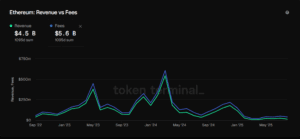

Ethereum (ETH) reached a record high of $4,957 on August 24, 2025. Yet the network’s financial revenue declined sharply during the same month. Data from Token Terminal shows that Ethereum revenue fell by about 44% in August, dropping from $25.6 million in July to $14.1 million.

Network fees also fell by nearly 20%, from $49.6 million in July to $39.7 million in August. These fees represent the cost users pay to transact on Ethereum. A portion of those fees are burned, reducing ETH supply and acting as revenue for holders.

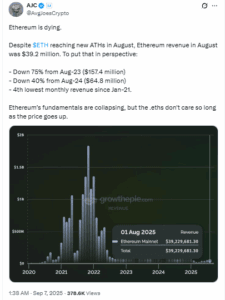

This disconnect between rising ETH prices and falling revenues has drawn scrutiny from analysts. Some see it as a structural weakness, while others argue it is a result of intentional upgrades.

Post-Dencun Fee Cuts Slash Protocol Income

Ethereum’s falling fee revenue traces back to the Dencun upgrade, completed in March 2024. This update introduced a system called “blobspace” for Layer-2 rollups. By using blob transactions instead of competing with Layer-1 blockspace, rollups can post data at far lower costs.

As a result, average transaction fees dropped by more than 90% over the past year, from levels near $80 to less than $1 in many cases. This made Ethereum transactions more affordable, but it also reduced the network’s direct income.

Critics argue that such low fees may weaken the network’s economic security model. Less revenue from fees means less value flowing to validators and ETH holders. Supporters counter that lower fees improve scalability, encourage more users to interact with Ethereum, and shift economic value into staking yields rather than transaction costs.

Wall Street Bets on ETH Staking and ETFs

Even as protocol revenue shrank, institutional activity around Ethereum has accelerated in 2025. Etherealize, a firm dedicated to promoting Ethereum to public companies and financial institutions, raised $40 million in September to build infrastructure for corporate adoption.

Public companies have also begun adding ETH to their balance sheets. Recent disclosures show more than $1.2 billion worth of ETH accumulated by treasury firms in early September. Meanwhile, staking continues to absorb more of the ETH supply. By mid-2025, about 29.6% of the total supply—nearly 35.7 million ETH—was locked in staking contracts, worth close to $90 billion.

The exchange-traded fund market is another driver. BlackRock’s ETHA ETF has grown to about $16.33 billion in assets under management as of Sep.5 , helping institutional investors gain exposure without directly holding the token.

The debate over Ethereum’s fundamentals remains unresolved. Revenue in August 2025 was down about 30% from a year earlier and 75% from August 2023. Some analysts argue falling Layer-1 revenue weakens Ethereum’s long-term security model.

On the other side, advocates argue that Ethereum is evolving into a settlement network where value accrues through staking, Layer-2 adoption, and institutional inflows, rather than high fees on individual users. They point to record staking levels and growing ETF exposure as evidence that Ethereum remains financially attractive despite weaker protocol revenue.