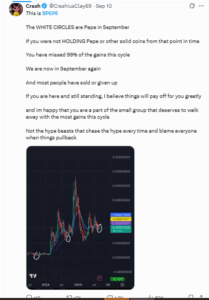

A trader known as Crash claims September has been the launchpad for every major rally in PEPE (PEPE). In a post on X, he wrote:

“The white circles are PEPE in September. If you were not holding from that point, you have missed 99% of the gains this cycle.”

The trader added that most investors have given up by this stage of the cycle, but those who remain could “walk away with the most gains.” The token’s performance in September 2024 supports the argument. PEPE traded near $0.00000062 at the start of the month and reached $0.00000221 by December, a gain of more than 350%. September 2023 also marked the start of an accumulation period before the subsequent cycle high.

PEPE Holds Key Support Near $0.00000100 in September

PEPE price currently stands at $0.00000106 with a market capitalization of about $4.45 billion. The token has been rangebound for months, holding above a support zone between $0.00000100 and $0.00000105.

Charts from TradingView show short-term exponential moving averages flattening while the 100-day EMA sits just above current price. Moving averages are often used by traders to spot trend shifts. For now, PEPE remains compressed inside a narrowing band.

The Relative Strength Index (RSI) is at 53, which is neutral. In past September rallies, RSI moved higher from similar levels into the 60–70 zone. The chart is also shaping into a symmetrical triangle, a structure that often precedes sharp breakouts once momentum builds.

If PEPE price breaks above $0.00000128, it would move past the cluster of moving averages that has limited price action in recent weeks. That could clear a path toward $0.00000150, a level that capped rallies earlier this year. A continuation from there could retest the December 2024 peak near $0.00000220, which would almost double the price from current levels.

If the token falls below $0.00000100, the bullish outlook would weaken. A breakdown at that level could push PEPE toward the next visible support near $0.00000082, breaking the pattern of September rallies unless broader market conditions improve.

Additionally, on-chain data shows that daily active addresses increased sharply in September 2024 at the start of the rally. This September, network activity remains lower but has started to rise again.

September Rally Theory Faces First Real Test in 2025

The trader’s claim that September has triggered every PEPE rally is supported by the last two cycles. Both September 2023 and 2024 lined up with accumulation phases that preceded strong gains.

But the rallies also occurred during Bitcoin’s recovery and wider surges across meme coins. Without those conditions, the September effect may not repeat this year.

PEPE is again sitting at a level where previous rallies began. Whether the cycle repeats will depend on Bitcoin’s trajectory above $113,000 and the ability of smaller investors to drive momentum in the absence of whale support.