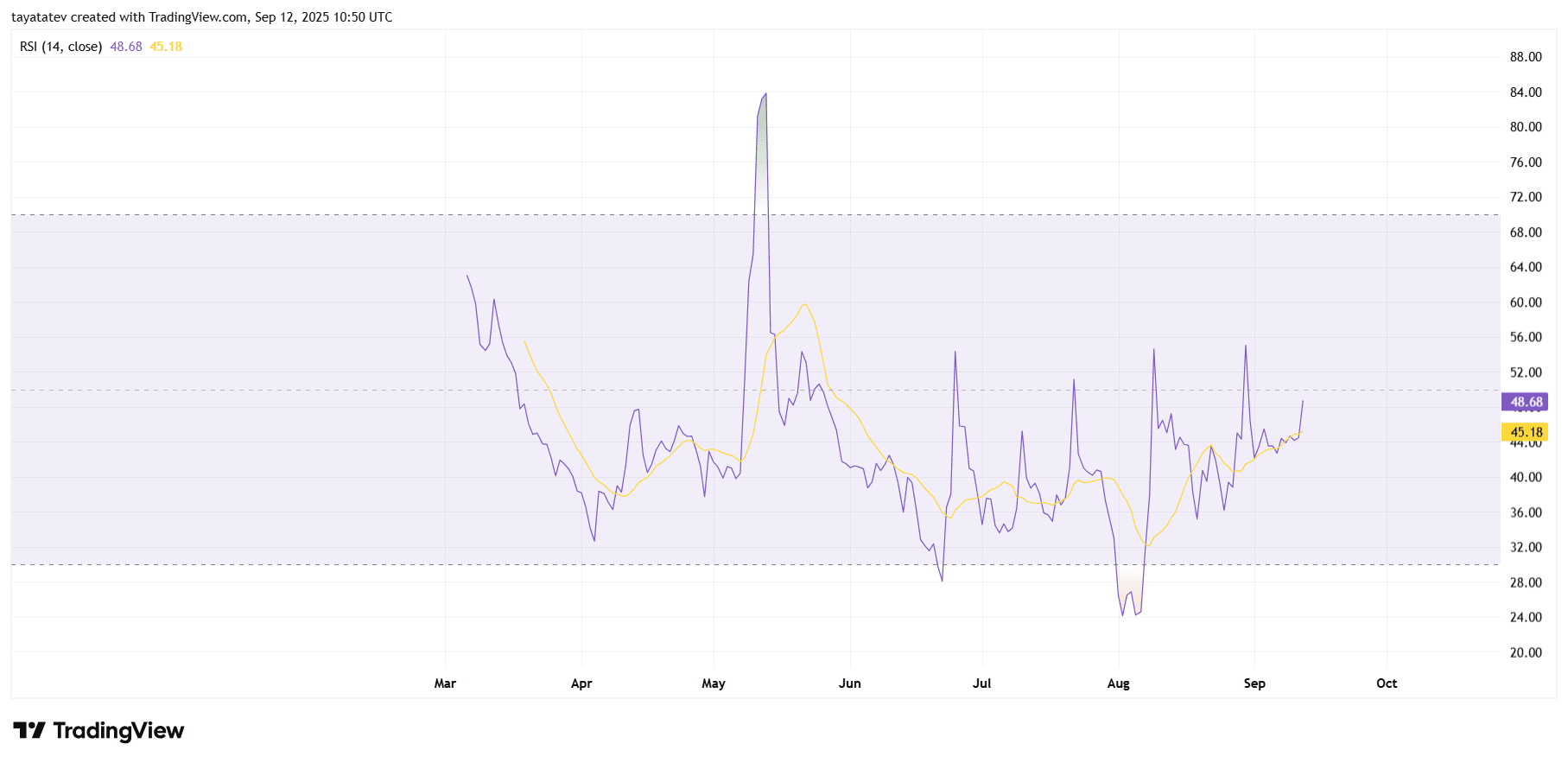

RSI steadies near neutral as momentum improves

On September 12, 2025, PI/USDT’s daily RSI (14) printed 48.68, while the overlay average sat at 45.18. The indicator has moved back into the 40–50 band, which typically reflects neutral momentum on a daily basis. The move follows a multiweek climb off early-August oversold readings below 30.

Since late August, the RSI has formed a sequence of higher lows, and, importantly, it now sits above its overlay average (48.68 vs 45.18). Consequently, short-term strength outpaces the medium-term gauge, and the slope of the average has turned upward. The pattern points to stabilizing participation after August’s volatility shock.

However, the RSI remains just under the 50 midline that often coincides with stronger upside follow-through on daily charts. Recent rallies toward the 55–60 area faded quickly, and the indicator has yet to establish time above that zone. For now, momentum has improved, yet the signal reads neutral rather than decisive.

MACD edges above zero as momentum firms

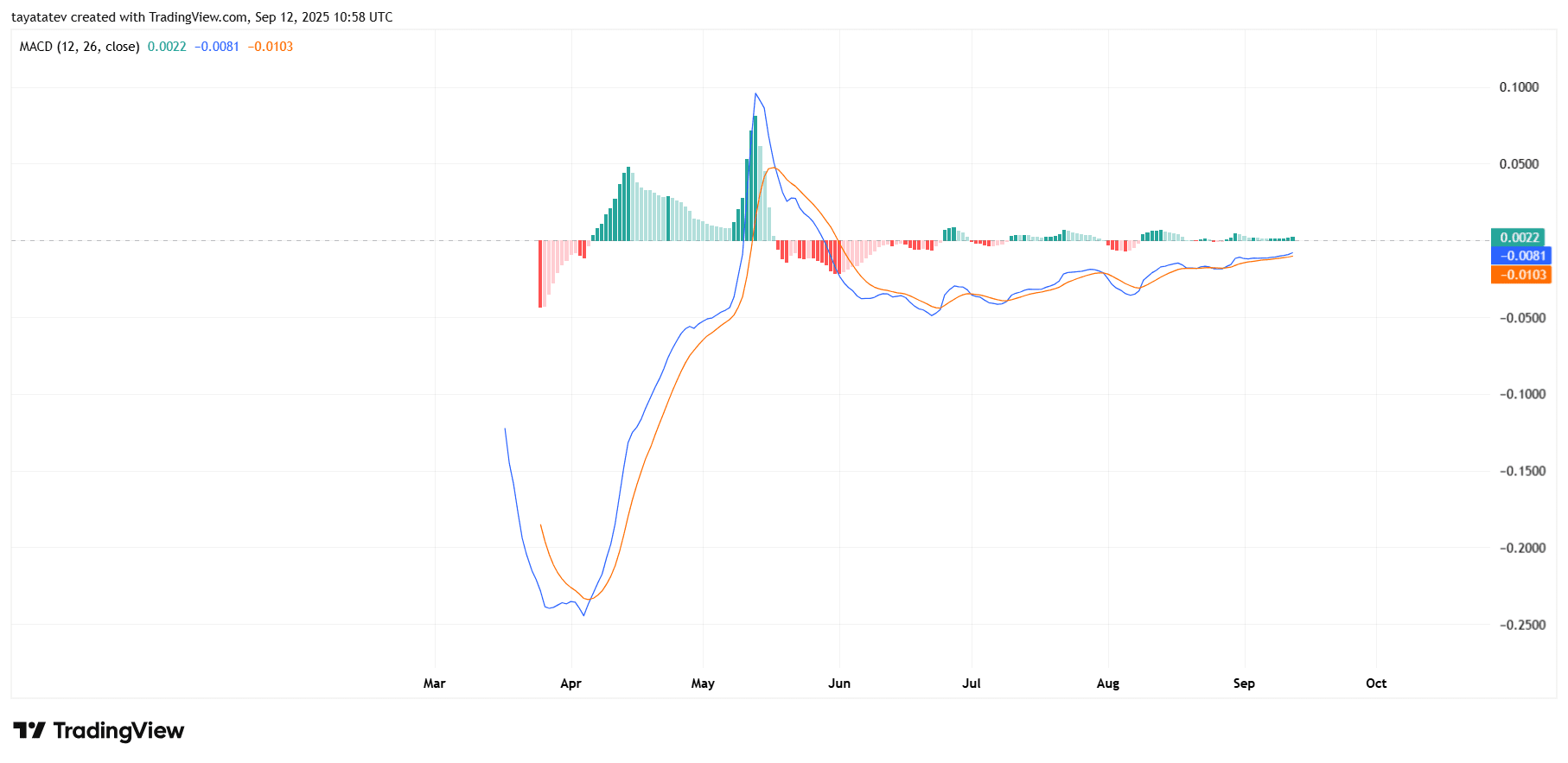

Meanwhile, PI/USDT’s daily MACD (12,26,9) turned slightly positive near 0.002, while the signal line held just below zero around -0.008. Therefore, the spread flipped positive by roughly 0.01, and the histogram hovered close to the zero line. The move places momentum on the front foot, yet it remains modest in size.

Since late August, both MACD and the signal line have trended upward from deeper negatives. Consequently, the histogram has printed small green bars, showing improving—but still light—buy-side momentum. The posture contrasts with May’s sharp spike, which quickly faded and pushed the gauge back into negative territory through June and July.

Even so, the indicator now sits essentially flat around the midpoint, which often aligns with range-bound trading. Thus, the MACD shows stabilization rather than a clear directional push. It complements the price action that still trades under the 50-day EMA, indicating firming momentum but not a confirmed trend shift.